Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

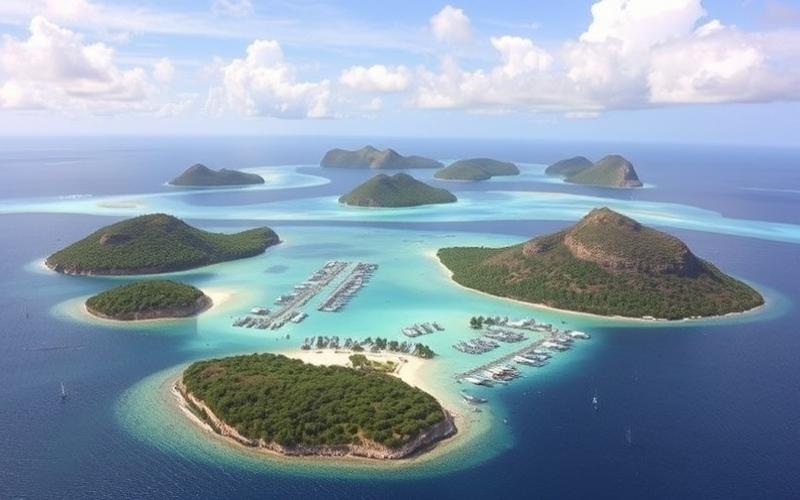

The Cayman Islands, a renowned tax haven located in the Caribbean, attract numerous foreign investors due to their favorable tax environment and political stability. However, before venturing into real estate acquisition in this British Overseas Territory, it is crucial to understand the specific regulations governing foreign ownership. In this article, we will explore in detail the legal aspects, approval procedures, as well as the rights and obligations of foreign investors in the Cayman Islands.

Legal Framework: Limited Restrictions for Foreign Investors

Unlike many jurisdictions, the Cayman Islands offer a relatively open environment for foreign investors regarding real estate ownership. The Cayman government has implemented policies aimed at encouraging foreign investment while preserving local interests.

Non-residents and foreign companies are permitted to acquire real estate in the Cayman Islands without major restrictions. This liberal approach contrasts with the more restrictive policies adopted by other tax havens or popular tourist destinations. However, there are some important nuances to consider:

- Foreigners can purchase residential and commercial properties without area limitations.

- There is no restriction on the number of properties a foreigner can acquire.

- Foreign investors enjoy the same property rights as local citizens.

- Certain specific areas, particularly those of strategic or environmental interest, may be subject to special regulations.

It is important to note that although restrictions are limited, the Cayman government reserves the right to modify these policies based on the country’s economic and social needs. Foreign investors should therefore stay informed about potential legislative changes that could affect their investments.

Good to Know:

The Cayman Islands offer a favorable legal framework for foreign investors, with few restrictions on real estate acquisition. However, it is essential to stay informed about potential regulatory developments.

Approval Process: A Simplified Yet Rigorous Procedure

Although the Cayman Islands are relatively open to foreign investment, the approval process for property acquisition involves several important steps. This procedure aims to ensure transaction transparency and protect the interests of all involved parties.

The approval process for foreign investors in the Cayman Islands typically proceeds as follows:

1. Property Identification: The investor must first identify the real estate property they wish to acquire.

2. Due Diligence: A crucial step involves conducting thorough due diligence on the property, including verification of the title deed and any existing encumbrances or restrictions.

3. Purchase Agreement: A purchase agreement is drafted and signed between the buyer and seller.

4. License Application: Although foreigners do not need a special license to purchase real estate, certain transactions may require approval from the Trade and Business Licensing Board.

5. Property Registration: Once the transaction is finalized, the property must be registered with the Cayman Islands Land Registry.

It is important to note that the Cayman government has implemented measures to combat money laundering and terrorist financing. Foreign investors must therefore be prepared to provide detailed information about the source of funds used for the acquisition.

Furthermore, although the process is relatively straightforward, it is highly recommended to engage a local attorney specializing in real estate law. These professionals can guide investors through the nuances of the Cayman legal system and ensure all legal requirements are met.

Good to Know:

The approval process for property acquisition in the Cayman Islands is relatively simple for foreign investors, but requires careful attention to legal details and compliance. Assistance from a local attorney is highly recommended.

Rights and Responsibilities: What Foreign Owners Need to Know

Once the property is acquired, foreign investors in the Cayman Islands enjoy rights similar to those of local owners, but they must also be aware of their specific responsibilities.

Rights of Foreign Owners:

- Full and complete ownership rights: Foreigners can hold full title deeds to their real estate properties.

- Leasing rights: Foreign owners can lease their properties for short or long terms.

