Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

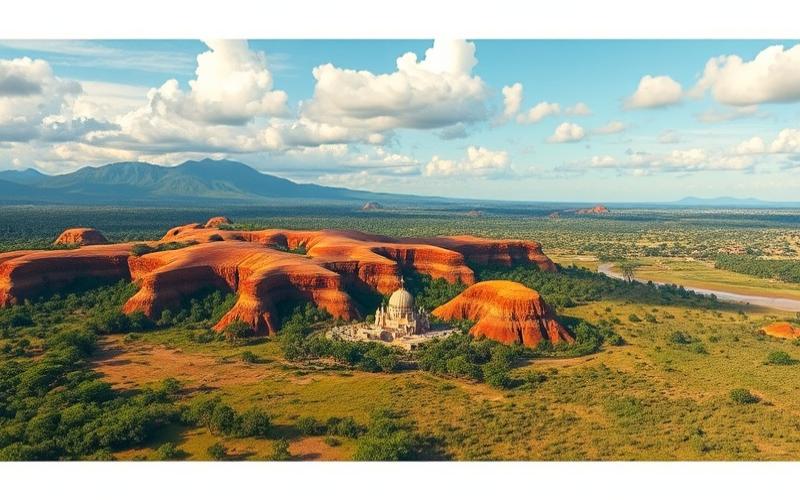

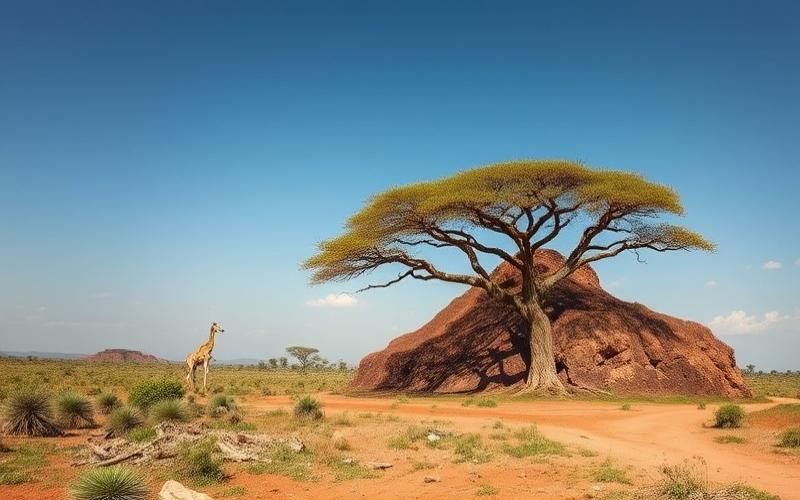

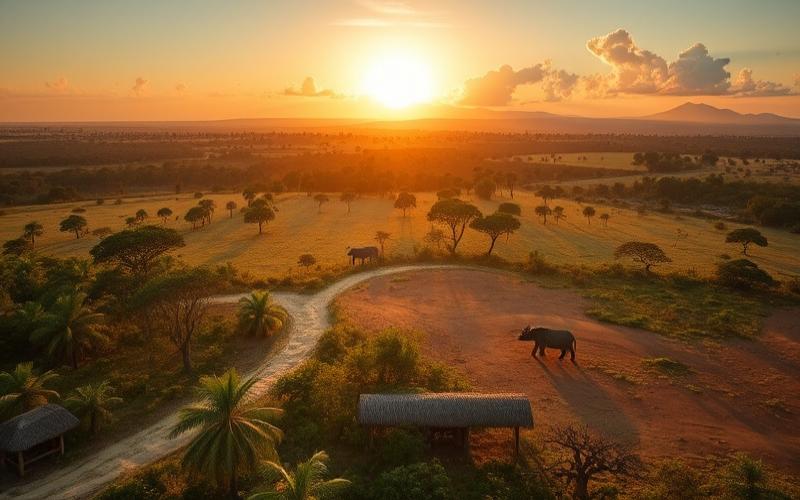

Madagascar, nicknamed the continent island, is a tourist destination that continues to gain popularity. This growth in the tourism sector has a significant impact on the local real estate market, creating new investment opportunities and transforming the urban landscape of certain regions. Let’s explore together how tourism is shaping the Malagasy real estate market and what the prospects are for investors.

