Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Navigating the complexities of the pension system can seem daunting, especially when it comes to early retirement in South Africa. However, a clear understanding of the specific conditions and benefits available can turn this complexity into an opportunity to reach a life stage dedicated to personal and professional passions sooner.

This article guides you through the essential steps to access early retirement, exploring the necessary criteria and potential benefits that can help you effectively plan your future, while highlighting crucial elements to consider for making an informed choice.

Steps to Follow for Early Retirement in South Africa

Administrative Steps to Apply for Early Retirement in South Africa:

- Identify the desired type of early retirement (public, private, expatriate).

- Contact the relevant pension organization (South African pension fund, pension scheme, or home country fund for expatriates).

- Complete the specific early retirement application form for the organization.

- Prepare and attach the required documents (see table below).

- Submit the application to the organization or via an online portal, according to local procedures.

- Wait for confirmation of receipt and, if applicable, respond to any requests for additional documents.

- Track the application processing until the decision notification.

- If approved, complete the necessary banking procedures for pension collection.

Required Documents and Forms to Provide:

| Required Document | Detail / Function |

|---|---|

| Official application form | To be obtained from the relevant organization |

| Identity document | South African passport or ID card |

| Birth certificate | Original or certified copy |

| Proof of residence | Recent utility bill, lease, or certificate |

| Employment/salary certificates | Issued by the employer |

| Employment certificate | End of contract, reason for departure |

| Negotiated departure agreement | If early retirement is agreed upon |

| Career/contribution record | Summary of contribution years |

| Movement Declaration | For employees |

| Final pay slip | Signed by both parties |

Government Agencies to Contact:

- Department of Home Affairs for identity and residence verification.

- South African Social Security Agency (SASSA) for certain public pensions.

- Private pension funds or corporate retirement plans.

- For expatriates: home country pension fund + embassy or consulate for additional formalities.

Specific Conditions for Early Retirement Eligibility:

- Minimum age: Generally, early retirement can be requested from age 55 (varies by scheme).

- Contribution years: Often a minimum of 10 to 15 years of contributions depending on the pension fund.

- Employment status: Justify cessation of activity or legitimate reason (health, restructuring, etc.).

- Pension amount: For expatriates, the “retired person” visa requires a monthly pension of at least 37,000 Rands.

- Other legal requirements: Not to engage in paid activity with a retiree visa.

Processing Times and Associated Fees:

- Processing times: Vary between 1 and 6 months depending on the organization and complexity of the case. For the retiree visa, expect several weeks to several months.

- Fees: Administrative fees may apply for processing the application and visa issuance (varies by service).

Practical Tips to Facilitate the Process:

- Prepare documents in advance and verify their validity.

- Make certified true copies for all supporting documents.

- Use online portals to speed up submission and tracking.

- Keep written records of all correspondence and receipts.

- Regularly check the application status.

- Consult a specialized advisor or social law attorney if needed.

Tax Benefits and Other Advantages Associated with Early Retirement:

- Possibility of reduced taxation on pensions under tax treaties.

- Access to certain social benefits or discounts for retirees (transport, healthcare, etc.).

- For expatriates, pensions received outside South Africa may be exempt from local tax under bilateral agreements.

- Flexibility in managing assets and investments in case of early departure.

Important Note

For any procedure, consult the official websites of South African organizations and verify the latest eligibility conditions and updated forms.

Preparing your application thoroughly in advance helps avoid delays or rejections due to missing documents.

Good to Know:

Ensure you correctly complete the BIR32 form and attach proof of contributions to organizations like the Department of Social Security; it’s important to know that the assessment can take up to six months with possible processing fees. Consider checking if you’re eligible for specific tax deductions related to early retirement to optimize your income.

Necessary Conditions to Benefit from Early Retirement

Minimum Age Required for Early Retirement:

- The standard minimum age for early retirement in South Africa is generally 55 years for public sector employees, according to recent legislation.

- Certain specific professions, including military personnel, may qualify for early retirement from 50 years or after a certain number of years of service.

Required Years of Contribution:

- For civilians: 25 years of effective service

- For career officers and non-commissioned officers: 20 years of effective service

- For contract military personnel: 15 years of effective service

Professions Eligible for Early Retirement:

| Profession | Minimum Age | Required Years of Service |

|---|---|---|

| Civilians (public service) | 55 years | 25 years |

| Career officers/NCOs | 55 years | 20 years |

| Contract military | 50 years | 15 years |

| Other specific professions | Variable | Variable |

The possibility of early departure may also apply to agents on detachment or leave.

Legal and Administrative Requirements:

Forms to Complete:

- Official early retirement application form (available from employer or pension fund)

Documents to Provide:

- Valid identity document

- Service certificate or career record

- Proof of contribution years

- For health-related departures: detailed medical certificate

- Notification of approval from employer administration

Special Situations Entitling to Early Retirement:

Health Issues (Disability or Permanent Incapacity):

- Early departure may be granted in case of permanent incapacity recognized by an approved doctor and validated by the pension fund.

- Need to provide a complete medical file and expert report.

Exceptional Economic Circumstances:

- In case of restructuring or voluntary departure measures initiated by the state or public employer, it’s possible to benefit from early retirement even if all age or contribution conditions are not strictly met.

- Voluntary departure programs specify eligibility criteria and procedure to follow.

Summarized Administrative Procedure:

- Complete the official early retirement application form

- Attach all necessary supporting documents (identity, career, health if applicable)

- Submit the application to the employer administration or pension fund

- Wait for validation and official departure notification

Important Remarks:

- The recent reform of South Africa’s pension system aims to centralize and simplify procedures, especially for civil servants.

- Specific terms may vary by sector (public/private) and applicable collective agreements.

