Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Financial Leverage in Bahrain Real Estate

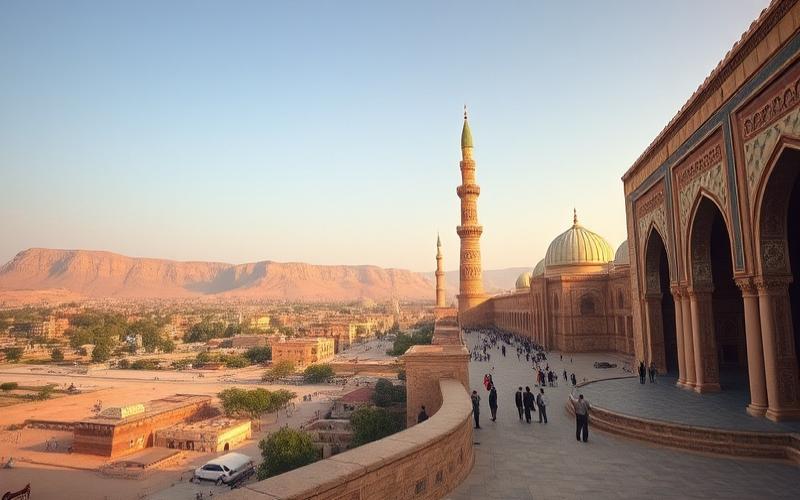

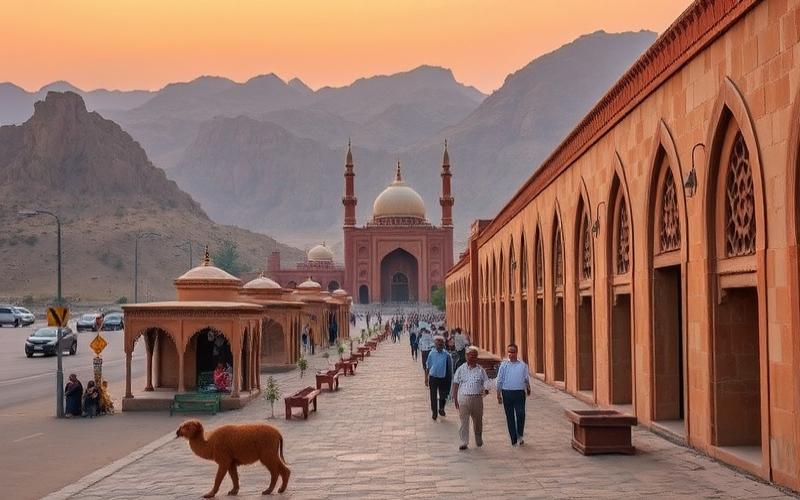

In the dynamic and ever-evolving landscape of Bahrain’s real estate market, the use of financial leverage proves to be an essential strategy for investors seeking to maximize their return potential.

This small archipelago in the Persian Gulf, known for its business-friendly climate and attractive taxation, offers unique opportunities to leverage financing to multiply real estate investments.

Good to Know:

Bahrain is renowned for its regulatory framework favorable to foreign investment, making it a preferred destination for international real estate investors.

Optimization and Risk Reduction

By understanding how to use this leverage wisely, investors can not only optimize their portfolios but also reduce risks associated with market fluctuations.

Strategies for Smart Investors

This article will explore the ways smart buyers can maximize this strategy while navigating Bahrain’s legal framework and cultural specificities.

Understanding Leverage in Bahrain Real Estate

Leverage refers to the ability to increase investment capacity by using borrowed funds, typically through mortgages, to acquire property worth more than the initial contribution. In Bahrain, as elsewhere, it involves using credit to purchase property, hoping that profitability (rents, capital gains) exceeds financing costs.

Simple Definition of Leverage Applied to Bahrain Real Estate

Leverage allows an investor to purchase real estate with limited equity by using a bank loan, to benefit from higher returns on invested capital. If investment profitability exceeds the loan rate, the leverage effect is positive.

Financial Mechanisms of Leverage

- Use of a mortgage from a local or international bank.

- Often low personal contribution (sometimes 10-20% of property price).

- Possibility of additional financing through partnerships or investment companies.

- Profitability calculation:

- Economic return = (Rents – expenses – taxes) / (contribution + loan)

- Financial return = (Net profit) / (personal contribution)

| Mechanism | Description |

|---|---|

| Mortgage loan | Bank credit granted to finance property purchase, with the property as collateral |

| Personal contribution | Amount invested by the buyer (typically 10-20% in Bahrain) |

| Leverage effect | Ability to invest beyond equity through borrowing |

| Debt ratio | The higher it is, the more powerful the leverage, but also riskier |

Concrete Examples in Bahrain

- Financing residential projects in Manama, with investors mobilizing 20% contribution and benefiting from 15% property appreciation in 3 years, multiplying initial contribution returns.

