Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

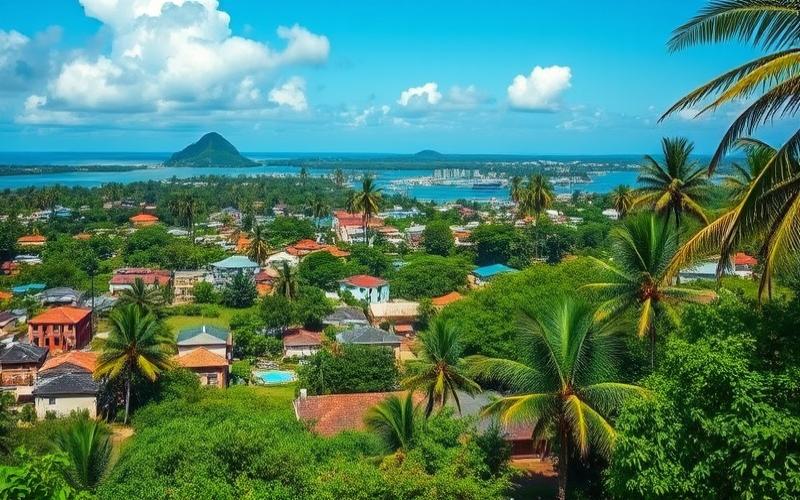

The Dominican Republic is attracting more and more foreign entrepreneurs thanks to its dynamic economy and business-friendly environment. However, before getting started, it’s crucial to fully understand the costs associated with starting a business in this Caribbean country. Let’s take a detailed look at the different financial aspects to consider for launching your venture with peace of mind.

Essential Fees for Formalizing Your Business

The first step to creating your company in the Dominican Republic is to officially register it with the competent authorities. This process involves several fees to anticipate:

– Business Name Reservation: approximately $100 USD – Registration with the National Taxpayers Registry: $350-$500 USD – Obtaining a Tax Identification Number: $150-$200 USD – Trademark Registration (optional but recommended): $150-$300 USD

In total, budget between $750 and $1100 USD for basic registration fees. These amounts may vary slightly depending on the type of company chosen and the complexity of your structure.

It’s important to note that these fees only cover the administrative aspect of the creation. Other expenses will be added to make your business fully operational.

Good to Know:

Hiring a local lawyer specialized in business law can save you valuable time in these administrative procedures, even if it represents an additional cost.

Becoming Compliant: A Necessary Investment

Once your company is officially registered, you’ll need to ensure its compliance with Dominican regulations. This involves several expenses not to be overlooked:

– Obtaining Licenses and Permits Specific to Your Activity: $200-$1000 USD depending on the sector – Setting Up an Accounting System Meeting Local Standards: $500-$1500 USD – Document Translation and Legalization Fees: $100-$300 USD per document – Mandatory Insurance: variable depending on your activity, but budget at least $500 USD/year

These compliance costs may seem high initially, but they are essential to operate legally and avoid future complications with Dominican authorities.

Investing in compliance from the start will save you many headaches later and allow you to focus peacefully on developing your business.

Good to Know:

Some free trade zones offer tax benefits and simplified procedures that can reduce these compliance costs. Inquire about opportunities in your industry.

The Lifeblood: Initial Investment

Beyond administrative fees, starting a business in the Dominican Republic requires a substantial initial investment to concretely launch your activity. Here are the main items to budget for:

– Minimum Share Capital: There is no legal minimum amount, but plan for at least $10,000 USD to be credible with partners and authorities.

– Office Rental: $500-$2000 USD/month depending on location and size – Equipment and Furniture: $5000-$20,000 USD depending on your needs – Staff Recruitment and Training: $2000-$5000 USD for the first months – Website Development and Marketing Tools: $1000-$5000 USD

The total initial investment can thus range between $20,000 and $50,000 USD for a small structure, and easily exceed $100,000 USD for a more ambitious company.

It’s crucial to properly assess your actual needs and establish a detailed business plan to avoid financial surprises.

Good to Know:

Many Dominican banks offer loans to newly created businesses. Explore these financing options to ease your initial investment.

Your Business’s Daily Operations: Master Your Operating Expenses

Once your company is launched, you’ll need to handle recurring expenses to ensure its proper functioning. Here’s an estimate of the main items to budget for monthly:

– Rent and Utilities: $500-$2000 USD – Salaries and Social Charges: $300-$1000 USD per employee – Telecommunications and Internet: $100-$300 USD – Electricity: $200-$500 USD (be aware of frequent outages) – Accounting and Legal Services: $300-$1000 USD – Marketing and Advertising: variable, but budget at least $500 USD

In total, monthly operating expenses can range between $2000 and $10,000 USD depending on the size and activity of your company.

It’s essential to properly control these recurring costs to ensure the sustainability of your business, especially in the first months when revenue may still be limited.

Good to Know:

The Dominican Republic offers competitive labor costs compared to other Caribbean destinations. Take advantage of this to build a qualified local team at advantageous rates.

Optimize Your Budget: Our Tips for Reducing Costs

Starting a business in the Dominican Republic represents a significant investment, but there are several strategies to optimize your expenses:

1. Choose a Coworking Space rather than dedicated offices in the first months. You’ll save on rent while benefiting from a professional environment.

2. Outsource Certain Functions like accounting or marketing to local providers rather than hiring full-time.

3. Take Advantage of Tax Incentives offered in certain sectors like tourism or renewable energy. Inquire with the Export and Investment Center (CEI-RD).

4. Negotiate Local Partnerships to share certain costs or benefit from preferential rates with suppliers.

5. Invest in Renewable Energy Solutions (solar panels for example) to reduce your electricity bills in the long term.

By applying these strategies, you can potentially reduce your costs by 20 to 30% without compromising the quality of your business.

Good to Know:

The Dominican government regularly offers assistance programs for SMEs. Stay alert for these opportunities to benefit from grants or loans with advantageous rates.

Starting a business in the Dominican Republic certainly represents a substantial initial investment, but the growth opportunities in this dynamic market can quickly make it profitable. By carefully planning your budget and optimizing your costs, you’ll maximize your chances of success in your entrepreneurial adventure in the Caribbean.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.