Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

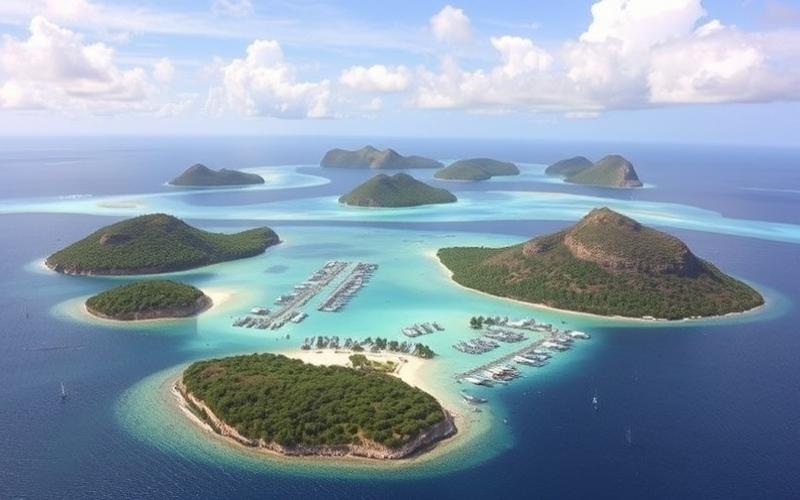

The Cayman Islands, a British Overseas Territory located in the Caribbean, have long been recognized as one of the world’s most attractive offshore jurisdictions. With a favorable tax environment, political and economic stability, and a sophisticated regulatory framework, the Caymans attract numerous international entrepreneurs and investors seeking to optimize their financial and business operations. In this article, we will explore in detail the benefits and procedures for creating a company in the Cayman Islands, as well as the practical aspects of managing a business in this tax haven.

Discover our articles on creating a company in the Cayman Islands:

The Cayman Islands, a British Overseas Territory located in the Caribbean, are renowned for their particularly advantageous tax regime for [...]

The Cayman Islands, a British Overseas Territory located in the Caribbean, are renowned for their robust financial sector and advantageous [...]

The Cayman Islands, a renowned tax haven and premier offshore financial center, attracts numerous international businesses. However, recruiting personnel in [...]

The Cayman Islands, a British archipelago located in the Caribbean, are much more than just a dream destination for tourists [...]

The Cayman Islands, a renowned Caribbean tax haven, attract numerous entrepreneurs and investors worldwide due to their favorable tax environment [...]

The Cayman Islands, a renowned tax haven and premier offshore financial center, attracts numerous entrepreneurs and investors from around the [...]

The Cayman Islands are renowned for their favorable tax environment and business-friendly legal framework. However, establishing a company in this [...]

The Cayman Islands, a renowned Caribbean tax haven, attracts numerous entrepreneurs looking to benefit from a favorable tax environment. However, [...]

The Cayman Islands, famous for their status as a tax haven, also offer a robust legal framework for intellectual property [...]

The Cayman Islands, a British archipelago located in the Caribbean, are renowned for their thriving offshore financial sector and idyllic [...]

The Cayman Islands, this small British Caribbean archipelago, are not only famous for their white sand beaches and crystal-clear waters. [...]

The Cayman Islands, a British archipelago in the Caribbean, are renowned for their advantageous tax environment and business-friendly regulatory framework. [...]

The Cayman Islands, a British archipelago located in the Caribbean, are much more than just a paradise destination. This UK [...]

The Cayman Islands, renowned for their status as a tax haven and dream beaches, are now positioning themselves as an [...]

The Cayman Islands, a renowned tax haven located in the Caribbean, attract numerous foreign investors due to their favorable tax [...]

The Cayman Islands: A Tax Haven in the Heart of the Caribbean

The Cayman Islands offer numerous advantages for international entrepreneurs and investors. Here are the main reasons why many companies choose to establish their headquarters there:

1. Favorable Taxation: One of the main attractions of the Cayman Islands is the absence of direct taxes. There is no income tax, corporate tax, capital gains tax, or inheritance tax. This favorable tax policy allows businesses to maximize their profits and more easily reinvest their earnings.

2. Political and Economic Stability: As a British Overseas Territory, the Cayman Islands benefit from great political stability. Furthermore, their economy is strong, primarily based on financial services and tourism, providing a business-friendly environment.

