Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

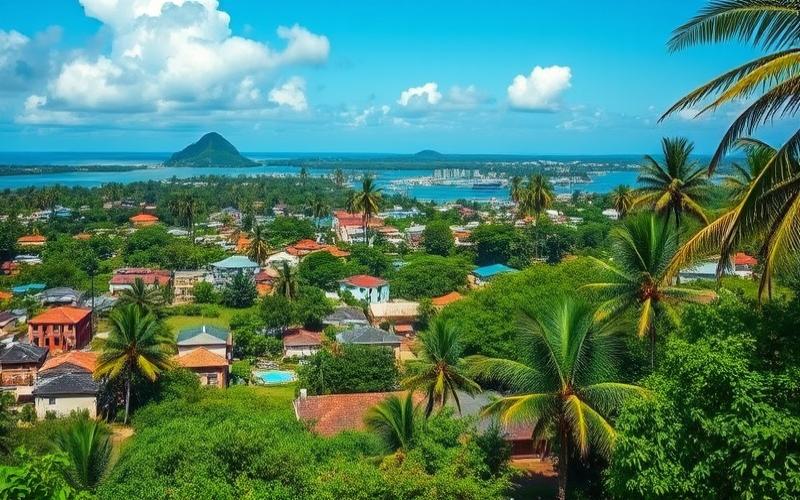

In recent years, the Dominican Republic has become an increasingly popular destination for entrepreneurs and foreign investors seeking to benefit from favorable taxation in the Caribbean. With its competitive tax framework and simplified procedures, the country offers numerous advantages for businesses looking to optimize their tax burden. Let’s explore the main aspects of corporate taxation in the Dominican Republic and the benefits it offers compared to other offshore jurisdictions.

A Favorable Tax System for Businesses

The Dominican Republic has established an attractive tax regime for corporations, with moderate tax rates and numerous tax incentives. The main taxes that businesses are subject to include:

Corporate Tax: The standard rate is 27% on profits. However, many exemptions and reductions are available, particularly for companies established in free zones that can benefit from full exemption for 15 years.

VAT: Called ITBIS in the Dominican Republic, its standard rate is 18%. Certain essential goods and services benefit from reduced rates.

Social Security Contributions: Employers must contribute approximately 7.10% of their employees’ gross salary for social insurance.

Asset Tax: It amounts to 1% of the net value of the company’s assets.

Customs Duties: They vary by product but are generally between 0% and 20% for imports.

Property Tax: It applies to real estate properties with a rate of 1% on the value exceeding 7.7 million Dominican pesos.

It’s important to note that many exemptions and tax incentives exist, particularly for exporting companies, those in the tourism sector, or companies established in free zones. These tax benefits can significantly reduce the tax burden for eligible businesses.

Good to Know:

Companies operating in free zones can benefit from a complete corporate tax exemption for 15 years, along with other substantial tax advantages.

Setting Up Your Business and Registering with the Dominican Tax Authorities: A Simplified Procedure

The Dominican Republic has implemented simplified procedures to facilitate the registration of foreign businesses. Here are the main steps to follow:

1. Choose the legal form of the business (SA, LLC, branch, etc.)

2. Reserve the company name with the National Office of Industrial Property (ONAPI)

3. Draft and authenticate the company’s articles of incorporation

4. Register with the Chamber of Commerce and Production

5. Obtain the tax identification number (RNC) from the General Directorate of Internal Taxes (DGII)

6. Register with the National Taxpayer Registry

7. Open a bank account in the company’s name

8. Obtain the necessary licenses and permits according to the business activity

All these steps can typically be completed within a few weeks. Many law firms and consulting practices offer services to assist foreign entrepreneurs with these formalities.

A Single Window to Simplify Procedures

To further facilitate business creation, the Dominican government has established a single window called “Formalízate.” This online platform allows most registration procedures to be completed centrally and digitally.

Good to Know:

Thanks to the “Formalízate” single window, it’s possible to set up your business and obtain your tax number in just 7 business days on average.

