Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Buying Agricultural Land in Bahrain: An Ambitious Investment

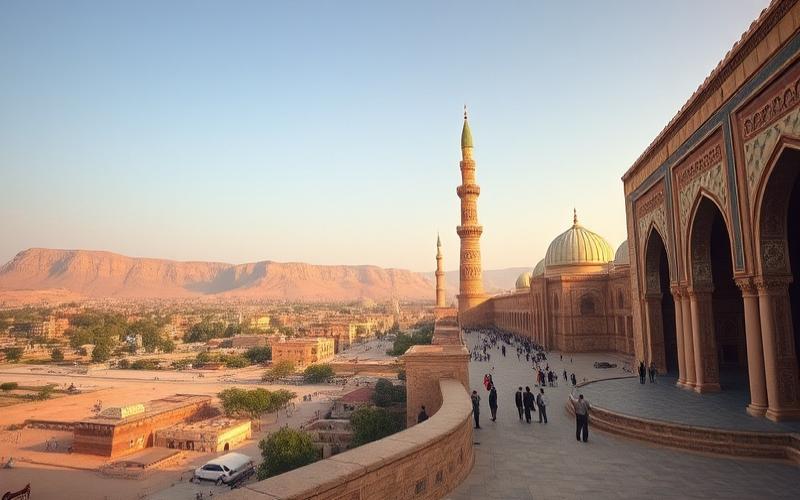

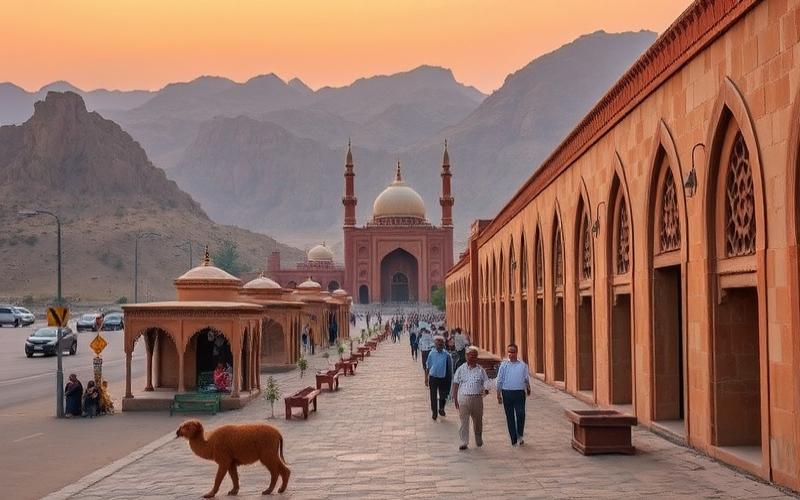

Buying agricultural land in Bahrain may seem like an ambitious undertaking, especially for foreign investors seeking unique opportunities in the world of agriculture. With its arid yet fascinating landscapes, this small archipelago in the Persian Gulf offers unexpected prospects for those looking to get involved in the booming agricultural market.

Good to Know:

Bahrain has a specific legal framework for foreign investments in agriculture, with conditions and restrictions that must be carefully studied before any purchase.

However, navigating through Bahrain’s complex legal framework and sometimes confusing regulations requires a thorough understanding and careful planning.

Essential Legal Aspects to Know

This article will guide you through the essential legal aspects, focusing on:

- Purchase conditions

- Land restrictions

- Crucial administrative procedures

These elements are essential to ensure a successful investment in the Bahraini agricultural sector.

Overview of the Legal Framework for Buying Agricultural Land in Bahrain

Current Laws and Regulations

The purchase of agricultural land in Bahrain is primarily governed by national laws on land ownership and agriculture. For Bahraini citizens, ownership of agricultural land is permitted without particular restrictions. For foreigners, acquiring agricultural land in full ownership is generally restricted: direct access to agricultural property is limited, but there are investment mechanisms, particularly through leasing public agricultural land within the framework of government tenders.

| Buyer Status | Right to Purchase in Full Ownership | Access via Lease |

| Bahraini Citizen | Yes | Yes |

| Foreign Resident | Generally no | Yes (under conditions) |

| Non-Resident | Generally no | Yes (under conditions) |

Specific Restrictions for Non-Resident Buyers

Non-resident buyers generally cannot purchase agricultural land in full ownership. However, they can participate in public tenders for leasing state-owned agricultural land, subject to meeting certain administrative conditions (e.g., registration as a farmer with the relevant ministry, minimum financial capacity, absence of current contracts for other agricultural lands).

