Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

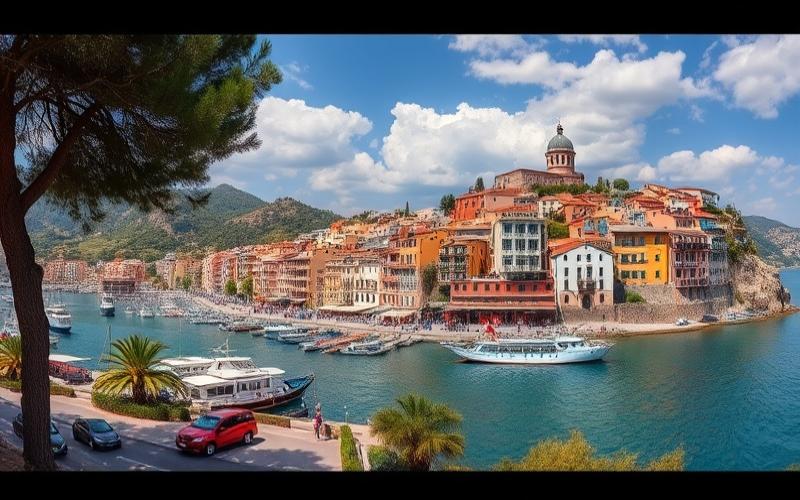

Greece, with its rich cultural heritage, picturesque landscapes, and Mediterranean climate, is attracting an increasing number of foreign investors to the real estate sector. Whether you’re looking to acquire a vacation home on an idyllic Greek island or invest in commercial real estate in Athens, it’s crucial to understand the current regulations regarding foreign property ownership. This article will guide you through the essential aspects you need to know to invest confidently in Greece.

A Warm Welcome for Foreign Investors

Contrary to some misconceptions, Greece offers a relatively open and welcoming framework for foreign investors in the real estate sector. Foreign and domestic entities have the legal right to establish and own businesses in Greece, with only minor restrictions in certain sensitive sectors[2]. This foreign investment-friendly approach is part of the broader Greek government’s initiative to stimulate the economy and attract foreign capital.

The government has implemented several reforms aimed at simplifying administrative procedures and creating a business-friendly environment. Among these initiatives are:

- An accelerated system for strategic investments

- The creation of the Investor’s Ombudsman at Enterprise Greece to resolve issues and streamline licensing

- Increasing digitization of government services

These efforts have significantly improved Greece’s competitiveness on the international investment stage. However, it’s important to note that some challenges persist, particularly regarding bureaucratic complexity and judicial system delays.

Good to Know:

Greece currently ranks 59th out of 180 economies according to the Corruption Perceptions Index and 113th out of 184 countries in the latest Economic Freedom Index[2]. These rankings, while improving, highlight the importance for foreign investors to conduct thorough research and work with experienced local professionals.

Legal Restrictions: Important Limitations to Know

While Greece is generally open to foreign investment, certain restrictions exist, primarily related to national security considerations. Limitations apply to foreign ownership in sectors deemed sensitive, such as:

- Airport operations

- The electricity sector

- Media

It’s important to note that these restrictions generally don’t apply to standard real estate investments, but rather to specific strategic sectors.

A particular consideration involves purchasing land in certain geographical areas. Restrictions apply to land acquisition in border areas and on certain islands[2]. These measures aim to preserve national security and the country’s territorial integrity. If you’re considering investing in these regions, you’ll need to obtain special permits from the relevant authorities.

Outside of these special cases, foreign investors generally enjoy the same rights as Greek nationals regarding property acquisition and management. The Greek legal system protects the property rights of foreign and Greek nationals equally[2].

Good to Know:

While restrictions exist in certain sectors and geographical areas, the majority of real estate investments in Greece are open to foreigners without major limitations. However, it’s recommended to verify the specific status of the targeted property before committing.

The Acquisition Process: Key Steps for Foreign Investors

Acquiring property in Greece as a foreigner follows a relatively standardized process, but includes some particularities to be aware of. Here are the main steps to follow:

1. Obtaining a Greek Tax Number (AFM)

Before any real estate transaction, it’s essential to obtain a Greek tax number, called AFM (Arithmos Forologikou Mitroou). This number is necessary for all administrative and tax procedures related to your investment[9]. Obtaining the AFM is done through Greek tax services and typically doesn’t require a complex procedure.

2. Opening a Greek Bank Account

While you don’t need to be a Greek resident to acquire property, opening a bank account in Greece is highly recommended, and even necessary for certain transactions[9]. This account will facilitate payments related to your investment and future property management.