3. Confidentiality and Asset Protection: The Cayman Islands are renowned for their strict respect for financial information confidentiality and corporate structures. Although reforms have been implemented to combat money laundering and tax evasion, the country maintains a high level of asset protection.

4. Developed Financial Infrastructure: The Caymans have a sophisticated financial sector, with many international banks, law firms, and corporate service providers. This infrastructure facilitates the management of international business affairs.

5. Business-Friendly Regulation: The Cayman Islands government has established a business-friendly regulatory framework, with simplified procedures for company creation and management.

Good to Know:

The Cayman Islands offer an extremely favorable tax and regulatory environment for international businesses, with no direct taxes and a developed financial infrastructure. However, it is crucial to comply with local and international regulations regarding financial transparency.

The Most Popular Legal Structures in the Cayman Islands

The Cayman Islands offer several types of legal structures for businesses. Here are the most commonly used ones:

1. Exempted Company

This is the most popular legal form for international businesses. The main characteristics are: – Tax exemption for 20 years (renewable) – Ability to have a single shareholder and a single director – No requirement to hold general meetings in the Cayman Islands – Confidentiality of shareholder and director information

2. Limited Liability Company (LLC)

Similar to the American LLC, this structure offers: – Limited liability for members – Great flexibility in management and profit distribution – The possibility of being tax transparent

3. Exempted Limited Partnership

Ideal for investment funds, this structure offers the following advantages: – No separate legal personality – Flexibility in profit and loss distribution – Enhanced confidentiality for limited partners

4. Foundation Company

Introduced more recently, this hybrid structure combines characteristics of a company and a foundation: – Can be used for wealth management and philanthropy – Offers great flexibility in its structure and management – May or may not have members, depending on needs

5. Segregated Portfolio Company (SPC)

Particularly useful for investment funds and insurance companies, the SPC allows: – Creation of segregated portfolios within the same legal entity – Legal separation of assets and liabilities between different portfolios

The choice of legal structure will depend on your business objectives, management needs, and tax requirements. It is highly recommended to consult a lawyer specializing in Cayman Islands business law to guide you in this choice.

Good to Know:

The Exempted Company is the most commonly used structure by international businesses in the Cayman Islands, offering an optimal combination of tax benefits, flexibility, and confidentiality. However, each structure has its own advantages and it’s important to choose the one that best fits your specific needs.

Corporate Taxation in the Cayman Islands: A Paradise for Entrepreneurs

One of the main attractions of the Cayman Islands for international entrepreneurs is its extremely favorable tax regime. Here is a detailed overview of corporate taxation in this territory:

1. Absence of Direct Taxes

The most notable characteristic of the Cayman Islands tax system is the complete absence of direct taxes. This means there is no: – Corporate tax – Personal income tax – Capital gains tax – Inheritance or gift tax – Withholding tax on dividends, interest, or royalties

This tax policy allows businesses to keep all of their profits, thus promoting reinvestment and growth.

2. Indirect Taxes

Although there are no direct taxes, some indirect taxes are applied: – Customs duties on imports (generally between 22% and 27%) – Stamp duty on certain real estate transactions and legal documents – Registration and licensing fees for businesses

3. Guaranteed Exemption

Exempted Companies can obtain a guarantee certificate from the Cayman Islands government, ensuring they will not be subject to corporate tax for a period of 20 years (renewable). This guarantee offers long-term security for investors.

4. Double Taxation Agreements

The Cayman Islands have not signed comprehensive bilateral tax treaties with other countries. However, they have concluded Tax Information Exchange Agreements (TIEAs) with many countries, including the United States, United Kingdom, and France. These agreements aim to prevent tax evasion while preserving the territory’s tax appeal.

5. International Tax Compliance

Although the Cayman Islands offer an advantageous tax environment, they are committed to complying with international standards on tax transparency. The territory participates in automatic information exchange under the OECD’s Common Reporting Standard (CRS) and has implemented regulations to combat money laundering and terrorist financing.

6. Tax Implications for Owners and Investors

It’s important to note that although companies in the Cayman Islands are not subject to local tax, owners and investors may be subject to tax in their country of residence on income generated by their Cayman company. It is therefore crucial to consult a tax advisor in your country of residence to understand the overall tax implications of creating a company in the Cayman Islands.

