Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

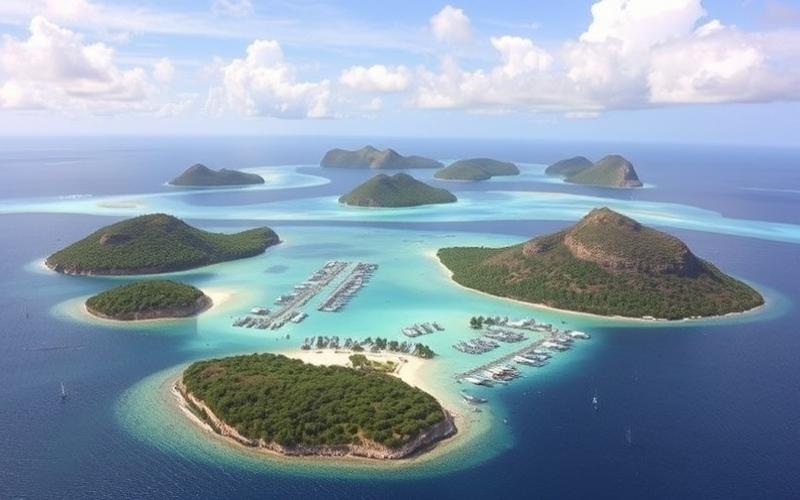

The Cayman Islands are renowned for their favorable tax environment and business-friendly legal framework. However, establishing a company in this British Overseas Territory requires following a well-defined administrative process. Here is a detailed guide to the steps and required documents for setting up your business in this Caribbean tax haven.

Key steps to launch your Cayman Islands company

Choose the appropriate legal structure

The first crucial decision is selecting the most suitable type of legal entity for your business. The Cayman Islands offer several options, with the most common being:

- Limited Liability Company (LLC)

- Exempt Company

- Limited Duration Company (LDC)

- Exempted Limited Partnership (ELP)

Each structure offers specific advantages in terms of taxation, confidentiality, and operational flexibility. It is recommended to consult with a local specialized attorney to determine the most appropriate legal form for your objectives.

Reserve your business name

Once the structure is chosen, you must submit a name reservation request to the Cayman Islands Companies Registry. This step ensures that your desired name is available and complies with local regulations.

Prepare the incorporation documents

Drafting the articles of association and other founding documents for your company is a crucial step. These documents must comply with Cayman Islands legislation and accurately reflect your company’s structure and objectives.

Appoint directors and registered office

You will need to appoint at least one director and one secretary for your company. Additionally, it is mandatory to designate a physical registered office address in the Cayman Islands.

Obtain necessary licenses

Depending on your industry, you may need to obtain specific licenses or permits from Cayman Islands authorities.

Good to know:

The Cayman Islands do not impose a minimum capital requirement for company formation, offering great flexibility to entrepreneurs.

Administrative file: essential documents

Compiling your administrative file is a crucial step for registering your company in the Cayman Islands. Here are the main required documents, which may vary slightly depending on the chosen legal structure:

For all structures:

- Duly completed registration application form

- Company articles of association (Memorandum and Articles of Association)

- Proof of registration fee payment

- Copy of passports for directors and shareholders

- Proof of address for directors and shareholders

- Bank reference letter for each director and shareholder

Specific documents by structure:

- LLC operating agreement

- Compliance declaration signed by a Cayman Islands attorney

- Tax residency declaration

- Detailed business plan

- Partnership agreement

- Limited partnership registration declaration

Good to know:

All documents must be written in English or accompanied by a certified translation.

Final registration: the culmination of your efforts

Once your file is complete, you can proceed with the final registration of your company with the Cayman Islands Companies Registry. This step includes:

File submission

Submit your complete file to the Companies Registry, along with payment of registration fees.

File review

Authorities will review your application to ensure compliance with local legislation.

Obtaining the certificate of incorporation

If your file is approved, you will receive a certificate of incorporation, marking the official birth of your company in the Cayman Islands.

Opening a bank account

Although not mandatory for registration, opening a local bank account is highly recommended to facilitate your operations.

Good to know:

The average processing time for company registration in the Cayman Islands is approximately 5 to 10 business days, but may vary depending on the complexity of your file.

Establishing a company in the Cayman Islands offers numerous advantages, particularly in terms of taxation and confidentiality. However, the administrative process requires careful attention and thorough preparation. It is highly recommended to work with experienced local professionals to navigate these procedures effectively and ensure your company’s compliance with Cayman Islands legislation.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.