Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

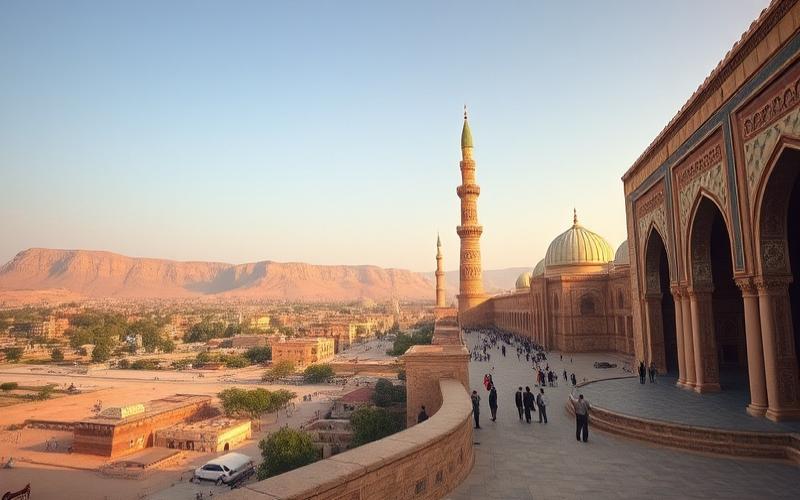

Real Estate Inheritance in Bahrain

Real estate inheritance in Bahrain holds crucial importance for families and individuals concerned with managing their assets. Thanks to a well-defined legal framework, this process ensures a smooth transition of real estate properties between generations, while respecting local traditions and legal requirements.

This article provides a detailed exploration of the complete procedure, from drafting the will to distributing assets to heirs, including administrative and tax intricacies. By understanding these steps, property owners and their families can anticipate potential challenges and ensure their inheritance intentions are respected.

Good to Know:

Real estate inheritance in Bahrain is governed by local laws that may differ from Western systems. It’s recommended to consult a local legal expert to navigate this complex process.

Understanding the Specifics of Real Estate Inheritance in Bahrain

Legal Framework of Real Estate Inheritance in Bahrain

In Bahrain, real estate inheritance is primarily governed by a set of laws that distinguish between Muslim and non-Muslim inheritances. The legal and cultural specifics largely stem from the application of Sharia for Muslims, while non-Muslims may be subject to different rules depending on their nationality or the presence of bilateral agreements.

| Category | Muslims | Non-Muslims |

| Applicable Law | Islamic Sharia (primarily Maliki school) | Civil law or law of country of origin, sometimes limited choice |

| Reserved Heirs | Yes (fixed shares defined by Sharia) | Variable, depends on applicable or chosen law |

| Foreign Will Recognized | Limited, subject to compatibility with Sharia | Possible, but registration often required |

Main Influences of Sharia on Real Estate Inheritance

- Inheritance distribution is determined by Islamic law, which precisely defines heirs’ shares according to their degree of kinship.

- Heirs’ shares are fixed and generally cannot be modified by will, except for one-third of the estate (bequest), subject to reserved heirs’ consent.

- Women generally inherit a smaller share than men of the same kinship rank.

- Children from different religions or illegitimate children may be excluded according to strict interpretation of Sharia.

Administrative Formalities

Opening the inheritance requires an application to the relevant religious courts for Muslims, or to civil courts for non-Muslims.

Registration of inherited real estate properties must be completed with Bahrain’s land registry. Required documents include a death certificate, proof of kinship relationship, inheritance judgment, and payment of registration fees.

For foreigners, real estate ownership is only permitted in designated areas (free zones) and under certain financial and administrative conditions (e.g., bank deposit, health insurance, clean criminal record).

Example Procedure for a Muslim Heir:

- Death declaration and obtaining death certificate.

- Submission of file to religious court for inheritance certificate establishment.

- Distribution of shares according to Sharia.

- Transmission of judgment to land registry for property title transfer.

International Inheritance and Foreign Property Owners in Bahrain

Foreigners can own real estate properties only in specific areas, subject to minimum investment and other administrative conditions.

Upon the death of a foreign owner, the property inheritance first follows the law of the deceased’s country of origin, unless Bahraini law imposes Sharia application (particularly if the deceased was Muslim).

International tax conventions, like the one between France and Bahrain, provide for distribution of tax jurisdiction in inheritance matters to avoid double taxation.

Registration of a foreign heir requires presentation of translated and legalized documents, as well as proof of compliance with local requirements.