Good to Know:

The Cayman Islands tax regime is extremely advantageous for businesses, with a complete absence of direct taxes. However, it is essential to remain compliant with international tax regulations and consider the tax implications in your country of residence. Careful tax planning and professional advice are essential to optimize the benefits of this tax regime while remaining compliant with laws.

Creating Your Company in the Cayman Islands: A Simplified Process

Creating a company in the Cayman Islands is a relatively simple and quick process, generally achievable within a few days. Here are the detailed steps to create your legal structure:

1. Choose a Name for Your Company

– Check name availability with the Cayman Islands Companies Registry – The name must end with “Limited”, “Ltd.”, “Corporation”, “Corp.”, “Incorporated” or “Inc.” – Avoid names similar to existing businesses or containing regulated words

2. Prepare the Incorporation Documents

– Draft the company’s constitutional documents (Memorandum and Articles of Association) – These documents must include the company name, purpose, share capital, and operating rules

3. Appoint Directors and Shareholders

– Choose at least one director (who can be an individual or corporation) – Identify shareholders (a single shareholder is sufficient) – Prepare KYC (Know Your Customer) information for each person involved

4. Engage a Local Registered Agent

– It is a legal requirement to have a registered agent in the Cayman Islands – This agent will serve as the official point of contact and help maintain legal compliance

5. Submit the Registration Application

– File the constitutional documents with the Companies Registry – Pay the registration fees (which vary depending on the company’s share capital)

6. Obtain the Certificate of Incorporation

– Once the application is approved, the Registry will issue a certificate of incorporation – This document formalizes the creation of your company

7. Apply for a Business License (if necessary)

– Certain activities may require a specific license – Check with the Cayman Islands Department of Commerce and Investment

8. Open a Bank Account

– Choose a local or international bank in the Cayman Islands – Prepare all necessary documents for the due diligence process

9. Establish the Governance Structure

– Organize the first board of directors meeting – Adopt internal regulations and company policies

10. Ensure Ongoing Compliance

– Maintain company records – Submit required annual returns – Maintain compliance with local and international regulations

It is highly recommended to use a local lawyer or corporate service provider to guide you throughout this process. They can not only help you navigate the legal requirements but also advise you on the best structure for your business based on your specific objectives.

Good to Know:

Creating a company in the Cayman Islands can be completed within a few days through a simplified process. However, it is crucial to comply with all legal and regulatory requirements. The assistance of a local professional can greatly facilitate the process and ensure that your business is properly established and compliant from the start.

Cayman Islands vs Other Offshore Jurisdictions: A Strategic Choice

When it comes to choosing an offshore jurisdiction to establish a company, the Cayman Islands stand out with their unique advantages. However, it’s important to compare this destination with other popular offshore jurisdictions to make an informed choice. Here is a comparative analysis:

1. Cayman Islands vs British Virgin Islands (BVI)

– Taxation: Both offer zero taxation, but BVI has lower annual fees. – Reputation: The Caymans have a better reputation in the international financial sector. – Regulation: The Caymans have a more sophisticated regulatory framework, particularly appreciated for investment funds. – Cost: Incorporation and maintenance fees are generally higher in the Caymans.

2. Cayman Islands vs Bermuda

– Stability: Both jurisdictions offer great political and economic stability. – Key sectors: Bermuda is better known for insurance and reinsurance, while the Caymans excel in banking services and investment funds. – Confidentiality: The Caymans offer a slightly higher level of confidentiality. – Cost of living: Bermuda has a higher cost of living, which may affect operational costs.

3. Cayman Islands vs Jersey

– Location: Jersey, located near Europe, may be more convenient for European businesses. – Tax regime: Jersey has a slightly different tax regime, with a 0% tax rate for most businesses, but 10% for financial services. – Regulation: Both jurisdictions have strong and respected regulatory frameworks. – International relations: Jersey has closer relations with the EU, which may be an advantage or disadvantage depending on needs.

4. Cayman Islands vs Singapore

– Taxation: Singapore has a more complex tax system with low but non-zero tax rates. – Business environment: Singapore is recognized as one of the best places in the world to do business. – Access to Asian markets: Singapore offers better access to growing Asian markets. – Cost: Operational costs in Singapore are generally higher than in the Caymans.

