Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

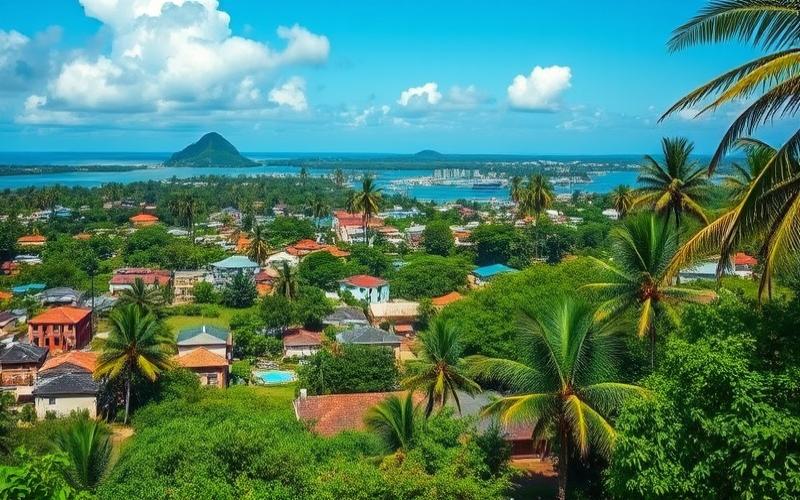

The Dominican Republic, a Caribbean country sharing the island of Hispaniola with Haiti, has experienced significant economic growth in recent years. This development has been accompanied by a gradual modernization of its labor law, aiming to balance employer interests with the protection of workers’ rights. Let’s dive into the specifics of Dominican labor law, a crucial topic for any company considering establishing operations in this country with promising economic potential.

Employment Contracts: The Cornerstone of Professional Relationships

In the Dominican Republic, employment contracts are governed by the Labor Code (Código de Trabajo), established in 1992 and regularly updated. This legal framework defines the rights and obligations of employers and employees, thus ensuring a solid foundation for labor relations.

Employment contracts can be written or verbal, but the written form is strongly recommended to avoid any disputes. There are several types of contracts:

- Indefinite-term contract: This is the most common form, offering long-term stability to employees.

- Fixed-term contract: Limited in duration, it is used for specific projects or temporary replacements.

- Seasonal contract: Commonly used in the tourism and agriculture sectors.

- Apprenticeship contract: Intended for young people in vocational training.

An important aspect of Dominican labor law is the probation period. It is generally three months, during which the employer or employee can terminate the contract without notice or compensation. This provision offers some flexibility to companies while allowing employees to evaluate their new work environment.

The legal working hours are set at 44 hours per week, spread over 5 or 6 days. Beyond that, hours are considered overtime and must be paid at a higher rate.

Good to know:

In the Dominican Republic, employment contracts are presumed to be indefinite-term unless proven otherwise. This presumption aims to protect workers’ rights by ensuring them certain employment stability.

Social Obligations: An Evolving System for Better Protection

The Dominican social security system has undergone significant reforms in recent years, aiming to improve the coverage and quality of benefits offered to workers. Employers are required to register with the social security system and enroll their employees.

The main components of the social security system are:

- Old-age, disability, and survivors insurance

- Health and maternity insurance

- Occupational risk insurance

Contributions are shared between the employer and employee, with a larger portion borne by the employer. In 2025, the contribution rates are as follows:

- Old-age insurance: 7.10% for the employer, 3.28% for the employee

- Health insurance: 7.09% for the employer, 3.04% for the employee

- Occupational risk insurance: 1.20% exclusively borne by the employer

It is important to note that the Dominican social security system also covers foreign workers, provided they are legally residing in the country. This provision is particularly relevant for international companies wishing to establish operations in the Dominican Republic with their own staff.

Maternity leave is set at 14 weeks, with 6 weeks before childbirth and 8 weeks after. During this period, the employee receives her full salary, funded by the social security system.

Good to know:

The Dominican Republic recently introduced a voluntary supplementary pension system, allowing employers and employees to supplement the basic pension from the public system. This initiative aims to improve the financial protection of workers in retirement.

Minimum Wage: A Tool for Combating Poverty

In the Dominican Republic, the minimum wage is set by economic sector and periodically reviewed by the National Wage Committee. This sectoral approach allows for consideration of the specificities of each branch of the economy.

As of January 1, 2025, the main monthly minimum wages are as follows:

- Non-sectorized private sector: 21,000 Dominican pesos (approximately $360 USD)

- Export free zone: 18,500 Dominican pesos (approximately $320 USD)

- Public sector: 17,000 Dominican pesos (approximately $290 USD)

- Agricultural sector: 15,500 Dominican pesos (approximately $265 USD)

It is important to note that these amounts are subject to regular revisions to account for inflation and changes in the cost of living. Employers are required to comply with these minimums under penalty of sanctions.

The minimum wage plays a crucial role in combating poverty and improving the living conditions of Dominican workers. However, it remains a subject of debate, with some arguing that it is still insufficient to cover basic needs, while others fear that too rapid an increase could hinder business competitiveness.

Good to know:

In addition to the minimum wage, Dominican employers are required to pay a 13th-month salary, called “salario de Navidad” (Christmas bonus). This bonus, equivalent to one month’s salary, must be paid between December 1st and 20th of each year.

