Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

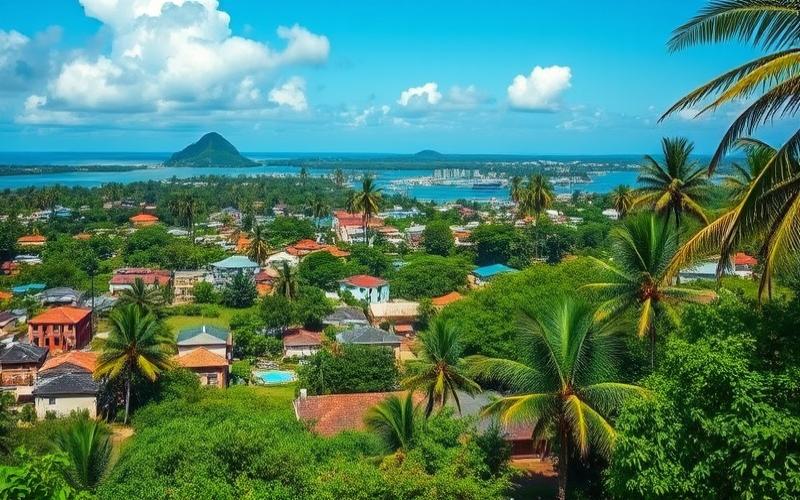

The Dominican Republic, with its white sand beaches, tropical climate, and rapidly growing economy, is attracting more and more foreign investors. Whether you’re considering buying property for your retirement in the sun or to develop a real estate project, it’s crucial to understand the local regulations. This article will guide you through the essential aspects of foreign property ownership in the Dominican Republic, enabling you to make informed decisions and maximize your investment opportunities.

The Legal Framework: An Open Door for Foreign Investors

The Dominican Republic stands out for its open policy toward foreign investors. Unlike many countries that impose strict restrictions, Dominican legislation provides a favorable and equitable environment for foreign property owners.

The principle of equal treatment is at the heart of Dominican regulations. Foreign investors enjoy the same rights and protections as Dominican citizens regarding real estate property. This inclusive approach is enshrined in the country’s Constitution and reinforced by Law 16-95 on foreign investment.

However, there are some important nuances to be aware of. Although foreigners can acquire properties without restrictions in most areas, certain border and coastal regions are subject to specific regulations. For example, within a 20-kilometer strip along the border with Haiti, property acquisition by foreigners may require special government authorization.

The transparency of the acquisition process is another major asset of the Dominican Republic. Real estate transactions are governed by a well-established land registry system, providing legal security to foreign buyers. Each property has a unique title deed, registered with the Title Registry, which facilitates verification of the property’s history and reduces the risk of disputes.

Good to Know:

The Dominican Republic offers a favorable legal framework for foreign investors, with few restrictions on property ownership. However, it is crucial to inquire about specific regulations in border and coastal areas before any purchase.

The process of acquiring property in the Dominican Republic is relatively straightforward, but it requires careful attention to certain key steps to ensure a safe and legal transaction.

Due diligence is a crucial step that every foreign investor must take seriously. It involves a thorough verification of the property title, any existing liens or mortgages, and the property’s compliance with local regulations. It is highly recommended to hire a local attorney specializing in real estate law to conduct this investigation.

Once due diligence is completed, the purchase process typically follows these steps:

- Signing a purchase agreement

- Payment of a deposit (typically between 10% and 20% of the purchase price)

- Obtaining a Dominican tax number for the foreign buyer

- Payment of taxes and fees associated with the transaction

- Signing the deed of sale before a public notary

- Registering the new property title with the Title Registry

Government approval is generally not required for property purchases by foreigners, except in the specific areas mentioned previously. However, it’s important to note that some real estate development projects, particularly large-scale ones or those located in ecologically sensitive areas, may require additional permits.

