Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

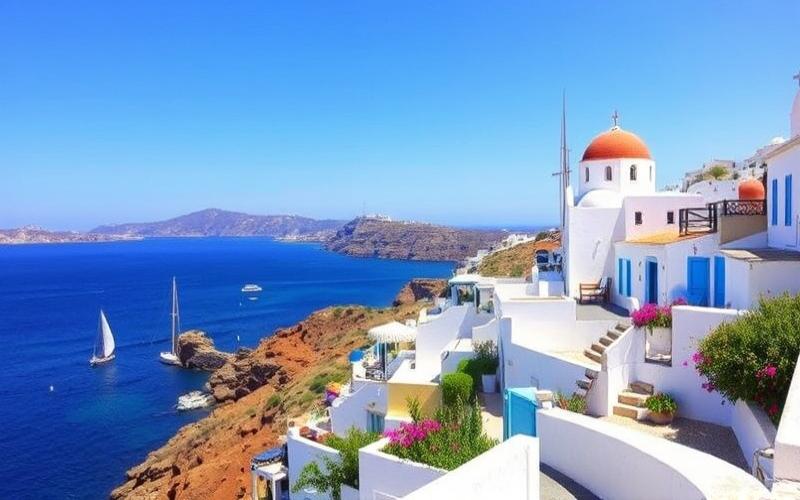

Greece, with its rich cultural heritage and Mediterranean lifestyle, is increasingly attracting expatriate entrepreneurs eager to establish their businesses under the Hellenic sun. This comprehensive guide will walk you through the essential steps to bring your entrepreneurial project to life in Greece as an expatriate.

Understanding the Business Environment in Greece

Before diving into business creation in Greece, it’s crucial to thoroughly understand the country’s economic and entrepreneurial context. Greece, an EU member since 1981, offers privileged access to the single European market while benefiting from a strategic geographic position between Europe, Asia, and Africa.

Greek Economy at a Glance: – GDP: €214.87 billion (2022) – Economic Growth: 5.9% (2022) – Main Sectors: tourism, shipping, agriculture, services

Despite economic challenges over the past decade, Greece has undertaken significant reforms to improve its business climate. The country has notably simplified administrative procedures for business creation and implemented tax incentives to attract foreign investors.

Advantages for Expatriate Entrepreneurs: – Relatively low cost of living compared to other European countries – High quality of life and pleasant climate – Skilled and competitive workforce – Modern and continuously improving infrastructure

Choosing the Right Legal Structure

Greece offers several legal forms for businesses. Choosing the most suitable structure will depend on your activity, objectives, and personal situation.

Main Legal Forms in Greece:

1. Public Limited Company (AE – Ανώνυμη Εταιρεία) – Equivalent to French SA – Minimum capital: €25,000 – Suitable for large companies and major projects

2. Limited Liability Company (EPE – Εταιρεία Περιορισμένης Ευθύνης) – Equivalent to French SARL – No minimum capital required – Suitable for SMEs and family businesses

3. Private Capital Company (IKE – Ιδιωτική Κεφαλαιουχική Εταιρεία) – Recent legal form, similar to simplified LLC – Minimum capital: €1 – Ideal for startups and small businesses

4. Sole Proprietorship – For solo entrepreneurs – Simplified procedures but unlimited liability

Good to Know: The IKE legal form is particularly popular among expatriate entrepreneurs for its flexibility and low initial capital requirements.

Key Steps to Create Your Business in Greece

Creating a business in Greece involves several administrative steps. Although the process has been simplified in recent years, it’s recommended to work with a local professional to navigate the procedures effectively.

1. Choose and Reserve the Company Name – Check availability with the Greek commercial registry (GEMI) – Ensure compliance with Greek regulations on company names

2. Prepare Company Statutes – Define business purpose, capital, share distribution, etc. – Translate documents into Greek if necessary

3. Open a Business Bank Account – Choose a Greek bank or international bank present in Greece – Deposit initial share capital

4. Register with GEMI (Γενικό Εμπορικό Μητρώο) – Equivalent to French commercial registry – Obtain the company’s unique identification number

5. Obtain a VAT Number – Register with the Greek tax authority (DOY) – Provide necessary supporting documents

6. Register with Social Security – Register with EFKA (Ενιαίος Φορέας Κοινωνικής Ασφάλισης) – Mandatory for directors and employees

7. Obtain Specific Licenses and Permits – Depending on your sector (tourism, food service, etc.)

Good to Know: The Greek government has implemented an electronic one-stop shop (e-ΥΜΣ) to simplify business creation procedures. However, proficiency in Greek remains a significant advantage for navigating the administrative system.

Good to Know:

Creating a business in Greece can typically be completed in 2 to 4 weeks, but it’s advisable to allow more time for potential administrative contingencies.

Tax Considerations for Expatriate Entrepreneurs in Greece

Taxation is a crucial aspect to consider when creating a business abroad. Greece has implemented several measures to attract foreign investors and entrepreneurs, but it’s essential to understand your tax obligations thoroughly.

