Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Purchasing Agricultural Land in Vanuatu: What You Need to Know

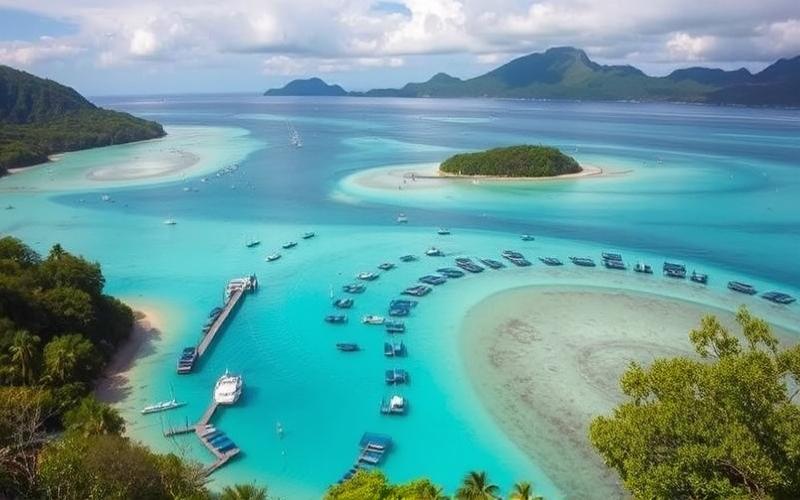

Purchasing agricultural land in Vanuatu, a South Pacific island paradise, is attracting increasing numbers of international investors seeking lucrative opportunities in an idyllic setting. However, before embarking on this venture, it’s crucial to fully understand the legal nuances governing this process in this island nation.

Vanuatu offers a unique real estate market with specific rules that differ significantly from those found elsewhere. To avoid common pitfalls and secure your investment, familiarizing yourself with legal aspects, such as ownership restrictions for foreigners and tax obligations, proves essential.

This article will guide you through the necessary steps and allow you to navigate Vanuatu’s regulatory framework with confidence, transforming your agricultural project into a flourishing reality.

Good to Know:

Vanuatu imposes certain restrictions on land ownership for foreigners. It’s essential to verify acquisition conditions before finalizing any purchase.

Legal Advice on Purchasing Agricultural Land in Vanuatu

Key Points to Follow When Acquiring Agricultural Land in Vanuatu:

- Foreigners can acquire agricultural land only through leasehold arrangements (long-term leases), typically for 75 years with renewal options. Freehold land ownership is reserved for local customary communities.

- All acquisitions must comply with local legislation on customary property and leases, with particular attention paid to traditional landowners’ rights.

- For any commercial agricultural activity, a foreign investor must obtain a specific permit from the Director of Agriculture. This permit requires a written application accompanied by payment of an administrative fee and may be subject to various restrictive conditions depending on the sector or nature of the agricultural product involved.

- Certain agricultural activities are exclusively reserved for nationals under the Vanuatu Foreign Investment Promotion Act; therefore, it’s imperative to verify whether the planned activity appears on this list before any commitment.

Local Regulations and Tax Implications:

| Subject | Detail |

|---|---|

| Type of Acquisition | Leasehold (up to 75 years) |

| Customary Ownership | Mandatory consultation with traditional owners |

| Operating Permit | Required for any commercial agricultural activity |

| Taxes & Fees | Legal fees (~1% transaction value, negotiable), variable annual rents |

- The purchase incurs legal fees (attorney or notary fees) around 1% of the sale price; they remain negotiable but are strongly recommended even if not legally mandatory.

- The annual rent depends particularly on the size, category, and location of the land.

Foreigners’ Rights on Agricultural Land:

- No formal restrictions for leasing long-term (for foreign individuals or entities).

- Direct access to resident status may be facilitated if real estate investment exceeds certain financial thresholds.

Legal Steps Required to Secure the Purchase:

- Precise identification of desired land and preliminary verification with competent authorities regarding its land status.

- Negotiation with local customary rights holders in the presence of a specialized local attorney to avoid any subsequent disputes related to traditional claims.

