Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

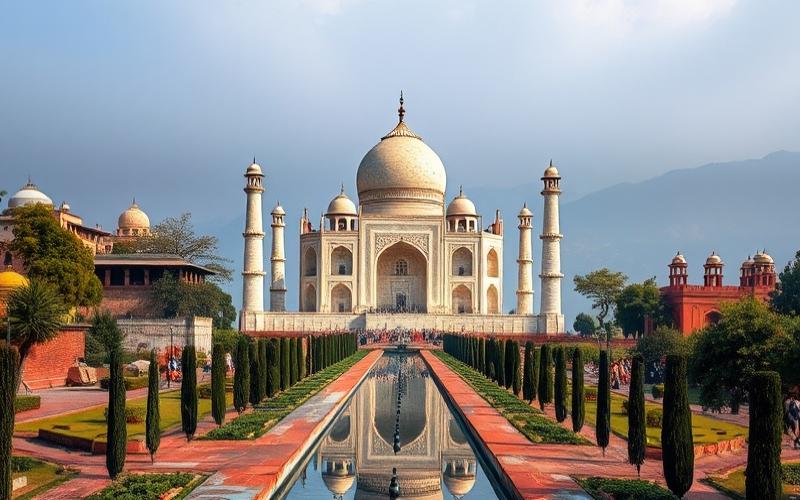

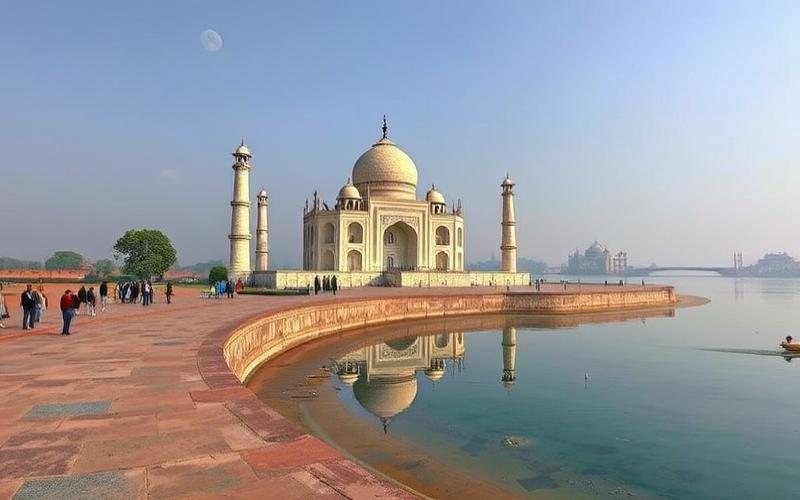

Exploring India as a retirement destination might seem like a bold choice, but for those seeking an enriching and affordable experience, it can be an appealing option. Indeed, the country offers not only a multitude of exotic landscapes and vibrant cultures but also attractive tax benefits for international residents.

Retirees in search of a harmonious quality of life and daily cultural discoveries can find a perfect balance, where reasonable living costs blend with traditional festivities and urban dynamism. Discovering what it means to spend one’s golden years immersed in this captivating mosaic can reveal often overlooked benefits.

Promoting India as a Retirement Destination

India attracts many retirees through its diverse landscapes, rich cultural and historical heritage, and remarkably low cost of living.

- Varied Landscapes: from Kerala’s tropical beaches to Himalayan peaks, through the Ganges plains and Rajasthan deserts, each region offers a unique environment for nature lovers or explorers.

- Cultural and Historical Wealth: temples, palaces, UNESCO World Heritage sites, festivals, and ancient traditions punctuate daily life and invite permanent exploration.

- Low Cost of Living: it’s possible to live comfortably even with a modest income, enjoying affordable domestic services, quality housing, and diverse food options.

| India’s Assets for Retirees | Details and Concrete Examples |

|---|---|

| Cultural and Historical Heritage | Temples, forts, festivals, museums, living traditions |

| Landscapes | Himalayas, beaches, forests, deserts |

| Cost of Living | Affordable housing, services, food |

| Climate | Warm and sunny climate outside monsoon season |

| Diverse Cuisine | Regional gastronomy, vegetarian options, varied spices |

| Expatriate Communities | Presence of French and international networks |

| Modern Medical Infrastructure | Reputed private hospitals, English-speaking doctors |

| Wellness, Yoga, Meditation | Numerous ashrams, retreats, specialized centers |

| Access to Dynamic Metropolises | Cities like Mumbai, Delhi, Bangalore, Chennai |

Medical infrastructure is of international standard, particularly in major cities where many private hospitals offer modern care at rates lower than in the West. Retirees can also subscribe to international health insurance for greater peace of mind.

Expatriate communities are well-established in main urban centers and some tourist cities. They facilitate integration, offer logistical support, and promote social networking through clubs, associations, or activity groups.

