Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

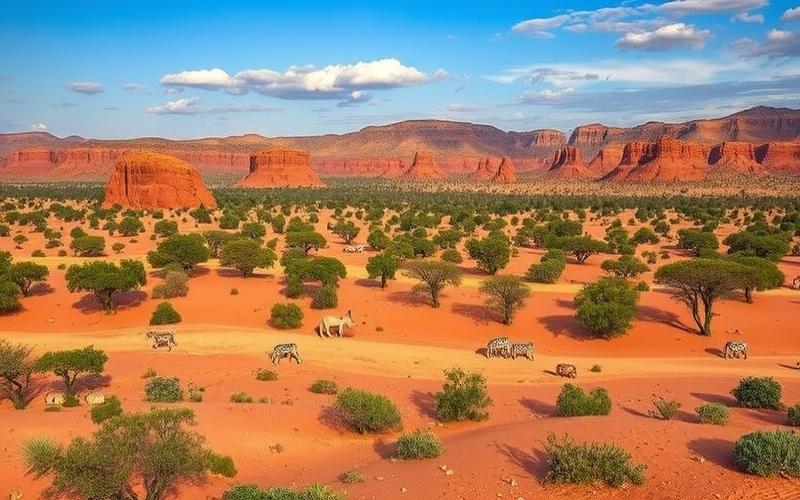

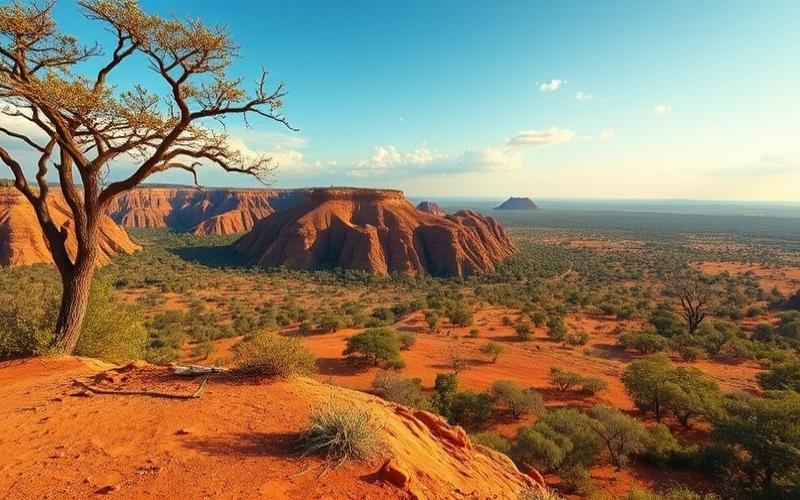

Exploring the dynamics of South Africa’s real estate market can be both an exciting and rewarding opportunity for expatriates. With a captivating blend of breathtaking landscapes and growing cities, this country offers a diverse range of options for investors. However, before embarking on this venture, it’s essential to understand the specific regulations and financial return opportunities involved. This guide aims to provide you with practical advice and key information about real estate investment in South Africa, ensuring you can approach this process with confidence and clarity.

Legal Considerations for Expatriates Looking to Invest in South Africa

Local Laws and Regulations Governing Property Purchases by Foreigners

Foreigners can purchase real estate in South Africa without major restrictions regarding nationality or property type (residential, commercial, land).

Residency in South Africa is not mandatory to become a property owner. However, local bank financing is limited: without a residence permit, a foreigner must finance the property entirely with their own funds. With a residence permit, it’s possible to obtain a bank loan, typically up to 50% of the property’s value, subject to a substantial personal contribution.

Need for a Residence Permit to Purchase Property

No residence permit is required to purchase real estate.

However, to access certain benefits (local bank financing, administrative facilities), holding a temporary or permanent residence permit is recommended.

Types of Visas or Permits Facilitating Real Estate Investment

- Temporary Residence Permit: Facilitates access to bank financing and certain rights (extended stay, on-site property management).

- Permanent Residence Permit: Accessible through investment (notably by contributing a net worth of at least 12,000,000 ZAR and paying administrative fees). It provides greater security and stability for the investor and their family.

- Business Visa: Possibility to obtain a temporary permit by creating a local company, subject to investment and job creation conditions for South African citizens.

