Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

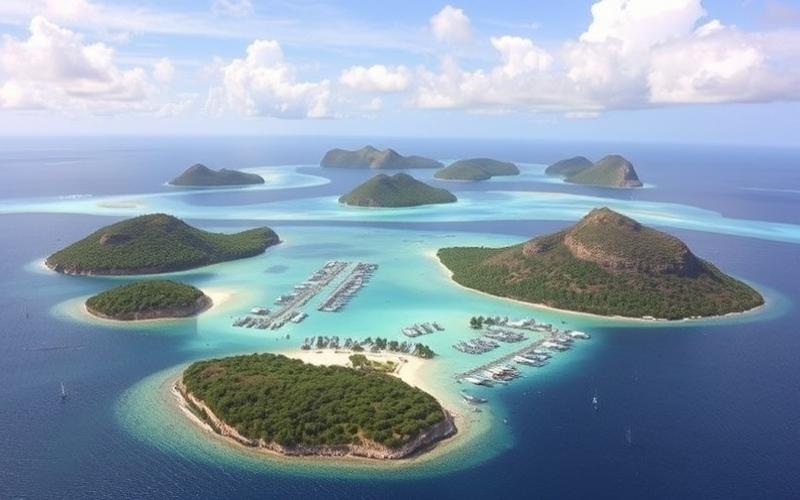

The Cayman Islands, a British archipelago in the Caribbean, are renowned for their advantageous tax environment and business-friendly regulatory framework. However, establishing a company in this tax haven involves significant costs that should be anticipated. Let’s examine in detail the various financial aspects related to setting up a business in the Cayman Islands, along with strategies to optimize these expenses.

Registration Fees: The Essential First Step

Establishing a company in the Cayman Islands begins with its official registration with the competent authorities. This step involves several fees to consider:

Government Registration Fees: The amount varies depending on the type of company and its share capital. For an exempted company (the most common form for foreign investors), fees typically range from 600 to 2,000 Cayman Islands dollars (KYD), approximately 720 to 2,400 euros.

Incorporation Fees: These fees cover the preparation and filing of the company’s formation documents. They can range from 1,500 to 3,000 KYD (1,800 to 3,600 euros) depending on the complexity of the structure.

Annual License Fee: Every company registered in the Cayman Islands must pay an annual license fee. For an exempted company, these fees amount to approximately 700 KYD (840 euros) per year.

Registered Agent Fees: Cayman Islands law requires every company to have a local registered agent. Annual fees for this service range between 1,000 and 2,500 KYD (1,200 to 3,000 euros).

It’s important to note that these costs can change, and it’s recommended to consult a local professional for the most up-to-date rates.

Good to Know:

Registration fees in the Cayman Islands are generally higher than in other offshore jurisdictions, but this reflects the reputation and stability of the Cayman financial center.

Compliance Costs: An Investment for Credibility

Compliance with local and international regulations is crucial to maintaining the legitimacy and reputation of your company in the Cayman Islands. These costs include:

Accounting and Audit Fees: Although the Cayman Islands do not impose income taxes, companies must maintain proper accounting records. Annual costs for these services can range from 5,000 to 15,000 KYD (6,000 to 18,000 euros) depending on the size and complexity of the business.

Legal and Advisory Fees: To ensure ongoing compliance with local and international laws, it’s recommended to engage legal advisors. These fees can amount to several thousand dollars per year.

Regulatory Reporting Costs: The Cayman Islands have strengthened their financial transparency requirements. Companies must submit regular reports to authorities, which can incur additional costs of 2,000 to 5,000 KYD (2,400 to 6,000 euros) per year.

Anti-Money Laundering Compliance Fees: Businesses must implement anti-money laundering and counter-terrorism financing procedures. These costs can vary significantly depending on the nature of the activity, but expect at least 3,000 to 5,000 KYD (3,600 to 6,000 euros) per year.

Good to Know:

Although these costs may seem high, they are essential to maintain your company’s reputation and avoid potentially costly penalties.

Initial Investment: Beyond Administrative Fees

The initial investment to create a company in the Cayman Islands isn’t limited to registration and compliance fees. You should also consider:

Minimum Share Capital: Although there’s no legal minimum capital for exempted companies, it’s common to have an authorized capital of at least 50,000 KYD (60,000 euros) to project an image of financial strength.

Banking Fees: Opening a bank account in the Cayman Islands can be a costly and time-consuming process. Account opening fees can reach 1,000 to 2,000 KYD (1,200 to 2,400 euros), not including annual maintenance fees.

Virtual Office Costs: If you don’t have a physical presence on the island, you’ll likely need to rent a virtual office or registered address. These services can cost between 1,500 and 3,000 KYD (1,800 to 3,600 euros) per year.

Structuring Advisory Fees: To optimize your company’s structure, it’s recommended to engage experts in international taxation and corporate structuring. These services can easily cost between 10,000 and 30,000 KYD (12,000 to 36,000 euros) depending on the complexity of your situation.

Good to Know:

A well-planned initial investment can prevent additional long-term costs and allow you to fully leverage the benefits offered by the Cayman Islands.

Operational Expenses: Managing Daily Activities

Once your company is established, you’ll face regular operational expenses to maintain your activities in the Cayman Islands:

Management and Administration Fees: If you opt for local management of your company, annual fees can range from 10,000 to 30,000 KYD (12,000 to 36,000 euros) depending on the level of service required.

Personnel Costs: If you decide to hire local staff, be aware that salaries in the Cayman Islands are relatively high. A qualified employee can cost between 50,000 and 100,000 KYD (60,000 to 120,000 euros) per year.

Travel Expenses: Regular visits to the Cayman Islands may be necessary to maintain the economic substance of your company. Budget 10,000 to 20,000 KYD (12,000 to 24,000 euros) annually for travel and accommodation.

Insurance: Insurance policies to cover your activities and directors can cost between 5,000 and 15,000 KYD (6,000 to 18,000 euros) per year, depending on the nature of your business and the desired coverage level.

Good to Know:

Although operational costs in the Cayman Islands may seem high, they are often offset by the absence of corporate tax and the tax benefits offered by the jurisdiction.

Optimization Strategies: Reducing Costs Without Compromising Quality

Despite the significant costs associated with establishing and managing a company in the Cayman Islands, there are strategies to optimize these expenses:

International Tax Planning: Use the Cayman structure within a comprehensive tax strategy to maximize benefits and reduce your company’s overall tax burden.

Service Sharing: Consider sharing certain administrative or compliance services with other companies to reduce fixed costs.

Remote Management Technologies: Invest in technological tools that enable effective remote management, reducing the need for constant physical presence and associated costs.

Service Fee Negotiation: Don’t hesitate to negotiate fees with local service providers, especially if you anticipate significant business volume.

Holding Structure: Use a Cayman holding structure to centralize the management of multiple entities, thereby reducing overall administrative costs.

Good to Know:

A well-designed optimization strategy can significantly reduce costs while maintaining the benefits offered by the Cayman jurisdiction.

Establishing a company in the Cayman Islands represents a significant investment but can offer considerable benefits in terms of tax planning and asset protection. It’s crucial to carefully evaluate all involved costs and weigh them against potential long-term benefits. Meticulous planning and assistance from experienced professionals are essential to effectively navigate this process and maximize the benefits of your Cayman structure.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.