Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Greece offers numerous opportunities for foreign entrepreneurs looking to establish their business there. However, embarking on an entrepreneurial venture in a foreign country comes with its share of challenges and pitfalls to avoid. Here is a comprehensive guide to common mistakes not to make when creating your business in Greece, along with tips for a successful establishment.

A Flawed Business Plan: The Entrepreneur’s Original Sin

One of the most frequent and damaging mistakes when starting a business in Greece is neglecting the crucial planning phase. Too many entrepreneurs dive in headfirst without sufficiently studying the Greek market and its specificities.

A solid business plan is the cornerstone of your project. It should include an in-depth analysis of the Greek market, local competition, as well as a detailed strategy for penetrating this market. Foreign entrepreneurs must particularly consider cultural specificities and Greek consumer habits.

Moreover, your business plan should present realistic financial projections for at least 3 years. According to a study by the Athens Chamber of Commerce and Industry, 40% of new businesses in Greece close within the first 3 years, often due to overly optimistic forecasts.

Do not hesitate to consult local experts to help refine your business plan. Specialized consulting firms like Deloitte Greece offer support services for foreign entrepreneurs.

Good to know:

Allow at least 3 to 6 months to develop a solid business plan tailored to the Greek market. It’s an investment that will significantly increase your chances of success.

Risky Financial Management: The Trap for Overconfident Entrepreneurs

Another fatal mistake is underestimating cash flow needs and mismanaging finances, especially in the first months of operation. Greece has experienced a major economic crisis and the context remains fragile, requiring impeccable financial management.

Ensure you have sufficient reserves to cover at least 6 months of expenses. Payment delays in Greece can be lengthy, averaging up to 60 days according to the European Payment Delay Observatory. Therefore, plan for substantial cash flow to absorb these delays.

It is also crucial to master Greek taxation, which can be complex for a foreigner. The corporate tax rate is currently 22%, but there are numerous taxes and social contributions to consider. Seek guidance from a local accountant to optimize your tax situation legally.

Finally, do not neglect financial management tools. Use accounting software adapted to the Greek market like Softone or Entersoft to track your finances daily.

Good to know:

The Bank of Greece recommends that new businesses plan a cash reserve equivalent to at least 20% of their projected annual revenue.

In the Greek Administrative Maze: Beware of Regulatory Missteps

Greek bureaucracy can be a real headache for foreign entrepreneurs. Neglecting regulatory aspects is a mistake that can be costly, both financially and in terms of lost time.

Make sure you fully understand all the necessary administrative steps to create and manage your business in Greece. Procedures have been simplified in recent years but remain complex. For example, obtaining a tax identification number (AFM) is essential and can take several weeks.

Also be aware of sector-specific regulations. Certain fields like tourism, hospitality, or healthcare are subject to strict regulations. Inquire with competent authorities like the Ministry of Development and Investments.

Do not hesitate to hire a lawyer specialized in Greek business law to guide you through the process. Firms like Zepos & Yannopoulos offer dedicated services for foreign entrepreneurs.

Good to know:

The gov.gr portal centralizes many administrative procedures online. Use it to save time and simplify your processes.

David vs. Goliath: Don’t Underestimate Your Local Competitors

A common mistake among foreign entrepreneurs is underestimating local competition in Greece. The Greek market may seem small, but it is often highly competitive, with well-established local players.

Conduct a thorough competitive analysis before launching. Identify your main competitors, their strengths and weaknesses. Study their positioning, marketing strategy, and reputation among Greek consumers.

Remember that local companies benefit from better market knowledge and established networks. To stand out, focus on innovation and service quality. According to a study by IOBE (Foundation for Economic and Industrial Research), 72% of Greek consumers are willing to pay more for innovative products or services.

Also consider strategic partnerships with local players. This can help you penetrate the market faster and benefit from their expertise.

Good to know:

The Franco-Hellenic Chamber of Commerce and Industry regularly organizes networking events. Participate to meet potential partners and better understand your competitive environment.

Winning Strategies: Keys to Your Successful Establishment in Greece

To avoid these common mistakes and maximize your chances of success, here are some strategies to implement:

1. Invest in Meticulous Preparation

Take the time to prepare thoroughly before launching. This involves:

- An in-depth market study

- A detailed and realistic business plan

- A good understanding of the Greek legal and tax environment

- Learning the basics of the Greek language, a significant asset

2. Build a Strong Local Team

Surround yourself with competent Greek professionals. This can include:

- A lawyer specialized in business law

- An accountant mastering Greek taxation

- A human resources consultant to assist with your recruitment

3. Adopt Rigorous Financial Management

- Implement appropriate financial tracking tools

- Plan sufficient cash flow for the first months of operation

- Be vigilant about payment deadlines and managing unpaid invoices

4. Cultivate Your Local Network

Networking is crucial in Greece. Actively participate in professional events, join entrepreneur associations. The Athens Chamber of Commerce and Industry regularly organizes business meetings that can be very useful.

5. Adapt Your Offer to the Greek Market

Don’t just transfer your existing model. Adapt your offer to the specificities of the Greek market, considering local consumption habits and Greek customer expectations.

Good to know:

Enterprise Greece, the official investment promotion agency, offers free support services for foreign entrepreneurs. Do not hesitate to contact them to benefit from their expertise.

Conclusion: Transforming Challenges into Opportunities

Starting a business in Greece may seem like a significant challenge, but with adequate preparation and a good understanding of the pitfalls to avoid, you can turn these obstacles into opportunities.

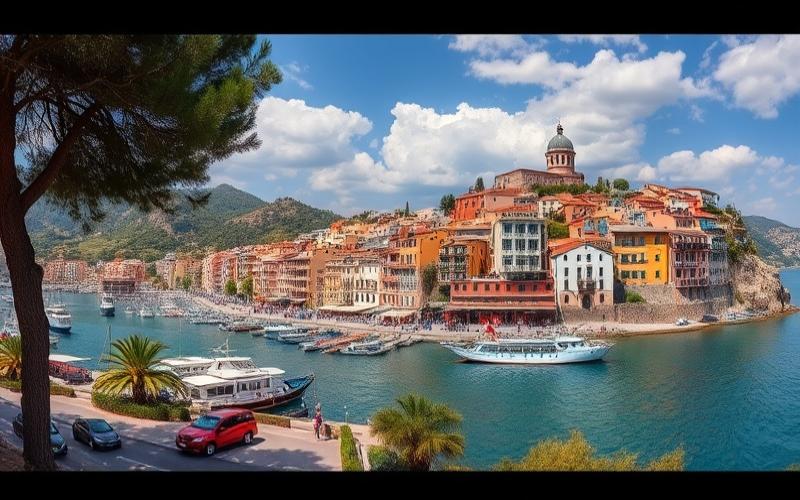

Greece offers many advantages for foreign entrepreneurs: a strategic position at the crossroads of Europe, the Middle East, and North Africa, a relatively low cost of living, and an attractive living environment. Moreover, the Greek government has implemented incentive measures in recent years to attract foreign investors, particularly in tourism, technology, and renewable energy sectors.

By avoiding the common mistakes mentioned in this article and following the recommended strategies, you will maximize your chances of success in the Greek market. Remember that patience and perseverance are essential qualities: it takes time to establish yourself sustainably in a new market.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.