Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

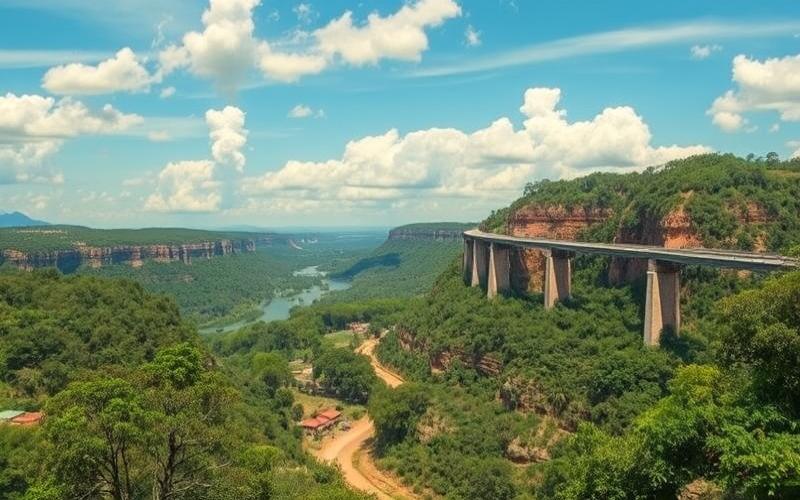

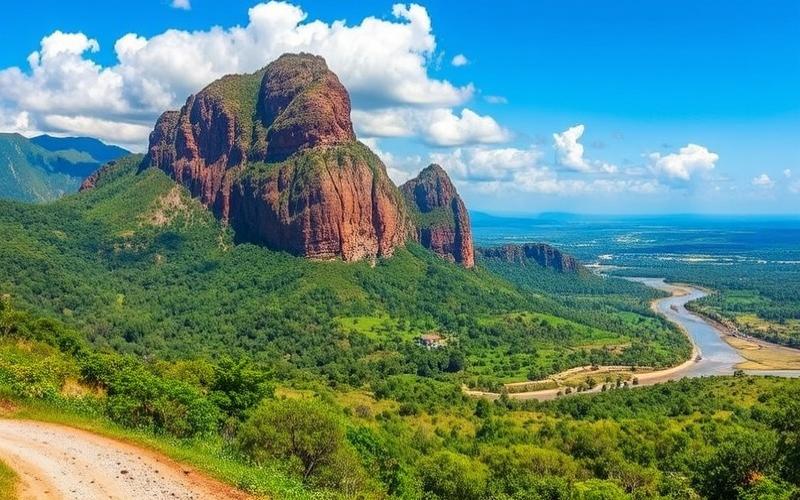

Paraguay, a landlocked country in the heart of South America, is increasingly attracting foreign investors through its economic opportunities and favorable regulatory framework. In this article, we will explore in detail foreign ownership regulations in Paraguay, a country distinguished by its openness to international capital.

A Welcoming Legal Framework for Foreign Investors

Paraguay stands out for its liberal policy regarding foreign investments. Unlike many countries, it imposes very few restrictions on non-resident investors looking to acquire real estate or establish businesses within its territory.

Key takeaways:

– Foreigners enjoy the same rights as Paraguayan citizens regarding property ownership. – There are no limitations on the percentage of foreign ownership in Paraguayan companies. – Foreign investors can own 100% of shares in a local company. – Purchase of agricultural land by foreigners is permitted, with certain restrictions in border areas.

This open approach aims to stimulate the national economy by attracting foreign capital and promoting development in key sectors.

Good to know:

Paraguay regularly ranks among the most attractive countries in Latin America for foreign direct investment, thanks to its political and economic stability as well as its favorable regulatory framework.

Simplified Formalities: A Fast and Efficient Approval Process

The Paraguayan government has implemented simplified procedures to facilitate foreign investors’ entry into its market. The approval process for property acquisition or business creation is generally quick and transparent.

Main steps:

1. Obtaining a tax identification number (RUC) from the Subsecretaría de Estado de Tributación. 2. Company registration with the Public Registry of Commerce. 3. Obtaining necessary licenses and permits according to the business sector. 4. For real estate purchases, registration with the Property Registry.

Average timeframes:

– Business creation: 2 to 4 weeks – Property acquisition: 1 to 2 months (including legal verifications)

It’s important to note that although the process is relatively simple, it’s highly recommended to engage a local attorney or specialized firm to ensure compliance with all current regulations.

Good to know:

Paraguay has a single window for foreign investors, SUACE (Sistema Unificado de Apertura y Cierre de Empresas), which centralizes administrative procedures and greatly facilitates the establishment process.

Rights and Responsibilities: What Every Foreign Investor Should Know

When investing in Paraguay, foreigners enjoy numerous benefits but must also comply with certain legal and tax obligations.

Main rights:

– Equal treatment with domestic investors – Freedom to repatriate profits and capital – Protection against expropriation without fair compensation – Access to tax incentives and free trade zones

Essential obligations:

– Compliance with Paraguayan laws and regulations – Payment of taxes and fees (corporate tax rates among the lowest in Latin America) – Annual declaration of income and assets – Compliance with current environmental and social standards

It’s crucial for every foreign investor to fully understand these rights and obligations to operate legally and fully benefit from the opportunities offered by the Paraguayan market.

Good to know:

Paraguay has signed numerous bilateral investment agreements and double taxation treaties, providing additional protection for foreign investors.

Expert Tips for Successful Investment in Paraguay

To maximize your success chances as a foreign investor in Paraguay, here are some key recommendations:

1. Conduct thorough due diligence: Before any investment, ensure you fully understand the local market, specific regulations in your business sector, and potential risks.

2. Build a trusted local team: Surround yourself with local experts (attorneys, accountants, consultants) who are well-versed in the nuances of the Paraguayan market and can effectively guide you.

3. Master the language: Although English is increasingly used in business, proficiency in Spanish (and ideally Guarani) will be a major asset for your negotiations and relationships with local authorities.

4. Leverage tax incentives: Inform yourself about the numerous tax benefits offered to foreign investors, particularly under the Maquila law or free trade zones.

5. Respect local culture: Take time to understand and respect Paraguayan customs and business practices to establish lasting relationships with your local partners.

Promising sectors for foreign investors:

- Agribusiness

- Renewable energy

- Information technology

- Tourism

- Infrastructure

Good to know:

Paraguay offers a young and competitive workforce, with operational costs among the lowest in the region, making it an attractive destination for companies seeking to optimize their production costs.

In conclusion, Paraguay presents a particularly favorable environment for foreign investors, with a flexible regulatory framework, simplified procedures, and numerous tax benefits. Although challenges persist, particularly in terms of infrastructure and bureaucracy, the opportunities offered by this growing market are substantial for savvy investors.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.