Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

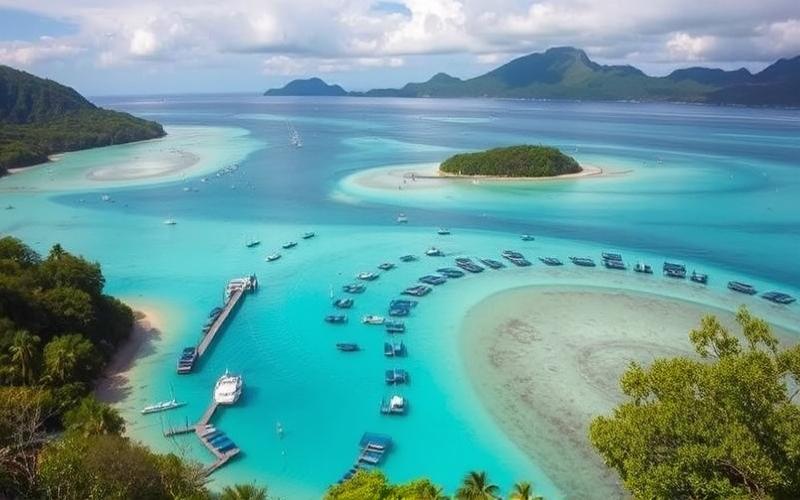

Investing in Vanuatu through a Civil Real Estate Company (SCI) presents an attractive opportunity to diversify one’s portfolio while benefiting from the numerous advantages offered by this unique destination. Renowned for its idyllic landscapes and paradise beaches, Vanuatu provides a favorable environment for real estate investment with advantageous taxation, reinforced by the absence of income and inheritance taxes.

However, despite these appealing benefits, potential investors must be aware of potential pitfalls, such as administrative and legal complexities, to fully succeed in this venture. In this article, we will thoroughly explore the benefits of such an investment and the precautions to take to skillfully navigate this exotic investment environment.

Optimizing the Legal Structure to Invest in Vanuatu

Investors in Vanuatu have several legal structures to organize their activities. Each form presents advantages and disadvantages depending on investment objectives, the level of protection sought, and the tax situation.

| Legal Structure | Advantages | Disadvantages |

|---|---|---|

| International Company (IC) | – Total exemption from offshore profit taxes – High confidentiality – Very low minimum capital (1 USD) – Single shareholder/director possible | – Less suitable for local activities – Certain sector restrictions |

| Limited Liability Company (LLC) | – Limited liability – Management/profit flexibility – No minimum capital required | – Less popular than IC |

| Trust | – Effective asset protection – Tax benefits for inheritance | – Complex administration – Setup costs |

| Sole Proprietorship | – Administrative simplicity | – Unlimited liability |

The Civil Real Estate Company (SCI) in Vanuatu

Although the classic French concept of SCI is not explicitly provided for in Vanuatu law, it is nevertheless possible to adapt a similar structure, typically in the form of an LLC or through a real estate trust. Investors wishing to jointly own real estate can form a local company with the exclusive purpose of managing real estate assets.

Potential Advantages:

- Clear separation between private assets and real estate properties

- Ease in transferring or selling shares

- Tax optimization depending on the structure

- Limited liability if the structure is adapted

Disadvantages:

- Precise rules applicable to a “French-style” SCI do not exist; one must rely on local forms

- Often requires assistance from local legal counsel

Tax Implications:

- Vanuatu levies no corporate tax, income tax, or traditional property taxes

- In case of distribution or real estate sale, examine international tax treaties and potential reporting obligations in the beneficiary’s country

Legal Requirements for Creation/Operation

- Reservation of the trade name

- Filing of the application with the competent registry along with signed articles of association

- Provision of supporting documents: identities of shareholders/directors, local address

- Payment of annual administrative fees according to company type

- Prior registration with the Vanuatu Investment Promotion Authority if a foreign investor

Key Factors to Optimize Protection & Tax Management:

