Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

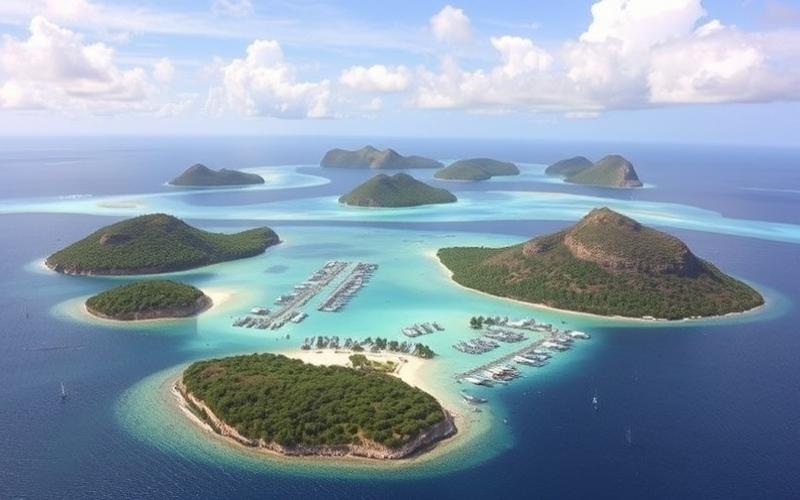

The Cayman Islands, a British Overseas Territory located in the Caribbean, are renowned for their particularly advantageous tax regime for businesses. This small archipelago of only 264 km² attracts numerous international companies thanks to its attractive taxation and stable business environment. In this article, we will explore in detail the tax aspects that make the Cayman Islands a sought-after destination for establishing offshore companies.

An exceptional tax regime: zero direct taxation for businesses

One of the main advantages of the Cayman Islands regarding taxation is the complete absence of direct corporate taxes. This unique characteristic makes it one of the most attractive jurisdictions worldwide for companies seeking to optimize their tax burden.

No corporate income tax

Unlike most countries, the Cayman Islands do not levy any tax on corporate profits, regardless of their origin. This means that companies registered in the Caymans can retain all of their profits without having to pay a portion to the local government.

No capital gains tax

Capital gains realized by companies, whether from the sale of assets or shares, are also not subject to tax in the Cayman Islands. This provision is particularly advantageous for investment companies and holding companies.

Exemption from withholding tax

The Cayman Islands do not apply any withholding tax on dividends, interest, or royalties paid to non-residents. This characteristic facilitates international transactions and allows companies to repatriate their profits without additional tax costs.

This exceptional tax regime allows companies to maximize their profits and more easily reinvest their earnings. However, it is important to note that companies operating in the Cayman Islands must still comply with certain administrative and regulatory obligations.

Good to know:

The Cayman Islands offer a unique tax environment with zero direct corporate taxation, no capital gains tax, and no withholding tax, allowing businesses to retain all of their profits.

Business registration: a simplified but regulated procedure

Although the Cayman Islands are known for their advantageous taxation, registering a company in this territory is not a completely deregulated process. Local authorities have established procedures to maintain the integrity of the financial system while facilitating business establishment.

Choice of legal structure

Entrepreneurs wishing to establish themselves in the Cayman Islands can choose from several legal forms, the most common of which are:

- Limited Liability Company (LLC)

- Exempted Company

- Limited Duration Company

- Foundation Company

Each structure has its own advantages and disadvantages in terms of flexibility, confidentiality, and management costs. It is recommended to consult a local expert to choose the legal form most suitable for your business.

Registration process with the Companies Registry

Registering a company in the Cayman Islands is done through the Registrar of Companies. The main steps are as follows:

1. Choose a unique company name and have it approved by the Registry. 2. Prepare the incorporation documents (articles of association, memorandum, etc.). 3. Appoint a local registered agent. 4. Submit the registration application along with the required fees. 5. Obtain the certificate of incorporation.

The process can typically be completed within a few business days, demonstrating the administrative efficiency of the Cayman Islands.