- Resale rights: There are no restrictions on the resale of properties owned by foreigners.

- Legal protection: Foreign owners benefit from the same legal protection as local owners in case of disputes.

Obligations and Responsibilities:

1. Taxes and fees: Although the Cayman Islands are known for their favorable tax regime, foreign owners must be aware of tax obligations related to their real estate investment. There is no income tax, capital gains tax, or property tax, but stamp duty applies to real estate transactions.

2. Maintenance and management: Owners are responsible for maintaining their property and must comply with local building and planning regulations.

3. Regulatory compliance: Foreign owners must stay informed and comply with all local regulations, including those related to the environment and land use.

4. Declarations: Although there is no income tax, owners may be required to make declarations to local authorities, particularly regarding the leasing of their property.

5. Insurance: It is highly recommended to obtain adequate insurance to protect your investment, especially considering natural risks in the Caribbean region.

It is crucial for foreign investors to understand that, although the Cayman Islands’ tax regime is attractive, they may have tax obligations in their home country on income or capital gains generated by their Cayman property. Consultation with tax experts in their country of residence is strongly recommended to avoid any tax complications.

Good to Know:

Foreign owners in the Cayman Islands benefit from extensive rights, but must also be aware of their responsibilities, particularly regarding regulatory and tax compliance. Proactive management of these obligations is essential for a successful investment.

Winning Strategies: Tips for Successful Real Estate Investment in the Cayman Islands

To maximize the chances of success in their real estate investment in the Cayman Islands, foreign investors must adopt a strategic and well-informed approach. Here are some essential tips for effectively navigating the Cayman real estate market:

1. Conduct thorough research: Before committing, it is crucial to understand the local real estate market, price trends, and the most promising areas. The Cayman Islands offer various opportunities, from luxury properties on Seven Mile Beach to more affordable residential developments in other parts of Grand Cayman.

2. Assemble a local team of professionals: Surrounding yourself with local experts is essential. This includes an attorney specializing in real estate law, a reputable real estate agent, and potentially an accountant familiar with the tax specifics of the Cayman Islands.

3. Understand associated costs: Beyond the purchase price, consider transaction fees, stamp duty, legal fees, and long-term maintenance costs. Detailed financial planning is essential to avoid surprises.

4. Consider rental potential: If the investment targets rental income, it is important to assess the property’s rental potential. The Cayman Islands attract many tourists and expatriates, offering interesting opportunities for short and long-term leasing.

5. Familiarize yourself with local regulations: Although restrictions are limited, it is crucial to understand specific regulations that may affect your investment, particularly regarding planning and environment.

6. Consider an appropriate ownership structure: Depending on your objectives, it may be advantageous to structure your investment through a Cayman company or trust. This can offer benefits in terms of tax and estate planning.

7. Stay informed about economic and political developments: The Cayman Islands are an important international financial center. Changes in global financial regulations or local policies can impact your investment.

8. Consider natural risks: Given the geographical location of the Cayman Islands, it is important to account for risks related to hurricanes and other natural phenomena. Adequate insurance and protective measures are essential.

9. Plan for the long term: The Cayman real estate market has historically shown stable appreciation. Adopting a long-term perspective can maximize your investment potential.

10. Respect local culture and environment: The Cayman Islands have a unique culture and fragile environment. Investors who show respect and engage positively with the local community are often better received and may benefit from additional opportunities.

By following these tips and adopting a cautious, well-informed approach, foreign investors can maximize their chances of achieving successful real estate investment in the Cayman Islands. The combination of a favorable tax environment, stable real estate market, and robust legal framework makes the Cayman Islands an attractive destination for international real estate investors.

Good to Know:

The key to success for real estate investment in the Cayman Islands lies in meticulous preparation, thorough understanding of the local market, and assistance from local experts. A long-term approach that respects the local environment can greatly contribute to the success of your investment.

In conclusion, the Cayman Islands offer a favorable environment for foreign investors wishing to acquire real estate. With limited restrictions, a relatively simple approval process, and extensive property rights, this British Overseas Territory positions itself as an attractive destination for international real estate investment. However, as with any foreign investment, it is crucial to approach the Cayman market with meticulous preparation, thorough understanding of local regulations, and support from local experts.

Investors who take the time to familiarize themselves with the nuances of the Cayman real estate market, who respect legal and tax obligations, and who adopt a long-term approach, are well positioned to benefit from the opportunities offered by this Caribbean paradise. Whether for a luxury second home, a rental investment, or a wealth diversification strategy, the Cayman Islands continue to attract the attention of savvy investors worldwide.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.