Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Vanuatu’s Notary System: Between Tradition and Modernity

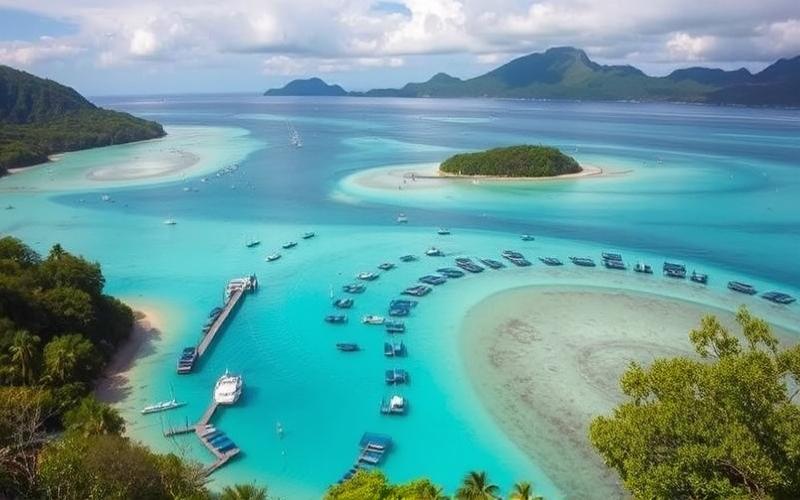

Located in the Melanesian archipelago of the South Pacific, Vanuatu offers a captivating blend of local traditions and modern legal practices that shape its unique notary system.

Whether you’re considering purchasing property or embarking on an investment, understanding the essential roles of notaries along with the fees associated with their services is crucial for navigating this complex legal landscape.

This article will guide you through the nuances of Vanuatu’s notary system, enabling you to make informed decisions with confidence.

Good to Know:

Vanuatu’s legal system combines local customary law with elements of British and French law, a legacy of its colonial past.

Understanding the Notary’s Role in Property Purchases in Vanuatu

The notary in Vanuatu is a public officer responsible for ensuring the security, legality, and incontestability of real estate transactions. Their primary role involves verifying that all legal conditions are met to guarantee property transfer between seller and buyer, while protecting the interests of the involved parties as well as those of the State.

Specific Steps of Notary Involvement in Property Purchases in Vanuatu:

- Verification of the validity of the property titles being sold.

- Check of the property’s mortgage status.

- Preparation and verification of the complete file including mandatory technical diagnostics (natural, mining, technological risks…).

- Drafting or validation of the authentic deed of sale.

- Supervision of official signing by all concerned parties.

- Legal and administrative registration of the transfer with competent authorities.

Legal and Ethical Obligations:

- Strictly respect local real estate law at every stage.

- Ensure that both parties’ consent is free and informed.

- Maintain absolute neutrality throughout the process: they are neither agent nor exclusive representative of one party but neutral guarantor of the transaction.

- Prevent any attempt or risk of fraud or hidden defects affecting legal validity.

Notary Particularities in Vanuatu (International Comparisons):

| Aspect | Notary System in Vanuatu | Other Countries (e.g., France, Indonesia) |

| Nature of Acts | Certain acts must be established in notarial form (authentic wills, important contracts…) | Same requirement in many other civil law systems |

| Preparation | The notary fully supervises preparation & drafting | Same in civil law tradition countries |

| Registration | Mandatory registration with local authorities after signing | Similar procedure but formalities vary by country |

Responsibilities Towards:

Buyer

- Ensure the purchased property is legally sound

- Inform about all known risks related to the property

Seller

- Guarantee they actually hold all necessary rights

- Assist in potential removal of mortgages or charges

State

- Proper collection of registration-related taxes

- Faithful transmission to public records

Rights & Recourses in Case of Dispute or Failure:

If a party believes they have suffered harm due to notarial fault (intentional/material omission), they can:

- Engage the notary’s professional civil liability to obtain compensation;

- Refer to disciplinary bodies if proven ethical failure;

- File a complaint with competent civil courts to challenge/cancel a flawed transaction.

The Vanuatu notary’s scrupulous respect thus guarantees not only legal security but also contractual fairness between local and international buyers.

Good to Know:

The notary in Vanuatu plays a crucial role in real estate transactions, acting as guarantor of the purchase’s legitimacy and security. They intervene from the verification of property titles to ensure the seller is indeed the legitimate owner, and draft the deed of sale in compliance with local laws. Unlike other countries, Vanuatu’s notary system requires the notary to register the deed of sale with the land registry, thus solidifying the transaction. As an impartial representative, the notary ensures the protection of the buyer’s, seller’s, and State’s interests by verifying that all tax and legal obligations are met. If a dispute arises, parties can turn to the notary or initiate legal proceedings to rectify the situation, leveraging the notary’s high degree of legal and ethical responsibility that provides recourses to resolve any failure.

Analysis of Notary Fees and Hidden Costs for Property Purchases in Vanuatu

In Vanuatu, notary fees for property purchases are not mandatory but may be required in certain cases. Generally, they represent approximately 1% of the property value if the buyer decides to use a notary or legal practitioner.