Statistical Elements or Practical Cases

The majority of real estate inheritances in Bahrain involving foreigners concern residents or investors in free zones.

Dispute cases frequently arise when nationality, religion, or applicable inheritance law are not clearly established in the will or official documents.

Cultural Points to Remember

The extended family plays an important role in inheritance management, especially in the absence of a clear will.

Respect for religious traditions is paramount during inheritance settlement for Muslim families.

In Bahrain, real estate inheritance is therefore strongly influenced by Sharia for Muslims, while non-Muslims and foreigners must navigate between local law, their country of origin’s legislation, and international agreements, with strict administrative formalities for property registration and transfer.

Good to Know:

In Bahrain, real estate inheritance is governed by a legal framework influenced by Sharia, particularly for Muslim inheritances, where part of the inheritance is predetermined for direct heirs according to Islamic precepts, while non-Muslim inheritances may follow the individual’s personal laws. Property registration with the Survey and Land Registration Bureau is necessary to confirm inheritance rights. It should be noted that Bahrain applies specific procedures for international inheritances, ensuring respect for local laws while considering relevant foreign legislation, which is particularly relevant for expatriates. Recent statistics indicate a 10% increase in real estate transactions involving international inheritance elements, highlighting the growing importance of this dimension in the country.

Inheriting Property in Bahrain: Steps and Procedures

Inheritance in Bahrain is primarily governed by Islamic law (Sharia), which applies to both nationals and foreign residents for properties located in the country. Inheritance rules distinguish according to religious affiliation: Muslim inheritance mainly follows the Maliki school, while non-Muslim inheritance may be subject to their national law under specific conditions. Regarding real estate, there are particularities: only Bahraini citizens and certain Gulf Cooperation Council nationals can freely own real estate; for foreigners, ownership is strictly limited to certain designated areas.

Administrative Steps to Initiate Real Estate Inheritance in Bahrain:

- Obtain an official death certificate issued by local authorities.

- Identify or register the will (if existing) with a notary or competent court.

- Gather proof of ownership of the concerned real estate property (land title, purchase deed).

- Provide identity proof and possibly marriage or birth certificate attesting family relationship.

- Submit formal application for inheritance opening to the competent religious court (Sharia court for Muslims, civil otherwise).

| Required Document | Detail/Issuing Authority |

|---|---|

| Death Certificate | Hospital/Ministry of Health |

| Will | Notary/Court |

| Land Title | Cadastral Authority/Land Office |

| Identity Proof | Civil Administration |

| Family Proofs | Civil Status |

The process often involves several court stages: after document verification and possible hearing of stakeholders, the judge rules on the identity and respective shares of heirs according to applicable law.

The central role belongs to:

- Courts, which validate heir legitimacy and order official property transfer.

- Lawyers, whose intervention is recommended or necessary in case of dispute, complex assets, or presence of minor/incapacitated heirs.

Timeframes vary but generally range from 3 months (for simple uncontested cases) up to 1 year or more if legal challenges arise.

Regarding Taxes:

There are currently no (2025) official inheritance taxes on hereditary transfers in Bahrain, whether on movable or immovable property. However:

- Modest administrative fees may apply during cadastral transfer,

- Transfer may incur certain bank fees related to inheritance release,

- Some exemptions exist when all heirs are direct (spouse/children).

Common Obstacles Faced by Heirs:

- Difficulty locating all required original documents

- Absence/disputed uniqueness of will

- Presence of heirs residing outside Bahrain requiring legalization/apostille

- Temporary bank freeze pending inheritance judgment

- Disagreements among co-heirs regarding distribution

Practical Recommendations:

- Begin all administrative procedures promptly after death;

- Engage a local lawyer specialized in inheritance law from the outset;

- Check if an international will exists – this often greatly simplifies the procedure;

- Prepare officially certified translations if any document is not in Arabic;

- Maintain regular communication with all stakeholders to avoid future blockages;

Typical Example:

A European resident dies while owning an apartment in an area authorized for foreigners. His family must obtain all documents related to family relationship from his home country, translated into Arabic then apostilled; they then appoint a Bahraini lawyer who files with the competent court so it officially rules on their inheritance rights before effective transfer with the local notary/cadastral administration.

The current official absence of inheritance taxes does not always completely exempt from ancillary costs – anticipating these expenses remains prudent in any international estate planning.

