Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

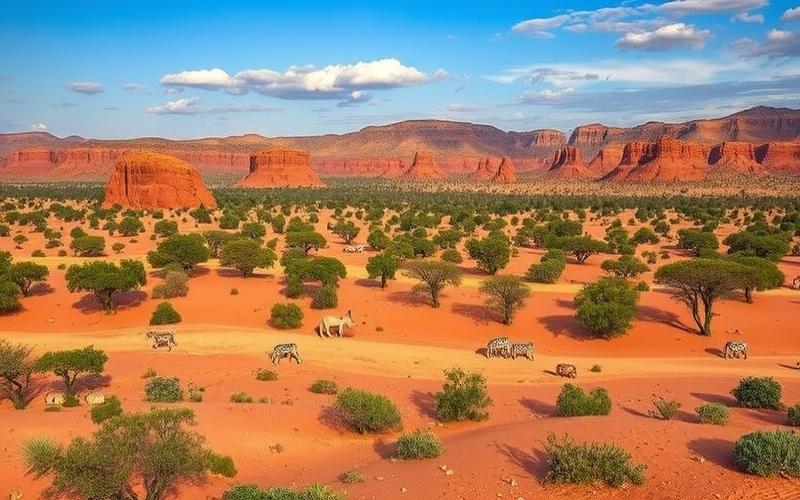

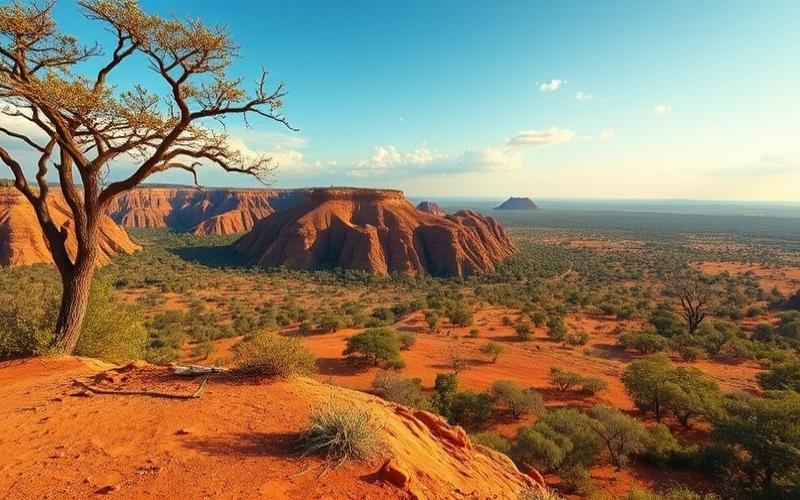

South Africa, with its breathtaking landscapes and cultural richness, has become a sought-after destination for those considering retirement in an exotic and vibrant setting. Beyond the sunny climate and diverse wildlife and flora, the country offers attractive tax benefits for foreign retirees, making the cost of living particularly affordable for those looking to maximize their capital.

Whether you’re drawn to idyllic beaches, majestic mountains, or the cultural and historical richness of South African cities, every day can be a new adventure in this country that blends tradition and modernity.

Why Choose South Africa for Retirement

Advantages of choosing South Africa for retirement:

- Pleasant and varied climate: South Africa enjoys a mild and sunny climate for most of the year, with temperate coastal regions, cool mountainous areas, and weather diversity that allows everyone to find an environment suited to their preferences. This climate promotes a high quality of life for retirees.

- Exceptional natural beauty:

- Vast beaches on two oceans.

- Majestic mountains (Drakensberg, Table Mountain).

- Renowned nature reserves (Kruger National Park).

- Unique wildlife: Big Five sightings.

- Cultural richness & recreational activities:

- Art and music festivals throughout the year.

- Local cuisine rich in blended flavors.

- Museums, art galleries, diverse craft markets.

- Accessible sports activities: golf, hiking, surfing, horseback riding.

Affordable cost of living:

| Category | South Africa | Western Europe |

|---|---|---|

| Housing | Low | High |

| Food | Moderate | High |

| Medical services* | Competitive | Variable |

| Recreation | Affordable | More expensive |

*Private care is generally more financially accessible than in Europe or North America.

- Accessibility to private medical care:

Major cities have modern and specialized hospitals as well as a wide range of private clinics. International or local health insurance allows quick access to quality treatments.

- Warm welcome & facilitated integration:

The South African population is known for its hospitality.

A strong international presence makes daily life easier for expatriates thanks to:- French/English-speaking groups organizing social events

- Active expatriate communities in all major urban areas

- Networking facilitated by social clubs or cultural associations

Summary list of main advantages:

- Mild climate year-round enabling an active and healthy life

- Spectacular natural landscapes conducive to regular excursions

- Intense cultural life offering constant discoveries

- Overall cost lower than in major European or North American countries

- Access to competitive private care (insurance recommended)

- Potentially advantageous taxation depending on international status

- Welcoming population; numerous social opportunities through expatriate communities

South Africa combines a magnificent natural setting with a high and affordable quality of life—all within an open society where it’s easy for foreign retirees to integrate sustainably.

