Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

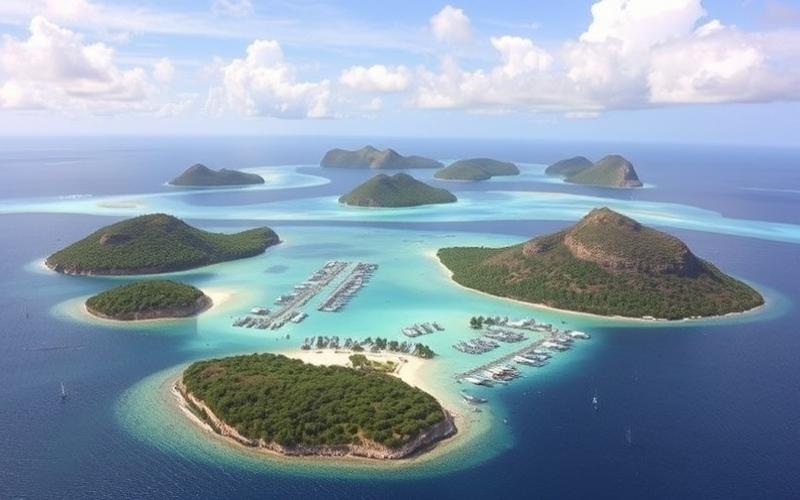

The Cayman Islands, a British archipelago located in the Caribbean, are much more than just a paradise destination. This UK Overseas Territory has established itself as one of the world’s most important financial centers, attracting numerous entrepreneurs and investors seeking an environment conducive to developing their businesses. In this article, we will explore the benefits of creating a startup in the Cayman Islands, the most suitable legal structures, and the funding options available for ambitious entrepreneurs.

A Fertile Ecosystem for Innovation and Growth

The Cayman Islands offer particularly fertile ground for creating and developing innovative startups. This small territory of only 264 km² is home to a dynamic and sophisticated economy, primarily focused on financial services and tourism. But beyond these traditional sectors, the Caymans have positioned themselves as an attractive hub for technology companies and startups from various backgrounds.

The attractiveness of the Cayman Islands for startups is based on several key factors. First, the extremely favorable tax framework is a major asset. Indeed, the Caymans levy no corporate tax, no income tax, and no capital gains tax. This advantageous tax policy allows young companies to reinvest a larger portion of their profits into their growth and development.

Furthermore, the Cayman Islands benefit from remarkable political and economic stability, guaranteed by their status as a British Overseas Territory. This stability, combined with a legal system based on English law, provides a secure environment for investors and entrepreneurs. The presence of numerous international financial institutions and specialized law firms also facilitates access to high-level professional services.

The modern infrastructure and international connections of the Cayman Islands are also significant assets. The archipelago has excellent air links with the United States, the United Kingdom, and other international destinations, thus facilitating business travel. State-of-the-art telecommunications and the presence of secure data centers meet the needs of the most demanding technology companies.

Finally, the Caymanian government has implemented initiatives aimed at attracting and supporting innovative startups. Cayman Enterprise City, a special economic zone, offers additional benefits to technology companies, including simplified immigration procedures for qualified employees and additional tax incentives.

Good to Know:

The Cayman Islands offer an extremely advantageous tax environment, political and economic stability, and modern infrastructure, making this territory a top choice for entrepreneurs looking to launch their startup in a setting conducive to innovation and rapid growth.

The Ideal Legal Structures for Your Cayman Startup

When it comes to creating a startup in the Cayman Islands, choosing the appropriate legal structure is crucial. The Cayman legal system, based on English law, offers several options tailored to the specific needs of innovative young companies. Here are the main structures to consider:

The Limited Liability Company (LLC)

The LLC is a popular legal form for startups in the Cayman Islands. It offers great flexibility in terms of management and capital structure, while protecting the founders’ personal assets. The main characteristics of the Cayman LLC are:

- Limited liability for members

- Flexibility in profit distribution

- No minimum capital required

- Possibility of having a single member

- Reduced administrative formalities

The LLC is particularly suitable for technology startups and service companies, as it allows for flexible management and a simplified governance structure.

The Exempted Company

The exempted company is another popular option for international startups looking to establish themselves in the Cayman Islands. This structure is designed for companies that primarily conduct their business outside the Caymans. The advantages of the exempted company include:

- Guaranteed tax exemption for 20 years

- Enhanced shareholder confidentiality

- Possibility of having only one director

- No obligation to hold annual general meetings in the Caymans

- Ease of transferring the registered office to another jurisdiction

This structure is particularly interesting for startups with an international vision from their inception.

The Foundation Company

Introduced more recently into Cayman law, the foundation offers an interesting alternative for certain startups, particularly those involved in non-profit projects or with a philanthropic dimension. The foundation combines the characteristics of a company and a trust, offering great flexibility in asset management and achieving the company’s objectives. Its main advantages are:

- Separate legal personality

- No shareholders, but beneficiaries

- Great flexibility in defining objectives and governance

- Possibility to combine commercial and philanthropic objectives

This structure can be particularly suitable for startups in the fields of social impact, environment, or education.

