Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

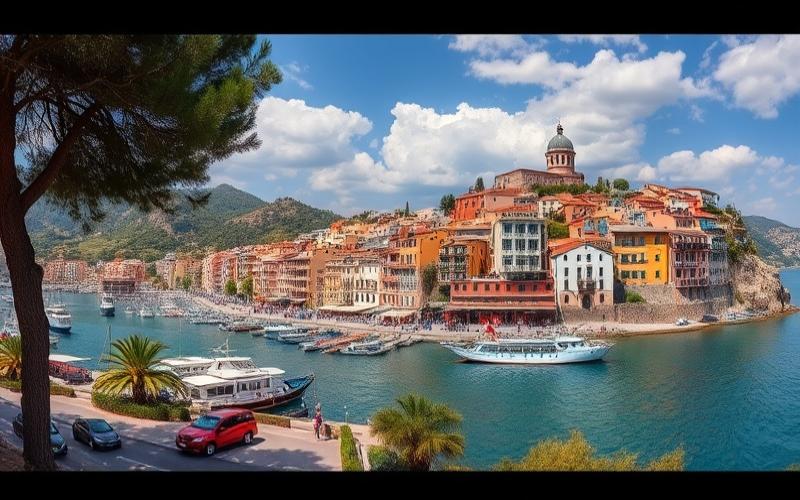

Greece, with its recovering economy and strategic location at the crossroads of Europe, Africa, and Asia, is attracting more and more foreign entrepreneurs. However, before embarking on the Hellenic entrepreneurial adventure, it’s crucial to fully understand the costs associated with establishing a company in this Mediterranean country. This article will guide you through the various expenses to anticipate and offer strategies to optimize your investment.

Initial Outlay: Essential Registration Fees

When you decide to establish a company in Greece, the first step involves paying registration fees. These costs vary depending on the type of company you wish to set up, but they typically range between €700 and €1,500 for a Limited Liability Company (EPE) or a Public Limited Company (AE).

Main registration fees include:

- Notary fees for drafting and authenticating company statutes (approximately €300-500)

- Registration fees with the Commercial Registry (GEMI) (approximately €150-250)

- Publication fees in the Official Gazette (approximately €100-200)

- Fees for obtaining a tax identification number (AFM) (free, but requires administrative procedures)

It’s important to note that these fees may vary slightly depending on the region where you establish your company and the complexity of your business structure. For example, if you opt for a Single-Member Private Capital Company (IKE), costs may be slightly lower, while a Public Limited Company with significant share capital could result in higher fees.

Additionally, you should budget for extra fees to open a professional bank account, which is mandatory for all companies in Greece. Greek banks typically charge between €50 and €100 for this service.

Good to know:

Registration fees in Greece are relatively competitive compared to other European countries, but it’s essential to budget at least €1,000 to €2,000 to cover all initial registration and compliance costs.

Staying Compliant: Compliance Costs Not to Overlook

Once your company is registered, you’ll face recurring costs to maintain compliance with Greek legislation. These expenses are essential to avoid penalties and ensure the proper functioning of your business.

Main compliance costs include:

- Fees for a certified accountant for bookkeeping and tax return preparation (approximately €200-500 per month, depending on company size and complexity)

- Annual audit fees for companies exceeding certain revenue or balance sheet thresholds (starting from €3,000 per year)

- Social security contributions for directors and employees (approximately 25% of gross salary)

- Renewal fees for licenses and permits specific to your industry

It’s crucial not to underestimate these compliance costs, as they can represent a significant portion of your operational expenses. In Greece, tax audits are frequent, and penalties for non-compliance can be severe.

Additionally, Greek legislation requires companies to file annual financial reports with GEMI. While the filing itself is free, preparing these reports often requires professional intervention, resulting in additional costs.

To minimize these costs, consider the following strategies:

- Opt for a simplified business structure like IKE if your activity allows it

- Use modern accounting software to facilitate bookkeeping

- Train yourself in the basics of Greek regulations to reduce dependence on external consultants

Good to know:

Budget at least €5,000 to €10,000 annually for compliance costs of a small business in Greece. This amount can increase significantly for larger companies or those operating in heavily regulated sectors.

Investing for Success: Required Initial Investment

The initial investment to establish a company in Greece goes well beyond mere registration fees. It’s essential to allocate sufficient capital to cover expenses for the first months of operation and ensure your business’s viability.

