Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

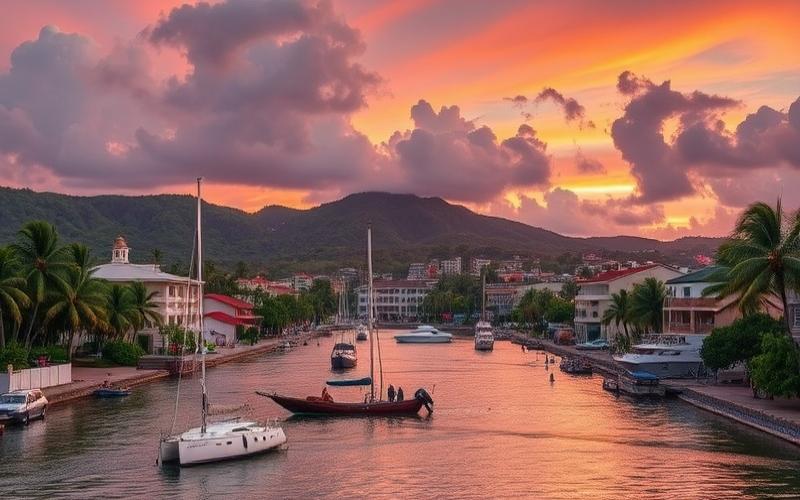

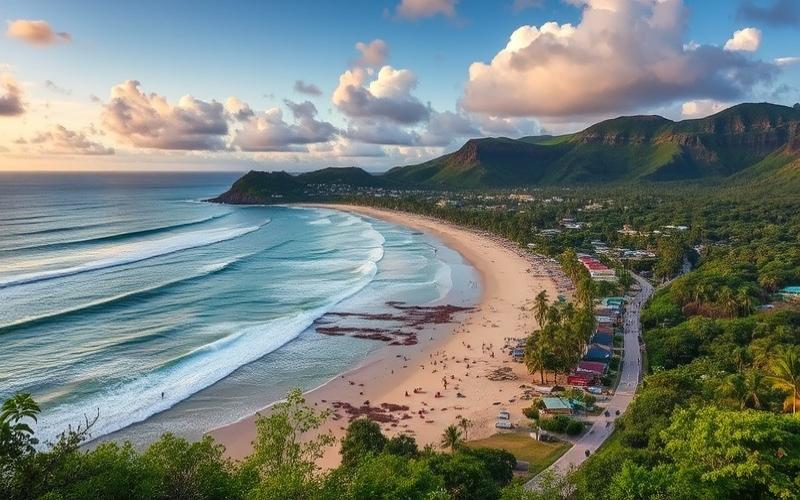

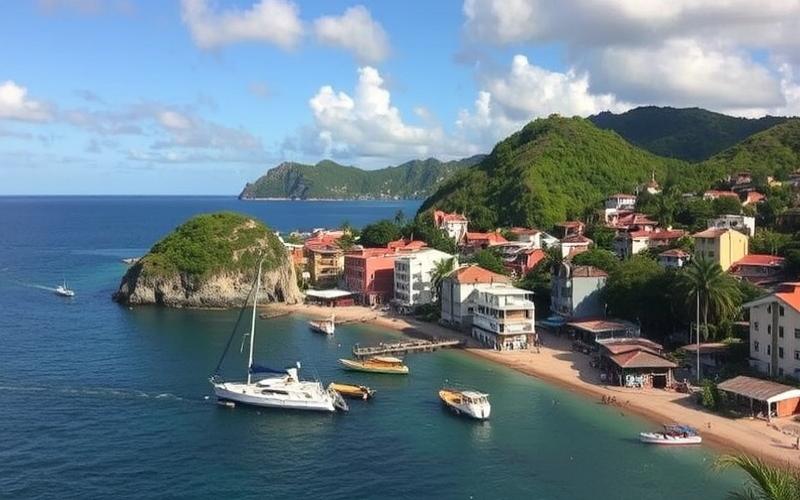

The Dominican Republic, with its white sand beaches, tropical climate, and rapidly growing economy, is attracting more and more foreign investors to the real estate sector. Whether you’re looking to acquire a second home, rental property, or simply diversify your investment portfolio, understanding the nuances of real estate financing in this Caribbean country is essential. This article will guide you through the key steps to obtaining a mortgage in the Dominican Republic as a foreigner.

The Accessible Dream: Can Foreigners Really Get Real Estate Financing?

The good news for international investors is yes, it is entirely possible to obtain real estate financing in the Dominican Republic as a foreigner. The country has implemented policies favorable to foreign investment, particularly in the real estate sector, which facilitates access to credit for non-residents.

However, it’s important to note that conditions can vary between banks and financial institutions. Some Dominican banks offer mortgages specifically designed for foreign buyers, while others may have stricter requirements.

Generally, Dominican lenders evaluate each application on a case-by-case basis, considering factors such as:

- The applicant’s financial stability

- Their credit history (even from abroad)

- The value and type of property to be financed

- The amount of personal down payment

It’s common for Dominican banks to require a higher down payment from foreign buyers, typically between 30% and 50% of the property value, compared to 20% to 30% for Dominican residents.

Interest rates for real estate loans in the Dominican Republic are generally higher than in many Western countries, often ranging between 7% and 12% per year. Loan terms can extend up to 20 or 25 years, although shorter terms are often offered.

Good to Know:

While obtaining real estate financing is possible for foreigners in the Dominican Republic, it’s recommended to work with an experienced local broker or specialized attorney to navigate the process and secure the best possible terms.