- Investment in rental buildings at Amwaj Islands, where rental yield exceeding loan rates generated positive cash flow while repaying the credit.

Advantages and Risks of Leverage in Bahrain

Advantages:

- Enables acquisition of properties worth more than available equity.

- Optimization of invested capital returns.

- Faster building of real estate assets.

Risks:

- Rising local interest rates potentially reducing profitability or causing negative cash flow.

- Strict real estate regulations: some areas reserved for nationals or approved foreign investors.

- Risk of property depreciation: if property value decreases, leverage amplifies losses.

Bahrain-Specific Factors:

- Local interest rates are generally indexed to international markets, with an upward trend in recent years.

- The real estate sector is regulated, with some areas open only to foreign investors.

- Banks often require solid guarantees and minimum contributions.

Practical Tips for Investors in Bahrain:

- Always compare expected returns with offered interest rates.

- Prioritize properties in high rental demand areas to secure income.

- Research foreign ownership access regulations.

- Anticipate interest rate evolution when signing loans.

- Maintain a safety margin to cover vacancy periods or value decreases.

Key Takeaways:

Leverage enables real estate investment in Bahrain with limited capital, but requires rigorous risk management, good local market knowledge, and anticipation of rate and regulation changes.

Good to Know:

Leverage in Bahrain real estate involves using borrowed funds to maximize investment, often through mortgages, allowing investors to own higher-value properties than their available capital would permit. Successful projects like Amwaj Islands residential complex illustrate how this mechanism can generate high returns. However, using leverage carries risks, including sensitivity to local interest rate fluctuations and potential regulatory changes in the real estate sector. To optimize leverage, thorough analysis of current rates and market conditions is essential, while ensuring investments generate sufficient cash flow to cover financial obligations. Investors should also monitor government land ownership policies, which can affect leveraged real estate investment profitability.

Smart Debt Strategies to Maximize Investment

Benefits of Using Leverage in Bahrain Real Estate

- Increased Investment Potential: Leverage enables acquisition of real estate properties worth more than initial contribution by using external financing. This maximizes investment capacity and provides access to larger projects or portfolio diversification.

- Optimized Financial Returns: By investing a reduced portion of equity and financing the remainder through borrowing, return on invested capital can be significantly higher than equity-only investment. For example, well-managed leverage can achieve over 40% annual returns over 10 years, compared to less than 15% for debt-free investment.

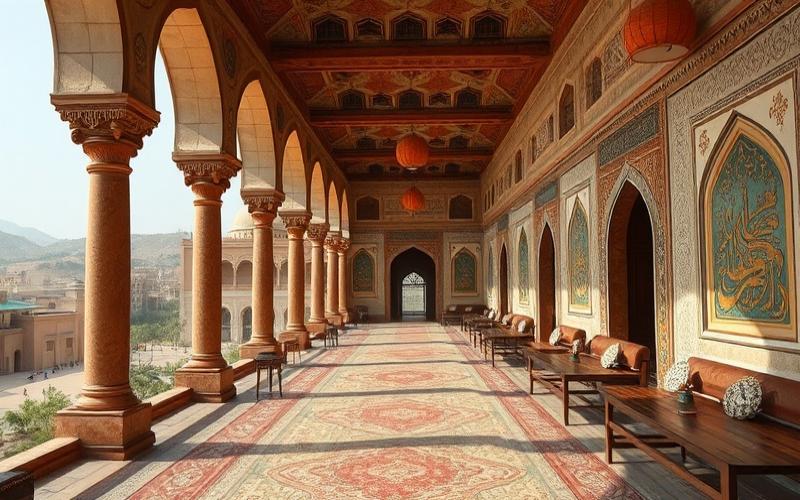

- Easier Access to Strategic Projects: Bahrain offers attractive real estate opportunities to foreign investors in designated areas, with no profit repatriation restrictions and advantageous taxation.

Available Financing Options for Investors

| Financing Option | Main Characteristics |

|---|---|

| Mortgage loan | Conventional bank loan, fixed or variable interest rates, typically 10-25 year terms. |

| Islamic financing (Murabaha, Ijara, etc.) | Compliant with Islamic finance principles, interest-free, based on lease-to-own or profit margin structures. |

| Partnership with local players | Co-investment with Bahraini partners, capital and risk sharing, easier market access. |

Tips for Managing Debt-Related Risks

- Carefully Assess Interest Rates: Compare offers from different banking institutions or Islamic finance providers, and anticipate potential rate increases’ impact on project profitability.

- Understand Local Market Dynamics: Study price trends, rental demand, upcoming infrastructure projects, and local regulations to anticipate vacancy or depreciation risks.

- Diversify Assets: Avoid concentrating entire investment on single property or geographic area to limit negative impacts of localized market downturns.

- Protect Against Payment Defaults: Maintain cash reserves to handle potential repayment difficulties or rental vacancies.

