Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

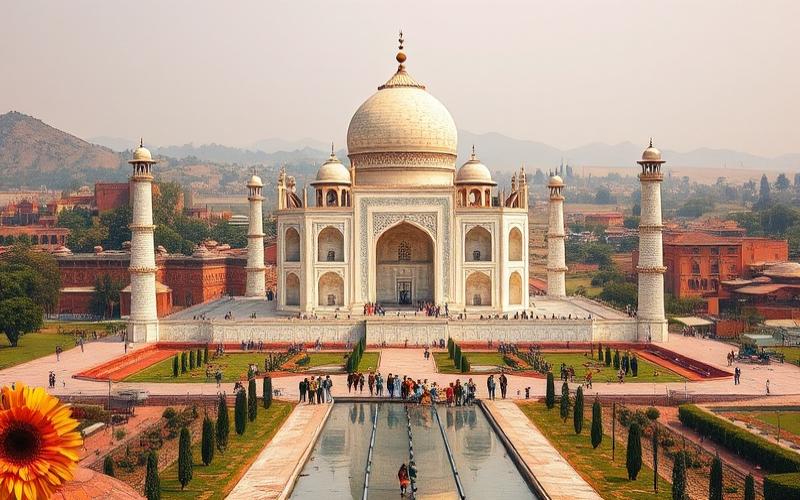

Establishing a business in India means embarking on an entrepreneurial journey that is as captivating as it is complex. With its booming market and dynamic population, India offers exceptional opportunities for investors ready to adapt to a unique economic environment.

However, challenges related to culture, bureaucracy, and regulation can appear daunting for expatriates, requiring thorough preparation and a deep understanding of the local business landscape.

This guide aims to illuminate each step of the process, from initial planning to success in the Indian market, providing you with essential tools to turn your vision into reality.

Understanding Legal Structures in India for Expatriate Businesses

| Legal Structure | Description | Advantages | Disadvantages |

|---|---|---|---|

| Private Limited Company (Pvt Ltd) | Limited liability company, 2 to 50 shareholders, min. capital 100,000 INR | Limited liability, credibility, easier access to foreign investment, flexible structure | Complex registration process, increased compliance obligations, mandatory annual audit |

| Sole Proprietorship | Business owned and managed by a single person | Simple procedure, low management costs, total control | Unlimited liability, difficulty raising funds, less professional image |

| Partnership Firm | Partnership of persons, 2 to 20 partners | Simple formation, contractual flexibility, collective management | Unlimited and joint liability, potential disputes between partners, limited funding |

| Limited Liability Partnership (LLP) | Partnership variant, limited liability for partners | Limited liability, flexible management, reduced obligations | Less recognized by some investors, sectoral restrictions for foreign investment |

| Wholly Owned Subsidiary (WOS) | Subsidiary 100% owned by a foreign company | Full control by parent company, asset protection, access to Indian market | Strict regulation, reporting obligations, sectoral restrictions depending on activity |

Registration Procedures and Required Documents

- Private Limited Company (Pvt Ltd)

- Obtaining a Digital Signature Certificate (DSC) for each director

- Obtaining a Director Identification Number (DIN)

- Reserving the company name with the Registrar of Companies (RoC)

- Drafting the Memorandum of Association (MoA) and Articles of Association (AoA)

- Filing documents on the MCA (Ministry of Corporate Affairs) portal

- Timeframe: 10 to 20 business days

- Sole Proprietorship

- No formal registration obligation, but in practice:

- Registration with local authorities (Shop and Establishment Act)

- Opening a business bank account

- Obtaining specific licenses depending on the sector

- Timeframe: a few days to two weeks

- No formal registration obligation, but in practice:

- Partnership Firm

- Drafting a partnership agreement

- Optional registration with the Registrar of Firms (recommended)

- Providing partner ID documents, proof of registered office address

- Timeframe: 7 to 14 days

- LLP

- Procedure similar to Pvt Ltd (DSC, DIN, name reservation, filing of statutes)

- Timeframe: 15 to 20 days

- Wholly Owned Subsidiary

- Creating a Pvt Ltd 100% owned by the foreign company

- Steps identical to Pvt Ltd, plus specific approvals depending on the sector

- Timeframe: 15 to 30 days depending on complexity and sector

Tax Implications for Expatriate Companies

- Private Limited Company / WOS

- Taxed at a rate of 40% on profits (foreign companies)

- Surcharge of 2% beyond 10,000,000 INR profits, additional 5% beyond 100,000,000 INR

- VAT (GST) between 12% and 15% depending on State and sector

- Sole Proprietorship

- Taxed at the marginal personal income tax rate (up to 30%)