Legal Registration Procedures

- Any land transaction must be registered with the competent services, under the supervision of the Ministry of Municipalities Affairs and Agriculture.

- Candidates for lease or purchase must present a land title or proof of registration, as well as identification and financial capacity documents.

- For public leasing, registration occurs after selection in a tender, with the obligation to be registered as a farmer with the authorities.

Role of Government Agencies

- The Ministry of Municipalities Affairs and Agriculture is the main actor for the allocation, registration, and management of agricultural lands, whether private or public.

- The Tender Board oversees tenders for leasing public agricultural lands, ensuring transparency and equal access.

- Public notaries and cadastral services are involved in the authentication and registration of transactions.

Tax Implications

- Owning agricultural land may result in specific property taxes or fees, depending on the land’s status (private or public).

- Income generated from agricultural operations is subject to corporate tax or other levies, depending on the operator’s legal structure.

- Certain tax exemptions or reductions may apply to encourage local production or investment in the agricultural sector.

Recent or Prospective Legislation

Recent initiatives aim to facilitate the leasing of public agricultural lands to stimulate local production, particularly through transparent tenders and favorable conditions for new operators. Reforms may also be considered to strengthen the legal security of transactions and clarify access for foreign investors, but no major changes to the legal framework have been officially adopted to date.

Summary of Requirements for Leasing Public Agricultural Lands (Example Tender 2025)

| Requirement | Detail |

| Registration as a Farmer | Mandatory with the relevant ministry |

| Proof of Financial Capacity | Bank statement with a required minimum balance |

| Prohibition for Current Contract Holders | Must not already hold a lease contract with the ministry |

| Lease Contract Duration | 10 years, with a one-year grace period for startup |

Good to Know:

In Bahrain, the purchase of agricultural land is governed by specific laws that differ for local citizens and foreigners; the latter face restrictions, including the prohibition of acquiring certain strategically located parcels. Land transactions must be registered with the Ministry of Justice and Islamic Affairs and require rigorous verification of property documents. Agencies such as the Survey and Land Registration Bureau play a central role in the registration process. Tax-wise, the purchase and ownership of agricultural land may include transfer taxes and annual registration fees. Recently, reforms have been considered to facilitate foreign investment in agriculture; however, they are still under debate and could transform the market in the future.

Identifying Rural Areas Suitable for Agricultural Development

Geographical and Climatic Criteria Favorable for Agricultural Development in Bahrain’s Rural Areas

- Arid to extremely arid climate: High summer temperatures (up to 38°C), low annual rainfall (about 75-83 mm), very high evaporation rate (1840 mm/year), naturally limiting crop choices but favoring certain species resistant to drought and heat.

- Favorable microclimates: Some depressions or low-lying areas in the northwest and center of the island benefit from a slightly more temperate microclimate, with relative humidity and protection from drying winds, allowing for the cultivation of date palms, greenhouse vegetables, and adapted forage plants.

- Topography and geology: Agricultural lands are mainly concentrated in the northern and central plains, where soils are relatively deeper and less prone to marine salinization than in the eastern or southwestern coastal regions.

| Rural Area | Geographical Assets | Microclimate | Dominant Crops |

|---|---|---|---|

| North and Northwest | Proximity to Dammam Aquifer | Slight humidity | Date palms, vegetables |

| Center | Deep plains | Sheltered from winds | Vegetables, forage |

| Southwest | Gypsiferous soils, drainage | Drier | Forage experimentation |

Soil Quality and Water Resources

- Soils:

- Mostly calcareous-gypsiferous (8-24% gypsum, high calcium carbonate content), sandy-loam to loamy texture.

- Moderate to low fertility, requiring organic inputs and careful salinity management.

- Increased risks of salinization, particularly in the east (marine intrusion) and southwest (brackish water upwelling).

- Water:

- Very limited freshwater resources, dependence on the Dammam Aquifer (quality varies by area: better in the northwest, saltier in the east and south).

- Supplementary supply via desalinated water and treated effluents (TSE) for irrigation, especially in pilot agricultural development areas.

- Priority management of groundwater resources in development projects (prevention of overexploitation and salinization).