The Winning Application: What Documents to Prepare for Your Loan Request

To maximize your chances of obtaining real estate financing in the Dominican Republic, it’s crucial to prepare a complete and convincing application. Here’s a list of documents typically required by Dominican financial institutions:

- Valid passport: A copy of your current passport is essential to prove your identity.

- Proof of income: Provide your latest pay stubs, tax returns, and any other documents demonstrating stable income sources.

- Bank statements: Statements from the last 6 to 12 months of your personal and business accounts will be reviewed.

- Credit history: A credit report from your home country may be requested to assess your creditworthiness.

- Bank reference letter: A letter from your main bank attesting to your good financial management can strengthen your application.

- Employment contract or proof of professional activity: For employees, a current employment contract. For entrepreneurs, documents proving the stability of your business.

- Property details: A detailed description of the property you wish to acquire, including its appraisal and preliminary sales contract.

- Financing plan: A document detailing how you plan to finance the purchase, including the personal down payment and the requested loan amount.

- Life insurance: Some banks may require life insurance covering the loan amount.

It’s important to note that all these documents will need to be translated into Spanish by a certified translator if they are in another language. Additionally, some documents may require an apostille to be recognized in the Dominican Republic.

The careful preparation of these documents will not only speed up the approval process but will also demonstrate your seriousness and financial stability to Dominican lenders.

Good to Know:

Prepare your application well in advance and have it reviewed by a local professional to ensure it meets all the specific requirements of the Dominican market. This could make the difference between approval and rejection of your loan application.

Keys to Success: Essential Conditions for Securing Your Financing

Obtaining real estate financing in the Dominican Republic as a foreigner requires meeting certain specific conditions. Here are the main criteria that Dominican banks and financial institutions consider when evaluating your application:

1. Financial Stability

Lenders primarily seek to ensure your ability to repay the loan. They will carefully examine:

- Your stable monthly income

- Your overall assets

- Your existing debts and debt capacity

Generally, the debt-to-income ratio (loan payment relative to income) should not exceed 30% to 35% of your monthly income.

2. Credit History

Although you don’t have a credit history in the Dominican Republic, lenders will consider your history from your home country. A good credit score and a history of timely payments will significantly strengthen your application.

3. Personal Down Payment

As mentioned earlier, Dominican banks typically require a higher down payment from foreign buyers. Be prepared to contribute between 30% and 50% of the property value. The larger your down payment, the better your chances of obtaining a loan with favorable terms.

4. Property Type and Value

The property itself plays a crucial role in the financing decision. Lenders consider:

- The property’s location (popular tourist areas are often viewed favorably)

- The condition and age of the property

- The resale or rental potential

5. Insurance

Most banks will require you to obtain:

- Homeowners insurance covering the property

- Life insurance covering the loan amount

6. Legal Status in the Dominican Republic

While permanent residency isn’t necessary to obtain a loan, having a stable legal status (such as an investor visa) can facilitate the process and potentially give you access to better terms.

7. Applicant’s Age

Age can influence the maximum loan term. Generally, the sum of your age and the loan term should not exceed 70 to 75 years, depending on bank policies.

8. Clear Real Estate Project

Having a clear plan for your investment (second home, rental property, long-term investment) can reassure lenders about your commitment and understanding of the local market.

Good to Know:

While these conditions may seem strict, they aim to protect both the borrower and the lender. A strong application meeting these criteria will significantly increase your chances of obtaining financing with advantageous terms.

Winning Strategies to Maximize Your Chances

To optimize your chances of obtaining favorable real estate financing in the Dominican Republic, here are some strategies to consider:

1. Work with a Local Broker

An experienced broker familiar with the Dominican market can help you:

- Identify the best financing options

- Prepare a strong application tailored to local requirements

- Negotiate more favorable terms with lenders

2. Establish Local Banking Presence

Opening a bank account in the Dominican Republic and maintaining a substantial balance can demonstrate your commitment to the country and facilitate future transactions.

3. Consider a Co-borrower

If you have a partner or family member with stable income, adding a co-borrower can strengthen your loan application.

4. Choose a “Financeable” Property

Certain types of properties are more easily financeable than others. Apartments in well-established tourist complexes or homes in sought-after residential areas are generally viewed favorably by lenders.

5. Prepare a Business Plan

If you plan to use the property as a rental investment, a detailed business plan showing income potential can strengthen your application.

6. Be Flexible on Terms

Being open to shorter loan terms or slightly higher rates can increase your chances of approval, especially for a first purchase.

Good to Know:

Patience is key in this process. The processing time for a real estate loan application in the Dominican Republic can range from 4 to 8 weeks. Allow sufficient time in your purchase timeline to avoid unnecessary stress.

Conclusion: Your Dominican Dream Within Reach

Obtaining real estate financing in the Dominican Republic as a foreigner is a process that requires preparation, patience, and a good understanding of the local market. However, with the right strategies and a strong application, it’s an entirely achievable goal.

The key to success lies in careful preparation, complete documentation, and choosing the right local partners to guide you through the process. Remember that each case is unique, and what works for one investor may not be the best approach for another.

Investing in Dominican real estate not only offers the possibility of owning a piece of Caribbean paradise but also interesting return opportunities in a growing market. Whether you’re aiming for a vacation home, rental investment, or portfolio diversification, the Dominican market has much to offer savvy investors.

With a thoughtful approach, good preparation, and appropriate advice, your dream of real estate investment in the Dominican Republic can become a rewarding and profitable reality.

Good to Know:

Even after obtaining your financing, remain vigilant about the legal aspects of your purchase. Make sure to work with an attorney specialized in Dominican real estate law to secure your investment and navigate local legal subtleties.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.