- Complete due diligence on:

- Authenticity of title/lease

- Absence of ongoing disputes or claims

- Signing before a recognized local notary/attorney

- Official registration of the contract with relevant cadastral authorities

- Potential application (if commercial activity) then effective obtaining of the required permit/agreement from the Agriculture Director

Available Legal Services & Precautions Against Land Fraud/Disputes:

Available Services:

- Specialized firms in Vanuatu land law primarily located in Port Vila offer:

- Due diligence assistance

- Drafting/validation of bilingual French/English contracts

- Support in all administrative procedures

Essential Precautions:

- Always engage an experienced local attorney familiar with subtleties between modern written law and customary practices

- Require all original documents related to the lease/title – absolute distrust of uncertified copies

- Refuse any informal transaction without official notarial validation or final cadastral registration

Notable Example: Several recent cases have seen leases invalidated due to inadequate consultation with all concerned customary rights holders; these situations resulted either in forced additional payments or, in some serious cases, outright cancellation of rights acquired by the foreign investor after several years.

Key Takeaway: Professional legal support from the beginning remains essential to guarantee maximum legal security during a real estate transaction involving agricultural land in Vanuatu—both regarding state laws and mandatory respect for traditional practices recognized by the local Constitution.

Good to Know:

Before purchasing agricultural land in Vanuatu, it’s crucial to consult a local attorney to navigate regulations governing land acquisition by foreigners, as they can only obtain long-term leases rather than freehold title. Ensure you verify the land status through the land registry to prevent any competing claims. Vanuatu’s tax system being favorable, there’s no capital gains tax on real estate, but it’s advisable to inquire about specific tax impacts related to leases. Local legal services can assist with drafting and verifying contracts and complying with legal procedures. To avoid fraud, conduct exhaustive due diligence and enlist specialized advisors in land transactions, being wary of overly attractive offers that might conceal unresolved disputes. A case law example illustrates that insufficient due diligence can lead to prolonged disputes, emphasizing the importance of meticulous preparation in this process.

Understanding Rural Zoning and Non-Buildable Land

Rural zoning in Vanuatu defines land use outside urban centers, aiming to support agriculture, environmental preservation, and balanced development of rural communities. This zoning relies on a combination of national laws and local regulations governing permitted uses for each land category.

Main Rural Zoning Categories:

- Agricultural Zone: reserved for cultivation, livestock, and activities related to primary production.

- Rural Residential Zone: allows residential use with sometimes small agricultural or artisanal activity.

- Special or Protected Zones: include forests, sensitive coastal areas, or customary lands subject to additional restrictions to preserve biodiversity.

Specific Regulations by Category

| Category | Permitted Uses | Main Restrictions |

|---|---|---|

| Agricultural | Cultivation, livestock, agricultural storage | Prohibition of non-agricultural constructions |

| Rural Residential | Individual housing | Limitation on building density and height |

| Protected/Special Zones | Controlled activities (e.g., ecotourism) | Heavily restricted development |

Agricultural lands are strictly regulated: it’s not possible to freely build houses or commercial infrastructure without specific administrative procedures. The objective is to prevent rural sprawl and preserve natural resources to ensure sustainable food security.

For a Potential Buyer:

- Land use will depend entirely on the zone type indicated in the land lease.

- Land classified as “non-buildable” can only be developed for agriculture; any other construction requires an official application to the Local Council accompanied by a building permit complying with technical standards (particularly cyclone resistance).

- Market value is generally lower than buildable land but may increase if legal reclassification is obtained.

Restrictions on Non-Buildable Land

These restrictions exist to:

- Protect fertile soils from excessive urbanization

- Ensure sufficient space remains dedicated to essential food crops

- Prevent conflicts related to overlap between customary rights and private development

Relevant Local Laws and Regulations

Urban planning rules are established by:

- National legislation on rural planning (Agriculture Act No. 17 of 2018)

- Local guidelines imposing minimum distances between structures, height/density limitations

Any construction systematically requires a permit issued after review by the competent Local Council.

Legal Procedure to Reclassify Non-Buildable Land

- Submission to the Local Council/Land Department of a motivated application specifying the planned project.

- Technical study including plans conforming to anti-cyclonic standards.

- Potential consultation with customary owners if applicable.

- Official issuance (or refusal) after verification of compatibility with local urban plans.

Exceptions exist but remain rare: they mainly concern projects deemed essential to community development or meeting specific national policy (sustainable tourism for example).

Key Takeaway:

Any intention to modify initial use must scrupulously follow legal procedure under penalty of administrative or even judicial sanctions; this vigilance protects both buyers and investors against any subsequent risk regarding their land acquisition.

Good to Know:

In Vanuatu, rural zoning classifies land into various categories based on permitted use, such as exclusively agricultural, mixed, or conservation zones. These regulations directly influence agricultural land use, as agricultural zones are generally reserved for agricultural production, thus limiting possibilities for residential or commercial development. Non-buildable land is subject to strict restrictions preventing development for purposes other than agriculture, often to protect sensitive ecosystems or due to local urban planning laws. Understanding these regulations is crucial for potential buyers, as they affect land value and compliance with local laws. Although legal procedures exist to reclassify non-buildable land, it’s often complex and requires examination by competent authorities. Respect for current laws is imperative to avoid penalties or legal complications, and local expertise in zoning law and procedures may prove essential to navigate these matters.