- Judicious choice between IC/LLC/trust based on asset, family, or commercial objectives

- Possible use of an international holding company

- Strict compliance with local formalities to avoid any future challenges

- Systematic recourse to a local lawyer specialized in corporate/investment law

Specific Regulations for Foreign Investors:

- Obligation of prior registration with the competent Chief Executive Officer

- Precise declaration of the primary and secondary activity targeted by the investment

- Complete supporting documents required during initial filing (identity of ultimate beneficial owners)

Common Administrative Obstacles:

- Potential delays during anti-money laundering checks

- Increased documentary complexity for certain regulated sectors

- Frequent need for a local representative/resident

Simplified Case Study:

A European family group wishes to acquire several tourist villas in Vanuatu. They opt for a local LLC holding the land titles; each member then holds their shares directly or via a family trust. This organization not only facilitates future transfer but also allows flexible collective management while fully benefiting from Vanuatu’s favorable tax regime.

Practical Recommendations:

- Prefer an International Company if the activity is primarily offshore/confidentiality is sought.

- Opt for an LLC or equivalent for collective real estate/local projects.

- Imperatively consult a local law firm to adapt articles of association and governance to Vanuatu’s requirements.

- Anticipate any inheritance issues by possibly setting up an appropriate trust.

For any significant investment in Vanuatu, combining international tax advice and local legal expertise remains essential to ensure asset security and optimal regulatory compliance.

Good to Know:

In Vanuatu, investors can choose from various legal structures such as the Civil Real Estate Company (SCI), Limited Liability Company (LLC), or Public Limited Company (PLC). The SCI is favored for real estate investments, offering management flexibility and tax optimization, although it is subject to certain strict administrative constraints to be respected. Accounting obligations and capital requirements must be carefully evaluated before creation, as well as market accessibility for foreign investors, keeping in mind possible restrictions and the need for local legal advice. A case study showed that a well-structured SCI effectively protects assets while benefiting from a favorable tax framework, although transparency with tax authorities remains crucial to avoid disputes. It is recommended to combine an SCI with other structures to diversify and secure investments, while considering the specific objectives of each project and the constantly evolving local regulations.

The Tax Benefits of the SCI in Vanuatu

Investors choosing to use an SCI in Vanuatu benefit from a particularly advantageous tax environment, which stands out clearly from most other international jurisdictions.

Specific Tax Benefits in Vanuatu for SCIs

- Total absence of corporate tax: Profits made by a civil real estate company (SCI) or any other entity registered in Vanuatu are not subject to corporate tax.

- No taxation on local income, real estate capital gains, dividends, or distributions to partners.

- Zero wealth tax and no inheritance tax or gift duties.

- A single VAT rate set at 15%, mainly applicable to local goods and services. Businesses with turnover exceeding approximately 30,000 euros/year must register for VAT.

- Possibility to structure international real estate holdings via the “International Company” status offering increased confidentiality and administrative simplification.

Comparative Table with Other Popular Jurisdictions

| Jurisdiction | Corporate Tax | Real Estate Capital Gain | Inheritance/Gift Taxes | Confidentiality/Procedures |

|---|---|---|---|---|

| Vanuatu | 0% | 0% | 0% | High / Simple Procedures |

| France | Up to 25% CIT | Progressive rates | Duties up to 60% | Moderate / Formal |

| Luxembourg | Approx. 24.94% | Depending on residence | Possible exemptions | Good |

| Portugal | Up to 21% | Local taxation | Reduced duties under NHR* conditions |

Additional Exemptions and Tax Agreements

Vanuatu’s framework allows for almost total exemption for any international operation conducted from the Vanuatu SCI, as long as these operations have no direct tax link with a country taxing its worldwide residents or domestic sources.

To date, Vanuatu has very few bilateral tax treaties. This implies that there is generally no automatic or spontaneous exchange of tax information with most other states. This situation further increases the country’s appeal for those seeking discretion and international tax optimization.

