Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

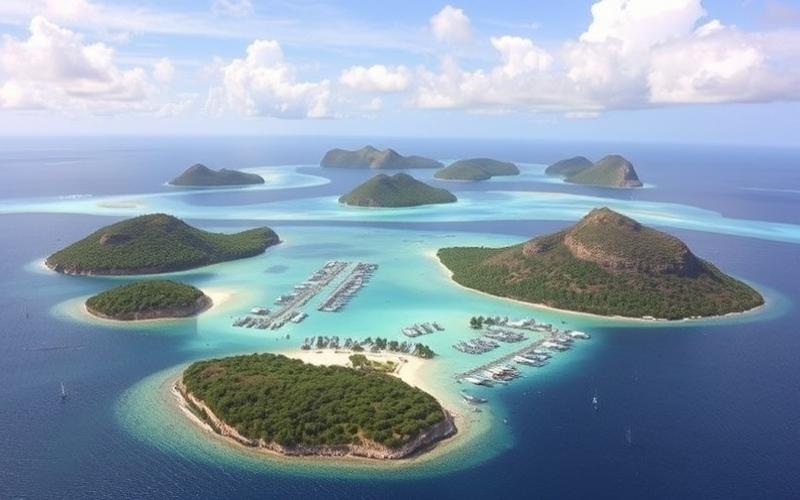

The Cayman Islands, a British archipelago located in the Caribbean, are much more than just a dream destination for tourists seeking paradise beaches. This UK overseas territory has established itself as one of the world’s most important financial centers, offering a favorable environment for business development across various sectors. With a stable economy, favorable regulatory framework, and advantageous tax system, the Cayman Islands attract numerous international entrepreneurs and investors.

In this article, we will explore the most promising sectors for creating and developing a business in the Cayman Islands, as well as effective strategies for raising funds and financing your entrepreneurial project in this tax haven. Whether you’re an experienced entrepreneur or an investor seeking new opportunities, discover how to leverage the unique advantages offered by the Cayman Islands to propel your business toward success.

The Gems of the Cayman Economy: Key Sectors for Your Success

The Cayman Islands offer fertile ground for business development in several dynamic sectors. Here’s an overview of the most promising areas that deserve your attention:

1. Financial Services: The Beating Heart of the Cayman Economy

The financial services sector is undoubtedly the pillar of the Cayman Islands’ economy. This small territory has established itself as one of the world’s most important offshore financial centers, attracting international financial institutions, investment funds, and wealth management companies.

The Cayman Islands host more than 11,000 investment funds, making it one of the most popular jurisdictions for fund domiciliation. Tax benefits, political and economic stability, and the favorable regulatory framework have contributed to this dominant position.

- Private banking and wealth management

- Trust and corporate services

- Insurance and reinsurance

- Investment funds and asset management

- Compliance and regulatory services

By establishing your business in this sector, you’ll benefit from a sophisticated business environment, skilled workforce, and an international network of financial professionals.

Good to know:

The Cayman Islands are recognized for their robust regulatory framework and adherence to international standards in anti-money laundering and counter-terrorism financing, which enhances the credibility of businesses established there.

2. Luxury Tourism: Harnessing the Potential of a Tropical Paradise

Tourism is another major pillar of the Cayman economy, with particular emphasis on the high-end segment. The Cayman Islands attract wealthy visitors from around the world each year, seeking luxury experiences in an idyllic setting.

In 2019, before the pandemic, the Cayman Islands welcomed over 2.3 million visitors, generating substantial revenue for the local economy. Although the sector was impacted by the health crisis, it’s experiencing rapid recovery and offers numerous opportunities for visionary entrepreneurs.

- Luxury hotels and resorts

- Fine dining restaurants and unique culinary experiences

- High-end concierge services and event planning

- Business tourism and MICE (Meetings, Incentives, Conferences, and Exhibitions)

- Ecotourism and exclusive wellness experiences

By investing in this sector, you can capitalize on the Cayman Islands’ reputation as a luxury destination and offer exceptional services to a demanding and affluent clientele.

Good to know:

The Cayman Islands are renowned for their white sand beaches, crystal-clear waters, and exceptional marine biodiversity, providing an ideal setting for developing unique, high-end tourism experiences.

3. Technology and Innovation: Riding the Digital Wave

Although less known than the financial and tourism sectors, the technology and innovation field is experiencing rapid growth in the Cayman Islands. The Cayman government has implemented initiatives to promote innovation and attract technology companies, creating an environment conducive to the development of startups and cutting-edge businesses.

In 2018, the Cayman Islands launched “Cayman Enterprise City,” a special economic zone dedicated to technology and innovative businesses. This initiative offers attractive tax and regulatory benefits for tech sector companies.

