Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

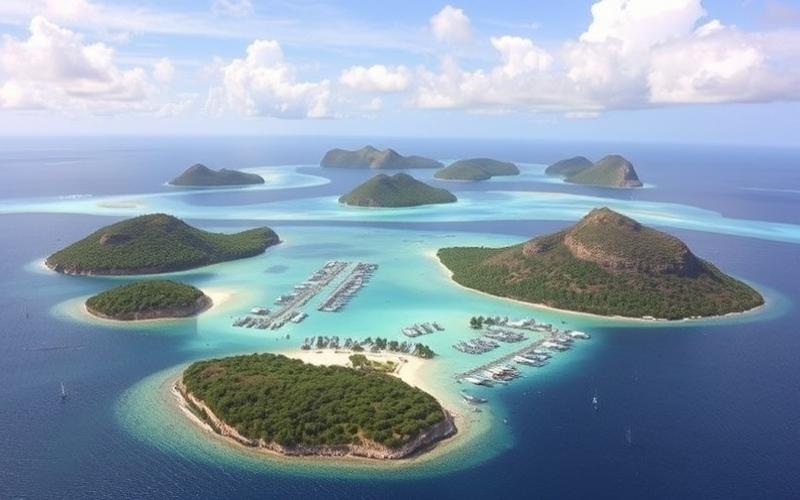

The Cayman Islands, a renowned Caribbean tax haven, attract numerous entrepreneurs and investors worldwide due to their favorable tax environment and business-friendly regulatory framework. However, selecting the appropriate legal structure for your business in this British Overseas Territory requires a thorough understanding of the available options and their implications. In this article, we will explore the main legal structures offered in the Cayman Islands and guide you in choosing the most suitable one for your entrepreneurial project.

Legal Structures Driving Success in the Cayman Islands

The Cayman Islands offer several types of legal structures for businesses, each with its own characteristics and benefits. Here are the main options to consider:

1. Limited Liability Company (LLC)

The LLC is one of the most popular legal forms in the Cayman Islands. It offers great flexibility in terms of management and taxation, while protecting the owners’ personal assets. The main features of the Cayman LLC are:

– Limited liability for members – Flexibility in management structure – No minimum capital requirement – Enhanced confidentiality of member information

2. Exempted Company

The exempted company is particularly attractive to international investors. It benefits from significant tax advantages and great operational flexibility. Its main strengths are:

– Tax exemption on profits for 20 years (renewable) – Possibility of having only one shareholder and one director – No requirement to hold annual meetings in the Cayman Islands – Enhanced confidentiality regarding shareholder identity

3. Limited Duration Company (LDC)

The LDC is a variant of the exempted company, with a predefined lifespan. It is often used for specific projects or investment funds. Its characteristics include:

– Limited lifespan (typically maximum 30 years) – Flexibility in profit distribution – Possibility of conversion to a standard exempted company

4. Foundation Company

Introduced more recently, the Cayman foundation combines the advantages of a company and a trust. It is particularly suitable for wealth management and philanthropy. Its strengths are:

– Separate legal personality – No shareholders, but beneficiaries – Great flexibility in governance – Enhanced asset protection

Good to know:

The choice of legal structure will depend on many factors, including the nature of your business, your tax objectives, and your long-term development strategy. It is crucial to consult a local legal and tax expert to guide you in this important decision.

Sole Proprietorship or Corporation: Which Path to Choose in the Cayman Islands?

The question of creating a sole proprietorship or a corporation is crucial for any entrepreneur setting up in the Cayman Islands. Each option has its advantages and disadvantages:

Sole Proprietorship:

Although less common in the Cayman Islands for foreign investors, a sole proprietorship may suit certain types of activities. Its characteristics are:

– Simplicity of creation and management – Total control over the business – No separation between personal and business assets – Unlimited liability for the owner

Corporation:

Creating a corporation (LLC, exempted company, etc.) is generally preferred in the Cayman Islands for several reasons:

– Protection of personal assets through limited liability – More advanced tax optimization – Increased credibility with partners and clients – Ease in raising funds and attracting investors

Factors to Consider in Your Choice:

– Size and Nature of Business: A small-scale or consulting business may work as a sole proprietorship, while a larger or riskier activity will require the protection of a corporate structure.

– Growth Objectives: If you plan rapid expansion or bringing in investors, a corporation will be more suitable.

– Taxation: Corporations in the Cayman Islands benefit from significant tax advantages, including no corporate tax for offshore activities.

– Confidentiality: Corporate structures generally offer greater confidentiality regarding owner information and operations.

Good to know:

Although a sole proprietorship is simpler to manage, creating a corporation in the Cayman Islands generally offers more advantages in terms of legal protection, tax optimization, and operational flexibility. This is why the majority of foreign investors opt for a corporate structure.

Key Steps to Create Your Business in the Cayman Islands

Once you have chosen the legal structure most suitable for your project, here are the main steps to follow to create your business in the Cayman Islands:

1. Choose a Business Name: Check name availability with the Cayman Islands Companies Registry.

2. Prepare Incorporation Documents: Depending on the chosen structure, these will include articles of incorporation, memorandum of association, etc.

3. Appoint Officers and Directors: At least one director is generally required.

4. Open a Bank Account: Choose a local or international bank present in the Cayman Islands.

5. Obtain Necessary Licenses: Certain activities require specific licenses (finance, insurance, etc.).

6. Register the Business: Submit your file to the Companies Registry and pay the registration fees.

7. Appoint a Local Agent: A local representative is mandatory for certain structures.

Timelines and Costs:

– The registration process can be quick, often achievable within a few days. – Costs vary depending on the chosen structure, but budget between $1,000 and $5,000 for initial registration fees. – Annual maintenance fees should also be anticipated.

Good to know:

Although the business creation process in the Cayman Islands is relatively simple, it is highly recommended to engage a local attorney or specialized firm to ensure compliance with all applicable regulations.

Optimizing Your Structure for Sustainable Growth

Choosing the right legal structure is only the first step. To ensure the long-term success of your business in the Cayman Islands, consider the following points:

– Tax Planning: Although the Cayman Islands offer a favorable tax regime, careful planning is necessary to optimize your overall tax situation, particularly regarding international operations.

– Regulatory Compliance: Stay informed of regulatory developments, particularly regarding anti-money laundering and tax information exchange.

– Corporate Governance: Implement strong governance structures to protect the interests of all stakeholders.

– Exit Strategy: Anticipate exit or business transfer scenarios from the outset.

– Professional Network: Develop a strong network of local professionals (attorneys, accountants, bankers) to support your growth.

In conclusion, the Cayman Islands offer an environment conducive to business creation and development, with a range of legal structures suited to various needs. The choice between a sole proprietorship and a corporation will depend on your specific objectives, but in most cases, a corporate structure offers more advantages for foreign investors. Whatever your decision, careful planning and professional advice are essential to successfully navigate the entrepreneurial landscape of the Cayman Islands.

Good to know:

The Cayman Islands’ reputation as a premier offshore financial center comes with increased scrutiny. It is crucial to ensure all operations are conducted in strict compliance with local and international laws to maintain the sustainability of your business.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.