Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

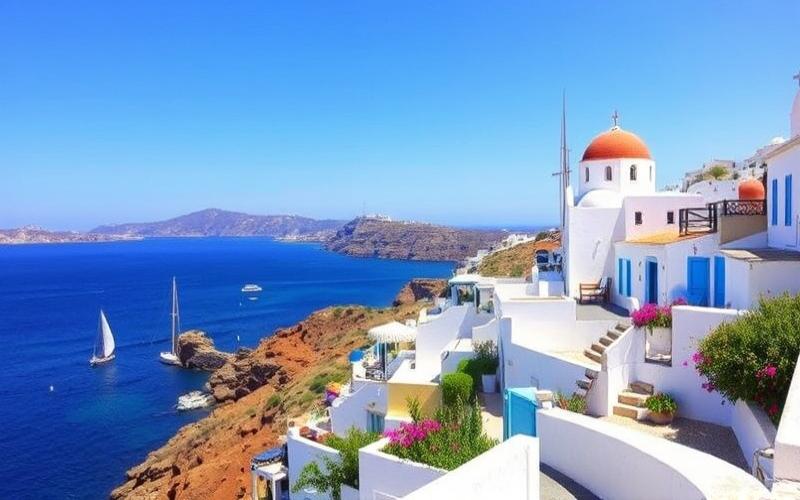

Greece, with its Mediterranean climate, breathtaking landscapes, and rich cultural heritage, is attracting an increasing number of expatriates looking to invest in real estate. This comprehensive guide will help you navigate the complexities of real estate investment in Greece as an expatriate, covering essential legal, financial, and practical aspects you need to know.

The Greek Real Estate Market: Attractive Potential for Expatriates

The Greek real estate market currently offers interesting opportunities for foreign investors. Following a period of economic crisis, property prices in Greece experienced a significant drop, making investment more affordable. However, in recent years, a gradual market recovery has been observed, particularly in major cities like Athens and popular tourist regions.

- Increased demand in urban and tourist areas

- Price stabilization in certain regions

- Growing interest from foreign investors

This positive dynamic makes Greece a prime destination for expatriates wishing to invest in real estate, whether for a primary residence, vacation home, or rental investment.

Legal Framework for Property Purchase in Greece

One of the strengths of the Greek real estate market lies in its openness to foreign investors. The Greek government has implemented favorable policies to facilitate property acquisition by non-residents, making Greece a particularly attractive destination for international investment.

- No major restrictions for foreign buyers

- Transparent purchasing process with recommended legal assistance

- Requirement to obtain a Greek tax number (AFM) for any real estate transaction

It’s important to note that certain areas, particularly near borders or on specific islands, may be subject to special restrictions for national security reasons. Therefore, it’s crucial to research thoroughly before initiating any purchase procedures.

The “Golden Visa” Program: An Opportunity for Non-European Investors

Greece offers a particularly attractive “Golden Visa” program for non-European investors. This program, launched in 2013, provides a 5-year renewable residence permit to non-European investors who purchase property with a minimum value of €250,000.

- Access to the Schengen Area

- Possibility to obtain Greek citizenship after 7 years of residence

- Inclusion of family members in the residence permit

This program makes Greece one of the most accessible gateways to Europe, offering a dual opportunity for real estate investment and international mobility.

Good to Know:

The Greek “Golden Visa” program is one of the most competitive in Europe in terms of the required investment threshold, making it a particularly attractive option for non-European investors.

Property Purchase Process in Greece

The property purchase process in Greece, although involving several steps, is generally transparent and well-structured. Here are the main steps to follow:

1. Property Search and Selection Start by defining your criteria (budget, location, property type) and conduct thorough research. Don’t hesitate to use local real estate agencies specializing in transactions with expatriates.

2. Preliminary Checks Before committing, ensure the property’s legality: verify the title deed, building permits, and absence of debts or disputes related to the property.

3. Obtaining a Greek Tax Number (AFM) This number is essential for any real estate transaction in Greece. You can obtain it from the local tax office.

4. Signing a Preliminary Contract This contract sets the terms of the sale and typically involves paying a deposit.

5. Finalizing the Purchase The final deed of sale is signed before a Greek notary. This is when full payment is made and the property transfer is formalized.

6. Property Registration The deed of sale must be registered with the local cadastral office to finalize the property transfer.