The average time to finalize a real estate transaction in the Dominican Republic is approximately 45 to 60 days, although this timeframe may vary depending on the complexity of the transaction and the efficiency of the parties involved.

Good to Know:

Although the acquisition process is relatively simple, thorough due diligence and the assistance of a local attorney are essential to secure your investment. Allow 45 to 60 days to finalize the transaction.

Rights and Responsibilities: What Every Foreign Owner Should Know

As a foreign property owner in the Dominican Republic, you enjoy extensive rights, but you must also be aware of your legal and tax responsibilities.

Property Rights: Foreign owners enjoy the same rights as Dominican citizens regarding property. This includes the right to use, rent, sell, or transfer the property through inheritance. You can also use your property as collateral to obtain loans from Dominican financial institutions.

Investment Protection: The Dominican Republic has signed numerous bilateral investment agreements and free trade treaties that provide additional protection for foreign investors. These agreements guarantee fair and equitable treatment, as well as protection against expropriation without adequate compensation.

Tax Obligations: Foreign owners are subject to the same tax obligations as local owners. This includes:

- Property Tax (IPI): a rate of 1% applies to property values exceeding 7.7 million Dominican pesos (approximately $133,000 USD)

- Capital Gains Tax: a rate of 27% applies to profits made from the sale of a property

- Municipal taxes: vary by locality

Residency and Citizenship: Purchasing property in the Dominican Republic does not automatically grant residency rights or citizenship. However, it can facilitate obtaining a residence permit for investors who meet certain criteria, including a minimum investment of $200,000 USD.

Property Management: If you are not a permanent resident, it is recommended to appoint a local representative or property management company to handle the maintenance of your property and manage administrative aspects in your absence.

Good to Know:

As a foreign owner, you enjoy the same rights as Dominican citizens, but you must be vigilant about your tax obligations. Purchasing property can facilitate obtaining a residence permit, but does not automatically grant this status.

Winning Strategies for Foreign Investors: Maximize Your Investment

To get the most out of your real estate investment in the Dominican Republic, here are some essential tips to keep in mind:

1. Choose Your Location Wisely: The Dominican Republic offers a diversity of attractive destinations, each with its own advantages. Tourist areas like Punta Cana or Puerto Plata may offer good rental potential, while cities like Santo Domingo or Santiago can be interesting for long-term investments.

2. Work with Trusted Local Professionals: Partner with an attorney specializing in real estate law, a licensed real estate agent, and an accountant familiar with Dominican taxation. Their local expertise is invaluable for navigating the nuances of the market and regulations.

3. Consider Development Opportunities: The Dominican Republic offers attractive incentives for tourism and real estate development projects. Law 158-01 on the promotion of tourism development, for example, offers significant tax exemptions for qualified projects.

4. Pay Attention to Sustainability: With the growth of ecotourism, environmentally friendly properties are becoming more attractive. Consider investing in sustainable projects or incorporating ecological features into your property.

5. Diversify Your Portfolio: Don’t put all your eggs in one basket. Consider different types of properties (residential, commercial, land) and different regions to spread your risk.

6. Stay Informed About Market Trends: The Dominican real estate market is evolving rapidly. Follow economic trends, infrastructure projects, and regulatory changes that could affect your investment’s value.

7. Plan Your Exit Strategy: From the beginning, have a clear idea of your long-term goals. Whether you plan to resell, rent, or use the property for your retirement, a well-defined strategy will help you make the right decisions.

Good to Know:

A successful investment in the Dominican Republic requires a strategic approach. Choose your location wisely, surround yourself with trusted local professionals, and stay attentive to market opportunities and trends to maximize your return on investment.

In conclusion, the Dominican Republic offers a favorable and dynamic environment for foreign real estate investors. With its open regulations, transparent acquisition process, and growth potential, the country positions itself as a prime destination for diversifying your international real estate portfolio. However, as with any foreign investment, a cautious and well-informed approach is essential for success.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.