Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

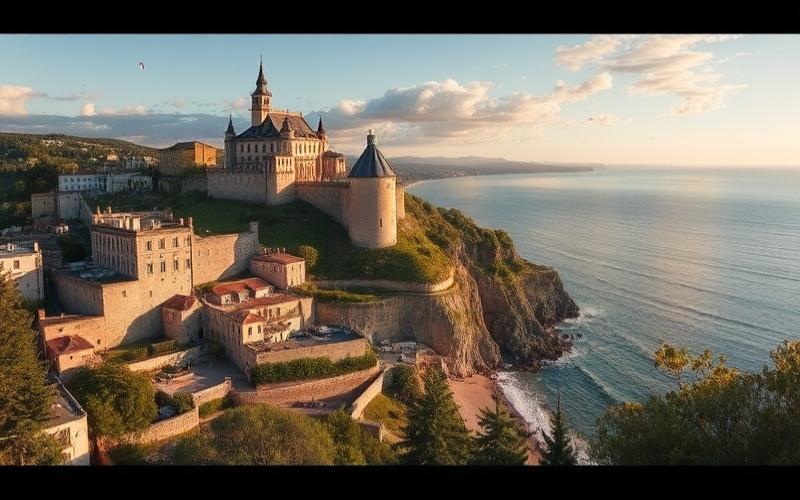

Malta, with its Mediterranean climate, rich historical heritage, and favorable tax framework, is attracting an increasing number of foreign investors eager to purchase property on the island. Whether for a second home, a rental investment, or a retirement project in the sun, the Maltese real estate market offers excellent opportunities. However, financing such a project can raise many questions, especially for non-residents. In this article, we will explore in detail the possibilities for real estate financing in Malta for foreigners, the necessary documents, and the requirements to make your Mediterranean dream a reality.

Are the Doors of Maltese Real Estate Open to Foreigners?

The good news is yes, foreigners can obtain real estate financing in Malta! The country has established a regulatory framework favorable to international investors, recognizing the importance of the economic contribution of foreign buyers to the local real estate market.

Maltese banks offer mortgage loans to non-residents, whether they are from the European Union or third countries. However, it is important to note that conditions may vary depending on your status (EU resident or non-EU) and your personal situation.

Here are some key points to remember:

- Maltese banks can finance up to 70-80% of the property value for EU residents, and generally up to 60-70% for non-EU residents.

- Interest rates are generally higher for non-residents, reflecting the perceived higher risk.

- The maximum loan term can go up to 25-30 years for EU residents but is often limited to 15-20 years for non-EU residents.

- Some banks require the borrower to take out life insurance and home insurance with Maltese companies.

It is highly recommended to use a broker specialized in real estate loans for expatriates in Malta. These professionals are well-versed in the specifics of the local market and can help you find the best financing terms suited to your situation.

The Winning File: Essential Documents for Your Loan Application

To maximize your chances of obtaining real estate financing in Malta, it is crucial to prepare a strong and complete file. Maltese banks are generally more demanding of foreign borrowers and require detailed documentation to assess their creditworthiness.

Here is the list of generally required documents:

- Copy of your passport or ID card

- Recent proof of address (less than 3 months old)

- Bank statements for the last 6 months

- Proof of income: For employees: pay slips for the last 3 months and employment contract For self-employed: balance sheets and income statements for the last 3 years

- For employees: pay slips for the last 3 months and employment contract

- For self-employed: balance sheets and income statements for the last 3 years

- Latest tax return

- Details of your real estate and financial assets

- Preliminary sales agreement or detailed description of the property you wish to acquire

- Financing plan including the amount of your personal contribution

- For non-EU residents: proof of tax residence in your home country

- For non-EU residents: copy of your visa or residence permit in Malta (if applicable)

Note: all documents must be provided in English or translated by a certified translator.

Good to know:

Some Maltese banks may request additional documents depending on your personal or professional situation. It is recommended to prepare your file well in advance and check with the bank or your broker for the exact list of required documents.

Keys to Success: Conditions for Securing Your Financing

Obtaining a real estate loan in Malta as a foreigner is not impossible, but it requires meeting certain conditions. Maltese banks carefully evaluate each application to ensure the borrower’s repayment capacity.

Here are the main conditions to meet to maximize your chances of obtaining financing:

- A strong financial situation: Maltese banks place great importance on the stability of your income and your savings capacity. A stable job or sustainable professional activity are major assets.

- A substantial personal contribution: As mentioned earlier, you will need to have a contribution of at least 20-30% of the property value for EU residents, and 30-40% for non-EU residents.

- A reasonable debt-to-income ratio: Maltese banks generally apply a maximum debt ratio of 30-35% of your net income. This means that all your credit charges, including the future real estate loan, should not exceed this percentage.

- Good creditworthiness: An impeccable credit history in your home country is an important asset. Maltese banks may request an international credit report to assess your financial reliability.

- A well-defined real estate project: Banks appreciate applications where the acquisition project is clearly presented, with a detailed and realistic financing plan.

- Life insurance: Most banks require the borrower to take out life insurance covering the loan amount. This insurance can usually be taken out with a Maltese company.

- Property collateral: The real estate property you are purchasing will serve as collateral for the loan. Maltese banks typically conduct an independent appraisal of the property to ensure its value.

It is important to note that these conditions may vary from one bank to another and depending on your profile. Some institutions may have additional requirements, especially for non-EU residents.

Good to know:

If you do not meet all these conditions, don’t despair! Some Maltese banks may offer alternative solutions, such as loans secured by financial assets or financial arrangements involving guarantors. A specialized broker can help you explore all available options.

Conclusion: Your Maltese Dream Within Reach

Obtaining real estate financing in Malta as a foreigner is entirely possible, provided you prepare your file well and meet the conditions required by local banks. The Maltese real estate market offers excellent opportunities, whether for a rental investment, a second home, or a long-term life project.

Here are some tips to maximize your chances of success:

- Start your procedures well in advance of your purchase project

- Use a broker specialized in real estate loans for expatriates in Malta

- Prepare a complete and well-organized file, with all documents translated if necessary

- Be transparent about your financial situation and your real estate project

- Do not hesitate to compare offers from several banks to get the best terms

With proper preparation and the right advice, your dream of acquiring property in Malta can become a reality. The island offers an exceptional living environment, pleasant weather year-round, and interesting investment opportunities. So, are you ready to embark on the Maltese adventure?

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.