It is highly recommended to hire a local attorney specializing in real estate law to guide you through this process and ensure all procedures are correctly followed.

Good to Know:

The property purchase process in Greece typically takes between 1 and 3 months on average. Therefore, allow sufficient time if you have deadline constraints.

Financing Your Property Purchase in Greece

Financing a property purchase in Greece as an expatriate can be done in several ways. Here are the main options to consider:

1. Greek Bank Financing Greek banks offer mortgages to foreigners, although conditions may be stricter than for residents. Generally, Greek banks can finance up to 70% of the property value for non-residents.

2. Financing in Your Home Country Some expatriates choose to finance their purchase with a loan obtained in their home country. This option can be advantageous if you benefit from better credit terms in your country.

3. International Financing International banks specializing in loans to expatriates may offer financing solutions tailored to your situation.

4. Self-Financing Using personal funds remains a popular option, especially for investors benefiting from the “Golden Visa” program.

Regardless of the option chosen, it’s crucial to compare offers carefully and consider all associated fees (application fees, insurance, etc.) to evaluate the total cost of your financing.

Tax Aspects of Real Estate Investment in Greece

Taxation is a key element to consider when investing in real estate abroad. In Greece, several taxes apply to property owners:

1. Property Transfer Tax It amounts to 3.09% of the property value for existing properties. For new properties, a 24% VAT applies instead of the transfer tax.

2. Rental Income Tax If you rent out your property, rental income is subject to Greek income tax. Rates range from 15% to 45% depending on the income amount.

3. Annual Property Tax (ENFIA) This tax is calculated based on the property value and location. It can vary significantly from one property to another.

4. Capital Gains Tax If you sell the property, a capital gains tax may apply, with a rate of 15% on the difference between the purchase price and sale price.

It’s important to note that Greece has signed tax treaties with many countries to avoid double taxation. However, the application of these treaties may vary. Therefore, it’s highly recommended to consult a tax expert familiar with both Greek regulations and those of your home country to optimize your tax situation.

Good to Know:

Greece offers tax incentives for certain types of real estate investments, particularly for the renovation of historic buildings or in specific development zones. Inquire about these opportunities that can reduce your tax burden.

Rental Management and Rental Yield in Greece

Rental investment in Greece can be an interesting option for expatriates, especially in popular tourist areas. Here are some key points to consider:

Rental Yield: Rental profitability in Greece generally ranges between 4% and 8% gross per year, with potentially higher yields for seasonal rentals in sought-after tourist destinations.

Rental Management: You can choose to manage your property yourself or hire a rental management agency. The latter option is often preferred by non-resident expatriates.

Rental Regulations: Greece has implemented specific regulations for short-term rentals (like Airbnb). Make sure to understand these rules thoroughly to remain compliant.

Taxation of Rental Income: Rental income is subject to Greek income tax, with progressive rates. Don’t forget to declare this income in your country of tax residence as well.

Practical Considerations for Expatriate Investors

As an expatriate investing in Greek real estate, certain practical aspects deserve special attention:

1. Opening a Greek Bank Account Although not mandatory, having a bank account in Greece can greatly facilitate your transactions and property management.

2. Home Insurance Make sure to take out appropriate home insurance, considering specific regional risks (for example, earthquakes in certain areas).

3. Remote Management If you’re not a permanent resident in Greece, consider entrusting your property management to a local professional for maintenance, repairs, and rental management if applicable.

4. Professional Network Build a network of trusted professionals: lawyer, accountant, real estate agent, property manager. Their local expertise will be invaluable for navigating the specifics of the Greek market.

Conclusion: Greece, an Attractive Destination for Expatriate Real Estate Investment

Investing in Greek real estate as an expatriate offers numerous advantages: a market accessible to foreigners, attractive prices in certain regions, interesting yield potential, and the possibility of obtaining a residence permit through the “Golden Visa” program.

However, as with any investment abroad, it’s crucial to prepare thoroughly and surround yourself with competent professionals. A deep understanding of the local market, legal and tax aspects, along with a clear investment strategy are essential for the success of your real estate project in Greece.

Whether you’re looking for a sunny vacation home, a profitable rental investment, or a gateway to Europe, Greece offers varied opportunities to meet the needs of expatriate investors.

Good to Know:

The Greek real estate market continues to evolve, with development projects in certain regions and regular regulatory changes. Stay informed about the latest trends and regulations to optimize your investment in the long term.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.