Good to know:

South Africa offers a pleasant and varied climate, accessible quality healthcare, and a lower cost of living than many Western countries. Thanks to cultural richness and the warmth of the inhabitants, retirees can enjoy beautiful landscapes and easily integrate into dynamic expatriate communities.

Tax Benefits for Retirees in South Africa

Retirees in South Africa benefit from specific tax advantages, including partial exemption schemes, reduced tax rates on pensions, and incentives for retirement savings, with notable differences depending on whether they are permanent residents or expatriates.

Types of special tax regimes for retirees:

Exemptions and reduced rates on pensions:

- Retirement pensions may benefit from reduced taxation, especially for expatriates based on their international tax status.

- Certain foreign pension incomes may not be taxed locally, under conditions, particularly in cases of bilateral agreements or tax treaties to avoid double taxation.

Tax incentives for retirement savings:

- Contributions to approved South African pension funds (recognized by the Pension Funds Act) are deductible from taxable income, up to an annual legal limit.

- Withdrawals from certain retirement savings products are partially exempt or subject to favorable tax rates.

Income limits and eligibility conditions:

| Tax provision | Limit/eligibility condition |

|---|---|

| Deduction of retirement contributions | Annual limit set by South African income law |

| Exemption on foreign pension | Subject to tax residence and existence of a treaty |

| Reduced rate on retirement withdrawals | Applicable on first brackets, progressive rate thereafter |

Differences between permanent residents and expatriates:

Permanent residents:

- Full access to tax deduction schemes for South African retirement savings.

- Right to benefit from social assistance and access to public services, which can indirectly optimize purchasing power.

- No minimum annual residence requirement to maintain status.

Expatriates:

- Possibility to avoid double taxation on foreign pensions, subject to tax treaties between South Africa and the country of origin.

- Potential exemption on certain external income, under specific conditions.

- Limited access to certain provisions reserved for permanent residents.

Concrete examples and impact on quality of life:

- An expatriate retiree receiving a pension from a country with a tax treaty (e.g., France, Germany) may, in some cases, only be taxed in their country of origin or benefit from a local exemption on this pension, thus optimizing their disposable income.

- Annual deductible contributions for retirement savings reduce the taxable base, increasing the retiree’s net income.

- According to recent statistics, the affordable cost of living in South Africa combined with these tax benefits allows retirees to increase their purchasing power by 20 to 30% compared to retirement in some European countries.

- Easier access to private healthcare and real estate ownership contributes to a notable improvement in retirees’ quality of life.

| Tax advantage | Permanent residents | Expatriates | Concrete impact |

|---|---|---|---|

| Deduction of retirement contributions | Yes | Limited | Decrease in income tax |

| Exemption on foreign pension | No | Yes (under conditions) | Increase in disposable income |

| Access to social assistance | Yes | No | Reduction in health and housing expenses |

| Reduced rate on withdrawals | Yes | Yes | Reduced taxation on capital withdrawals |

Numerical example:

An expatriate retiree couple receiving €2,000 monthly pension, exempt from double taxation and benefiting from a reduced tax rate on their withdrawals, see their local purchasing power equivalent to that of a couple with €3,000 monthly in a major European city, due to the cost of living differential and tax exemptions.

Boxed summary:

Retirees in South Africa benefit from tax deductions on savings, partial exemptions on pensions, and a reduced cost of living. The provisions vary depending on resident or expatriate status but generally favor a significant improvement in purchasing power and quality of life in retirement.

Good to know:

In South Africa, retirees can benefit from tax exemption on the first 141,250 ZAR of their annual income, with a reduced tax rate on pensions; however, these tax benefits vary for expatriates, who do not enjoy the same exemptions as permanent residents.

Understanding the Cost of Living for Retirees

The main expense categories affecting the cost of living for retirees in South Africa are housing, food, healthcare, and recreation.

| Expense category | Monthly urban range | Monthly rural range | Main remarks |

|---|---|---|---|

| Housing | $440 to €650 | $250 to €400 | Cheaper in rural areas |

| Food | $130 to $210 | $100, less access | Private clinics recommended |

| Recreation | Cinema: ~€5-6, restaurant: ~€8 | Local activities cheaper | Variability depending on preferences |

Main factors influencing costs by region and desired standard of living

- In urban areas (Johannesburg, Cape Town), housing and service costs are higher, but access to private medical care and cultural activities is much better.

- In rural areas or secondary cities, housing is significantly more affordable. However, specialized medical offerings are reduced and some services may be limited.

- A “comfortable” standard of living includes regular dining out, varied recreation, and premium health insurance; a “moderate” level prioritizes local products, home cooking, and free or low-cost activities.