Legal Steps Associated with Property Purchase

- Signing the Offer to Purchase between seller and buyer.

- Due diligence: Verification of the property’s legal status (title deed, absence of mortgage or dispute, zoning compliance).

- Opening a local bank account (optional for non-residents, but necessary for fund transfers).

- Transfer of funds from abroad, in compliance with South African Central Bank regulations.

- Property registration (“Deeds Office”): The deed is signed before a conveyancer and registration is completed with the land registry. Registration and conveyancer fees typically represent 1 to 2% of the purchase price.

- Obtaining the official title deed in the buyer’s name.

Tax Implications for Foreign Investors

- Transfer Duty: Progressive tax due upon acquisition, calculated based on the property’s value.

- Rental Income Tax: Rental income is taxable in South Africa, even for non-residents.

- Capital Gains Tax: Taxation of gains upon resale, according to South African rules.

- Reporting Obligations: It’s advisable to consult a local tax specialist to optimize the situation and avoid double taxation.

Property Rights Protection

| Protected Right | Relevant Local Law | Specific Features |

|---|---|---|

| Property Right | South African Constitution | Foreigners enjoy the same rights as citizens. |

| Land Registration | Deeds Registries Act | Guarantees transaction security and enforceability of rights. |

| Legal Recourse in Case of Dispute | Courts of South Africa | Possible access to courts to assert rights. |

Practical Tips: Engaging Local Experts

It’s highly recommended to consult:

- An attorney specialized in international real estate law to secure the transaction, conduct due diligence, and verify regulatory compliance.

- A licensed real estate agent familiar with expatriate transaction specifics and capable of assisting with administrative procedures.

- A tax specialist to anticipate tax consequences in South Africa and the investor’s country of residence.

To secure your investment, guidance from local experts is essential at every stage of the transaction.

Good to Know:

In South Africa, foreigners can purchase real estate without needing a residence permit, but it’s recommended to engage a local attorney to navigate the legal steps and ensure compliance with property laws; temporary visas like the intermediate work visa can facilitate investments while allowing temporary residence in the country.

Administrative Procedures and Local Regulations for Property Purchase

Real Estate Purchase Process in South Africa

Essential Steps

- Property Search: Define your needs, review listings, and visit properties.

- Purchase Offer: Draft an “offer to purchase” with the help of a real estate agent. This document, once accepted by the seller, legally binds both parties.

- Obtaining a South African Tax Identification Number: Mandatory for all foreign buyers to fulfill tax obligations related to property purchase.

- Deposit Payment: Typically paid into an attorney’s trust account (South African notary equivalent).

- Title Deed Verification: The conveyancer conducts a comprehensive legal check of the property (ownership, absence of mortgages, compliance of technical certificates).

- Signing the Sale Deed and registration at the Deeds Office (land title registration office).

- Property Transfer: The conveyancer finalizes the transfer after payment of fees and taxes.

Role of a Local Conveyancer

- Drafting the sale deed.

- Verifying title deed regularity and mandatory certificates (electricity, water, pests).

- Managing the deposit.

- Paying transfer taxes and fees.

- Official registration of the property in the buyer’s name.

Specific Regulations for Foreigners

- Purchase Right: Foreigners can acquire real estate, but purchasing agricultural land or properties in certain areas may be subject to restrictions.

- Mortgage Loan: Non-residents can obtain a mortgage, typically limited to 50% of the property’s value, or up to 75% with a residence title.

- Tax Obligations: Obtaining a Tax Identification Number, paying taxes, and complying with exchange regulations (if using foreign financing).

Transfer Costs and Local Taxes

| Cost Type | Approximate Amount or Rate | Who Pays? |

|---|---|---|

| Agency Fees | Included in sale price | Seller |

| Transfer Duty | 5 to 8% of purchase price | Buyer |

| Conveyancer Fees | Scale based on amount (e.g., 30,000 ZAR for 5M, 45,000 ZAR for 10M) | Buyer |

| Local Taxes (municipal rates) | Varies by municipality | Owner |

Tips for Securing Your Purchase

- Choose a Licensed Real Estate Agent: Verify registration with the EAAB (Estate Agency Affairs Board).

- Consult a Real Estate Attorney: To validate document compliance, anticipate risks, and secure the transaction.