Corporate Tax Obligations: A Clear Regulatory Framework

Once registered, businesses operating in the Dominican Republic must comply with certain tax obligations:

Monthly Filings: Companies must submit monthly declarations for VAT, payroll withholding taxes, and corporate tax advance payments.

Annual Corporate Tax Return: It must be filed within 120 days after the fiscal year closing, typically April 30th for companies closing on December 31st.

Accounting Maintenance: Companies are required to maintain accounting records in compliance with Dominican standards and retain their accounting documents for 10 years.

Electronic Invoicing: The Dominican Republic is in the process of generalizing the use of electronic invoicing for all businesses.

Tax Audit: Large companies may be subject to regular tax audits.

It’s recommended to engage a local accounting expert to ensure compliance with all these tax obligations. Many firms offer accounting and tax management services tailored to foreign businesses.

Penalties for Non-Compliance

Failure to comply with tax obligations can result in significant financial penalties, ranging from 10% to 100% of taxes due, plus late payment interest. In the most serious cases, criminal proceedings may be initiated.

Good to Know:

The General Directorate of Internal Taxes (DGII) offers online assistance services and free training to help businesses comply with their tax obligations.

International Tax Agreements: An Advantage for Avoiding Double Taxation

The Dominican Republic has signed several tax treaties aimed at avoiding double taxation and preventing tax evasion. These agreements facilitate international trade and investments. The main countries with which the Dominican Republic has concluded tax treaties include:

– Canada – Spain – France – United Kingdom – United States (limited agreement)

These treaties generally provide for reduced withholding tax rates on dividends, interest, and royalties paid between signatory countries. They also define rules for taxing cross-border income to avoid double taxation.

Automatic Exchange of Tax Information

The Dominican Republic has committed to implementing automatic exchange of tax information under the OECD’s Common Reporting Standard (CRS). The first information exchanges began in 2020, thereby strengthening international tax transparency.

Good to Know:

Thanks to the tax treaty with France, French companies established in the Dominican Republic can benefit from a tax credit for taxes paid locally, thus avoiding double taxation.

The Dominican Republic Compared to Other Tax Havens: A Competitive Positioning

Compared to other renowned offshore jurisdictions, the Dominican Republic offers several advantages:

An Attractive Tax Framework: With its 27% corporate tax rate and numerous exemptions, the Dominican Republic positions itself advantageously compared to destinations like the Bahamas (0% tax but high operational costs) or Panama (25% corporate tax).

Political and Economic Stability: Unlike some tax havens facing international pressures, the Dominican Republic enjoys a good reputation and stability appreciated by investors.

Strategic Market Access: Its geographical position offers privileged access to North American and Latin American markets, an advantage compared to more isolated jurisdictions like the Cayman Islands.

Competitive Operational Costs: Labor and real estate costs remain advantageous compared to other offshore destinations like Singapore or Hong Kong.

A Continuously Improving Regulatory Framework: Dominican authorities are actively working to improve the business climate, with regular reforms to simplify administrative procedures.

Nevertheless, the Dominican Republic faces certain challenges, particularly in terms of infrastructure and workforce training, which may disadvantage it compared to more developed jurisdictions like Dubai or Ireland.

Good to Know:

The Dominican Republic regularly ranks in the top 10 best destinations for foreign investment in Latin America according to international rankings.

Conclusion: The Dominican Republic, A Smart Choice for Tax Optimization

The Dominican Republic offers an attractive tax framework for foreign businesses, combining moderate tax rates, numerous tax incentives, and simplified administrative procedures. Its strategic geographical positioning and political stability make it an interesting alternative to traditional tax havens.

However, as with any international tax optimization strategy, it’s crucial to thoroughly evaluate all legal, tax, and operational aspects before establishing operations in the Dominican Republic. Support from local experts is highly recommended to effectively navigate the country’s tax and regulatory environment.

With its tax and economic advantages, the Dominican Republic stands out as a destination of choice for businesses seeking to optimize their taxation while benefiting from a favorable business environment in the Caribbean.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.