Registration fees constitute the main fixed cost and vary according to the buyer’s status:

| Buyer Status | Registration Fee Percentage |

| Resident | 2% |

| Non-resident | 5% |

To these fees may potentially be added:

- Various administrative fees (document preparation)

- Bank fees in case of financing

- Costs for technical inspections or property appraisals (not systematic but recommended)

- Fees for specialized lawyers or legal practitioners if mandated

- Specific government taxes depending on property nature or location

The overall cost structure can be presented as follows:

| Fee Type | Calculation Method | Usual Range |

| Notary/legal practitioner | Variable | Approximately 1% |

| Registration fees | Fixed | 2% (residents) / 5% (non-residents) |

| Inspection/Appraisal | Flat rate/hourly | Variable |

| Other administrative costs | Fixed/variable | Several dozen to hundreds USD |

Regional comparison:

In Vanuatu, registration fees are significantly higher than in some neighboring countries like New Caledonia where they hover around 3%, but remain comparable or even lower than those observed in Fiji for foreigners. “Notary fees” in the strict sense are often lower than in mainland France, where they range between 6 and 8% of the total price with a significant portion going to various public taxes.

Practical Tips to Anticipate and Manage Your Property Budget in Vanuatu:

- Consider not only the listed price but also all ancillary fees from the first budget simulation.

- Systematically request a written quote detailing each item from the chosen professional.

- Verify your tax/residential status before any commitment to accurately estimate the applicable rate.

- Allow for an additional margin in your overall budget to cover inspections and potential unforeseen events.

In summary: planning between 3% and up to over 6% of the total amount depending on services requested and tax status allows for a realistic approach when acquiring property in Vanuatu.

Good to Know:

When purchasing property in Vanuatu, notary fees generally represent about 1 to 2% of the property value, a variable amount that depends on the total acquisition price. To these fees are often added significant additional costs: government taxes that can reach up to 7% of the transaction amount, property transfer fees, and inspection or appraisal fees that are sometimes mandatory. Compared to other neighboring countries like Fiji or Solomon Islands where some of these fees may be lower, it is crucial for buyers to carefully plan their budget to avoid unpleasant surprises. To better anticipate these expenses, it is advisable to request complete quotes including all costs from local notaries or real estate advisors, and verify any restrictions or specific taxes for certain islands or regions of Vanuatu.

Tips to Optimize Notary Fees in Vanuatu

Notary fees in Vanuatu are not mandatory for all transactions, but they frequently apply to real estate operations or authentic acts. Local regulations sometimes allow for the use of legal practitioners or lawyers instead of traditional notaries.

Calculation of Notary Fees and Local Regulations

- Notary fees (or equivalent fees) are generally around 1% of the real estate property value.

- To this are added registration fees, such as stamp duty (2%) and mortgage registration (5%).

- If the acquisition concerns a property held by a company, it is possible, via a share transfer rather than direct property transfer, to reduce these fees to approximately 4% total.

Possible Reductions

- Optimization mainly occurs through the chosen legal structure: opting for a share purchase can reduce payable fees.

- Some fees can be negotiated with the chosen professional depending on the case complexity and volume of acts to process.

| Type of Act | Standard Fees | Possible Reduction |

|---|---|---|

| Direct purchase | ~1% + 7% ancillary | No |

| Transfer via company | ~4% all inclusive | Yes |

Practical Tips to Optimize Costs

Prepare all necessary documents in advance: land titles, identification papers, company statutes if purchasing through a company. This limits time spent with the professional and thus their potential fees.

Verify with the professional which exact supporting documents will be required to avoid any delays or additional billable processing.

List of Often Requested Documents:

- Passport

- Proof of address

- Signed contract/agreement

- Documents related to marital status

- Company statutes if purchase by company

Compare Rates Between Professionals

All authorized professionals (local notaries, specialized legal practitioners) set their own fees. It is strongly recommended to:

- Obtain several detailed quotes before any signing.

- Request a precise breakdown: pure fees vs official taxes.

Online Procedures

Certain administrative procedures or preliminary requests can be completed online with Vanuatu public services or via your local legal representative:

Advantages: savings on physical travel; possible reduction on certain ancillary costs like paper printing or manual processing.

Verification of Qualifications & Reputation

- Consult local official directories to verify your contact is accredited (particularly if they are not called “notary” but “legal practitioner”).

- Search for recent client reviews on their efficiency and reliability.

- Request written confirmation regarding their professional insurance coverage as well as their degrees/certifications.

Key Takeaway

Optimizing your fees requires rigorous administrative preparation,

active comparison between providers,

intelligent use of appropriate legal structures,

as well as constant vigilance regarding the actual qualifications of the chosen professional.

These best practices guarantee not only controlled costs but also the indispensable legal security during notarial operations in Vanuatu.

Good to Know:

In Vanuatu, notary fees are governed by local regulations that generally calculate them based on the transaction value; it is therefore useful to know the different scales to estimate costs. To optimize these fees, preparing all necessary documents in advance reduces time spent with the notary, and thus associated costs. Comparing rates between several notaries is essential, as they can vary, and it is sometimes possible to negotiate reductions, especially for complex or repeated transactions. Additionally, certain procedures can be completed online, which helps reduce additional fees. Finally, ensure you verify the notary’s qualifications and reputation, as an experienced professional guarantees quality services, thus justifying the investment made.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.