Agricultural Investment Trends and Government Initiatives

- Concentration of investments in the northern and central rural areas, where water and soil quality remain most suitable for modern agriculture and where pilot TSE irrigation projects have been launched.

- Government initiatives:

- Support for rural development through modernization of irrigation systems (drip irrigation, use of treated wastewater).

- Encouragement of high-value crops adapted to the local climate (dates, greenhouse vegetables, aromatic plants).

- Sustainable resource management policies (salinity control, rational fertilization programs).

- Tax incentives or administrative facilities for investors in sustainable agriculture.

Concrete Examples of Developed Rural Areas and Benefits for Buyers

- Abu Saiba and Barbar Region (Northwest):

- Pilot projects for modern irrigation and greenhouses, facilitated access to treated water.

- Development of state-supported agricultural cooperatives.

- A’Ali and Salmabad (Center):

- Experimentation with forage and vegetable crops using treated effluents.

- Incentive programs for the establishment of young farmers.

Legal and Financial Benefits for Buyers

- Legal framework: The purchase of agricultural land by Bahraini nationals is protected by land legislation, with restrictions for foreigners but the possibility to invest through local companies or partnerships.

- Potential benefits:

- Access to subsidies for irrigation and agricultural equipment purchase.

- Tax exemptions or reductions on income generated from sustainable agriculture.

- Priority access to technical support programs and administrative assistance for innovative projects.

The rural areas of northern and central Bahrain remain the most attractive for agricultural development, thanks to the relative availability of better quality water, suitable soils, and direct support from government initiatives.

Good to Know:

In Bahrain, rural areas suitable for agricultural development are distinguished by specific geographical and climatic criteria, such as the northern part of the country where microclimates allow for the cultivation of fruits and vegetables due to moderate temperatures and adequate sunlight. Soil quality, often sandy but improved through treatment efforts, and water availability, mainly through desalination and irrigation projects, are vital. Current trends show growing interest in investments in areas like Budaiya, favored by government initiatives aimed at encouraging the use of modern and sustainable agricultural technologies. Recent projects in this region have benefited from financial and tax incentives for buyers, in line with the legal framework that supports agricultural land acquisitions while respecting current regulations.

Avoiding Pitfalls Related to Non-Buildable Land

Legal Criteria Defining Land as Non-Buildable in Bahrain:

- Zoning and Land Classification: Bahraini legislation classifies land according to its permitted use (residential, commercial, industrial, agricultural, or protected). Land is considered non-buildable if it is located in an area classified exclusively for agriculture, environmental conservation, or if it has major natural constraints (high salinity, presence of shallow groundwater, gypsiferous soil).

- Environmental Restrictions: Wetlands (sabkhas), natural reserves, and soils with a risk of flooding or erosion may be subject to a strict construction ban.

- Classification of Agricultural Soils:

- Solonchaks: Saline soils often modified for irrigation but difficult to make buildable.

- Regosols and Yermosols: Sandy/desert soils rarely cultivated or urbanized.

- Fluvisols: Found in alluvial depressions but generally reserved for specific crops.

Local Regulations on Agricultural Land Classification and Construction Restrictions:

– Converting agricultural land into a buildable zone requires prior authorization from the relevant ministry as well as a modification of the local urban plan. Without this official reclassification by government decree, any construction is illegal.

– Some agricultural lands benefit from public subsidies for their preservation; they are therefore protected against any change of use.

Administrative Steps to Verify Land Status Before Purchase:

- Request an official zoning certificate from the Land Registration Bureau (“Survey and Land Registration Bureau” – SLRB).

- Obtain from local municipal authorities the updated cadastral plan specifying the precise classification of the desired lot.

- Consult the Ministry of Public Works & Urban Planning regarding any specific restrictions related to the geographical or environmental sector concerned.

- Verify if the land is part of a public easement (planned road network, pipeline) that would make any future construction impossible even after administrative reclassification.

Legal and Financial Risks Associated with Purchasing Non-Buildable Land:

- Legal impossibility of obtaining a building permit later.

- High risk that the market value remains low or even decreases over time.

- Possibility that the administration orders demolition in case of illicit constructions carried out afterward.

