Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

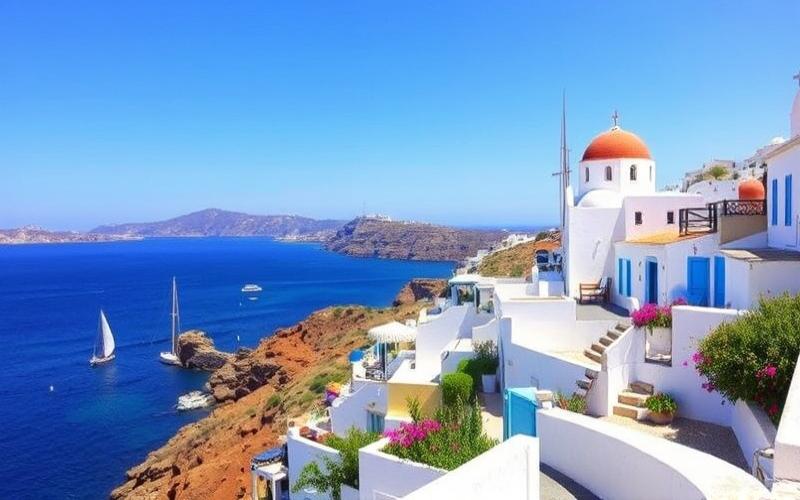

Greece, with its picturesque landscapes, rich cultural heritage, and Mediterranean lifestyle, attracts numerous expatriates from around the world. However, settling in this enchanting country requires navigating through several administrative procedures. Here is a detailed guide to help you through these crucial steps and realize your dream of living in Greece.

Unlock Greece’s Door: Obtaining Your Visa

The first step to settling in Greece is obtaining the appropriate visa. The type of visa you’ll need depends on your personal situation and the intended duration of your stay.

For EU/EEA Citizens: If you are a citizen of a European Union member country or the European Economic Area, you benefit from freedom of movement. You can enter Greece without a visa and stay for up to 3 months without special formalities. Beyond this period, you must register with local authorities.

For Non-EU/EEA Nationals: If you are not an EU/EEA citizen, you will need to obtain a visa before arriving in Greece. The most common visa for long stays is the Type D visa, which allows you to remain in Greece for more than 90 days. To obtain it, you must provide the following documents:

- A passport valid for at least 3 months after the requested visa’s expiration date

- Recent passport photos

- A duly completed visa application form

- Proof of sufficient financial resources for your stay

- Health insurance valid in Greece

- Proof of accommodation in Greece

- A criminal record certificate

The visa application process can take several weeks, or even months. Therefore, it is recommended to start the process well in advance.

Good to Know:

Greece also offers a “Golden Visa” for non-European investors. This program provides a 5-year renewable residence permit in exchange for a real estate investment of at least 250,000 euros.

Find Your Cozy Nest: The Quest for the Perfect Home

Once you have your visa, the next step is finding housing. The Greek real estate market offers a wide variety of options, from city apartments to traditional houses in picturesque villages.

Renting: Renting is often the preferred solution for expatriates, especially at the beginning of their stay. Rental contracts in Greece typically have a minimum duration of one year. To rent a property, you will need the following documents:

- A copy of your passport or ID card

- Proof of income (employment contract, bank statements)

- A Greek phone number

- A Greek tax identification number (AFM)

Buying: If you plan to buy real estate in Greece, be aware that the process can be complex for foreigners. You will need to obtain a Greek tax identification number (AFM) and open a Greek bank account. Additionally, for non-EU residents, purchasing property in certain border areas or on specific islands may require special authorization from the Ministry of Defense.

It is highly recommended to hire a lawyer specialized in real estate law to guide you throughout the purchasing process.

Good to Know:

Real estate prices in Greece have significantly decreased since the 2008 economic crisis, creating interesting opportunities for foreign investors. However, prices are starting to rise again in some popular tourist areas.

Stay Legal: Renewing Your Residence Permit

Once settled in Greece, it is crucial to maintain your legal status by renewing your residence permit on time.

For EU/EEA Citizens: If you stay in Greece for more than 3 months, you must register with the local police and obtain a registration certificate. This certificate is valid indefinitely but must be renewed every 5 years.

For Non-EU/EEA Nationals: Your residence permit renewal must be completed at least two months before its expiration. The required documents generally include:

- A renewal application form

- Your passport and copies of all pages

- Your current residence permit

- Recent passport photos

- Proof of sufficient financial resources

- Valid health insurance

- Proof of address in Greece

The renewal process can take several months. Therefore, it is crucial to start the process well in advance to avoid any status issues.

Good to Know:

Greece has recently implemented an online appointment system for residence permit applications, greatly facilitating the process for expatriates.

Living in Greece involves familiarizing yourself with certain essential administrative procedures. Here are the main ones to know:

Obtaining a Tax Identification Number (AFM): The AFM is essential for many procedures in Greece, including opening a bank account, signing a rental contract, or buying real estate. To obtain it, visit the local tax office (DOY) with your passport and proof of address.

Registering for Social Security: If you work in Greece, you must register with EFKA (Unified Social Security Entity). This registration will give you access to the Greek public healthcare system.

Obtaining a Greek Driver’s License: If you reside permanently in Greece, you must exchange your foreign driver’s license for a Greek one within 185 days of settling in.

Registering to Vote: EU citizens residing in Greece have the right to vote in municipal and European elections. To do so, they must register on the electoral lists of their municipality.

Good to Know:

Greece recently launched an online platform, gov.gr, which centralizes many administrative procedures and allows certain processes to be completed remotely.

Know Your Rights: Laws and Regulations Concerning Foreigners in Greece

As an expatriate in Greece, it is crucial to understand your rights and obligations. Here are some important points to know:

Labor Law: Expatriates working legally in Greece enjoy the same rights as Greek workers in terms of working conditions, minimum wage, and social protection. However, some public sector jobs are reserved for Greek citizens.

Property Rights: Foreigners have the right to purchase real estate in Greece, except in certain border or strategic areas that require special authorization.

Taxation: If you reside in Greece for more than 183 days per year, you will be considered a tax resident and must declare your worldwide income in Greece. Greece has implemented special tax regimes to attract foreign retirees and “digital nomads.”

Family Reunification: Non-EU residents holding a long-term residence permit can apply for family reunification for their spouse and minor children.

Data Protection: Greece applies the EU General Data Protection Regulation (GDPR), which guarantees a high level of protection for your personal data.

Good to Know:

Greece recently passed a law aimed at attracting foreign investors and skilled workers, offering significant tax benefits for those who transfer their tax residence to Greece.

Settling in Greece may seem like an administrative challenge, but with good preparation and a clear understanding of the procedures, you can navigate this process successfully. Remember that patience is a virtue appreciated in Greece, including in administrative procedures!

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.