- Verify Mandatory Inspections: Only certain certificates are mandatory (electricity, pests, etc.), with the rest often sold “as is” (voetstoots).

- Never Pay Money Directly to the Seller: Use a trust account managed by the local conveyancer.

Useful Resources

- Estate Agency Affairs Board (EAAB): To verify agents and obtain latest regulations.

- Deeds Office: To consult title deeds.

- BetterBond: To search for financing.

- Real Estate Law Firm: For customized legal support.

- Local Municipalities: For up-to-date taxes and municipal regulations.

Key Takeaways

A real estate purchase in South Africa requires administrative rigor, vigilance regarding title compliance, and support from competent professionals, particularly a conveyancer and specialized attorney.

Good to Know:

Obtaining a South African tax identification number is crucial before purchase, while a local conveyancer will verify title deeds; consult a real estate attorney to navigate regulations, such as restrictions on certain properties for foreigners. Ensure you understand transfer costs and local taxes, and engage a reputable real estate agent; for current information, consult reliable resources like South African government websites.

Financial Implications and Investment Strategies for Expatriates

Overview of Financial Implications

- Currency Fluctuations: South Africa, while benefiting from relative monetary stability compared to other African countries, remains exposed to its currency’s volatility. This instability can impact the value of real estate investments held in South African rands and complicate financial planning, particularly for expatriates whose income or assets are denominated in another currency.

- Local Taxes Applicable to Foreigners:

- Transfer Costs: Property acquisition typically involves transfer duties calculated on a progressive scale based on the purchase price.

- Other Fees: Conveyancer fees, legal fees, and potential recurring municipal taxes (property rates).

- Specific Restrictions: Foreigners can acquire real estate in South Africa without major restrictions, except for certain agricultural lands or sensitive areas where additional permits are required.

Investment Strategies

- Diversification across different property types:

- Residential (urban apartments, single-family homes)

- Commercial (offices, industrial premises)

- Tourism (seasonal accommodations in coastal or wine regions)

- Local partnerships and co-investments:

- Partnering with a South African partner not only provides better market understanding but also access to certain opportunities reserved for locally domiciled entities.

- Real Estate Investment Trusts (REITs) also offer a solution for risk pooling.

Financing Options

| Method | Details |

|---|---|

| Local Bank Loans | Possible for expatriates under strict conditions; often limited to ~50% of price |

| Initial Contribution | Generally required between 30% and up to over 50% for non-residents |

| Required Documentation | Documented stable income; sometimes mandatory opening of local bank account |

Insurance and Risk Management

- Subscribe to comprehensive home insurance covering natural disasters (flood, fire), civil liability, and protection against rental vacancy.

- Hedge against currency risk through dedicated financial instruments or by preferring partially denomination in your primary currency.

- Practical advice: Regularly monitor local macroeconomic developments to anticipate any sharp corrections affecting property value.

Legal and Administrative Aspects

Checklist:

- Prior verification of land title with South African registry

- Possible obtaining of additional permits depending on property type/location

- Signing before licensed public notary

- Full payment of tax duties before effective transfer

- Recommended collaboration with local specialized attorney mastering regulatory specifics

Economic Outlook and Market Trends

South African real estate remains attractive compared to the rest of the continent due to:

- Generally predictable monetary governance that reassures institutional investors,

- A solid financial sector despite some tensions related to global financial tightening,

- Moderate but positive prospects in certain major port cities or tourist destinations—where international rental demand is growing,

However:

- The global economic slowdown has weighed on the entire African continent since mid-2021; this sometimes limits the rapid appreciation expected by some investors,

- Future resilience will heavily depend on internal structural reforms as well as national capacity to absorb external shocks—determining factors for both valuation and future liquidity.

Final advice: Prioritize internal geographical diversification within the country (Johannesburg vs. Cape Town vs. Durban), carefully select local partners while maintaining flexibility for possible rapid adjustments in this emerging context.

Good to Know:

Rand fluctuations can affect your real estate investment returns in South Africa, making appropriate hedging and possibly local partnerships essential to optimize opportunities. To finance your project, consider taking out a loan from local banks, first verifying your eligibility conditions, such as an initial contribution and minimum required income.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.