Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

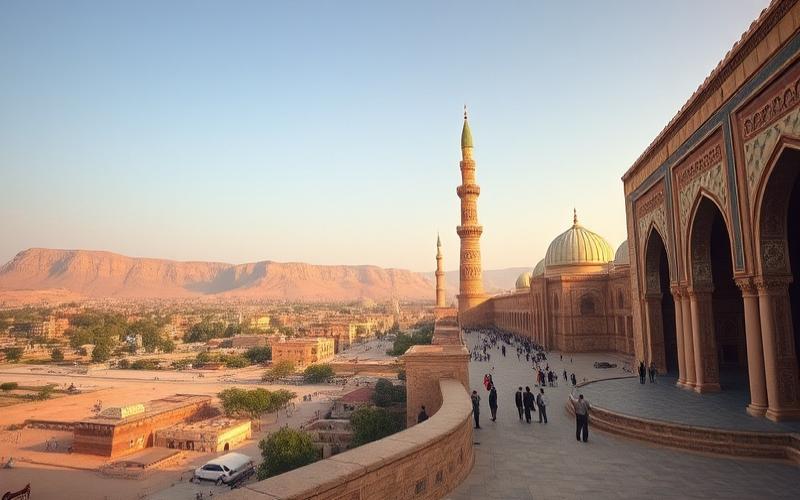

In an ever-evolving real estate market, interest in property prices has reached unprecedented levels in Bahrain, a kingdom where real estate plays a key role in the economy. By examining current trends, this article provides a detailed comparative analysis of real estate prices across different cities in the country, offering investors and prospective homeowners essential insights to make informed decisions.

From the capital Manama, with its urban vibrancy, to more tranquil locales like Riffa and Isa Town, we decode the factors influencing these price variations, ranging from supply and demand dynamics to the unique sociocultural criteria of each region.

These crucial elements not only shape the real estate landscape but also reveal savvy opportunities for anyone looking to engage in this dynamic sector.

Price Differences Between Major Cities in Bahrain

| City | Apartment (price/m²) | Single-Family Home (price/m²) | Land (price/m²) |

|---|---|---|---|

| Manama | 1,500–1,700 BHD | ~1,700 BHD | 600–700 BHD |

| Riffa | 1,200–1,400 BHD | ~1,400 BHD | 500–600 BHD |

| Muharraq | 1,100–1,300 BHD | ~1,300 BHD | 450–550 BHD |

| Hamad Town | 1,000–1,200 BHD | ~1,200 BHD | 400–500 BHD |

Prices vary depending on exact location, property quality, and amenities. Values are estimated averages for the residential market in urban areas.

Key Price Differences and Concrete Examples:

- A charming apartment in Muharraq: approximately $800,000 USD for a luxury three-bedroom property of about 300 m².

- A luxury villa in Manama: approximately $3,000,000 USD for 800 m², equating to nearly $3,750 USD/m² (~1,400 BHD/m²).

- A large waterfront house in Riffa: $2,500,000 USD for 750 m², or ~$3,333 USD/m² (~1,245 BHD/m²).

Key Economic Factors Influencing Differences:

– Manama concentrates the majority of the country’s tertiary and financial jobs along with modern infrastructure; this creates upward pressure on prices due to high demand from expatriates and local investors.

– Riffa is experiencing rapid growth thanks to its new residential neighborhoods favored by families seeking space and tranquility. Improved roads and infrastructure have enhanced local appeal.

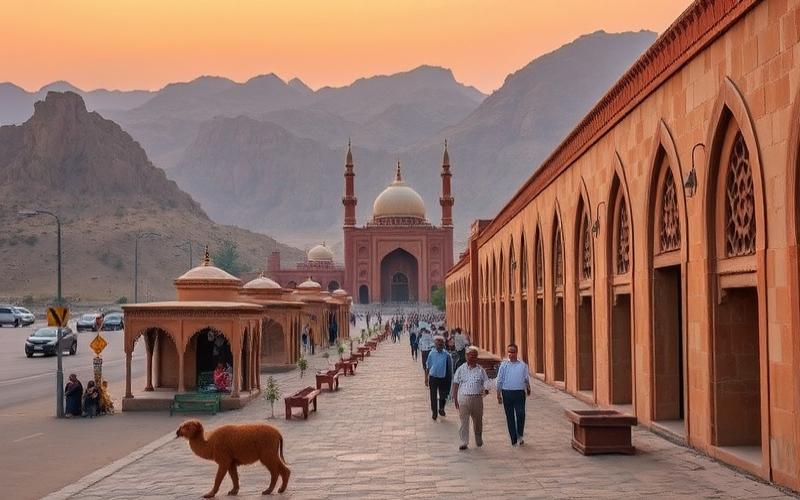

– Muharraq offers a balance between cultural tradition (former capital) and proximity to the economic center. It is also a sought-after area for those prioritizing sea views or investing in seasonal or tourist rentals.

Determining Social/Cultural Factors:

- Bahraini families often prefer Riffa or Hamad Town for their stronger community atmosphere and outdoor spaces.