Good to Know:

In Bahrain, real estate inheritance is governed by specific Islamic laws, with important particularities for property law, especially regarding distribution among heirs. To initiate the inheritance procedure, it’s crucial to gather a death certificate, valid will, and proof of property ownership. Bahraini courts, with the help of specialized lawyers, play a central role in inheritance oversight, with processing times that may vary depending on case complexity. Inheritance taxes may apply, although certain exemptions exist for close relatives. Heirs may encounter challenges related to document unavailability or family disputes, and assistance from a competent lawyer is recommended to anticipate these obstacles. For example, a common dispute may arise when all parties disagree on property valuation; a solution is then to call upon an expert to provide an objective appraisal.

Inheritance Rights for Foreigners in Bahrain

Current Legislation and Regulations in Bahrain Concerning Inheritances (Foreigner Focus)

In Bahrain, inheritance law is primarily governed by Islamic law (Sharia) for Muslims, while non-Muslims may have their inheritance governed by the law of the deceased’s country of origin if expressly stipulated in the will or accepted by Bahraini jurisdictions. In the absence of a will or contrary provision, Sharia applies by default, even for foreigners.

Key Points for Non-Citizens:

- Foreigners can designate, in their will, the application of their country of origin’s law for transferring their Bahraini assets.

- In the absence of a will, or if the will is not recognized, inheritance is subject to Sharia.

- Foreign heirs must generally obtain a local court decision to assert their inheritance rights.

Inheritance Procedure: Differences for Foreigners

The procedure for foreigners differs mainly on two points:

- Foreigners must provide legalized documents (death certificate, will, birth certificate, etc.) often translated into Arabic.

- Recognition of foreign decisions (inheritance judgments, notaries, etc.) depends on their compliance with Bahraini public order and Sharia.

In practice, inheritances involving foreigners are more complex, particularly in the absence of a will drafted according to local forms or international agreement.

Restrictions or Conditions for Foreigners Inheriting Real Estate

| Property Type | Access for Foreigners | Main Geographic Restrictions |

|---|---|---|

| Apartments, offices | Yes | Authorized areas: Juffair, Amwaj Islands, Reef Island, Durrat Al Bahrain, Seef District… |

| Individual villas | Yes, in certain areas | Areas designated by royal decree |

| Vacant land | Generally no | Except for foreign-capital companies |

Notes:

- Foreign heirs can only own real estate in areas expressly open to non-Bahrainis.

- If the heir doesn’t meet conditions, they may be forced to sell the property within a specified timeframe.

International Treaties and Bilateral Agreements Influencing Inheritance

Bahrain has no notable bilateral conventions regarding inheritance with most Western countries. However, some investment protection agreements provide mechanisms to facilitate asset transfer, but they don’t exempt from local inheritance procedures.

Inheritance Rights, Taxes, Exemptions

| Tax/Duty | Application in Bahrain | Exemptions or Particularities |

|---|---|---|

| Inheritance taxes | None | N/A |

| Capital gains tax | None | N/A |

| Administrative fees | Yes (court, notary) | Variable, depending on property value |

| Specific exemptions | Not provided | N/A |

- Bahrain levies no inheritance taxes or inheritance duties, whether the heir is a citizen or foreigner.

- Procedure or transfer fees may apply during property transfer.

Useful Local Resources for Foreigners

- Law firms specialized in international inheritance in Bahrain

- Public notaries (for document legalization and translation)

- Ministry of Justice, Islamic Affairs and Endowments (for judicial procedures)

- RERA (Real Estate Regulatory Authority) for real estate matters

Concrete Examples and Typical Challenges

- Example 1: A British national inherits an apartment in Amwaj Islands. They must provide a will recognized in Bahrain, obtain Bahraini court validation, then proceed with title transfer through RERA. Without a will, inheritance shares may be distributed according to Sharia.

- Example 2: A Filipino national inherits land not located in an authorized area: they must sell the property within a specified timeframe and cannot retain full ownership.

- Frequent challenge: Recognition and translation of foreign documents, slow judicial procedures, necessity to appoint a local lawyer to deal with authorities and ensure compliance with Bahraini laws.

Key Takeaways:

Foreigners can inherit in Bahrain, but are subject to area and property type restrictions, potential application of Sharia, and the obligation to go through local jurisdictions. No inheritance taxes are levied, but consulting local professionals is strongly advised to avoid administrative and legal pitfalls.

