Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

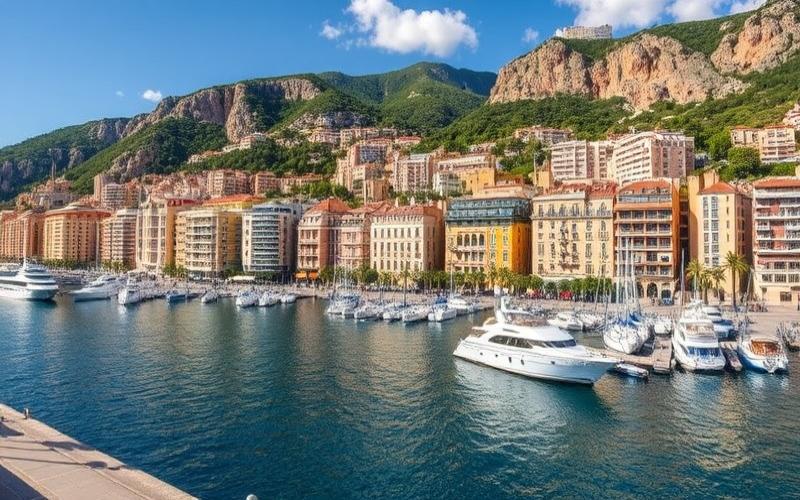

The Principality of Monaco, this small sovereign state nestled on the French Riviera, is renowned for its luxurious lifestyle and favorable tax regime. But what about regulations concerning foreign property ownership? Let’s dive into the legal intricacies and opportunities available to international investors looking to acquire real estate in this Mediterranean gem.

A Warm Welcome for Foreign Capital

Unlike many countries that impose strict restrictions on foreign investors, Monaco stands out with a particularly open approach. Indeed, the Principality makes no distinction between Monegasque nationals and foreigners when it comes to property acquisition. This liberal policy aligns with Monaco’s desire to attract international capital and maintain its status as a leading financial hub.

Almost Total Investment Freedom

Foreign investors enjoy almost complete freedom to buy, sell, or lease properties in Monaco. Whether it’s luxury apartments, lavish villas, or commercial premises, all property categories are accessible without restrictions related to the buyer’s nationality.

This openness also applies to foreign companies wishing to invest in Monegasque real estate. They can acquire properties in their own name, without needing to establish a local entity.

Strategic Sectors Under Scrutiny

Although freedom is the rule, it’s worth noting that certain sectors considered strategic may undergo more thorough review. This is particularly true for investments in areas related to national security or critical infrastructure. In these specific cases, prior authorization from the Monegasque government may be required.

Good to Know:

Monaco’s open policy toward foreign investors is a major asset for the Principality. It helps stimulate the local real estate market and maintain some of the highest property prices in the world.

A Well-Defined Acquisition Process

While property ownership is widely accessible to foreigners in Monaco, the acquisition process nevertheless follows specific rules that must be scrupulously respected.

A Procedure Managed by Professionals

Purchasing property in Monaco typically involves a licensed real estate agent. This professional plays a crucial role in the transaction, facilitating communication between seller and buyer, and ensuring compliance with legal procedures.

Once the property is selected and the offer accepted, a Monegasque notary intervenes to draft the deed of sale. Their role is essential as they guarantee the legality of the transaction and perform all necessary checks regarding the property and involved parties.

Timelines to Respect

The acquisition process generally follows these steps:

- Signing a preliminary sales agreement

- Payment of a deposit (typically 10% of the sale price)

- Securing financing if necessary

- Signing the authentic deed before a notary

- Payment of the balance and handover of keys

The timeframe between the preliminary agreement and final signing is usually 3 to 4 months, allowing for all necessary administrative and financial procedures.

Attractive Taxation but Anticipated Fees

While Monaco is famous for its absence of income and wealth taxes for residents, property acquisition nevertheless incurs certain fees:

- Registration fees: 4.5% of the sale price

- Notary fees: approximately 1.5% of the sale price

- Real estate agent commission: typically between 3% and 5% of the sale price

Good to Know:

Although acquisition costs may seem high, they remain competitive compared to other luxury destinations in Europe. Moreover, the absence of annual property tax makes the investment particularly attractive in the long term.

Privileges Come with Responsibilities

Becoming a property owner in Monaco confers important rights but also involves respecting certain obligations.

Strong Legal Protection

Foreign owners benefit from the same legal protection as Monegasque nationals regarding real estate property. Monegasque law guarantees respect for private property and offers effective recourse in case of disputes.

Freedom to Lease Your Property

Foreign owners have complete freedom to lease their property, whether for seasonal or long-term rental. However, it’s important to respect local regulations regarding lease agreements, which may differ from practices in other countries.

Reporting Obligations

Although Monaco doesn’t levy income tax, foreign owners must nevertheless declare rental income received in their country of tax residence. It’s therefore crucial to be well-informed about tax implications in your home country.

Property Maintenance

Like any property owner, foreign investors are required to maintain their property and respect the co-ownership rules in effect in the building. These charges can be significant, particularly in luxury residences offering high-end services.

Good to Know:

The exceptional quality of life in Monaco and the Principality’s political stability make it a safe and enduring investment. However, it’s essential to fully understand your obligations as an owner to avoid any inconvenience.

Keys to Success for a Successful Investment

To fully benefit from the opportunities offered by the Monegasque real estate market, here are some wise tips for foreign investors.

Surround Yourself with Local Experts

The Monegasque real estate market is complex and highly competitive. It’s therefore crucial to surround yourself with experienced professionals:

- A licensed real estate agent with thorough knowledge of the local market

- A notary specialized in international transactions

- A tax lawyer to optimize your investment

- A wealth manager for a comprehensive view of your investment strategy

Clearly Define Your Objectives

Before getting started, it’s essential to clarify your objectives:

- Is it a primary residence, secondary home, or rental investment?

- What is your investment horizon?

- What are your expectations in terms of return?

These questions will help you target properties most suited to your project.

Anticipate Hidden Costs

Beyond the purchase price, consider:

- Co-ownership charges, often high in luxury residences

- Renovation or fitting-out costs

- Management fees if you opt for rental

- Tax implications in your home country

Stay Informed About Regulatory Changes

Although Monaco is known for its stability, it’s important to stay informed about potential legislative changes that could impact your investment. Regular monitoring and contacts with local experts will help you anticipate these changes.

Good to Know:

The scarcity of available properties in Monaco makes it a particularly dynamic market. Don’t underestimate the importance of making quick decisions once you’ve identified the ideal property.

Conclusion: A Real Estate El Dorado Within Reach

Monaco offers foreign investors a particularly favorable framework for property acquisition. The absence of major restrictions, combined with an attractive tax environment and exceptional quality of life, makes it a prime destination for investors worldwide.

However, the market’s complexity and significant financial stakes require a prudent and well-informed approach. By following the advice provided and surrounding themselves with the right experts, foreign investors can fully enjoy the opportunities offered by this Mediterranean gem.

Real estate investment in Monaco represents much more than a simple financial transaction: it’s access to a unique lifestyle and a high-level international network. For those who take the step, it’s often the beginning of a new adventure rich in opportunities.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.