Madagascar’s Tourist Gems: Emerging Real Estate Hotspots

Tourism in Madagascar primarily concentrates around a few key areas, each offering unique assets and distinct real estate opportunities. These regions are experiencing accelerated real estate development, directly linked to tourist influx.

Nosy Be: The Pearl of the Indian Ocean

Nicknamed “the perfumed island,” Nosy Be has become one of Madagascar’s flagship destinations. Its tourism development has triggered a genuine real estate boom:

- Construction of luxury hotel complexes

- Development of high-end secondary residences

- Increased demand for seasonal rentals

The island is attracting more and more foreign investors, drawn by its tourism potential and the possibility of significant real estate capital gains.

Antananarivo: The Capital in Transformation

Although less touristy than coastal areas, Antananarivo is undergoing a real estate transformation linked to business tourism and its role as the capital hub:

- Development of international hotels

- Creation of conference centers and event spaces

- Renovation of the historic city center, attracting investments in older properties

Tamatave: The Eastern Gateway

Madagascar’s main port, Tamatave (Toamasina) is gradually becoming an essential stop for tourists wishing to explore the east coast:

- Development of hotel infrastructure along the coastline

- Renovation of the colonial city center

- Mixed real estate projects combining commercial and residential spaces

Good to Know:

Madagascar’s tourist areas offer varied real estate potential, ranging from luxury beachfront properties to innovative urban projects. Each region presents unique opportunities for savvy investors.

Tourism’s Effect on Real Estate Prices: An Upward Trend

The tourist influx has a direct impact on real estate prices in Madagascar’s most sought-after areas. This upward trend is observed at several levels:

Buildable Land: Scarcity Driving Up Prices

In the most popular tourist areas, particularly along the coasts, buildable land is becoming increasingly scarce. This land pressure leads to significant price increases:

- In Nosy Be, seaside land prices have increased by over 200% in 5 years

- On the east coast, near Tamatave, buildable land now trades at prices comparable to some French regions

Existing Properties: Rapid Appreciation

Properties already built in tourist areas are also experiencing strong appreciation:

- Sea-view villas in Nosy Be can double in value in less than 3 years

- In Antananarivo, upscale apartments in neighborhoods favored by expatriates and business tourists have seen prices increase by an average of 50% over the past 5 years

Seasonal Rentals: Attractive Returns

The seasonal rental market, boosted by tourism, offers particularly interesting returns:

- In Nosy Be, a well-located apartment can generate a gross rental yield of 8 to 12% per year

- In popular beach areas, luxury villas can achieve occupancy rates of 70% annually, with high daily rates

Good to Know:

The increase in real estate prices in Madagascar’s tourist areas offers interesting capital gain opportunities for investors. However, it is crucial to thoroughly study the local market and work with professionals to make a wise investment.

Tourist Rental Investment: An Expanding Sector

The development of tourism in Madagascar has created a flourishing market for rental investment, offering varied opportunities for local and international investors.

Seasonal Rentals: A Booming Model

The rise of peer-to-peer rental platforms like Airbnb has opened new perspectives for property owners:

- In Nosy Be, the number of Airbnb listings has tripled in 3 years

- Well-located and well-equipped properties can achieve occupancy rates of 80% during high season

- Generated revenues can be up to 3 times higher than those from long-term rentals

Tourist Residences: A Concept Attracting Investors

The concept of tourist residences, combining private ownership and professional management, is gaining ground in Madagascar:

- Several high-end residence projects are under development in Nosy Be and on the east coast

- These investments offer guaranteed returns (often around 5% net) and the possibility of personal use