- Cosmopolitan urban life tends to attract people to Manama; it appeals to expatriate professionals seeking modernity, nightlife, or proximity to their workplaces.

Local Supply/Demand Impact:

- Limited supply in historic centers or near the coast mechanically drives up prices in these desirable areas.

- Ongoing development in suburbs like Hamad Town partially meets growing demand but still maintains a significant price gap with Manama.

Influence of Government Policies:

- The Bahraini government promotes national homeownership through certain incentive programs reserved for local citizens – which particularly boosts areas like Hamad Town.

- Restrictions still exist regarding property acquisition by foreigners outside designated areas (“freehold”), thus concentrating their demand on specific neighborhoods where competition is high – typically in city centers or waterfront areas.

Summary List of Key Elements Explaining Variations:

- Economic attractiveness/job availability

- Modernity/recent infrastructure

- Average size of available properties

- Ease of access/developed road system

- Land policies favorable to nationals

Key Takeaway:

The price gap can exceed +30% between high-end urban Manama and family-oriented peripheries like Hamad Town. These differences reflect both the local socioeconomic environment and the targeted influence of proactive real estate policies in Bahrain.

Good to Know:

In Bahrain, real estate prices vary significantly between Manama, Muharraq, Riffa, and Hamad Town due to various factors. Manama, the capital, has the highest prices, with a square meter for a downtown apartment reaching up to 1,500 BHD, mainly due to its economic concentration and modern infrastructure. In Muharraq, prices are slightly lower, at around 1,200 BHD per square meter, influenced by its residential calm and proximity to the airport. Riffa, known for its cultural heritage, offers land at about 1,000 BHD/m², reflecting stable demand for single-family homes. Hamad Town provides the most affordable options, with prices around 800 BHD/m², due to lower demand and greater availability of plots. These variations are also guided by the government’s policy of stimulating affordable housing, as well as social factors such as proximity to schools and community centers.

Future Trends in Bahrain’s Real Estate Market

Analysis of Future Trends in Bahrain’s Real Estate Market

The outlook for Bahrain’s real estate market from 2025-2030 is shaped by a combination of local and global economic factors, attractive government policies, and major infrastructure investments.

Economic Factors and Global Influences

- Foreign Investments

- Reforms allowing 100% foreign ownership in certain areas, particularly waterfront neighborhoods and landmark projects like Bahrain Bay.

- Implementation of golden visas for investors, expanding the base of international buyers.

- Introduction of real estate tokenization via blockchain, facilitating access for global investors, especially in the high-end segment.

- Population Growth

- Increase in GCC (Gulf Cooperation Council) population and growth in the number of high-income households, particularly in Manama and Muharraq.

- High proportion of expatriates (over 70% of the rental market in 2023), supporting stable rental demand and the construction of mid-range housing.

- Government Policies

- Legislative changes since 2016 to enhance the market’s attractiveness to foreign investors.

- Social housing programs (Mazaya Finance) to meet local demand for affordable housing.

- Tax exemption on rental income, offering a competitive fiscal environment in the region.

Urban Developments and Major Infrastructure Projects

| Project/Initiative | Location | Expected Impact on Real Estate Market |

|---|---|---|

| Bahrain Bay, Water Garden City | Manama | Price increase in the premium segment |

| Bahrain Metro | Manama-North Corridor | Improved connectivity, increased residential demand |

| King Hamad Causeway (to Saudi Arabia) | Manama, North | Appreciation of nearby neighborhoods, appeal to foreign investors |

| Smart City Projects | Various | Modernization of real estate stock, increased property values |

| Development of Health and Wellness Real Estate | Manama, Riffa | Emerging segments, new demand |

Projections and Variations by City

| City | Key Trends | Expected Price Evolution | Determining Factors |

|---|---|---|---|

| Manama | Expansion of luxury segment, waterfront projects, arrival of branded residences | Significant increase, especially in premium neighborhoods | Foreign investments, mega-projects, enhanced connectivity |

| Riffa | Residential development for local families, affordable housing | Moderate increase, short-term stability | Domestic demand, social housing programs |

| Muharraq | Rise in high-end segment, proximity to King Hamad Causeway | Price progression in targeted neighborhoods | Improved access, regional connectivity projects |

Highlights of Recent Data and Projections

- The luxury residential market is expected to grow from 4.26 billion USD in 2025 to 6.12 billion USD in 2030 (+7.5% annually).

- Growth in real estate transactions: +4.8% in 2022, +5.1% in 2023.

- Expansion of freehold areas and diversification of offerings to meet demand from international and local investors.

- Villa prices increased by 1.5% year-over-year, with an upward trend supported by land scarcity and foreign demand.

Key Takeaway

Investor-friendly policies, infrastructure modernization, and population growth will continue to support the dynamism of Bahrain’s real estate market, with marked variations by city and segment. Premium neighborhoods in Manama and Muharraq are expected to see the most significant price increases, while Riffa will benefit from stability due to local demand and social initiatives.