India is also the birthplace of yoga and meditation, offering unique opportunities to practice these disciplines in specialized centers, ashrams, or during retreats, whether in Rishikesh, Goa, or Pondicherry.

Practical Aspects to Consider:

- Climate: pleasant and sunny most of the year, except during monsoon season (June to September).

- Cuisine: immense variety, suitable for all tastes, abundance of fruits, vegetables, traditional or international dishes.

- Comfortable Living with Modest Income: it’s possible to access a higher standard of living than in many European countries with the same budget.

Living in India thus allows for combining a peaceful lifestyle, close to nature and traditions, while remaining near dynamic and connected metropolises, offering a rare balance between tranquility and urban accessibility.

Good to Know:

India stands out as a retirement destination thanks to its varied landscapes, ranging from Kerala’s tropical beaches to the Himalayan mountains, offering a peaceful and inspiring setting. The country’s cultural and historical richness invites retirees to immerse themselves in a diversity of vibrant traditions and festivals. The cost of living is relatively low, allowing for comfortable living with a modest income. Modern and accessible medical infrastructure adds to retirees’ peace of mind. Expatriate communities facilitate social networking, and numerous opportunities exist to practice yoga and meditation. The diverse climate and varied cuisine add to the country’s appeal, while major cities like Mumbai and Bangalore offer an attractive balance between a tranquil lifestyle and cosmopolitan vibrancy.

Cost of Living for Retirees in India

Cost of Living for Retirees in India

| Expense Element | Major Cities (e.g., Mumbai, Delhi) | Rural Areas / Small Towns | Example Price (2025) |

|---|---|---|---|

| Housing | More expensive, modern comfort possible | Much cheaper, variable comfort | City center apartment: $450/month |

| Food | Wide choice, moderate prices | Very affordable, local markets | Restaurant meal: $3 |

| Healthcare | Accessible private clinics/hospitals | Fewer options, sometimes remote | Private consultation: $11 to $22 |

| Entertainment | Numerous options, affordable prices | Limited options, very low cost | Cinema: $3.50 – Museum visit: $1 to $8 |

| Utilities (water, elec.) | Higher, but still low | Very low | Housing utilities: $42/month |

City/Countryside Differences:

Major cities offer more services (hospitals, entertainment, international stores) but at a higher cost than rural areas.

In rural regions, daily life is extremely affordable, but access to specialized healthcare or modern entertainment may require long trips.

Expected Standard of Living with Average Budget

With a budget of $880 to $1,320/month, a retiree can live comfortably in most Indian cities, enjoy restaurant meals several times a week, have domestic help, and access quality private healthcare.

In rural areas, the same budget allows for an even higher standard of living, with the possibility of spacious housing and numerous services.

Local Services and Amenities

Major cities offer: international supermarkets, diverse restaurants, shopping malls, cinemas, sports clubs.

Medium-sized towns/rural areas: local markets, simpler infrastructure, but extremely low cost of living.

Comparison with Other Popular Retirement Destinations

| Country | Housing Cost ($/month) | Food ($/meal) | Private Healthcare (consultation) | Monthly Utilities ($/month) |

|---|---|---|---|---|

| India | 450 | 3 | 11-22 | 42 |

| Portugal | 770-1,100 | 11 | 33-55 | 110-165 |

| Thailand | 440-770 | 3-6 | 17-33 | 55-77 |

| Morocco | 330-550 | 2-4 | 11-28 | 44-66 |

Concrete Examples of Monthly Expenses (for a couple in Mumbai, 2025):

- 2-room apartment (city center): $450

- Utilities (water, electricity, internet): $42

- Food (groceries + occasional restaurants): $165

- Private healthcare: $44

- Entertainment (cinema, museums, outings): $44

- Local transportation: $33

- Total monthly: ~$770 to $880

Key Points to Remember:

- The cost of living is 60 to 70% lower than in France: even with a modest pension, the standard of living is high.

- Retirees benefit from easy access to services, especially in cities, but must anticipate distance from certain specialized care in rural areas.

- Daily leisure and pleasures are very affordable (hotel pool: $3-4, Kerala canoe ride: $50).

- Quality of life largely depends on the choice of region and desired lifestyle.

In India, retirees can afford superior comfort compared to many European or Asian countries on a moderate budget, while enjoying rich culture and varied services.

Good to Know:

In India, the cost of living for retirees can be very advantageous, especially compared to other popular destinations like Thailand or Mexico. Housing can vary significantly; in cities like Mumbai or Delhi, renting a one-bedroom apartment can cost approximately $500 to $1,000 per month, while in rural areas, costs can drop to $150. Food remains affordable, with a monthly budget of $150 to $200 sufficient for two people eating locally. Healthcare, although costs are low, about $20 to $30 for a specialist consultation, often requires international medical insurance to cover major procedures. Entertainment, such as cinema or dining out, is also inexpensive, with movie tickets around $3 to $5. A retiree with a monthly budget of approximately $1,500 can live comfortably, benefit from local services, and enjoy modern amenities, although the level of convenience varies between urban and rural areas.

