Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

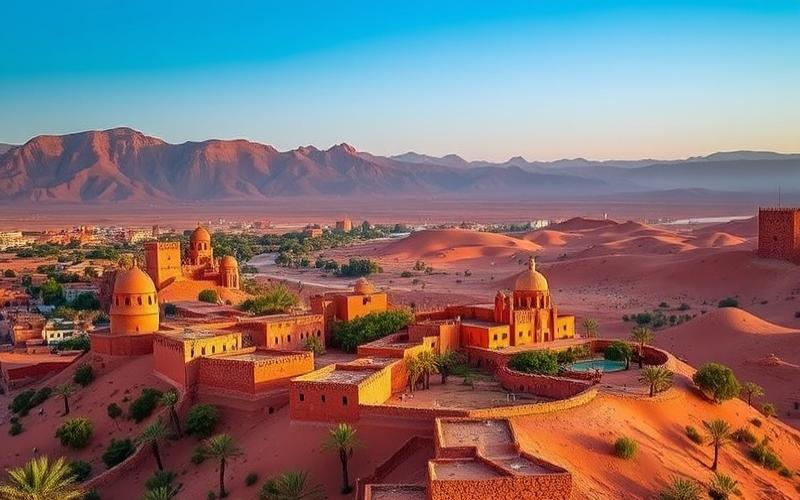

Morocco is establishing itself as a premier destination for entrepreneurs looking to expand their operations in North Africa. With a dynamic economy, strategic geographic location, and investment-friendly reforms, the Kingdom offers numerous opportunities for business creation. Here is a detailed guide to support your entrepreneurial venture in Morocco.

To learn more about company formation in Morocco, check out:

Morocco, a country undergoing significant economic and social transformation, has seen substantial evolution in its labor law in recent years. [...]

Opening a business bank account is a crucial step for any company looking to establish itself in Morocco. This process, [...]

Morocco offers a diverse and qualified talent pool for companies seeking workforce. However, the recruitment process in this North African [...]

Morocco is establishing itself as a land of opportunity for entrepreneurs and investors in 2025. Thanks to a dynamic economy [...]

Choosing a legal structure is a crucial step when starting a business in Morocco. This decision will significantly impact your [...]

Morocco offers a favorable environment for entrepreneurship, attracting numerous local and foreign investors. However, starting a business involves following a [...]

Morocco offers numerous opportunities for entrepreneurs looking to establish and grow their business. Whether you’re looking for commercial space, an [...]

Corporate culture plays a crucial role in the success and performance of organizations in Morocco. Understanding its subtleties and specificities [...]

Starting a business in Morocco in 2025 offers great opportunities but requires careful preparation to avoid pitfalls. Many entrepreneurs see [...]

Funding is a crucial element for the development and growth of any business. In Morocco, entrepreneurs have access to various [...]

Morocco is establishing itself as a land of opportunity for entrepreneurs, offering a dynamic economic environment and attractive growth prospects. [...]

Morocco offers a favorable environment for foreign investors looking to establish a business. However, it’s crucial to fully understand the [...]

Morocco is increasingly establishing itself as a dynamic hub for entrepreneurship and innovation in Africa. With a thriving ecosystem and [...]

E-commerce in Morocco is experiencing explosive growth, radically transforming the country’s commercial landscape. In 2025, the sector is reaching new [...]

Morocco, with its dynamic economy and strategic location, is attracting an increasing number of foreign investors. Whether you’re considering buying [...]

Morocco: A Land of Opportunity for Entrepreneurs

Morocco offers numerous advantages for foreign investors and local entrepreneurs:

Continuously improving business environment: The country has implemented significant reforms to simplify administrative procedures and attract investment. The World Bank’s Doing Business ranking reflects this progress, with Morocco consistently moving up in the rankings.

Strategic geographic position: Located at the gateway to Europe and Africa, Morocco offers privileged access to both markets. Modern infrastructure (ports, airports, road networks) facilitates commercial exchanges.

Competitive operational costs: Skilled labor at advantageous costs and tax incentives in certain sectors make Morocco attractive for many businesses.

Growing market: With a young population and expanding middle class, the domestic Moroccan market offers excellent development prospects.

Promising sectors: Automotive industry, aerospace, renewable energy, tourism, and outsourcing are all thriving sectors in Morocco.

Good to know:

The Industrial Acceleration Plan 2014-2020, extended until 2025, aims to strengthen Morocco’s industrial fabric and attract more foreign investment.

Main Legal Structures for Business in Morocco

Choosing the legal form is a crucial step when creating a company in Morocco. Here are the main options available to entrepreneurs:

Limited Liability Company (SARL): This is the most common form in Morocco, particularly suitable for SMEs. It offers great flexibility and limits partners’ liability to their contributions.

Public Limited Company (SA): This structure is preferred for large companies and projects requiring significant capital. It facilitates fundraising but involves stricter management and control obligations.

Simplified Joint Stock Company (SAS): Recently introduced in Morocco, it offers great freedom in the company’s internal organization. It is particularly suitable for startups and subsidiaries of foreign groups.

Self-Entrepreneur: This simplified status allows starting an individual business with streamlined formalities and advantageous taxation for small incomes.

Branch: Allows a foreign company to operate in Morocco without creating a separate legal entity. However, it does not have its own legal personality.

Good to know:

The Single-Member Limited Liability Company (SARL AU) is an interesting option for individual entrepreneurs wanting to benefit from a legal structure separate from their personal assets.

Corporate Taxation in Morocco: An Evolving System

The Moroccan tax system has undergone significant reforms in recent years, aiming to make it more competitive and attractive to investors. Here are the main elements to know:

Corporate Tax (IS): The standard rate is 31% for companies with profits exceeding 1 million dirhams. A progressive scale applies to lower profits, with rates ranging from 10% to 20%. Reduced rates are available for certain sectors or geographic areas.