- Less tax optimization possible

- Partnership

- Fixed tax rate of 30% on profits

- Possible surcharges depending on net income

- LLP

- Tax rate of 30%

- No dividends, direct distribution of profits

Criteria and Local Regulations for Foreign Ownership

- Foreign Ownership

- Pvt Ltd companies and LLPs can host foreign investors subject to Foreign Direct Investment (FDI) rules

- Certain sectors (defense, media, insurance, etc.) are subject to restrictions or foreign ownership caps

- Prior approval from the Indian government may be required in some cases

- Prohibited or Restricted Structures

- Sole Proprietorships and ordinary Partnerships cannot be directly owned by foreigners

- Creating a subsidiary or liaison/project office may require approval from the Reserve Bank of India (RBI)

Practical Tips and Useful Resources

- Engage a local law firm: essential to navigate administrative complexity and avoid costly errors

- Consult Franco-Indian Chambers of Commerce and economic development agencies for sector-specific information and qualified contacts

- Use the Ministry of Corporate Affairs (MCA) portal for online procedures and consultation of official forms

- Consider the regulatory diversity of Indian States (licenses, local taxes, specific permits)

- Plan for administrative and tax support from the incorporation phase

Challenges and Opportunities for Expatriate Entrepreneurs

- Challenges: administrative complexity, linguistic and cultural diversity, incorporation timelines, fluctuating sectoral regulation

- Opportunities: rapidly growing market, promising sectors (technology, services, industry), tax incentives in some States, easier access to venture capital for structured companies

Good to Know:

In India, expatriate companies can choose from several legal structures, each with its specificities. The private limited company is popular for its limited liability and requirement of a minimum of two directors and shareholders. The sole proprietorship, ideal for small businesses, offers simplified management but does not separate personal and professional assets, potentially exposing the owner to more risks. The partnership firm, on the other hand, allows collaboration between two or more partners with shared liability. To register these entities, it is essential to provide documents like proof of identity and address, and to anticipate varying timeframes, generally between 10 to 15 days for private limited companies. Tax implications differ; expatriate companies must particularly consider the specific tax rate for each structure. Regarding foreign ownership, certain sectoral restrictions may apply, requiring prior verification. It is prudent to consult local experts such as specialized lawyers to navigate this complex environment and obtain necessary support during company registration and management.

Being supported by local experts and anticipating sectoral and tax constraints constitutes a key success factor for any expatriate entrepreneurial project in India.

Administrative Procedures for Creating Your Business in India

Basic Legal Requirements to Create a Business in India:

- Hold a valid business visa for foreigners.

- Obtain a digital signature for each director.

- Apply for a DIN (Director Identification Number) for all directors.

- Define the legal address of the registered office.

- Prepare the Memorandum of Association (MoA) and the company’s Articles of Association (AoA).

- Obtain a PAN (Permanent Account Number) and a TAN (Tax Account Number).

Main Types of Available Legal Structures:

| Legal Structure | Description | Minimum number of partners/directors | Minimum capital required |

|---|---|---|---|

| Sole Proprietorship | Simplest form, no separation between the business and its owner | 1 | No minimum capital |

| Partnership | Two or more persons, unlimited liability | 2 | No minimum capital |

| LLP (Limited Liability Partnership) | Limited liability, hybrid between partnership and company | 2 partners | No minimum capital |

| Private Limited Company | Limited liability for shareholders | 2 to 50 shareholders | Approx. 100,000 INR (~1,400 €) |

| Public Limited Company | Company open to the public, increased regulatory requirements | Minimum 7 shareholders | Approx. 500,000 INR (~7,100 €) |

Steps to Follow to Register a Business:

- Choose the type of legal structure suited to your project

- Select and get the name approved via the SPICe+ form

- Gather all necessary documents:

- Digital signature of directors

- DIN of directors

- MoA & AoA

- Submit the application to the Registrar of Companies

- Receive the official Certificate of Incorporation

- Apply for PAN & TAN with the Income Tax Department

- Open a local bank account in the company’s name

- Complete tax registration according to the concerned state:

- Professional tax

- TDS (Tax Deducted at Source)

- Register with local authorities:

- Shop Establishment Certificate

Useful Government Online Platforms:

- MCA Portal (“Ministry of Corporate Affairs”) — SPICe+ procedure, document filing, application tracking

- NSDL/TIN — online application for PAN/TAN

- GST Portal — GST tax registration

- EPFO/ESIC Portals — social/employer management

Typical Timeframes & Potential Costs:

Full validation: generally between 4 and 12 weeks

Variable administrative cost depending on structure:

- Pvt Ltd Company: approx. ₹20,000–₹50,000

- LLP: often less expensive than Pvt Ltd or Public Ltd

- Additional fees possible for professional advice or document translation

Practical Tips on Engaging Local Experts:

- Engaging specialized consultants or Indian lawyers allows:

- Ensuring compliance with all local tax, social, and commercial laws,

- Facilitating the correct drafting of statutes/MoA/AoA,

- Speeding up administrative procedures thanks to their practical experience,

- Minimizing any legal risk related to Indian regional specificities.