Anti-money laundering requirements

Despite its reputation as a tax haven, the Cayman Islands have strengthened their regulations regarding anti-money laundering and counter-terrorism financing. Companies must therefore comply with due diligence procedures, including:

– Verification of the identity of beneficial owners – Maintenance of detailed records of transactions and clients – Appointment of a compliance officer

These measures aim to maintain the reputation of the Cayman Islands as a responsible financial center while preserving the tax benefits offered to legitimate businesses.

Good to know:

Registering a company in the Cayman Islands is a relatively quick and simple process, but it requires compliance with certain rules to ensure the integrity of the local financial system.

Tax obligations: minimal but existing

Although the Cayman Islands are known for their absence of direct taxes, companies established there are not completely exempt from tax and financial obligations. These obligations, although limited, contribute to the functioning of the local economy and the maintenance of the territory’s reputation.

Registration and annual renewal fees

Companies registered in the Cayman Islands must pay initial registration fees, as well as annual renewal fees. These amounts vary depending on the type of structure chosen and the company’s share capital. For example, for an exempted company:

– Initial registration fee: between 600 and 2,400 KYD (Cayman Islands dollars) – Annual renewal fee: between 700 and 2,900 KYD

These fees, although not negligible, are generally lower than corporate taxes levied in many other countries.

Annual returns

All companies registered in the Cayman Islands must submit an annual return to the Companies Registry. This return, although simple, must confirm certain essential information such as:

– Registered office address – Names and addresses of directors and shareholders – Amount of share capital

Although this return is not accompanied by a tax payment, it allows the authorities to maintain an up-to-date register of active companies in the territory.

Economic substance requirements

In response to international pressure, the Cayman Islands introduced economic substance requirements for certain companies in 2019. These rules aim to ensure that companies benefiting from the Cayman Islands’ advantageous tax regime conduct real economic activity in the territory.

The concerned companies must demonstrate that they:

– Conduct income-generating activities in the Cayman Islands – Employ an adequate number of qualified personnel on site – Incur sufficient operational expenses in the territory

These requirements vary depending on the type of business activity and may require greater physical presence in the Cayman Islands.

International tax reporting

Although the Cayman Islands do not directly tax companies, they participate in international tax transparency initiatives. Therefore, companies may be subject to certain reporting obligations, including:

– Automatic exchange of tax information (OECD standard) – Country-by-country reporting for large multinational groups – Declaration of beneficial owners

These measures aim to combat international tax evasion while preserving the tax attractiveness of the Cayman Islands for legitimate businesses.

Good to know:

Although direct tax obligations are minimal in the Cayman Islands, companies must comply with certain administrative and reporting requirements, as well as economic substance rules for certain activities.

International agreements: protection against double taxation

Although the Cayman Islands are known for their advantageous tax regime, they have also developed a network of international agreements aimed at facilitating economic exchanges and preventing double taxation. These agreements play a crucial role in the territory’s attractiveness for international businesses.

Tax Information Exchange Agreements (TIEA)

The Cayman Islands have signed numerous Tax Information Exchange Agreements (TIEAs) with various countries. These agreements allow for the exchange of tax information upon request, thus contributing to the fight against tax evasion while preserving the confidentiality of financial information.

Among the countries that have concluded TIEAs with the Cayman Islands are notably:

– United States – United Kingdom – France – Germany – Canada

These agreements strengthen the credibility of the Cayman Islands as a responsible financial center while offering certain legal security to companies established there.

Multilateral Convention on Mutual Administrative Assistance in Tax Matters

The Cayman Islands are signatories to the OECD’s Multilateral Convention on Mutual Administrative Assistance in Tax Matters. This convention facilitates international cooperation in tax matters, particularly regarding:

– Exchange of information on request – Automatic exchange of information – Assistance in tax recovery

This membership demonstrates the Cayman Islands’ commitment to respecting international standards of tax transparency.

Absence of classic bilateral tax treaties

Unlike many jurisdictions, the Cayman Islands have not concluded classic bilateral tax treaties aimed at avoiding double taxation. This situation is mainly explained by the absence of direct taxes in the territory.

However, the absence of double taxation is generally ensured by:

– The local tax regime that does not tax foreign-source income – Foreign tax credit mechanisms in investors’ countries of residence

This configuration allows companies based in the Cayman Islands to benefit from advantageous taxation while generally avoiding double taxation on their international operations.