- Total or partial loss of invested capital if reclassification is impossible or indefinitely delayed.

| Risk | Potential Consequence |

|---|---|

| Administrative Blockage | Land unusable for several years |

| Financial Sanctions | Significant fines in case of violation |

| Devaluation | Difficult or impossible resale |

| Forced Demolition | Immediate legal obligation without compensation |

Practical Tips to Avoid Pitfalls During Acquisition:

- Always consult a lawyer specialized in Bahraini land law before any written commitment.

- Systematically require all documents proving the exact legal nature and cadastral history of the desired property.

- Request from the seller a written attestation certifying that no administrative procedure is underway that could negatively affect the legal status of the property.

- Prefer thorough due diligence including site visits with a consulting engineer to identify all physical constraints invisible on official plans.

To secure your real estate investment in Bahrain:

– Hire a licensed professional from the pre-contractual phase

– Do not pay any deposit without complete documentary verification

– Remain vigilant regarding offers that are too attractive for so-called “exceptional” parcels outside urban areas

Good to Know:

In Bahrain, land is deemed non-buildable if it is classified solely for agricultural use according to local regulations governing soil classifications. Before purchase, it is essential to verify the land’s status with the competent authorities and inquire about construction restrictions that may apply, such as the ministerial decree concerning the use of agricultural land. Failure to perform these checks can lead to legal risks, such as disputes or the impossibility of using the land for purposes other than agriculture, resulting in potential financial losses. To avoid these pitfalls, it is advisable to seek the advice of land law professionals and conduct thorough due diligence, examining all available legal documents and verifying local urban plans. Ensure the land meets your needs by consulting experts for a detailed analysis to guarantee the security of your investment.

Obtaining Necessary Permits to Build in the Countryside

Types of Permits Needed to Build in the Countryside in Bahrain:

- Main building permit issued by local authorities (municipalities)

- Demolition permit if an existing structure must be removed before new construction

- Excavation permit or trench opening permit if necessary for preliminary work

Procedures to Obtain Permits:

- Submission of the application to the competent municipality or via the government online platform

- Submission of architectural plans and required supporting documents

- Compliance verification by technical services (urban planning, roads, environment)

- Final approval and issuance of the permit

Involved Government Agencies:

- Ministry of Works, Municipalities Affairs and Urban Planning

- Urban Planning and Development Authority

- Municipal technical services

Eligibility Criteria to Respect:

| Criterion | Minimum Requirement for Rural Areas |

|---|---|

| Land Area | 160 to 1,500 m² depending on the zone |

| Minimum Side Length | 8 to 30 m depending on the category |

| Land Use | Compliance with the development plan |

| Usage Justification | Conforming agricultural/residential use |

| Developer Approval | If land is in an approved project |

- Respect for the local urban plan and zoning

- Use conforming to agricultural or residential destination

- Minimum area set according to the type of rural zone

Specific Restrictions in Rural Areas:

- Prohibition of construction for industrial or tourist purposes without special authorization

- Limitation on construction density and heights

- Obligation to preserve agricultural vocation when the land is allocated for it

Typical Processing Times for Applications:

On average 2 to 6 weeks depending on the project’s complexity and the completeness of the file

Documents Required for Permit Application:

- Detailed architectural plans (AutoCAD/MicroStation format)

- Land ownership certificate

- Land use table (Excel)

- Developer approval for integrated projects

- Land reclamation certificate if the land is located on a sea-reclaimed area

- Notarized power of attorney if the applicant acts on behalf of the owner

- Identification documents and administrative forms

Inspections and Follow-ups After Work Begins:

- Initial compliance inspection before work commencement

- Periodic control visits by municipal inspectors

- Final inspection for issuance of compliance and completion certificate

Important Note:

Requirements may vary depending on the exact location of the project, the type of land, and the nature of the planned construction.

Incomplete applications or those non-compliant with urban plans are systematically rejected or require modifications before approval.

Good to Know:

To build in the countryside in Bahrain, it is essential to obtain several building permits approved by the Ministry of Municipalities and Urban Planning. The main building permit is issued by the local authority of the concerned region after verification of plans and compliance with regulations. You must submit essential documents, such as architectural plans, the title deed, and environmental impact studies. The procedure can take between one to three months, depending on the project’s complexity. Eligibility criteria include compliance with rural zoning standards and local architectural rules. Restrictions may apply in certain areas, particularly regarding building height or types of materials used. Following approval, an inspection schedule is established to monitor the work, and authorities may conduct control visits at different stages of construction.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.