- Early retirements for medical reasons require a rigorous medical expertise procedure.

It is advisable to consult updated administrative guidelines from the pension fund or relevant ministry, as conditions may change due to legislative reforms.

Good to Know:

To benefit from early retirement in South Africa, it’s necessary to be at least 55 years old and have contributed for at least 10 years; certain professions, like law enforcement, may be eligible for early retirement under specific conditions. Remember to complete the application form and provide supporting documents such as a medical certificate in case of health issues or documents proving difficult economic circumstances.

Benefits of Early Retirement for Expatriates in South Africa

Financial Benefits and Cost of Living

- The cost of living in South Africa is significantly lower than in many Western countries: up to 45% lower than in France and much lower than in countries like the United States, United Kingdom, Canada, or Australia.

- South African cities such as Johannesburg, Cape Town, or Durban rank among the world’s cheapest metropolises for expatriates. For example, an average monthly budget (excluding housing) ranges between €514 and €655 depending on the chosen city.

- It’s possible to optimize your budget by preferring local products or secondary cities where housing costs remain affordable.

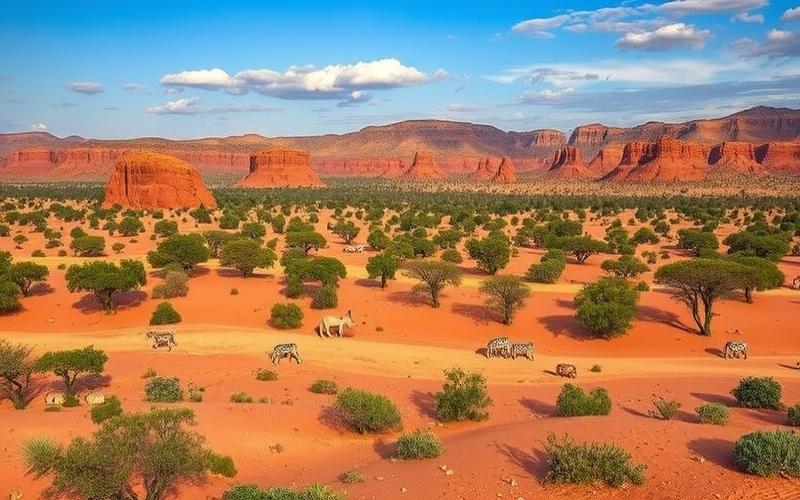

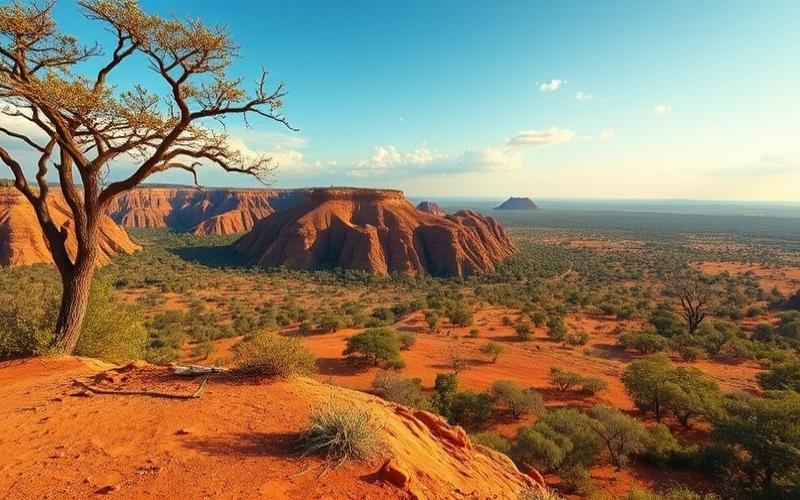

Opportunities Related to Climate and Landscapes

- South Africa offers a favorable climate year-round, conducive to outdoor activities: ocean beaches, spectacular mountains (Drakensberg), renowned vineyards, savannas, and national parks.

- Geographical diversity allows choosing an environment that matches your desires (seaside in Durban or Cape Town, peaceful countryside in the Karoo…).

Accessible Healthcare

Expatriates benefit from access to private medical care recognized for its quality, with rates often lower than those in many developed countries.

Quality of Life and Relaxed Pace

- South African culture values a more relaxed pace of life, especially on the coasts where the atmosphere is friendly. This promotes a serene transition to early retirement.

- The balance between active leisure (hiking, golf, water sports) and relaxation is an integral part of the local lifestyle.

Social Aspects: Integration & Cultural Activities

- Numerous expatriate communities facilitate social integration through:

- International clubs

- Local charitable associations

- Frequent multicultural events

- Easy access to a rich cultural offering: international artistic festivals (jazz music in Cape Town), various historical museums…

Exceptional Nature & Biodiversity

| Natural Assets | Benefits for Retirees |

|---|---|

| Renowned national parks | Easy observation of the “Big Five”, accessible safaris |

| Extensive coastline | Year-round beach activities |

| Abundant wildlife | Unique wildlife observation experiences |

Proximity to preserved nature significantly contributes to psychological well-being.

Potentially Advantageous Tax Environment

- Certain tax arrangements can be attractive for expatriates taking early retirement:

- Possibility depending on international tax status to avoid double taxation on certain foreign pensions

- Absence of local taxation on certain external income under specific conditions

The unique combination of low overall cost, pleasant year-round climate, easy access to quality private healthcare, and remarkable cultural and natural wealth makes South Africa a particularly attractive destination to serenely consider early retirement

Good to Know:

In South Africa, expatriates enjoy an affordable cost of living, mild climate, and magnificent landscapes, while benefiting from competitive healthcare and potential tax advantages. Integration into the local community and cultural richness offer an enriching daily life, complemented by diverse wildlife and accessible leisure activities.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.