3. Due Diligence and Legal Checks

Before finalizing any transaction, it’s crucial to conduct thorough due diligence. This particularly involves:

- Verifying the title deed

- Examining any existing charges or mortgages on the property

- Confirming the property’s compliance with urban planning regulations

It’s strongly advised to engage a local lawyer specialized in real estate law for this crucial step.

4. Signing the Preliminary Contract

Once checks are completed, a preliminary contract (purchase promise) is typically signed between the buyer and seller. This document sets the sale conditions and may include a down payment.

5. Payment of Transfer Tax

The transfer tax, called FMA in Greece, amounts to 3.09% of the purchase price and is the buyer’s responsibility[10]. This tax must be paid before finalizing the transaction.

6. Signing the Final Deed Before a Notary

The final step involves signing the definitive sale deed before a Greek notary. This deed formalizes the property transfer and must be registered with the local cadastre office.

Good to Know:

The acquisition process can take several weeks, or even months, depending on the transaction’s complexity and any necessary permits. It’s recommended to allow sufficient time and work with experienced professionals to ensure the procedure runs smoothly.

Rights and Obligations of Foreign Property Owners

Once you own property in Greece, you enjoy rights similar to Greek nationals, but you must also comply with certain specific obligations.

Rights of Foreign Property Owners

Foreign investors enjoy strong legal protection of their property rights in Greece[2]. This includes:

- The right to freely use, rent, or sell your property

- Protection against expropriation, except for public interest reasons and with fair compensation

- The right to transfer income and profits related to your real estate investment abroad

Additionally, foreign property owners may benefit from certain tax advantages, particularly under the Greek “Golden Visa” program, which offers a residence permit in exchange for a significant real estate investment.

Obligations and Responsibilities

As a foreign property owner in Greece, you must comply with several obligations:

- Payment of annual property taxes (ENFIA)

- Declaration of rental income, if applicable

- Compliance with local urban planning and environmental regulations

- For seasonal rentals, compliance with specific rules (for example, the 120-day annual limit for renting primary residences through platforms like Airbnb)[7]

It’s important to note that failure to comply with these obligations can result in significant financial penalties, or even legal proceedings. For example, undeclared property rentals can lead to fines of up to €5,000.

Good to Know:

Greece has implemented a special tax system for High Net Worth Individuals (HNWI) who wish to transfer their tax residence to the country. This regime provides for a flat annual tax of €100,000, regardless of the level of foreign income, offering an attractive option for certain investors[10].

Golden Tips for Foreign Investors

To maximize your chances of success and minimize risks when investing in Greek real estate, here are some essential tips:

1. Engage Local Professionals

The assistance of a lawyer specialized in Greek real estate law and an accountant familiar with local taxation is crucial. These professionals will help you navigate the complexities of the Greek legal and tax system, avoiding costly mistakes.

2. Conduct Thorough Due Diligence

Don’t underestimate the importance of preliminary checks. Ensure the property you’re considering purchasing is free of any charges or disputes and complies with current urban planning regulations.

3. Consider the “Golden Visa” Program

If you’re considering a significant investment (€250,000 or more), the Greek “Golden Visa” program can offer attractive benefits, including a renewable residence permit for you and your family[4].

4. Anticipate Additional Costs

Beyond the purchase price, budget for notary fees, transfer taxes, and any potential renovation or improvement work.

5. Stay Informed About Regulatory Changes

Greek legislation regarding foreign investments and real estate taxation evolves regularly. Stay updated on changes that could affect your investment.

6. Explore Local Financing Opportunities

While obtaining a mortgage in Greece may be more complex for non-residents, some Greek banks offer specific products for foreign investors. Compare offers and conditions before deciding[9].

Good to Know:

Greece offers interesting growth potential for real estate investors, particularly in the tourism sector. However, it’s essential to adopt a cautious and well-informed approach to maximize your investment’s chances of success.

Conclusion: A Promising Market for Savvy Investors

Real estate investment in Greece offers excellent opportunities for foreign investors, with a generally favorable regulatory framework and a recovering market. Recent reforms aimed at simplifying administrative procedures and attracting foreign capital have significantly improved the country’s attractiveness.

However, as with any foreign investment, it’s crucial to approach the Greek market with careful preparation and a thorough understanding of local regulations. Restrictions in certain sensitive sectors and geographical areas, although limited, must be considered in your investment strategy.

By following the advice provided in this article and working with competent professionals, you’ll be well-equipped to navigate the subtleties of the Greek real estate market and maximize your investment’s potential. Greece, with its priceless cultural heritage, Mediterranean climate, and economic growth potential, remains a top destination for savvy real estate investors.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.