Main Taxes for Businesses in Greece:

– Corporate Tax: 22% (rate in effect in 2023) – VAT: 24% (standard rate), with reduced rates for certain sectors – Social Security Contributions: approximately 24.8% for employer and 15.75% for employee

Tax Incentives for Expatriate Entrepreneurs:

Greece has introduced attractive tax measures for expatriates, including:

– A flat 7% tax rate on foreign income for new tax residents – 50% income tax exemption for 7 years for highly qualified expatriates

Tax Treaties:

Greece has signed tax treaties with many countries to avoid double taxation. It’s crucial to verify the existence and terms of these treaties with your home country.

Tax Optimization and Compliance:

– Work with a local accountant to optimize your tax situation – Ensure you understand your reporting obligations in Greece and your home country – Maintain rigorous accounting compliant with Greek standards

Good to Know: Greece has strengthened its tax controls in recent years. Transparent and compliant management of your business is essential to avoid problems with the tax authorities.

Financing Your Entrepreneurial Project in Greece

Financing is often a major challenge for expatriate entrepreneurs. Greece offers various funding options, but it’s important to prepare your application thoroughly and understand local specifics.

Available Funding Sources:

1. Greek Banks – Traditional bank loans – Business credit lines – Note: approval criteria can be strict

2. European Funds – EU funding programs (ERDF, ESF, etc.) – Grants for innovation and regional development

3. Venture Capital and Business Angels – Growing network of investors in Greece – Focus on innovative startups and high-potential sectors

4. Crowdfunding – Accessible local and international platforms – Suitable for innovative projects or those with strong social impact

5. Government Support – Support programs for SMEs and entrepreneurs – Tax incentives for certain sectors (technology, green energy)

Tips to Maximize Your Chances of Obtaining Funding:

– Prepare a solid business plan adapted to the Greek market – Develop a local network to access funding opportunities – Consider partnerships with established Greek companies – Explore specific programs for expatriate entrepreneurs

Good to Know: The “Elevate Greece” program launched by the government aims to support the startup ecosystem, offering tax benefits and facilitated access to funding for innovative companies.

Good to Know:

Greece has implemented several initiatives to attract foreign investment, particularly in technology, renewable energy, and sustainable tourism sectors. Research these specific programs that might match your project.

Understanding and adapting to Greek business culture is crucial for your company’s success. Greece has a unique entrepreneurial culture, blending Mediterranean traditions and modern practices.

Key Cultural Aspects to Consider:

– Importance of Personal Relationships: Networking and personal contacts play a crucial role in Greek business. – Flexible Hours: Work schedules may be more flexible than in Northern Europe, with longer lunch breaks. – Indirect Communication: Greeks may be less direct in their communication, preferring a more diplomatic style. – Hierarchy: Respect for hierarchy in companies, but with a generally less formal approach than in France.

Tips for Integrating into Greek Business World:

– Learn basic Greek, even though English is widely used in business – Participate in local networking events and join professional associations – Be patient in your negotiations and administrative procedures – Adapt to the local pace of life, especially during summer

Good to Know: Coffee culture is very important in Greece. Many business discussions take place over a frappé or traditional Greek coffee.

Resources and Support for Expatriate Entrepreneurs in Greece

Numerous resources are available to support expatriate entrepreneurs in their Greek adventure. Here are some key structures and organizations to know:

1. Enterprise Greece – Official agency for investment promotion and foreign trade – Offers information and assistance services for foreign investors

2. Bilateral Chambers of Commerce – For example, the Franco-Hellenic Chamber of Commerce and Industry – Valuable network for French-speaking entrepreneurs

3. Incubators and Accelerators – The Cube Athens, Orange Grove, etc. – Support programs for startups and young companies

4. Réseau Entreprendre Greece – Greek branch of the international entrepreneurial support network – Mentoring and support for new entrepreneurs

5. Embassies and Consulates – Economic services of diplomatic representations – Information and contacts for foreign nationals

Tips to Make the Most of These Resources:

– Participate in events and webinars organized by these structures – Use the legal and tax advisory services offered – Benefit from mentoring programs to gain experience from established entrepreneurs – Stay informed about regulatory changes and market opportunities through these networks

Good to Know: Greece regularly organizes international professional trade shows, particularly in tourism, food, and technology sectors. These events are excellent opportunities to develop your network and stay informed about market trends.

Creating a business in Greece as an expatriate is an exciting adventure offering numerous opportunities. With careful preparation, thorough understanding of the local market, and a good support network, you can turn your entrepreneurial dream into reality under the Greek sun. Remember that patience and flexibility are essential qualities for success in this country where tradition and modernity coexist harmoniously.

Good to Know:

Greece recently launched a “digital nomad” visa allowing foreign freelancers and entrepreneurs to temporarily settle in the country while working remotely. This initiative could be an excellent entry point to test the Greek market before establishing yourself permanently.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.