- Professional management ensures optimal property maintenance and effective marketing

Hotel Real Estate: Opportunities for Major Investors

The Malagasy hotel sector is attracting more and more international groups, but also offers opportunities for private investors:

- Development of boutique hotels and ecolodges, aligned with new sustainable tourism trends

- Opportunity to invest in shares of hotels under construction or renovation

- High potential returns, but an investment requiring specific expertise

Good to Know:

Tourist rental investment in Madagascar offers attractive return prospects but requires good knowledge of the local market and rigorous management. Partnering with experienced professionals is recommended to maximize success chances.

Although promising, the tourist real estate market in Madagascar also presents challenges that investors must address.

Regulatory Challenges: An Evolving Legal Framework

Acquiring real estate by foreigners in Madagascar is subject to specific rules:

- Need to obtain prior authorization for land purchases

- Requirement to create a Malagasy legal entity for certain types of investments

- Frequent evolution of legislation, requiring constant legal monitoring

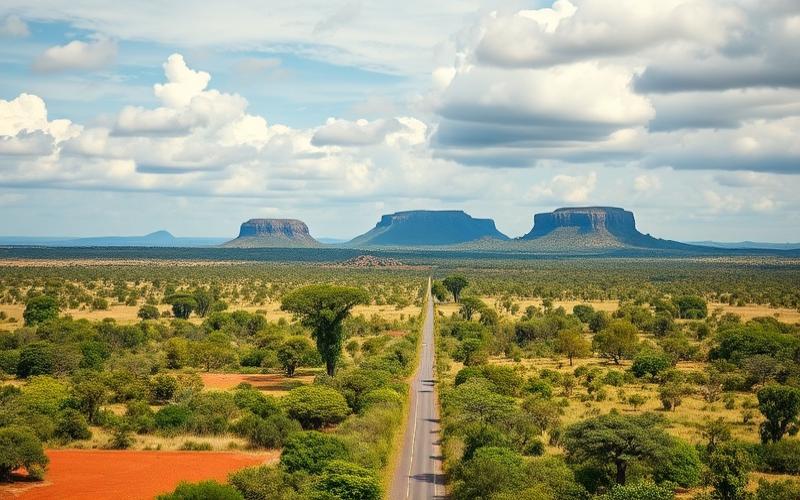

Infrastructure: Ongoing Development

Infrastructure development is crucial to support tourism and real estate growth:

- Gradual improvement of road and airport networks

- Investments in water and electricity networks, particularly in tourist areas

- Investment opportunities in private infrastructure projects (marinas, shopping centers, etc.)

Sustainability: A Major Challenge

Real estate development linked to tourism must consider environmental and social issues:

- Emergence of eco-responsible projects incorporating green technologies

- Growing importance of integrating local communities into tourism projects

- Opportunities in ecotourism development and sustainable real estate

Good to Know:

Investing in tourist real estate in Madagascar requires a comprehensive approach, considering legal, infrastructure, and environmental aspects. Investors who can address these challenges will benefit from unique opportunities in a rapidly growing market.

Conclusion: A Promising Market for Savvy Investors

The impact of tourism on the real estate market in Madagascar is undeniable and offers exciting prospects for investors. The growth of the tourism sector stimulates real estate development, creates new investment opportunities, and contributes to the modernization of the country’s infrastructure.

However, investing in Madagascar requires a cautious and well-informed approach. Investors must be aware of the country’s specific regulatory, infrastructure, and environmental challenges. In-depth knowledge of the local market, a clear investment strategy, and partnerships with experienced professionals are essential for success in this emerging market.

Despite these challenges, the growth and return potential of the Malagasy tourist real estate market remains very attractive. With its unique landscapes, exceptional biodiversity, and rich cultural heritage, Madagascar has all the assets to become a major tourist destination in the coming years. Investors who can seize these opportunities today could well be the big winners of tomorrow.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.