Good to Know:

The evolution of Bahrain’s real estate market could be influenced by various economic factors, such as population growth and foreign investments, particularly in infrastructure. The Bahraini government continues to develop policies conducive to foreign investment, and major infrastructure projects in cities like Manama and Muharraq, such as the expansion of the transport network and the creation of new residential neighborhoods, could boost the appeal of these areas. While Manama, with its many skyscraper projects, may experience price hikes, the more residential Riffa could see a more moderate increase, influenced by community developments. As for Muharraq, the revitalization of its historic neighborhoods may well enhance its appeal while maintaining some price stability. Current projections suggest continued market growth, with specific variations depending on government policies and fluctuations in the global economy.

Factors Influencing Real Estate Prices in Bahrain

Economic Factors Influencing Real Estate Prices in Bahrain:

- Economic Growth: The stability of Bahrain’s real estate market is supported by moderate economic growth and a developing tourism sector. The government is investing in infrastructure, which boosts real estate demand, particularly in the capital Manama and emerging regions like Muharraq.

- Job Market & Wage Levels: Local employment remains concentrated in finance, oil, and tourism. Wage fluctuations can influence homeownership access for residents and expatriates.

| Property Type | Average Price (BHD/m²) | Annual Change |

| Apartment | 668 | -3.5% |

| Villa | 640 – 2,800 | +1.5% |

| City Center | Up to 1,500 | Stable |

| Commercial | Up to 3,500 | Stable |

Prices vary by location: Manama shows higher rates than Muharraq.

Impact of Local Real Estate Laws:

- Foreign Ownership:

- Foreigners can freely purchase in certain designated areas (“freehold zones”), with full ownership rights.

- Outside these zones, acquisition is restricted for non-nationals.

- Tax Regulations

- Rental income is generally tax-exempt for individuals.

- Absence of income tax or capital gains tax on real estate enhances appeal for international investors.

Demand-Related Factors:

- Demographics:

- Steady population growth fueled by a strong expatriate presence primarily seeking modern urban apartments or family villas.

- Buyer Preferences:

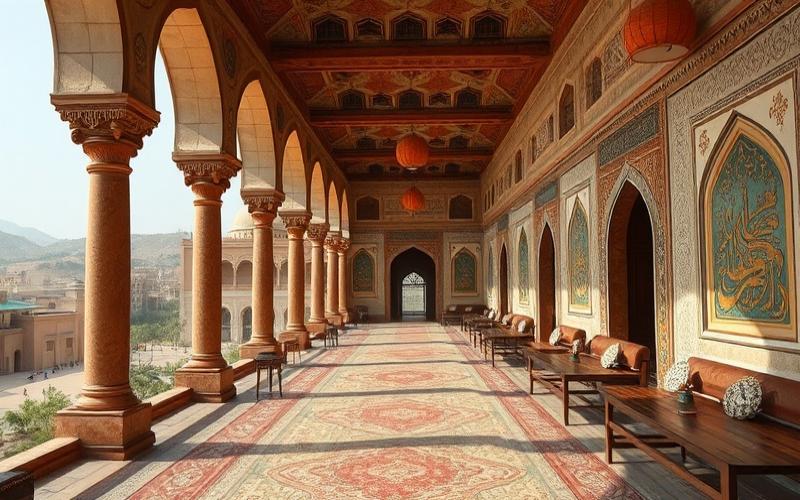

- Growing demand for new high-end housing with contemporary amenities (pools, security).

- Marked preference for neighborhoods served by good educational and medical infrastructure.

Supply-Related Factors:

- Land Availability:

- Limited supply in some central neighborhoods (Manama), encouraging vertical development (residential towers).

- Ongoing Projects:

- Several large residential and commercial projects launched to increase available stock while modernizing certain urban sectors.

Geopolitical Factors Affecting the Market:

- Relative political stability but sensitive to regional tensions in the Persian Gulf

- Fluctuating diplomatic relations that can temporarily impact foreign investor confidence

- Partial energy dependency on oil

Global Trends Impacting Foreign Investment:

- Enhanced attractiveness compared to neighboring markets due to light taxation

- Positive influence from the gradual return of international investors post-pandemic

- Increased sensitivity to global economic cycles (rise in international interest rates)

✦ Bahrain’s real estate market remains stable in 2025 thanks to a clear regulatory environment, facilitated access to foreign ownership in certain strategic areas, and advantageous taxation. However, it remains exposed to regional geopolitical uncertainties and heavily dependent on global trends related to foreign investment.

Good to Know:

Real estate prices in Bahrain are influenced by several economic factors, including the country’s positive economic growth which attracts investments and stimulates the job market with a direct impact on wage levels. Local laws also play a crucial role, particularly regulations concerning foreign ownership that can restrict or encourage market access for non-residents, as well as tax policies that influence costs for buyers and investors. Demand is affected by demographic elements, such as the increase in the expatriate population and evolving preferences of young buyers, while supply is modulated by limited land availability and numerous ongoing construction projects aimed at meeting this demand. Geopolitical factors, like regional stability, impact investor confidence, while global trends, such as fluctuations in oil prices or changes in migration policies, can promote – or slow down – foreign real estate investments.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.