Legal Stability and Tax Reliability

The Vanuatu tax system is recognized for its extreme simplicity:

- The historical absence of major changes in its tax regime provides strong predictability for international investors.

- The country’s political stability reinforces this regulatory security; there are no recent or announced intentions to impose significant direct taxes on the income of individuals or corporations.

In summary, choosing an SCI in Vanuatu allows not only for almost total exemption in terms of direct taxes but also a high level of confidentiality associated with a stable legal environment—two assets rarely combined in classic financial centers like London, Paris, or Lisbon. This context makes the setup via SCI particularly attractive for optimizing international asset management and inheritance transfer without major tax friction.

Good to Know:

Investing via an SCI in Vanuatu offers notable tax benefits, including the absence of corporate tax and capital gains taxes, unlike other popular jurisdictions like France or Spain, which impose significant tax rates. Vanuatu also provides exemptions on inheritance taxes, enhancing its appeal for investors seeking to optimize their legacy. Furthermore, the country has concluded tax agreements with several nations, including Australia, reducing the risk of double taxation, which is a considerable advantage compared to jurisdictions with less favorable tax regulations. The stability of its tax framework and Vanuatu’s commitment to maintaining transparent and predictable laws constitute another reassuring factor for international investors looking to invest in a favorable and reliable tax environment.

Understanding the Pitfalls of Real Estate Purchase via an SCI in Vanuatu

Purchasing real estate via an SCI in Vanuatu presents specific legal and tax complexities, as well as administrative requirements unique to the local context.

Legal and Tax Complexities

- Vanuatu’s tax environment is very attractive: there is no income tax, corporate tax, or real estate capital gains tax. However, a 15% VAT applies to all real estate transactions (recoverable for local businesses), along with registration duties set at 5% of the property value for non-residents. There is no annual property tax.

- Rental income generated via an SCI is not taxed locally. But it remains essential to check if this income will be taxable in the partners’ country of tax residence.

- Using an SCI allows optimization of asset and inheritance management but requires precise drafting of the articles of association according to applicable French or international law for the structure.

- As tax treaties with other countries are limited, the risk of double taxation will depend on the international legal framework specific to the investors.

Administrative Requirements Specific to Vanuatu

- Any acquisition by a foreigner must obtain prior approval from the Vanuatu government.

- Foreigners can only acquire leasehold titles up to 75 years (renewable), never full ownership of customary lands reserved for local communities.

- All transactions must be registered with the Land Titles Office.

- A specific program allows obtaining citizenship through real estate investment starting at 130,000 USD invested, in addition to government fees required during the operation.

| Requirement | Detail |

|---|---|

| Approval | Mandatory for each foreign transaction |

| Type of Ownership | Leasehold only |

| Maximum Lease Term | 75 years (renewable) |

| Registration | With the National Bureau |

Differences with Other Jurisdictions

Unlike some European countries where full ownership purchase is accessible to foreigners via SCI, Vanuatu systematically imposes a long-term lease system for any foreign investor.

Local taxation is much lighter than in France or many comparable destinations.

Potential Hidden Costs

- Sometimes high legal fees related to the mandatory use of a specialized local lawyer.

- Higher registration duties for non-residents (5%) compared to residents (2%).

- VAT non-recoverable for individual investors not registered as a local business.

Checklist:

- Legal fees

- Additional government fees

- Potential costs related to lease renewal or transfer

- Insurance against land disputes

Cultural and Linguistic Considerations

The process is conducted mainly in English; little to no official documentation is available in French. A fine understanding of customary rules and their interaction with modern legislation often requires the intervention of an experienced local interpreter or advisor.

Negotiation may also require particular sensitivity towards traditional authorities who retain real power over certain lands—even when they are put under leasehold.

Restrictions on Foreign Ownership

Customary lands remain inaccessible. Only certain types of land can be subject to leases granted to foreigners—which geographically and qualitatively limits some major real estate opportunities.