Procedure for Obtaining a Building Permit in Agricultural Zones

Steps and Procedures for Obtaining a Building Permit in Vanuatu’s Agricultural Zones

1. Eligibility and Restrictions Verification

- Confirm the project respects the land’s agricultural designation (rural/agricultural zone: minimum lot 2,500 m²).

- Verify that the planned activity isn’t reserved for Vanuatu citizens under foreign investment legislation.

- Consult local or regional urban plans to identify any additional constraints.

2. Preparation of Application File

- Gather mandatory documents:

- Completed official application form

- Cadastral plan of land/detailed site plan

- Architectural plans of proposed constructions

- Environmental study (if applicable)

- Proof of land rights or valid agricultural lease

- Proof of payment of applicable taxes (land tax, administrative fees)

For foreign investors, include a specific application to the Director of Agriculture with explanatory letter and payment of prescribed fees.

3. Submission to Competent Authorities

| Authority to Contact | Main Role |

|---|---|

| Provincial/Local Department | Urban planning review, zoning compliance |

| National or Provincial Agriculture Directorate | Review of “agriculture business” permit |

| Environment Department | Impact assessment if required |

4. Initial Administrative Review

The application is checked to ensure all required documents are present. If needed, the administration may request supplements within a given timeframe.

5. Public Consultation

A formal phase where the local community can express comments or objections regarding the planned project.

6. Final Decision

After technical analysis, administrative review, and potential consideration of public observations:

- Permit issuance conditioned on strict compliance with technical/environmental requirements.

- Official written issuance; validity generally limited to the calendar year with renewal possibility.

Typical Timeframes

- File preparation: variable depending on complexity (generally 2–4 weeks)

- Administrative review and public consultation: 4 to 12 weeks depending on feedback requested on missing documents/supplements required

Required Documents

- Properly completed official form

- Detailed cadastral & architectural plans

- Environmental study if required

- Proof of valid lease/agricultural lease

- Proof of payment of taxes/administrative fees

Main Eligibility Criteria

- Respect for exclusive or majority agricultural designation of land

- Minimum area compliant with rural/agricultural zoning (>2,500 m²)

- Non-inclusion in list of activities prohibited to non-citizens (if applicable)

Frequent Restrictions/Conditions

- Partial/total prohibition of any construction outside strictly agricultural use without prior exemption.

- Obligation to maintain buffer zones (“no build zones”) around water bodies/rivers/coastal strips.

- Specific conditions imposed by the Director upon permit issuance (example: environmental measures).

Practical Tips to Maximize Your Chances

- Consult early with a local expert familiar with Vanuatu procedures.

- Ensure all documents are complete before initial submission to avoid delays related to supplementary requests.

- Make direct contact with provincial services/Agriculture department to fully understand particular local expectations.

- Explicitly plan in your project how all environmental and social constraints expected by the local community will be respected.

| Step | Authority / Main Action | Key Documents | Indicative Timeframes |

|---|---|---|---|

| Eligibility Verification | Preliminary Urban Planning/Agriculture consultations | Land titles, existing plans | Few days |

| File Preparation | Owner/investor | All justifications mentioned above | 2–4 weeks |

| Submission & Administrative Review | Province/Agriculture Department | Complete file | 4–8 weeks |

| Public Consultation | Local administration | — | Up to 1 month |

| Final Decision | Agriculture Directorate/province | — | Few days/week(s) |

In Summary: Rigorous file preparation accompanied by proactive steps with concerned administrations constitutes the best way to quickly obtain authorization while avoiding subsequent sanctions related to non-compliance with Vanuatu agricultural regulations.

Good to Know:

To obtain a building permit in agricultural zones in Vanuatu, you must first submit an application to the Department of Agriculture, Quarantine, Forestry and Fisheries, including a detailed project plan, proof of ownership, and an environmental assessment. It’s crucial to verify that the project meets eligibility criteria, particularly preserving primary agricultural use and limited environmental impact. Also contact the Lands Department to check zoning restrictions. Application processing typically takes 2 to 3 months, but regular follow-up and proactive communication with authorities can accelerate the process. To maximize your chances, it’s recommended to engage local professionals who master regulatory subtleties and anticipate potential specific requirements for certain islands or local communities.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.