Value Added Tax (VAT): The standard rate is 20%, with reduced rates of 7%, 10%, and 14% for certain products and services.

Minimum Contribution (CM): Applies in the absence of profit or when the calculated corporate tax is below a certain threshold. Its rate varies between 0.25% and 0.5% of turnover.

Tax incentives: Morocco offers numerous tax benefits to encourage investment, particularly in free zones, priority industrial sectors, or less developed regions.

French-Moroccan tax treaty: Allows avoidance of double taxation for companies operating in both countries.

Good to know:

The 2025 Finance Law provides for a gradual convergence toward a single corporate tax rate of 20% by 2026, aiming to simplify and harmonize corporate taxation.

Creating Your Company in Morocco: A Simplified Process

Company formation in Morocco has been significantly simplified in recent years. Here are the main steps to follow:

1. Choose the legal form and prepare the incorporation documents (articles of association, minutes, etc.).

2. Obtain a negative certificate from the Moroccan Office of Industrial and Commercial Property (OMPIC) to validate the chosen company name.

3. Establish the articles of association and have them legalized by the competent authorities.

4. Open a bank account for the company and deposit the share capital.

5. Register with the Trade Register at the competent commercial court.

6. Obtain the tax identification number from the General Directorate of Taxes.

7. Register with the National Social Security Fund (CNSS) for social obligations.

8. Publish a notice of incorporation in a legal announcements newspaper and in the Official Bulletin.

Good to know:

The Regional Investment Center (CRI) in each region offers a one-stop shop to facilitate business creation procedures and can support entrepreneurs throughout the process.

Morocco vs. Other Offshore Jurisdictions: A Strategic Positioning

Morocco positions itself as an interesting alternative to traditional offshore jurisdictions, offering a balance between tax advantages and regulatory stability:

Comparative advantages: – Geographic proximity to Europe – Political and economic stability – Modern infrastructure – Skilled and competitive workforce – Free trade agreements with the EU and United States

Compared to other destinations: – More transparent than some tax havens – More advantageous tax regime than many European countries – Fewer regulatory constraints than in the EU – Lower operational costs than Dubai or Singapore

Attractive free zones: Tangier Med, Casablanca Finance City, offering specific tax advantages.

Good to know:

Morocco is not considered a tax haven by the OECD, giving it a better international reputation while offering significant tax advantages.

Social Obligations: An Evolving Framework

Companies in Morocco must comply with several social obligations:

CNSS registration: Mandatory for any company employing staff.

Social security contributions: Cover illness, maternity, disability, and old-age risks, shared between employer and employee.

Mandatory Health Insurance (AMO): Medical coverage system for private sector employees.

Labor law: The Moroccan Labor Code governs employer-employee relations, setting the legal working week at 44 hours.

Professional training: Companies are required to contribute to their employees’ continuing education.

Good to know:

The new strike law (97.15) now regulates social movements, offering more predictability to businesses while guaranteeing workers’ rights.

Opening a Corporate Bank Account in Morocco: Key Steps

Opening a bank account is a crucial step in creating a company in Morocco. Here is the procedure to follow:

1. Choose a bank: Compare offers from major Moroccan and international banks present in Morocco.

2. Prepare necessary documents: – Company articles of association – Trade Register registration certificate – Tax identification number – Identity documents of managers and signatories

3. Schedule an appointment with a bank advisor to present your project.

4. Sign the account agreement and associated documents.

5. Make an initial deposit to activate the account.

6. Obtain payment methods (checkbooks, bank cards) and access to online services.

Good to know:

Some banks offer specific packages for newly created companies, including tailored services and preferential rates.

Future Sectors in Morocco: Where to Invest in 2025?

Morocco has identified several priority sectors for its economic development:

Automotive industry: With major manufacturers established and a growing subcontractor ecosystem.

Aerospace: A rapidly growing sector, benefiting from significant investments and skilled workforce.

Renewable energy: Morocco aims to increase the share of renewable energy in its electricity mix to 52% by 2030.

Agribusiness: A key sector benefiting from the Green Morocco Plan to modernize agriculture and develop the food industry.

Tourism: Despite recent challenges, the sector remains strategic with opportunities in sustainable and luxury tourism.

Outsourcing: Morocco positions itself as a hub for outsourced services, particularly in IT and BPO domains.

Digital economy: With a dynamic startup ecosystem and government initiatives to promote digitalization.

Good to know:

The “New Generation of Entrepreneurs” program launched by the Moroccan government aims to support the creation of 10,000 startups by 2025, offering numerous opportunities in innovation and tech.

Building Your Team in Morocco: Recruitment Keys

To succeed in your establishment in Morocco, recruiting local talent is essential. Here are some tips for building your team:

Understand the local labor market: Morocco has a young and increasingly qualified workforce, particularly in technical fields and engineering.

Use the right recruitment channels: – Specialized job sites (Rekrute, Emploi.ma) – Professional social networks (LinkedIn) – Local recruitment agencies – Partnerships with universities and engineering schools

Respect labor legislation: Ensure you know the Moroccan Labor Code well to establish compliant contracts.

Offer attractive packages: Competitive salary, social benefits, career progression prospects to attract and retain the best talent.

Invest in training: Skills development is crucial for your company’s performance and employee retention.

Promote diversity: Morocco encourages youth employment and gender equality in the workplace.

Good to know:

The “Taehil” program offers training adapted to company needs and can co-finance the training of your future employees.

Creating a company in Morocco in 2025 offers numerous opportunities for visionary entrepreneurs. With a continuously improving regulatory framework, dynamic business sectors, and strategic positioning, the Kingdom establishes itself as a premier destination for business development in Africa and beyond.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.