Good to Know:

In Bahrain, inheritance rights are governed by specific laws that apply to both citizens and foreigners, although notable differences exist for the latter. Non-citizens may be subject to restrictions regarding inheritance of real estate, limited mainly to certain geographic areas and property types, such as residential properties in designated investment zones. International treaties or bilateral agreements, particularly with some Gulf Cooperation Council countries, may sometimes simplify the process for concerned nationals. Payable inheritance rights may include specific taxes and fees, but exemptions are possible, for example for Bahraini spouses or children of foreigners. To effectively navigate these legal complexities, consulting lawyers specialized in property law or local government services, such as the Ministry of Justice, is recommended. In practice, examples show that some foreigners face additional delays or unexpected fees during inheritance, illustrating the importance of understanding the rules before engaging in the process.

The Crucial Role of the Notary in International Inheritance

Specific Skills Required to Manage International Inheritance in Bahrain:

- Mastery of private international law and inheritance legislation applicable in Bahrain and the heirs’ or deceased’s countries of origin.

- Ability to interpret and apply different rules according to nationality, habitual residence, or asset location.

- Competence in verifying and authenticating civil status documents, wills, property deeds, and other multilingual supporting documents.

- Experience coordinating with foreign notaries, lawyers, or authorities to collect information and ensure document compliance.

- Aptitude for managing complex situations involving multiple heirs residing in different jurisdictions.

Notary Importance:

The notary is a central actor in guaranteeing the legality and efficiency of asset transfers in Bahrain. Their intervention:

- Secures real estate or movable property transfer.

- Guarantees procedure compliance with national and international laws.

- Protects heir interests and limits risks of challenge or fraud.

Administrative and Legal Steps by the Notary to Resolve Cross-Border Complexities:

| Step | Notary Action |

|---|---|

| Determination of applicable law | Analysis of nationality, deceased’s residence, and asset location to choose relevant legislation |

| Document collection and verification | Control of will authenticity, property deeds, death certificates, and other official documents from different countries |

| Recognition of inheritance rights | Official identification of legal or testamentary heirs, establishment of notarial certificate or equivalent |

| Real estate or movable transfer | Drafting property transfer deed compliant with local and international requirements |

| International collaboration | Communication with foreign counterparts to obtain necessary documents or information, verification of foreign-established deed compliance |

Facilitating Communication Between International Parties:

- Translation and explanation of legal documents to foreign heirs.

- Coordination of exchanges between heirs, lawyers, and notaries from different countries.

- Mediator role in case of conflict or misunderstanding between parties from different cultures or legal systems.

Establishment of Legal Documents and Protection of Stakeholder Interests:

- Drafting and verification of wills, distribution deeds, notarial certificates, and property registers.

- Verification that each heir’s rights are respected according to applicable law.

- Ensuring all tax and administrative obligations are fulfilled (e.g., payment of inheritance taxes in Bahrain and countries of origin).

- Guarantee that assets are effectively transferred and registered in beneficiaries’ names.

Specific Examples or Typical Cases:

Case 1: A French national deceased, residing in Bahrain, leaves real estate in Bahrain and France: the notary determines applicable law, requests French death certificates and wills, authenticates documents in Bahrain, and coordinates property transfer in each country.

Case 2: Heirs living in the United States, France, and Bahrain: the notary centralizes communication, collects necessary consents and signatures, verifies each document’s compliance, and ensures property transfers meet all three countries’ requirements.

Case 3: Presence of a will drafted abroad: the notary verifies will validity according to Bahraini and foreign law, proceeds with certified translation, then executes the deceased’s wishes.

Summary of Key Notary Missions in International Inheritance in Bahrain:

- Comparative legal analysis

- Document verification and authentication

- Cross-border coordination

- Drafting of legal acts and transfer deeds

- Protection of heir rights and interests

- Guarantee of tax and administrative compliance

The notary’s role is thus indispensable for providing security, transparency, and efficiency during international inheritance settlement in Bahrain.

Good to Know:

In real estate inheritance in Bahrain, the notary plays an essential role by guaranteeing the legality and efficiency of property transfers between multiple jurisdictions. Using their skills in private international law, the notary navigates through divergent inheritance laws, coordinating administrative and legal steps such as verifying will validity or establishing property registers compliant with local legislation. By securing communication between international parties, the notary prevents misunderstandings and protects heir interests, even when concerned parties are in different countries, for example, when an heir resides outside Bahrain and assets are scattered across several jurisdictions. A typical case might include managing assets of a deceased expatriate where the notary ensures the individual’s wishes are executed according to the respective laws of each concerned country.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.