Average Wages: An Indicator of Economic Development

Although the minimum wage is an important indicator, average wages provide a more complete picture of the Dominican labor market. In recent years, there has been an upward trend in average wages, reflecting the country’s economic growth.

According to data from the National Statistics Office (ONE), in 2025, the average monthly salary in the Dominican Republic is about 30,000 Dominican pesos (approximately $515 USD). However, there are significant disparities depending on economic sectors and skill levels:

- Financial and insurance sector: 45,000 – 60,000 pesos ($770 – $1,030 USD)

- Information technology: 40,000 – 55,000 pesos ($685 – $945 USD)

- Manufacturing industry: 25,000 – 35,000 pesos ($430 – $600 USD)

- Tourism and hospitality: 20,000 – 30,000 pesos ($345 – $515 USD)

It is important to note that these figures are averages and can vary considerably depending on experience, skills, and geographic location. Wages are generally higher in large cities like Santo Domingo and Santiago than in rural areas.

The trend of increasing average wages reflects not only the country’s economic growth but also the government’s efforts to attract foreign investment and develop high-value-added sectors, such as information technology and financial services.

Good to know:

Despite the increase in average wages, the pay gap between men and women remains a challenge in the Dominican Republic. The government has implemented initiatives to promote pay equality, but progress remains to be made in this area.

Wage Skills: A Changing Labor Market

The Dominican labor market is evolving rapidly, with growing demand for certain specific skills. This dynamic directly influences compensation levels and offers interesting opportunities for skilled workers.

The most sought-after and therefore best-paid sectors and skills are:

- Information technology: developers, cybersecurity engineers, artificial intelligence specialists

- Luxury tourism and hospitality: multilingual managers, digital marketing specialists

- Renewable energy: engineers specialized in solar and wind energy

- Financial services: financial analysts, regulatory compliance experts

- Healthcare: specialist doctors, qualified nurses

Proficiency in English is increasingly valued and can significantly increase salary prospects, especially in internationally-oriented sectors like tourism, business services, and export free zones.

The Dominican government, aware of the importance of human capital for economic development, has implemented vocational and technical training programs to meet labor market needs. The National Institute of Technical and Vocational Training (INFOTEP) plays a key role in this area, offering training in various priority sectors.

Good to know:

The Dominican Republic launched an ambitious program in 2024 aimed at training 100,000 young people in digital professions by 2028. This initiative should help bridge the skills gap in this rapidly expanding sector and attract more foreign investment in information technology.

Unions and Workers’ Rights: A Constantly Evolving Balance

Union rights are recognized and protected by the Dominican Constitution and the Labor Code. Workers have the right to form unions, join them, and participate in collective bargaining. However, the unionization rate remains relatively low, estimated at about 15% of the formal workforce in 2025.

The main unions in the country are:

- The National Confederation of Dominican Workers (CNTD)

- The Autonomous Confederation of Classist Unions (CASC)

- The National Confederation of Union Unity (CNUS)

These organizations play an important role in defending workers’ rights and participate in tripartite negotiations with the government and employer organizations on issues such as minimum wage, working conditions, and labor law reforms.

The right to strike is recognized but subject to certain conditions, including the obligation to follow a conciliation procedure before initiating a strike. Essential services, such as healthcare and public safety, are subject to additional restrictions to ensure service continuity.

Fundamental workers’ rights, such as protection against discrimination, harassment, and unfair dismissal, are guaranteed by law. The Ministry of Labor is responsible for ensuring compliance with these rights and has labor inspectors to conduct checks in companies.

Despite these legal protections, challenges persist, particularly in the informal sector, which represents a significant portion of the Dominican economy. Workers in this sector often do not benefit from the same protection as those in the formal sector.

Good to know:

The Dominican Republic has ratified the eight fundamental conventions of the International Labour Organization (ILO), demonstrating its commitment to fundamental workers’ rights. However, the effective implementation of these conventions remains a challenge, particularly in certain sectors like agriculture and domestic work.

Conclusion: An Evolving Legal Framework for a Dynamic Labor Market

Labor law in the Dominican Republic reflects the country’s efforts to balance worker protection and economic flexibility. Recent reforms and ongoing initiatives demonstrate the authorities’ willingness to adapt the legal framework to the realities of a rapidly changing economy.

For companies considering establishing operations in the Dominican Republic, it is crucial to understand these specificities of local labor law. Effective human resource management, respectful of workers’ rights and compliant with legislation, can constitute a significant competitive advantage.

The Dominican labor market offers interesting opportunities, particularly in growing sectors like information technology, luxury tourism, and renewable energy. The availability of an increasingly skilled workforce, combined with still competitive wage costs, makes the Dominican Republic an attractive destination for foreign investors.

However, challenges persist, particularly in terms of equal opportunity, formalization of the economy, and strengthening social dialogue. The future evolution of Dominican labor law will need to continue addressing these issues to ensure inclusive and sustainable economic development.

Good to know:

The Dominican Republic launched a digital platform in 2025 aimed at simplifying administrative procedures related to labor law. This initiative should facilitate human resource management for companies while improving the protection of workers’ rights through better traceability of contracts and social security contributions.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.