Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

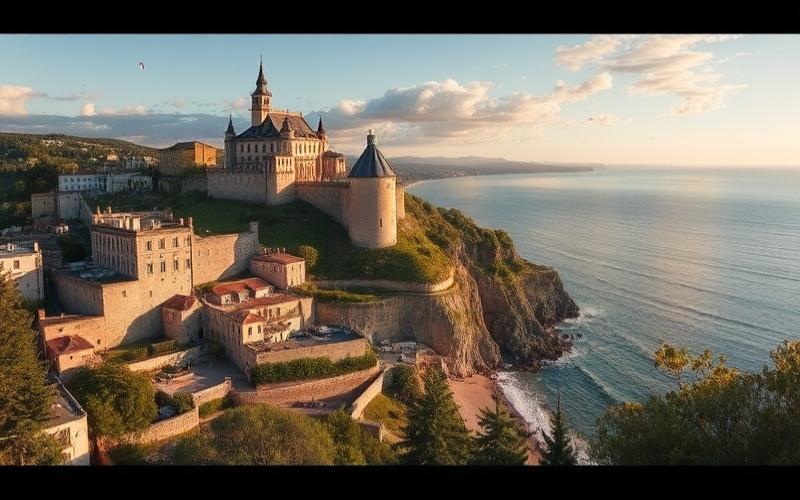

Commercial real estate in Malta is currently experiencing rapid development, offering numerous opportunities for savvy investors. This Mediterranean archipelago, a member of the European Union, is attracting an increasing number of international businesses thanks to its favorable tax environment and strategic location. Let’s dive into the details of this dynamic and promising market.

Commercial Properties for Every Taste

The Maltese commercial real estate market is characterized by a wide diversity of assets, meeting the varied needs of businesses:

- Modern offices: Numerous Class A office buildings have emerged in recent years, particularly in the business districts of Sliema, St Julian’s, and Valletta. These spaces offer high-end amenities and cutting-edge technologies to attract international companies.

- Retail spaces: The shopping streets of major Maltese cities are full of opportunities for investors looking to acquire shops or restaurants. Tourist areas like Sliema and St Julian’s are particularly sought after.

- Warehouses and logistics zones: With the development of e-commerce and Malta’s growing importance as a logistics hub, demand for storage and distribution spaces is on the rise.

- Hotels and tourist establishments: With tourism being a pillar of the Maltese economy, investment in hotels or leisure complexes can prove very lucrative.

This diversity allows investors to build a varied portfolio and spread risks across different market segments.

Attractive Returns, But Not Without Risks

Maltese commercial real estate offers attractive profitability prospects for investors:

- High rental yields: Gross yield rates for commercial real estate in Malta typically range between 5% and 8%, or even more for some well-located assets. These figures are significantly higher than those observed in many other European cities.

- Capital appreciation potential: Malta’s sustained economic growth and continuous influx of foreign businesses suggest appreciation in commercial property values in the medium and long term.

- Tax advantages: Malta’s tax regime, particularly favorable to businesses, helps stimulate demand for commercial spaces and supports real estate prices.

However, it’s important to remain vigilant about the inherent risks in this market:

- Market volatility: Like any real estate market, Malta’s can experience fluctuations. The recent health crisis, for example, had a significant impact on certain segments, particularly hospitality.

- Increased competition: The influx of foreign investors intensifies competition for the best opportunities, which can put upward pressure on prices.

- Evolving regulations: Maltese authorities regularly adapt their regulatory framework, which can have repercussions on the commercial real estate market.

A thorough market analysis and a well-defined investment strategy are essential to maximize returns while minimizing risks.

A Sector in Full Transformation

The Maltese commercial real estate market is currently experiencing several major trends shaping its future:

- Rise of coworking spaces: Demand for flexible and collaborative workspaces is sharply increasing, driven by the emergence of startups and evolving work patterns.

- Sustainable development: Commercial real estate projects are increasingly incorporating sustainability and energy efficiency criteria, meeting the demands of environmentally conscious businesses and investors.

- Digitalization: The growing adoption of smart technologies in commercial buildings (automated management systems, IoT sensors, etc.) enhances their attractiveness and value.

- Asset repurposing: In response to evolving needs, some commercial buildings are being transformed to accommodate new activities. For example, former warehouses can be converted into modern office spaces.

These trends open up new perspectives for investors capable of anticipating the market’s future needs and adapting their strategy accordingly.

Good to Know:

The Maltese commercial real estate market offers attractive opportunities, with high potential returns and a diversity of assets. However, thorough knowledge of the local market and careful risk management are essential for a successful investment.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.