Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

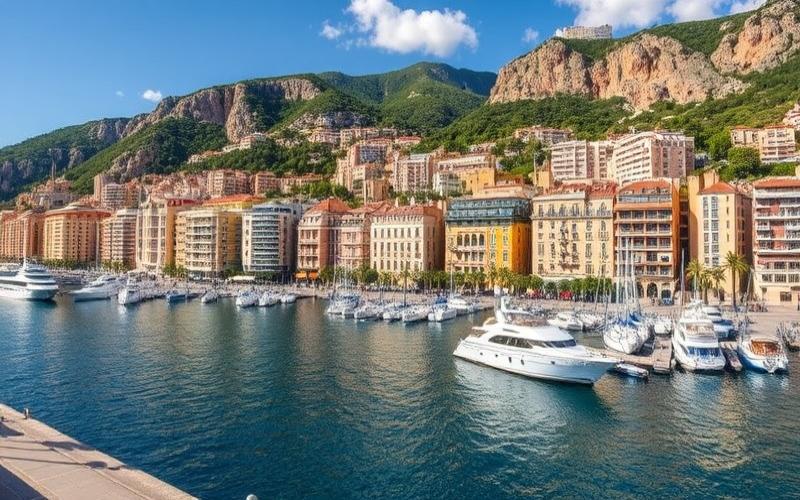

Monaco, this small Mediterranean principality, attracts numerous entrepreneurs thanks to its favorable tax framework and dynamic business environment. However, before embarking on the Monegasque entrepreneurial adventure, it’s crucial to fully understand the costs associated with establishing a company in this territory. Let’s dive into the details to provide you with a clear and precise vision of the necessary investments.

The Price of Excellence: Registration Fees in Monaco

Creating a company in Monaco begins with its official registration with the competent authorities. This step, although crucial, represents a significant investment for entrepreneurs.

Registration fees in Monaco consist of several elements:

- Articles of association filing: approximately €1,000 to €1,500

- Legal publication fees: between €800 and €1,200

- Registration with the Trade and Industry Registry: approximately €350

- Notary fees: variable, but generally between €3,000 and €5,000

It’s important to note that these amounts may vary depending on the complexity of your corporate structure and the type of activity you wish to conduct. In total, registration fees for a company in Monaco can range between €5,000 and €8,000, or even more for more complex structures.

Good to know:

Although these fees may seem high, they reflect the quality and rigor of the Monegasque registration process, thereby guaranteeing a solid foundation for your future business.

Compliance and Transparency: Costs to Stay Within the Lines

The Principality of Monaco is renowned for its strict regulatory framework and its commitment to maintaining an image of transparency and integrity. This rigor translates into significant compliance costs for businesses.

Here are the main compliance-related expense categories:

- Accounting fees: between €3,000 and €10,000 per year

- Audit fees (mandatory for certain structures): starting from €5,000 per year

- GDPR compliance costs: variable, but budget at least €2,000 initially

- Ongoing compliance training: approximately €1,500 per year

These costs can vary considerably depending on the size and complexity of your business. For a small structure, the annual compliance budget could be around €10,000, while for a larger company or one operating in a highly regulated sector (such as finance), this amount could easily exceed €50,000 per year.

Good to know:

Although these costs may seem high, they are essential to maintain your company’s reputation and avoid potentially costly penalties in case of non-compliance.

The Lifeblood of Business: Initial Investment to Get Started

Beyond administrative and compliance fees, creating a company in Monaco requires a substantial initial investment to start operations under good conditions.

Here are the main investment categories to anticipate:

- Minimum share capital: €15,000 for an LLC, €150,000 for a corporation

- Office rental: between €600 and €1,200 per square meter per year in prime areas

- Equipment and furniture: budget at least €10,000 for a small office

- Staff recruitment and training: variable, but plan at least €5,000 per employee

- Visual identity and website development: between €5,000 and €15,000

The total initial investment can thus vary considerably depending on your project. For a small LLC-type structure with a modest office, you should budget a minimum of €100,000 to €150,000. For a more ambitious company or one in a sector requiring significant infrastructure, the initial investment could easily exceed one million euros.

Good to know:

Although the initial investment may seem substantial, it is crucial to position your company competitively in the Monegasque market, known for its demands and excellence.

The Daily Life of a Monegasque Company: Operational Expenses

Once your company is created and operational, you need to anticipate the ongoing expenses related to its functioning. Monaco being known for its high cost of living, operational expenses can quickly accumulate.

Here’s an overview of the main operational expense categories in Monaco:

- Rent and utilities: between €7,200 and €14,400 per year for a small 12m² office

- Salaries: budget a minimum of €3,000 gross per month for a qualified employee

- Social security contributions: approximately 40% of gross salary

- Professional insurance: starting from €1,500 per year

- Banking services: between €500 and €1,000 per year

- Telecommunications and internet: approximately €1,200 per year

For a small structure with 2-3 employees, annual operational expenses can easily reach €200,000 to €300,000. For larger companies or those in sectors requiring substantial infrastructure, this amount can quickly climb to several million euros per year.

Good to know:

Although these costs may seem high, they reflect the exceptional quality of life and service level offered by the principality, thereby contributing to your company’s attractiveness to high-level clients and talent.

Optimizing Without Compromising: Strategies to Control Your Costs

Despite the high costs associated with creating and managing a company in Monaco, there are strategies to optimize your expenses without compromising the quality of your operations.

Here are some avenues to explore:

- Virtual office: opt for a prestigious address without the costs of a physical office

- Outsourcing: delegate certain tasks to external providers rather than hiring

- Lease negotiation: look for opportunities in less prime but well-connected areas

- Tax optimization: legally and ethically benefit from the tax advantages offered by Monaco

- Digitalization: invest in digital tools to reduce operational costs

By implementing these strategies, you could reduce your operational costs by 20% to 30%, or even more in some cases. However, it’s crucial not to compromise your service quality or regulatory compliance in this quest for optimization.

Good to know:

Cost optimization is a balancing act. It’s recommended to consult local experts to ensure your cost-reduction strategies align with Monegasque practices and regulations.

Conclusion: An Investment Worthy of the Opportunities

Creating and managing a company in Monaco represents a substantial investment, but one that can prove extremely profitable for well-prepared entrepreneurs. Between registration fees, compliance costs, initial investment, and operational expenses, you need to plan for a significant overall budget.

For a small structure, the total cost during the first year of operation could easily reach €300,000 to €500,000, while for more ambitious projects, this amount could exceed one million euros.

However, these costs must be put into perspective with the unique advantages Monaco offers: a favorable tax environment, remarkable political and economic stability, privileged access to a wealthy clientele, and exceptional networking opportunities.

The key to success lies in meticulous planning, rigorous management, and the ability to leverage the principality’s unique business ecosystem. With the right approach and wise investment, creating a company in Monaco can open the door to unparalleled growth and development opportunities.

Good to know:

Before taking the plunge, it’s highly recommended to consult local experts in business law, taxation, and business management. Their expertise will help you navigate the Monegasque business environment effectively and maximize your chances of success.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.