Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

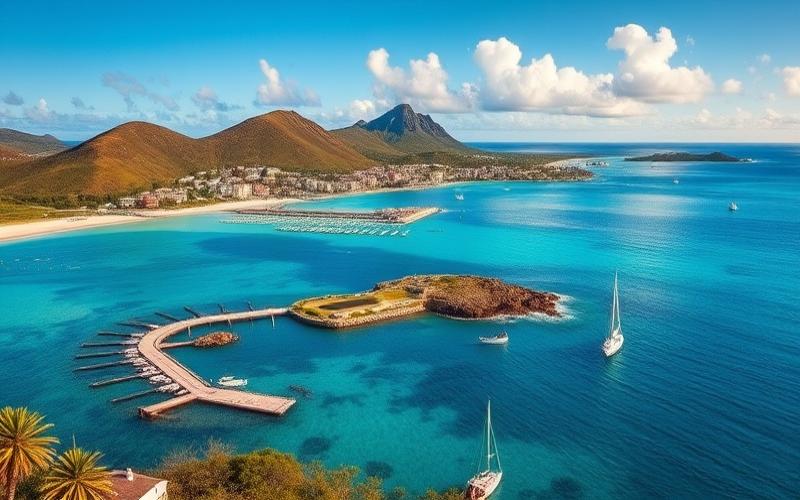

Bermuda, a British archipelago in the North Atlantic Ocean, is much more than a dream destination for tourists seeking paradise beaches. This UK Overseas Territory has established itself as one of the world’s most important offshore financial centers, offering a business-friendly environment thanks to its advantageous tax system and favorable regulatory framework. For visionary entrepreneurs, Bermuda represents a unique land of opportunity, where numerous promising sectors can be successfully developed.

Future Sectors in Bermuda: Focus on Innovation and Finance

Bermuda has successfully diversified its economy over the years, leveraging its natural assets and financial expertise to attract investors from around the world. Here’s an overview of the most promising sectors for entrepreneurs looking to establish themselves on the archipelago:

1. Insurance and Reinsurance: A Pillar of Bermuda’s Economy

The insurance and reinsurance sector is undeniably the driving force of Bermuda’s economy. The archipelago has established itself as one of the world’s leading centers in this field, attracting numerous international companies thanks to its favorable regulatory framework and recognized expertise. Bermuda is notably the global leader in natural catastrophe reinsurance, covering over 35% of the global market.

Opportunities in this sector are numerous, whether in creating new insurance companies, developing innovative products, or providing related services (actuarial, risk management, etc.). Entrepreneurs can particularly position themselves in rapidly growing niches like parametric insurance or cyber insurance.

Good to know:

Bermuda is home to more than 1,200 insurance and reinsurance companies, generating over 40% of the archipelago’s GDP.

2. Financial Services: A Dynamic Ecosystem in Constant Evolution

Beyond insurance, Bermuda offers a wide range of opportunities in the financial services sector. The archipelago is recognized for its expertise in asset management, investment funds, and offshore banking services. Entrepreneurs can particularly position themselves in:

- Creating and managing alternative investment funds (hedge funds, private equity, etc.)

- Wealth management services for an international high-net-worth clientele

- Developing innovative fintech solutions (payments, trading, etc.)

- Consulting services for financial and tax structuring

The Bermudian government actively encourages innovation in the financial sector, particularly through its “Innovation Hub” aimed at attracting and supporting fintech startups.

Good to know:

Bermuda ranks 4th globally in the Global Financial Centres Index’s financial center competitiveness ranking.

3. Information Technology: A Rapidly Expanding Sector

The information technology sector is experiencing rapid growth in Bermuda, driven by the needs of the financial sector and the government’s desire to diversify the economy. Opportunities are numerous for tech entrepreneurs, particularly in:

- Developing cloud and cybersecurity solutions for the financial sector

- Creating risk management platforms and data analytics for the insurance industry

- Developing blockchain applications and cryptocurrencies, with Bermuda having adopted favorable regulations for these technologies

- Providing secure hosting and data center services

The Bermudian government has implemented specific tax incentives to attract technology companies, including duty exemptions on importing computer hardware and software.

Good to know:

Bermuda launched a “Technology Innovation Hub” initiative in 2018 aimed at attracting 100 new tech startups to the archipelago by 2025.

4. Luxury Tourism: A Historic Sector in Full Revival

Although less predominant than in the past, tourism remains a key sector of Bermuda’s economy, with a decidedly high-end positioning. Opportunities for entrepreneurs in this field are numerous:

- Developing luxury hotels and resorts

- Creating exclusive tourist experiences (yachting, golf, spa, etc.)

- Organizing high-end events (weddings, corporate seminars, etc.)

- Concierge and property management services for a wealthy clientele

The Bermudian government has implemented tax incentives to encourage the development of new hotel projects, including profit tax exemptions during the first years of operation.

Good to know:

Bermuda welcomed over 800,000 visitors in 2019, with 40% arriving by sea, generating revenues exceeding $500 million.