Main elements of the initial investment include:

- Minimum required share capital (€1 for IKE, €4,500 for EPE, €25,000 for AE)

- Commercial property rental or purchase costs (variable by location, but average €10-15/m²/month in major cities)

- Office equipment and furniture (minimum budget of €3,000 to €5,000)

- Technology and software investments (starting from €1,000 for basic needs)

- Marketing and communication expenses for launch (recommended budget of at least €5,000)

It’s important to note that the Greek real estate market offers interesting opportunities for foreign investors. Commercial property prices remain attractive compared to other European destinations, although they have increased in recent years, particularly in tourist areas and major cities.

To optimize your initial investment, consider the following options:

- Start with a lightweight business structure like IKE, which requires only symbolic share capital

- Explore shared office or coworking space rental possibilities to reduce initial real estate costs

- Invest in scalable technology solutions that can adapt to your business growth

- Use social media and digital marketing to promote your business at lower cost

Good to know:

For a small business in Greece, plan for an initial investment of at least €30,000 to €50,000, in addition to required share capital. This amount can vary considerably depending on your industry and growth ambitions.

Managing Daily Operations: Anticipating Operational Expenses

Once your company is created and operational, you’ll face recurring expenses to maintain your business. These operational costs can vary considerably depending on your company’s nature, size, and location.

Main operational expenses to anticipate include:

- Salaries and social charges (minimum wage in Greece is approximately €780 gross per month in 2025)

- Rent and lease charges (variable by location, but average €10-15/m²/month in major cities)

- Electricity, water, and telecommunications fees (monthly budget of approximately €200-500 for a small business)

- Professional insurance (starting from €500 per year)

- Transportation and logistics costs

- Ongoing marketing and communication expenses

It’s important to note that the cost of living and doing business in Greece remains relatively affordable compared to other Western European countries. However, certain costs, particularly energy and telecommunications, may be higher than the European average.

To control your operational expenses, consider the following strategies:

- Optimize energy consumption by investing in low-consumption equipment and training employees in energy savings

- Negotiate long-term contracts with suppliers to benefit from preferential rates

- Explore teleworking possibilities to reduce office costs

- Use online management tools to automate certain administrative tasks

Good to know:

Monthly operational expenses for a small business in Greece can range between €3,000 and €10,000, excluding salaries. It’s crucial to maintain sufficient cash flow to cover at least 6 months of operational expenses.

Optimizing Your Budget: Effective Cost Reduction Strategies

In a competitive economic environment, cost control is essential to ensure the profitability and sustainability of your business in Greece. Here are some effective strategies to reduce your expenses without compromising operational quality:

1. Take advantage of tax incentives and grants: Greece offers various incentive programs to attract foreign investment. For example, the “Golden Visa” program allows non-European investors to obtain a residence permit in exchange for a real estate investment of at least €250,000. Additionally, certain sectors like information technology and renewable energy benefit from tax reductions and grants.

2. Optimize your legal structure: Choose the legal form most suited to your activity. For example, IKE (Single-Member Private Capital Company) offers great flexibility and reduced management costs for small businesses.

3. Leverage special economic zones: Greece has established several special economic zones, particularly in the ports of Piraeus and Thessaloniki, offering tax and customs advantages to businesses that establish themselves there.

4. Adopt technological solutions: Invest in online management tools and productivity software to reduce administrative costs and improve operational efficiency.

5. Form strategic partnerships: Collaborate with other local businesses to share resources, reduce costs, and access new markets.

6. Optimize your tax management: Greece offers competitive tax rates (currently 22% for corporate tax in 2025), but careful tax planning can help you achieve additional savings. Consult a local tax expert to explore all legal tax reduction options.

7. Leverage local human resources: Greece has a skilled and relatively affordable workforce. Consider hiring locally rather than expatriating staff, which can be costly.

8. Negotiate your lease contracts: The Greek real estate market still offers interesting opportunities. Don’t hesitate to negotiate the terms of your commercial lease, especially for long-term commitments.

Good to know:

Implementing these cost reduction strategies can help you save between 20% and 30% on your annual operational expenses. However, it’s crucial to maintain a balance between cost reduction and the quality of your products or services.

Creating and managing a company in Greece can be an exciting and potentially lucrative adventure. Although initial and operational costs may seem significant, they remain competitive compared to many other European countries. The key to success lies in careful planning, rigorous financial management, and a thorough understanding of the local market.

By considering registration fees, compliance costs, initial investment, and operational expenses, you can establish a realistic budget for your entrepreneurial project in Greece. Remember that every business is unique, and it’s always recommended to consult local experts for personalized advice tailored to your specific situation.

Greece, with its recovering economy, strategic location, and tourist attractions, offers numerous opportunities for visionary entrepreneurs. By mastering your costs and leveraging the advantages offered by the country, you can position your business for sustainable growth in this dynamic Mediterranean market.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.