Political & Economic Implications

Vanuatu historically benefits from relative political stability but remains exposed to major climatic hazards that could affect its tourism and agricultural economy. The almost total absence of public debt nevertheless reinforces its perceived financial solidity vis-à-vis international investors.

A thorough analysis must precede any commitment because any regional instability, sudden tax reform, or regulatory evolution could challenge certain current advantages.

Precautions Against Fraud & Scams

To avoid any risk:

- Always go through a recognized lawyer specialized in Vanuatu real estate law

- Meticulously verify all cadastral documents with the National Bureau

- Avoid any transaction involving direct purchase outside official procedure or oral promise without written guarantee

- Prefer reputable local partners

The apparent absence of taxation does not exempt the foreign investor—individual or via SCI—from scrupulously respecting official procedures under penalty of having their title contested later or even canceled!

Good to Know:

Investing in real estate via an SCI in Vanuatu presents several specific challenges, particularly due to the legal and tax framework unfamiliar to many foreign investors. The country imposes rigorous administrative requirements, with a need to translate and legalize several documents into English, considering differences with other jurisdictions. Hidden costs can quickly add up, notably local legal consultation fees to navigate administrative and tax complexities. Another important point is the local culture and language, which can complicate negotiations and understanding of processes. It is crucial to verify potential restrictions on foreign ownership, such as those conditioning property acquisition on certain government approvals. Although Vanuatu is generally stable, the political and economic environment must be monitored, as it can affect investment security. Moreover, it is prudent to be wary of real estate fraud by meticulously checking property histories and consulting only reputable agencies and lawyers to avoid scams.

Corporate Law in Vanuatu and Its Impact on Investment

Corporate law in Vanuatu is primarily based on the International Companies Act, regularly amended to adapt to the evolving economic and international context. This legal framework governs the creation, operation, and dissolution of commercial companies, including structures used for real estate investment such as civil real estate companies (SCI), although the term “SCI” is of French origin and less used in the Vanuatu Anglo-Saxon system.

Main Laws Governing Companies:

- International Companies Act: flagship structure for the incorporation of international companies allowing great flexibility in shareholding, management, and confidentiality.

- Law No. 3 of 2025 on Virtual Asset Service Providers: now regulates both the creation and management of digital assets by local or foreign entities.

- Other secondary texts adapted according to recent legislative developments.

Legal Specificities Related to Company Creation (Notably Real Estate):

- The procedure is fast, often achievable within a few working days.

- No strictly imposed minimum share capital for certain international corporate forms.

- Foreign shareholders allowed without major restriction; local directors sometimes required depending on the type of activity.

- High confidentiality on the identity of ultimate beneficial owners in certain international corporate schemes.

Comparative Table: Key Requirements in Vanuatu vs. Neighboring Jurisdictions

| Criterion | Vanuatu | Fiji | New Caledonia |

|---|---|---|---|

| Minimum Share Capital | Low/none | Moderate | Variable |

| Creation Time | Fast ( In May 2025, Law No.3 on virtual asset service providers came into effect to notably “rigorously regulate” these activities while maintaining an attractive environment through simplified license granting. Recurrent parliamentary discussions also aim to gradually strengthen certain reporting obligations to meet international expectations.

Common Pitfalls for Individual & Corporate Investors

Important Text In summary: Good to Know: Corporate law in Vanuatu, particularly concerning civil real estate companies (SCI), is governed by the Companies Act of 2012, which provides a flexible framework for investors, facilitating the creation of SCIs within a few days with minimum capital. Financial transparency and governance obligations are generally less strict compared to other Pacific jurisdictions, making foreign investment attractive. However, recent reforms aimed at strengthening global compliance may add layers of complexity, particularly regarding the sharing of financial information internationally. Unlike neighbors like Fiji, Vanuatu does not require public disclosure of partners, thus preserving confidentiality. Nevertheless, investors must be wary of pitfalls related to fluctuations in tax laws and bureaucratic constraints that may arise in real estate transactions. Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks. |