Key Takeaways:

Procedures may seem complex but are largely facilitated by official online platforms as well as local professional support; this ensures legal security and full compliance with current Indian regulations.

Good to Know:

To create a business in India, it is essential to understand the legal requirements, including the choice between different structures like the Sole Proprietorship or the Private Limited Company. The registration process includes choosing the name, obtaining a Certificate of Incorporation through the Registrar of Companies, and tax registration via GST (Goods and Services Tax). Then, registration with local authorities is required. Government platforms such as “MCA21” or the GST portal simplify these procedures. Generally, plan for a timeframe of a few weeks and variable costs depending on the chosen structure. Engaging local consultants or specialized lawyers ensures compliance with Indian laws and is often advantageous for navigating these complex procedures effectively.

International Tax Considerations for Expatriate Entrepreneurs in India

Expatriate entrepreneurs in India are subject to complex taxation that depends on their residency status, the type of business, and international agreements. Here are the main regimes and obligations:

Tax Status and Income Taxation

- An expatriate is considered an Indian tax resident if they stay in India for at least 182 days during the fiscal year (April 1 to March 31). Residents are taxed on their worldwide income; non-residents only on Indian income.

- The PAN (Permanent Account Number) is essential for any tax declaration or opening a professional bank account.

- Personal income tax varies according to progressive brackets; various deductions are provided:

| Type of Deduction | Maximum Deductible Amount | Eligible Examples |

|---|---|---|

| Life insurance, pension | 150,000 INR/year | Premiums, pension fund contributions |

| Tuition fees | Included in the limit | Annual fees for children |

| Housing loan interest | 200,000 INR/year | Loan for primary residence |

| Medical expenses | According to section 80D | Health premiums, major medical expenses |

VAT and Other Local Taxes

- The Value Added Tax (VAT) varies between 12% and 15%, depending on the Indian States.

- VAT/GST registration is mandatory as soon as the activity involves the sale of taxable goods or services.

Corporate Tax

Foreign companies are taxed at a standard rate of 40% on their profits earned in India.

- Additional surcharge: +2% if income exceeds ₹10 million; +5% beyond ₹100 million.

Double Taxation Avoidance Agreements

India has signed several agreements to avoid double taxation with European countries (including France), thus facilitating:

- Taking into account taxes already paid in the country of origin

- Compensation via tax credits

- Specific rules for determining the source of income

Tax Incentives for Foreign Investors

- Main incentives include:

- Full tax exemption for the first five years after establishment in certain zones or priority sectors.

- Progressive reduction thereafter up to ten years according to local schemes.

Advantages in Special Economic Zones (SEZs):

| SEZ Advantage | Description |

|---|---|

| Corporate tax exemption | Up to five years |

| Reduced rate in following years | Progressive application |

These measures aim to attract foreign direct investment and promote local innovation.

Timeframes & Administrative Tax Procedures

Main annual obligations:

- Mandatory accounting closure on March 31

- Publication of the annual financial statement

- Mandatory external audit each year

Simplified declaration procedure:

- Apply for PAN online before any tax procedure

- Register with the official “Income Tax Department” portal

- Electronic submission of declarations before the official deadline

The deadline varies by status but is generally between July and September following the closed fiscal year.

Available Specialized Resources

To optimize international tax management:

- International accounting firms present in Mumbai, Delhi, or Bangalore specialized in cross-border taxation

- Certified local advisors capable of supporting administrative procedures

- Official portals (“Income Tax Department”) with multilingual guides

Practical key points:

- Always maintain a valid local address for administrative correspondence

- Get accompanied by an expert during the initial statutory choice (sole proprietorship/Private Limited Company/Limited Liability Partnership)

- Regularly audit your situation to remain compliant with legislative changes

Good to Know:

Expatriate entrepreneurs in India must familiarize themselves with the local tax regime, including obligations related to income tax, VAT, and other taxes, depending on their resident status. Double taxation agreements in force between India and many countries allow avoiding double taxation of income. Special Economic Zones (SEZs) offer specific tax advantages, such as an income tax exemption for an initial period. The Indian government also offers tax incentives to attract foreign investment. It is crucial to respect deadlines and administrative procedures to fulfill tax obligations, which are often complex. Entrepreneurs can benefit from the services of accounting firms or specialized international tax consultants to navigate this tax environment, thus ensuring compliance and tax optimization.