Financing Your Project in Bermuda: Keys to Success

Once your business project is defined, the question of financing inevitably arises. Bermuda offers an investor-friendly environment, with several options for raising funds:

1. Equity: The Foundation of Every Entrepreneurial Project

Equity contribution remains the cornerstone of any business project in Bermuda. Local investors and financial institutions place great importance on the project leader’s financial commitment. It is therefore crucial to have a substantial personal contribution, typically at least 30% of the total project amount.

To increase your equity, several options are available:

- Personal and family savings

- Sale of personal assets

- Approaching angel investors specialized in offshore projects

- Finding financial partners willing to invest capital

Good to know:

Bermuda imposes no restrictions on foreign investments, thus facilitating the inflow of external capital.

2. Bank Loans: An Essential Financial Lever

Bermuda’s banking system is solid and offers various financing options for entrepreneurs. The main banks on the archipelago, such as HSBC Bermuda, Butterfield Bank, and Clarien Bank, offer business loans at competitive rates.

To maximize your chances of obtaining a bank loan:

- Prepare a solid and detailed business plan

- Demonstrate the financial viability of your project with realistic projections

- Provide solid guarantees (personal assets, guarantees, etc.)

- Prioritize sectors that are priorities for Bermuda’s economy (finance, insurance, technology)

Good to know:

Bermudian banks typically offer loans covering up to 70% of the total project amount, with terms extending up to 15 years for real estate investments.

3. Government Assistance: A Significant Boost

The Bermudian government has implemented several assistance programs to support business creation and development on the archipelago. Among the main initiatives:

- The “Economic Development Department” offers grants and preferential rate loans for innovative projects

- The “Bermuda Business Development Agency” provides personalized support and connections with potential investors

- The “Bermuda Economic Development Corporation” offers microcredits and loan guarantees for small businesses

These aids are particularly interesting for projects in priority sectors defined by the government, including fintech, renewable energy, and the blue economy.

Good to know:

The Bermudian government launched a $50 million investment fund in 2024 to support innovative startups in finance and technology.

4. Venture Capital: For High-Potential Projects

Bermuda is increasingly attracting the attention of international venture capital funds, particularly for projects in fintech and insurtech sectors. Several funds specialized in offshore investments have established a presence on the archipelago, offering financing opportunities for high-potential startups.

To attract the attention of venture capital investors:

- Develop an innovative and scalable concept

- Build a strong team with recognized expertise in your field

- Prepare a convincing pitch deck highlighting your competitive advantage

- Participate in startup events and competitions organized on the archipelago

Good to know:

In 2024, Bermudian startups raised over $200 million from venture capital investors, a record for the archipelago.

Bermuda’s Assets for International Entrepreneurs

Beyond sector opportunities and financing options, Bermuda offers numerous advantages for entrepreneurs wishing to develop their activities there:

1. An Attractive Tax Environment

Bermuda’s advantageous tax system is one of the archipelago’s main assets for international entrepreneurs. Among the notable tax benefits:

- No corporate tax, income tax, capital gains tax, or dividend tax

- No value-added tax (VAT) or inheritance tax

- Tax information exchange agreements with numerous countries

- Specific tax exemptions for certain priority sectors (new technologies, renewable energy, etc.)

This attractive tax system allows companies to maximize their profits and reinvest in their growth.

Good to know:

Bermuda has signed tax information exchange agreements with over 80 countries, ensuring transparency and compliance with international standards.

2. A Stable and Business-Friendly Regulatory Framework

Bermuda benefits from a strong legal system, based on English law, offering great security to investors. The regulatory framework is regularly updated to adapt to business world evolutions, while maintaining high standards of governance and transparency.

The main strengths of Bermuda’s regulatory framework include:

- A simplified and rapid business creation process (less than 48 hours in most cases)

- Strong protection of intellectual property rights

- Specific regulatory regimes for innovative sectors (fintech, blockchain, etc.)

- A regulatory authority (Bermuda Monetary Authority) internationally recognized for its expertise

Good to know:

Bermuda ranked 12th globally in the World Bank’s “Ease of Doing Business” index in 2024, reflecting the quality of its business environment.

3. A Skilled and International Workforce

Bermuda has a pool of highly qualified talent, particularly in finance, insurance, and technology. The archipelago also attracts many international professionals, creating a multicultural and dynamic work environment.

To facilitate the recruitment of foreign talent, the Bermudian government has implemented:

- Simplified procedures for obtaining work permits

- Special visas for entrepreneurs and investors

- Training programs and local skills development

Good to know:

Over 25% of Bermuda’s workforce consists of expatriates, demonstrating the archipelago’s attractiveness to international talent.

4. Exceptional Quality of Life

Beyond professional benefits, Bermuda offers an exceptional living environment that appeals to many entrepreneurs. Among the archipelago’s assets:

- A pleasant subtropical climate year-round

- Paradise beaches and breathtaking landscapes

- High security and low crime rate

- Modern infrastructure (healthcare, education, transportation)

- Rich cultural life and a dynamic international community

This quality of life helps attract and retain talent, thus fostering long-term business development.

Good to know:

Bermuda was ranked the 3rd global destination for expatriates in the 2024 “Expat Insider Survey,” highlighting the archipelago’s appeal to international professionals.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.