Concrete Examples and Case Studies

- An investor who acquired a Manama apartment in 2015 through mortgage saw property value increase 25% over 7 years while generating regular rental income. Through leverage, equity returns exceeded 40% during the period.

- A foreign company used Islamic financing (Murabaha) to acquire multiple commercial premises in a strategic area. Interest-free structure enabled better charge predictability and tax optimization.

- A partnership between European investor and Bahraini developer provided access to residential project, with shared financing and profits. Collaboration facilitated permit acquisition and management of local market knowledge risks.

Good to Know:

To maximize Bahrain real estate investment through leverage, it’s crucial to examine mortgages and Islamic financing options like Mudarabah and Ijarah, which comply with Islamic finance principles. These tools increase investment potential and optimize financial returns, while collaborating with local partners to benefit from their market expertise. Prudent management of debt-related risks, particularly through interest rate analysis and thorough understanding of Bahraini market, is essential. Diversifying asset portfolios helps mitigate risks. For example, an investor using Musharakah financing to acquire multiple residential properties successfully generated stable rental income, illustrating this strategy’s effectiveness.

Key Takeaway: Smart use of leverage in Bahrain real estate, combined with rigorous risk management, optimizes returns and provides access to strategic opportunities in a dynamic market attractive to international investors.

Calculating Return on Investment Through Leverage

Leverage in Bahrain Real Estate

Leverage in real estate involves using bank financing (loans) to acquire property worth more than personal contribution. This enables investing with reduced capital while maximizing returns on committed equity. The higher the loan portion relative to contribution, the stronger the leverage effect.

Return on Investment (ROI) Definition

Return on investment (ROI) measures real estate investment profitability. It’s calculated as follows:

Annual net gain typically corresponds to net rental income (rents received minus expenses, loan interest, and taxes).

Relationship Between Leverage and ROI

Leverage amplifies ROI:

- If property profitability (rental yield) exceeds loan costs, ROI on personal contribution increases significantly.

- Conversely, if rental yield is lower than borrowing costs, leverage becomes negative and ROI decreases.

Numerical Example for Bahrain Real Estate

Assume acquisition of Manama apartment, Bahrain:

| Element | Amount (BHD) |

| Purchase price | 80,000 |

| Personal contribution (20%) | 16,000 |

| Borrowed amount | 64,000 |

| Mortgage interest rate | 6%/year |

| Annual gross rent | 6,400 |

| Annual expenses | 800 |

| Annual taxes | 0 (in Bahrain, no rental income tax for non-residents) |

| Annual interest | 3,840 (64,000 x 6%) |

Annual net profit calculation:

- Rents received: 6,400

- Minus expenses: 800

- Minus loan interest: 3,840

- Net profit: 1,760 BHD

Without leverage (cash purchase), ROI would be:

- Rents received: 6,400

- Minus expenses: 800

- Net profit: 5,600 BHD

- Contribution: 80,000 BHD

Risks Associated with Leverage in Bahrain

- Real estate value fluctuations: Market decline can cause capital loss exceeding initial contribution, as loan must be repaid based on original amount.

- Interest rate variations: In Bahrain, mortgage rates are variable; rate increases raise interest expenses and reduce ROI.

- Rental vacancy risk: If property remains unrented, investor must continue loan repayments without rental income.

- Local market specificities: Bahrain market is relatively stable but heavily dependent on expatriate demand and regional economic context.

Tips to Optimize ROI While Limiting Risks

- Negotiate interest rates and prefer fixed rates when possible to reduce financial charge uncertainty.

- Prioritize high rental demand neighborhoods to minimize vacancy risk.

- Diversify investments to limit exposure to single property or sector.

- Anticipate expenses and maintain safety reserves to handle potential vacancy periods or unexpected repairs.

- Regularly monitor Bahrain real estate market evolution to adapt strategy (sale, renegotiation, refinancing).

Key Summary

- Leverage increases ROI on personal contribution through bank borrowing.

- However, it exposes to increased risks (market, rates, vacancy).

- Rigorous management and thorough Bahrain market analysis are essential to benefit from leverage while controlling risks.

Good to Know:

Leverage in Bahrain real estate increases return on investment (ROI) by using borrowed capital to finance property purchases, while benefiting from potential land appreciation. ROI is calculated by dividing net profit by total investment cost. For example, for a 100,000 BHD apartment with 20,000 BHD personal contribution and remainder financed by 5% mortgage, if annual rents reach 8,000 BHD and acquisition costs including interest and fees total 7,000 BHD, ROI reaches 5%. However, real estate value fluctuations and interest rate changes can harm leverage, amplifying potential losses if Bahrain market declines or rates climb. To optimize ROI while limiting these risks, choose properties in high rental demand areas, diversify real estate portfolio, and lock in fixed interest rates.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.