Accessing Funding and Support Resources for Expatriates in India

The main funding sources available for expatriates in India include:

- Government grants: The Indian government offers financial incentives, notably through the “Make in India” and “Digital India” initiatives, which support foreign direct investment in sectors like technology, renewable energy, or pharmaceutical manufacturing. Recent budgetary reforms facilitate access to grants and simplify the regulatory process for foreign companies.

- Private investors: Angel investors now benefit from reduced taxation thanks to the abolition of the “angel tax”. Venture capital funds are also very active in major Indian cities, especially in the technology sector.

- International financial institutions: International banks present in India (HSBC, BNP Paribas), as well as organizations such as the Asian Development Bank or IFC, offer specific credit lines for projects led by foreign entrepreneurs. Furthermore, the foreign direct investment cap has been raised in several strategic sectors.

Main Support Resources for Expatriate Entrepreneurs

Business Incubators

- T-Hub (Hyderabad)

- NASSCOM Startup Warehouse (Bangalore)

- IIT Incubator Network

Coworking Spaces

- WeWork India

- Innov8

- Awfis

Entrepreneurial Networks and Mentoring

- TiE Global – international network present in India offering mentoring and access to investors.

- French Tech India – local French community dedicated to supporting French startups.

Comparative Table of Resources

| Resource | Location | Services Offered |

|---|---|---|

| T-Hub | Hyderabad | Incubation, funding |

| NASSCOM Warehouse | Bangalore | Tech support |

| WeWork | Multiple cities | Flexible coworking |

| TiE Global | National/International | Mentoring, networking |

Requirements and Necessary Administrative Procedures to Access Funding

- Legal constitution: Register a company as a private limited company or LLP; obtain a CIN (Corporate Identification Number).

- Opening a professional bank account in INR with KYC documents adapted to foreign status.

- Possible application for FDI authorization from the Indian Department for Promotion of Industry and Internal Trade if investment exceeds certain sectoral thresholds.

- Rigorous preparation of the business plan and presentation conforming to local standards when submitting to incubators or investors.

Simplified List of Key Procedures

- Draft a business plan adapted to the Indian context

- Verify sectoral eligibility according to the FDI scheme

- Obtain all legal documents translated/validated

- Register on national platforms dedicated to startup funding

Practical Tips to Maximize Chances During Funding Applications or Local Partnerships

- Adapt your project to the local market through thorough study: notably consider the strong Indian commercial pragmatism and favor a collaborative approach with influential local partners.

- Cultivate your relational network from installation via binational professional chambers, sectoral events, or recognized incubators to obtain strategic recommendations during official applications.

- Present a complete file including strong international references but also demonstrating a real willingness for sustainable integration in India (local hiring, technology transfers…).

- Systematically seek specialized legal advice before any administrative procedure to avoid costly errors related to Indian regulatory complexity.

Indian Contextual Specificities

The Indian entrepreneurial environment combines progressive openness to foreign capital thanks to various tax reforms while maintaining a demanding administrative framework; it clearly favors innovative collaborations but requires patience in the face of often long administrative delays as well as a strong ability to navigate between varied local institutional networks.

Concrete example: The recent successful establishment in a regional solar park illustrates how articulation between public subsidy (“Make in India”), localized technical partnership with a recognized Indian university, and support by a national incubator allowed raising several million USD quickly from international funds while securing necessary authorizations on site.

Good to Know:

In India, expatriates can access several funding sources to create their business, including government grants aimed at promoting entrepreneurship, private investors attracted by the dynamism of the Indian market, and international financial institutions offering loans at favorable conditions. Incubators like T-Hub in Hyderabad and coworking spaces such as WeWork in India provide essential support in terms of mentoring, networking, and logistical resources. To benefit from these opportunities, foreign entrepreneurs must often constitute an appropriate legal structure, like a private limited company, and obtain necessary authorizations via the Foreign Investment Promotion Board (FIPB) or through the Startup India portal. To maximize your chances of success, it is recommended to surround yourself with experienced local advisors, understand Indian cultural norms well, and display a strong adaptability during negotiations. The Indian context, with its diversity and sometimes complex bureaucracy, requires a proactive and well-prepared approach to differentiate yourself and succeed in your funding applications or partnerships.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.