Specific sectoral agreements

The Cayman Islands have also concluded specific sectoral agreements to facilitate certain economic activities. For example:

– Information sharing agreements with financial regulatory authorities of other countries – Cooperation agreements in financial services with certain countries

These agreements contribute to creating a favorable environment for companies operating in specific sectors, particularly financial services and insurance.

Good to know:

Although the Cayman Islands do not have classic bilateral tax treaties, their network of information exchange agreements and their participation in international tax transparency initiatives provide a stable legal framework for international businesses.

Comparison with other offshore jurisdictions: the Cayman Islands leading the pack

The Cayman Islands stand out as one of the most attractive offshore jurisdictions worldwide. However, it is interesting to compare their tax regime with that of other popular destinations for international businesses.

The Cayman Islands vs the British Virgin Islands (BVI)

The British Virgin Islands are often considered the main competitor of the Cayman Islands in offshore financial services. Here are some points of comparison:

– Corporate taxes: Zero in both jurisdictions – Registration fees: Generally higher in the Cayman Islands – Confidentiality: Slightly higher in the BVI – International reputation: The Cayman Islands are perceived as more stable and better regulated

Although both jurisdictions offer similar advantages, the Cayman Islands are often preferred for more complex financial structures and investment funds.

The Cayman Islands vs Bermuda

Bermuda is another popular offshore jurisdiction, particularly in the insurance sector. Let’s compare the two:

– Corporate taxes: Zero in both cases – Cost of living and operations: Higher in Bermuda – Specialization sectors: Insurance for Bermuda, financial services for the Cayman Islands – Market access: The Cayman Islands have closer ties with North American markets

The Cayman Islands stand out for their more diversified financial ecosystem and more developed infrastructure for international banking services.

The Cayman Islands vs Jersey and Guernsey

These Channel Islands are important offshore financial centers, particularly for European clients. Here’s how they compare to the Cayman Islands:

– Tax regime: Low but non-zero tax rates in Jersey and Guernsey, compared to zero tax in the Cayman Islands – Regulation: All are well-regulated, but the Cayman Islands have a more flexible approach – Geographic location: Jersey and Guernsey are closer to Europe, the Cayman Islands to the Americas – Types of structures: The Cayman Islands are more popular for alternative investment funds

The Cayman Islands generally offer more advantageous taxation and greater regulatory flexibility, making them particularly attractive for certain types of businesses and investors.

The Cayman Islands vs Singapore

Although Singapore is not traditionally considered a tax haven, it has become a popular destination for international businesses. Let’s compare it to the Cayman Islands:

– Corporate taxes: 17% in Singapore versus 0% in the Cayman Islands – Business environment: Singapore is recognized for its ease of doing business – Access to Asian markets: Clear advantage for Singapore – Political and economic stability: High in both jurisdictions, but Singapore benefits from a better international reputation

Although Singapore offers less advantageous taxation, it compensates with a world-class business environment and privileged access to growing Asian markets.

Good to know:

The Cayman Islands stand out for their zero-tax regime, regulatory flexibility, and developed financial ecosystem, making them one of the most attractive offshore jurisdictions, particularly for financial services and investment funds.

In conclusion, the Cayman Islands offer an exceptional tax environment for businesses, characterized by the absence of direct taxes and business-friendly regulation. Although other offshore jurisdictions offer similar advantages, the Cayman Islands stand out for their political stability, sophisticated financial infrastructure, and reputation as a well-regulated financial center.

However, it is crucial to note that the use of offshore structures should always be done in compliance with international laws and regulations. Companies must be aware of the growing compliance and transparency obligations, even in low-tax jurisdictions.

The appeal of the Cayman Islands is not limited to its advantageous taxation. The quality of life, political and economic stability, as well as local expertise in financial services also contribute to its success as an international business center.

For entrepreneurs and businesses seeking legal tax optimization and an environment conducive to international business, the Cayman Islands remain a top choice. However, it is recommended to consult international tax and business law experts to ensure that the chosen structure is suitable for your specific needs and compliant with current regulations.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.