5. Cayman Islands vs Panama

– Confidentiality: Panama traditionally offered more confidentiality, but both jurisdictions have strengthened their regulations. – Structure diversity: Panama offers a greater variety of legal structures, including private foundations. – Cost: Incorporation and maintenance costs are generally lower in Panama. – International reputation: The Caymans enjoy a better reputation in the international financial sector.

Ultimately, the choice of jurisdiction will depend on your specific objectives, your industry sector, your confidentiality needs, your regulatory requirements, and your overall tax considerations. The Cayman Islands stand out for their sophisticated regulatory framework, political and economic stability, and excellent reputation in the international financial sector, particularly for investment funds and banking services.

Good to Know:

Although the Cayman Islands offer many advantages, each offshore jurisdiction has its own strengths. It is crucial to conduct thorough analysis and consult international law and tax experts before making a decision. The choice of jurisdiction should align with your long-term business strategy and consider regulatory and tax implications in your home country.

Social Obligations in the Cayman Islands: A Flexible Framework for Employers

Although the Cayman Islands are primarily known for their tax advantages, they also have a regulatory employment framework that aims to protect workers’ rights while offering some flexibility to employers. Here is an overview of the main social obligations for businesses operating in the Cayman Islands:

1. Labor Law

– The main law governing employment relationships is the “Labour Law” – It covers aspects such as employment contracts, wages, leave, and dismissals – Employers must provide written employment contracts to all employees

2. Minimum Wage

– There is a legal minimum wage in the Cayman Islands, periodically reviewed – The rate varies by sector and employee skills – Employers must ensure all employees are paid at least the applicable minimum wage level

3. Working Hours

– The standard work week is 45 hours – Overtime must be paid at a premium rate – Employees are entitled to at least one rest day per week

4. Paid Leave

– Employees are entitled to a minimum of 2 weeks paid leave per year – This entitlement increases with seniority, up to 4 weeks after 10 years of service – There is also leave for national holidays

5. Social Security

– Employers must contribute to the national pension system – Contribution rates are shared between employer and employee – There is also mandatory health insurance that the employer must provide

6. Occupational Health and Safety

– Employers have the obligation to provide a safe and healthy work environment – Regular inspections may be conducted to ensure compliance

7. Dismissal

– Dismissal procedures are regulated by law – Employees are entitled to notice or notice pay in case of dismissal – Severance payments may be due depending on the employee’s seniority

8. Non-Discrimination

– The law prohibits discrimination based on race, color, belief, gender, pregnancy, or any other protected characteristic – Employers must ensure equal opportunity in all aspects of employment

9. Work Permits

– Employers wishing to hire foreign workers must obtain work permits – The process involves demonstrating that no qualified local worker is available for the position

10. Reporting and Record Keeping

– Employers must maintain detailed records on employees, wages, and working hours – These records may be inspected by the competent authorities

Although these social obligations may seem less restrictive than in some developed countries, it is crucial for businesses operating in the Cayman Islands to comply with them scrupulously. Non-compliance with these obligations can result in financial and legal penalties, as well as damage to the company’s reputation.

Good to Know:

Although the Cayman Islands offer a business-friendly environment, they nevertheless have a regulatory framework aimed at protecting workers’ rights. Employers should be particularly attentive to minimum wage requirements, paid leave, and social security. It is recommended to consult a local labor law expert to ensure full compliance with all social obligations.

Opening a Corporate Bank Account in the Cayman Islands: A Rigorous Process

Opening a corporate bank account is a crucial step when creating a company in the Cayman Islands. Although the process may be more complex than in some other jurisdictions due to strict anti-money laundering (AML) and counter-terrorist financing regulations, it remains achievable with proper preparation. Here is a detailed guide on the procedure to follow:

1. Choose the Appropriate Bank

– Research local and international banks present in the Cayman Islands – Compare their services, fees, and minimum deposit requirements – Check their reputation and financial stability

2. Prepare the Necessary Documents

Company-related documents: – Certificate of Incorporation – Company’s constitutional documents (Memorandum and Articles of Association) – Register of directors and shareholders – Detailed business plan – Financial projections