Typical monthly budget examples for foreign retirees in South Africa

- Modest living in secondary city (excluding rent):

- Local food: ~$130

- Basic health insurance: ~$53

- Simple recreation: $120

- Varied recreation (cinema, gym…): >$50

Impact of inflation/exchange rates on foreign retirees

South African inflation mainly affects prices of imported food or technology; it can gradually reduce real purchasing power if not compensated by revaluation of foreign pensions.

Fluctuations in the exchange rate between the South African rand (ZAR) and foreign currencies strongly influence the local value of pensions paid from abroad. A depreciation of the ZAR favors those receiving their pension in a strong currency.

Availability & access to affordable services for seniors

- Urban private clinics offer good medical standards but remain costly without adequate coverage. Several dedicated expatriate insurances with international coverage exist.

- Public transportation is functional in major cities; personal cars are often necessary outside urban areas.

- Many free outdoor activities exist thanks to the favorable year-round climate (national parks, beaches…).

Specific tax benefits for foreign retirees

The South African tax system allows non-permanent residents to be taxed only on their locally generated income. Pensions received from abroad are generally not subject to local taxation if they do not come from employment exercised locally.

Key points to remember

The overall cost varies significantly depending on the chosen region; it remains competitive compared to many other Western countries thanks particularly to low prices of local products and specific tax benefits for senior expatriates.

Good to know:

In South Africa, housing in urban areas can be costly, while rural regions often offer more affordable alternatives; retirees will also benefit from tax advantages that reduce the overall cost, but must monitor inflation and exchange rate fluctuations, especially for health and recreation expenses.

An Overview of Retiree Lifestyle in South Africa

Cost of living for retirees in South Africa

The cost of living in South Africa is overall 40 to 45% lower than in France. Average monthly expenses for a retiree in Johannesburg are estimated around €1,300, all inclusive. This budget varies depending on place of residence and chosen lifestyle.

| Common expenses | Monthly price range (in €) |

| Housing (rent, 3 rooms) | 650 (Johannesburg) to 1,350 (Cape Town) |

| Food (groceries) | 120 to 200 |

| Health (insurance) | 50 to 150 |

| Transportation (public/car) | 35 to 150 |

| Recreation (cinema, sports) | 5 (cinema) to 38 (gym) |

| Restaurant meals | 8 (budget) to 21 (mid-range) |

Infrastructure for retirees

- Residential communities for seniors: Presence of secure residences with services (security, maintenance, green spaces, activities), particularly in major cities and along the coast. These residences offer a suitable environment, often with on-demand care.

- Healthcare services: The country has high-level private hospitals, accessible in urban areas. Private health insurance is recommended, as the public system remains unequal across regions. Many doctors speak English, facilitating care.

- Transportation: Major cities offer bus, train, and taxi networks, generally affordable. Cars remain widely used for more autonomy, especially outside urban centers. Road infrastructure is good, but traffic can be heavy.

- Volunteering opportunities: Many NGOs and associations seek volunteers, particularly in education, health, environment, and social support.

- Community activities: Leisure clubs, hiking groups, sports associations, craft workshops, wine tastings, and cultural events punctuate retirees’ social life.

- Outdoor life: Thanks to a pleasant climate, hiking, golf, seaside outings, and safaris are accessible year-round.

Examples and testimonials from retirees

“We chose to live in Durban to enjoy the mild climate, beaches, and a more affordable life than in Europe. The expatriate community is close-knit, and we participate in support actions at a local orphanage.”

— Jean and Monique, French retirees

“In Cape Town, I joined a hiking club and volunteer at a center for underprivileged children. The private healthcare system is excellent, but you need to choose your insurance carefully.”

— Marie, Belgian retiree

Challenges faced by retirees in South Africa

- Safety: Some urban areas have high crime rates. It’s advisable to prefer secure neighborhoods and gated communities.

- Access to healthcare: Public care can be insufficient or of variable quality, hence the need for good private health insurance.

- Social integration: Despite local friendliness, language or cultural barriers can hinder some newcomers. Participation in groups or associations facilitates integration.

- Regional inequalities: Infrastructure and services are unequal between major cities and rural areas.

Visual summary of lifestyles

| Lifestyle | Environment | Key activities | Estimated expenses/month |

| Coast (e.g., Durban) | Beaches, mild climate | Golf, swimming, volunteering | €1,000 to 1,400 |

| City (e.g., Joburg) | Secure neighborhoods | Culture, clubs, gastronomy | €1,200 to 1,600 |

| Countryside/Karoo | Nature, tranquility | Gardening, hiking, wine | €800 to 1,200 |

Good to know:

The cost of living for retirees in South Africa remains affordable with suitable housing, competitively priced healthcare, and a wide range of recreational activities; residential communities and well-developed transportation infrastructure facilitate daily life, while volunteering opportunities and rich cultural interactions offer an enriching social framework.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.