The choice of legal structure will depend on the specific objectives of your startup, your business model, and your growth plans. It is highly recommended to consult a lawyer specializing in Cayman business law to guide you in this crucial choice.

Good to Know:

The Cayman Islands offer several legal structures suitable for startups, including the LLC, the exempted company, and the foundation. Each offers specific advantages in terms of flexibility, taxation, and governance, allowing entrepreneurs to choose the form most appropriate for their project.

Funding the Future: Financing Options for Your Cayman Startup

Funding is often the lifeblood for startups, and the Cayman Islands offer a particularly favorable environment in this regard. The presence of numerous international investors, combined with a flexible regulatory framework and attractive tax incentives, makes the Caymans a prime destination for raising funds. Here are the main financing options to consider for your Cayman startup:

Venture Capital

The Cayman Islands are home to many venture capital funds attracted by the territory’s advantageous tax framework and regulatory flexibility. These funds are particularly interested in innovative startups in sectors such as technology, fintech, biotechnology, or renewable energy. To attract the attention of venture capital investors, your startup will need to:

- Have a solid and scalable business model

- Demonstrate significant growth potential

- Have an experienced management team

- Present a clear exit strategy for investors

Venture capital funds can bring not only capital but also valuable expertise and international networks to accelerate your company’s growth.

Angel Investors

The Cayman Islands also attract many wealthy individual investors, or angel investors, seeking investment opportunities in promising startups. These investors can be particularly interesting for startups in the early stages, as they are often more flexible than institutional funds and can provide valuable operational expertise.

To attract Cayman angel investors, it is important to:

- Have a convincing and well-prepared pitch

- Demonstrate a thorough understanding of your market

- Present realistic financial projections

- Be open to the investor’s active involvement in the company

Initial Coin Offerings (ICO) and Security Token Offerings (STO)

The Cayman Islands have positioned themselves as a jurisdiction favorable to cryptocurrencies and blockchain, attracting many startups in this field. For companies operating in blockchain or fintech, ICOs and STOs can represent interesting financing options. The Cayman regulatory framework offers some flexibility for these forms of fundraising, while ensuring adequate investor protection.

However, it is crucial to:

- Ensure compliance with local and international regulations

- Have a solid project and proven technology

- Implement transparent governance

- Plan a clear communication strategy for investors

Incubators and Accelerators

Although fewer than in the United States or Europe, incubators and accelerators are beginning to emerge in the Cayman Islands, particularly within the Cayman Enterprise City. These structures can offer not only initial funding but also valuable support in terms of mentoring, networking, and access to resources.

To benefit from these programs, your startup will generally need to:

- Have an innovative concept and significant growth potential

- Be ready to commit to an intensive development program

- Demonstrate the ability to adapt quickly and evolve

Government Grants

Although less developed than in some countries, the Cayman Islands offer a few grant programs to support innovation and entrepreneurship. These programs are often targeted at specific sectors considered strategic for the archipelago’s economic development, such as green technologies or digitalization.

To access these funds, it is important to:

- Stay informed about available programs

- Align your project with the Caymanian government’s development priorities

- Prepare strong and well-documented application files

The choice of funding method will depend on many factors, including the development stage of your startup, your industry, and your growth objectives. It is often wise to combine several funding sources to optimize your development strategy.

Good to Know:

The Cayman Islands offer a wide range of financing options for startups, ranging from traditional venture capital to ICOs, angel investors, and incubation programs. The key to success lies in meticulous preparation and a financing strategy tailored to the specifics of your project and the Cayman market.

Conclusion: The Cayman Islands, a Springboard for Your International Startup

Creating a startup in the Cayman Islands represents a unique opportunity for ambitious entrepreneurs wishing to benefit from an advantageous tax environment, political and economic stability, and facilitated access to international markets. The archipelago offers a setting conducive to innovation and rapid growth, supported by modern infrastructure and a sophisticated financial ecosystem.

Choosing the appropriate legal structure, whether an LLC, an exempted company, or a foundation, will optimize the benefits offered by the Cayman jurisdiction while meeting the specific needs of your business. The flexibility of the Cayman regulatory framework allows startups to quickly adapt to changes in their market and business model.

In terms of financing, the Cayman Islands offer a wide range of options, from traditional venture capital to more innovative methods like ICOs, angel investors, and incubation programs. This diversity of funding sources, combined with the presence of many international investors, creates an environment particularly favorable to the development of startups.

However, it is important to note that creating a startup in the Cayman Islands requires meticulous preparation and a thorough understanding of local specifics. It is highly recommended to surround yourself with experienced professionals, including lawyers and accountants familiar with the Cayman context, to navigate this environment effectively.

Ultimately, the Cayman Islands offer an exceptional springboard for visionary entrepreneurs wishing to give their startup an international dimension from its inception. With adequate planning and rigorous execution, your Cayman startup can benefit from a significant competitive advantage on the global stage.

Good to Know:

The Cayman Islands represent a prime destination for entrepreneurs looking to launch a startup in an advantageous tax environment conducive to innovation. With adequate preparation and professional support, your Cayman startup can benefit from an optimal framework for its development and international expansion.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.