Personal documents for directors and significant shareholders: – Certified passport copies – Recent proof of address (less than 3 months old) – Detailed CVs – Bank or professional references

3. Submit a Preliminary Application

– Contact the chosen bank to obtain their application form – Carefully complete all fields in the form – Attach all required documents

4. Undergo the Due Diligence Process

– The bank will conduct thorough checks on the company and involved persons – Be prepared to provide additional information if necessary – This process may take several weeks

5. Interview with the Banker

– Some banks may require an in-person or video conference interview – Prepare to explain your business and financial plans in detail

6. Approval and Account Opening

– Once the application is approved, you will receive the account opening documents – Sign all necessary documents – Make the required initial deposit

7. Activation of Online Banking Services

– Set up your online banking credentials – Familiarize yourself with the features offered

8. Maintaining Compliance

– Keep the bank informed of any significant changes in your business – Comply with all financial reporting regulations

Additional Tips:

– Be transparent: Transparency is crucial in the account opening process. Provide all requested information clearly and honestly.

– Prepare in advance: The process may take time. Start the procedures well before you need them for your business.

– Consider professional help: A local lawyer or corporate service provider can help you navigate this complex process.

– Maintain a good reputation: Banks in the Cayman Islands are very concerned about their reputation. Ensure your business has a good reputation and impeccable track record.

– Be patient: The due diligence process can be long and detailed. Patience is essential.

Good to Know:

Opening a corporate bank account in the Cayman Islands is a rigorous process that requires careful preparation and considerable patience. Banks apply strict due diligence procedures to comply with international anti-money laundering regulations. Thorough preparation, total transparency, and the assistance of a local professional can greatly facilitate this process.

Thriving Business Sectors in the Cayman Islands: Opportunities to Seize

The Cayman Islands, although primarily known for their financial sector, offer opportunities in various business areas. Here is an overview of the most promising sectors for entrepreneurs looking to establish themselves in this territory:

1. Financial Services

The financial sector remains the pillar of the Cayman economy: – Offshore banking and wealth management – Investment funds and hedge funds – Insurance and reinsurance – Trust services and asset management

Opportunities: Creation of fintechs, regulatory compliance services, financial cybersecurity solutions.

2. Luxury Tourism

The Caymans are a popular destination for high-end tourism: – Luxury hotels and resorts – Gourmet restaurants – Concierge and event organization services – Nautical tourism and scuba diving

Opportunities: Development of unique tourist experiences, luxury eco-tourism, wellness and spa.

3. Real Estate and Construction

The Cayman real estate market is dynamic, particularly in the high-end segment: – Luxury real estate development – Architecture and interior design services – Property management and luxury concierge

Opportunities: Development of sustainable real estate projects, rental management services for international investors.

4. Information and Communication Technology

The Caymans are investing in the development of their digital infrastructure: – Cloud computing and data storage services – Software and application development – Cybersecurity solutions

Opportunities: Creation of secure data centers, development of blockchain solutions for the financial sector.

5. Legal and Advisory Services

The presence of many international companies creates strong demand for these services: – Law firms specializing in offshore law – Accounting and audit services – Management and business strategy consulting

Opportunities: Regulatory compliance services, corporate governance consulting, legal services specialized in new technologies.

6. Health and Wellness

Medical tourism and the wellness sector are growing rapidly: – Private clinics and cosmetic surgery centers – Fitness and wellness centers – Specialized health services

Opportunities: Development of cutting-edge clinics, telemedicine services, holistic wellness centers.

7. Renewable Energy

The Caymans are moving toward sustainable energy solutions: – Installation and maintenance of solar panels – Development of energy storage solutions – Energy efficiency consulting

Opportunities: Large-scale solar energy projects, smart energy management solutions.

8. Maritime Services

As an island territory, the Caymans have a developed maritime sector: – Ship registration services – Yacht maintenance and repair – Nautical charter services

Opportunities: Development of luxury marinas, fleet management services for private yachts.

9. International Education

There is growing demand for quality educational services: – International schools – Professional training in financial and legal fields – Online education programs

Opportunities: Creation of specialized business schools, continuing education programs for professionals.

10. Sustainable Agriculture and Aquaculture

Although limited, this sector presents interesting opportunities: –

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.