- Fintech and blockchain

- Cybersecurity

- Artificial intelligence and machine learning

- Payment solutions and cryptocurrencies

- Maritime and environmental technologies

By establishing your technology business in the Cayman Islands, you’ll benefit from an advantageous tax framework, modern infrastructure, and proximity to the financial sector, offering opportunities for collaboration and innovation.

Good to know:

The Cayman Islands have state-of-the-art telecommunications infrastructure, with high-speed internet connections and 5G coverage being deployed, facilitating the development of technology businesses.

Funding Your Entrepreneurial Dream: Fundraising Strategies in the Cayman Islands

Once you’ve identified the promising sector in which you want to develop your business in the Cayman Islands, the next crucial step is securing the necessary funding to bring your project to life. Fortunately, the archipelago offers a favorable environment for fundraising, with various options tailored to the specific needs of each entrepreneur.

1. Venture Capital and Angel Investors: Attracting Savvy Investors

The Cayman Islands have become a preferred destination for many venture capital funds and angel investors seeking promising investment opportunities. The presence of a robust financial sector and favorable regulatory framework facilitates access to capital for innovative entrepreneurs.

According to Cayman Islands Monetary Authority data, over 70% of US venture capital funds are domiciled in the Cayman Islands. This concentration of potential investors offers unique opportunities for entrepreneurs seeking funding.

- Develop a solid business plan and clear growth strategy

- Highlight your project’s innovation and disruption potential

- Build an experienced and complementary management team

- Prepare a compelling pitch deck and realistic financial projections

- Participate in networking events and investor conferences in the Cayman Islands

By leveraging the Cayman Islands’ thriving investment ecosystem, you’ll increase your chances of obtaining the necessary funding to propel your business toward success.

Good to know:

The Cayman Islands regularly organize investment-focused events and conferences, offering valuable opportunities to meet potential investors and present your project.

2. Bank Financing: Leveraging a Robust Banking Sector

The Cayman Islands’ banking sector is one of the most developed and stable in the world. With over 150 licensed banks operating in the territory, including many renowned international institutions, entrepreneurs have access to a wide range of financial products and services to support their growth.

Caymanian banks collectively manage over $1.5 trillion in assets, demonstrating the strength and sophistication of the local banking sector. This abundant liquidity can be leveraged by entrepreneurs to fund their projects.

- Establish a strong relationship with a local or international bank present in the territory

- Prepare a comprehensive credit file, including audited financial statements and detailed projections

- Consider different types of bank financing, such as term loans, credit lines, or asset financing

- Explore government loan guarantee programs to strengthen your application

- Be prepared to provide collateral or security to secure financing

By leveraging the sophistication of the Cayman banking sector, you can access customized financing solutions to support your business growth.

Good to know:

Caymanian banks are renowned for their expertise in financing international projects and often offer flexible solutions tailored to entrepreneurs’ specific needs.

3. Government Programs and Incentives: Benefiting from Local Support

The Cayman Islands government has implemented several initiatives and programs aimed at supporting entrepreneurship and attracting foreign investment. These programs offer funding opportunities and tax benefits that can significantly reduce your business startup and operating costs.

“Cayman Enterprise City” offers tax incentives of up to 100% corporate tax exemption for 20 years for eligible businesses. This type of advantage can free up significant financial resources for your business development.

- Grant programs for innovation and research and development

- Tax incentives for businesses in priority sectors

- Subsidized training and skills development programs

- Export and internationalization support for businesses

- Immigration facilities for foreign entrepreneurs and investors

By researching these programs and working closely with local government agencies, you can access valuable resources to fund and develop your business in the Cayman Islands.

Good to know:

The Cayman Islands government regularly organizes seminars and workshops to inform entrepreneurs about available support programs and help them access them.

Conclusion: Seize the Opportunity for a Prosperous Future in the Cayman Islands

The Cayman Islands offer an exceptional environment for visionary entrepreneurs looking to develop their business in an advantageous tax framework and sophisticated business ecosystem. Whether you choose to venture into financial services, luxury tourism, or innovative technologies, you’ll benefit from a dynamic market and favorable government support.

By combining promising sector opportunities with the various available funding options, you can realize your entrepreneurial vision and propel your business to new heights. The Cayman Islands are not just a tax haven, but a true springboard for business innovation and growth on a global scale.

Remember that the key to success lies in meticulous preparation, thorough understanding of the local market, and the ability to leverage the unique resources and opportunities offered by the Cayman Islands. With the right strategy and rigorous execution, your business can thrive in this Caribbean business haven.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.