Tax Benefits for Retirees in India

Main Types of Deductions and Tax Exemptions for Retirees:

- Exemption of Provident Fund (PF) Income:

The capital withdrawn from PF, along with accumulated interest, is completely tax-exempt upon retirement. This exemption applies if withdrawal occurs at the legal retirement age (58 years), or from age 50 in case of early departure, under certain conditions. - Deduction on Pension Income:

Pensions received are taxable according to the progressive income tax scale, but several specific deductions and thresholds apply to elderly persons. - Specific Deductions for Seniors:

- Section 80C: Deduction up to 1.5 lakh INR per year for investments in provident products, life insurance, fixed deposits, etc.

- Section 80D: Deduction up to 50,000 INR for health insurance premiums paid by seniors (60 years and above).

- Section 80TTB: Tax exemption on bank account and deposit interest up to 50,000 INR per year for seniors.

- EPS (Employees Pension Scheme) Pensions:

EPS pays a complementary monthly pension, calculated based on salary and contribution duration. The minimum amount is 1,000 INR/month, with no ceiling, but limited to approximately 50% of final salary for a complete career.

Tax Scale and Applicable Income Thresholds (Fiscal Year 2024-2025)

| Taxpayer Category | Annual Taxable Income (INR) | Tax Rate |

|---|---|---|

| Under 60 years | Up to 2,50,000 | 0% |

| Seniors (60-80 years) | Up to 3,00,000 | 0% |

| Very Seniors (80 years and above) | Up to 5,00,000 | 0% |

Higher brackets are taxed at 5%, 20%, then 30%, according to income levels.

Seniors therefore benefit from higher exemption thresholds.

Impact of Regional Variations

Income tax is national, but some states offer complementary benefits (reductions on property tax, lower municipal service taxes, etc.).

Public pension schemes (civil servants) may benefit from specific exemption regimes or favorable taxation depending on the state of employment.

Government Policies Favoring Elderly Persons

Guarantees on Public Pension Funds: Investments in the Employees’ Provident Fund Organization (EPFO) benefit from sovereign guarantee.

Attractive Interest Rates: In 2025, the annual PF interest rate is 8.21%, higher than most traditional bank investments.

Dedicated Investment Plans:

- Senior Citizens Savings Scheme (SCSS): investment reserved for those 60 and above, offering preferential interest rate (approximately 8%), with interest partially tax-exempt.

- Pradhan Mantri Vaya Vandana Yojana (PMVVY): guaranteed rate life annuity for retirees.

Concrete Examples of Tax Savings

A 65-year-old retiree receiving an annual pension of 3.2 lakh INR, with 45,000 INR in bank interest, pays no income tax, thanks to the exemption threshold (3 lakh INR) and interest exemption (section 80TTB).

A retiree who invests 1.5 lakh INR in a PF and 50,000 INR in health insurance can deduct these amounts from taxable income, significantly reducing their tax base.

Summary of Main Benefits for Retirees in India

| Tax Benefit | Amount or Rate (2025) | Main Conditions |

|---|---|---|

| PF Exemption (capital + interest) | 100% | Withdrawal from age 58 |

| Exemption Threshold for Seniors | 3 lakh INR (60-80 years) | |

| Exemption Threshold for Very Seniors | 5 lakh INR (80 years and above) | |

| Section 80C Deduction | 1.5 lakh INR | Various investments |

| Health Insurance Deduction (Section 80D) | 50,000 INR | For those over 60 |

| Bank Interest Exemption (Section 80TTB) | 50,000 INR | For those over 60 |

| PF/EPFO Rate | 8.21% | Set by government |

Retirees in India thus benefit from a combination of pension exemptions, raised tax thresholds, targeted deductions, and savings products specifically designed for them, allowing significant reduction of tax pressure during retirement.

Good to Know:

Retirees in India benefit from several tax advantages, such as tax exemption up to 300,000 INR for persons aged 60 to 80 and up to 500,000 INR for those over 80. Additional deductions are available for investments in provident funds, up to 1.5 million INR under section 80C, as well as for health insurance under section 80D. Pension income and savings interest can be partially exempt depending on the chosen tax regime. Regional differences can influence taxation, particularly in states with favorable local policies. Government programs aimed at reducing tax burden include deductions for green investments or financial products specially designed for retirees. This can allow significant savings, for example reducing overall tax to less than 10% for an annual pension of 900,000 INR with appropriate strategic planning.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.