Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

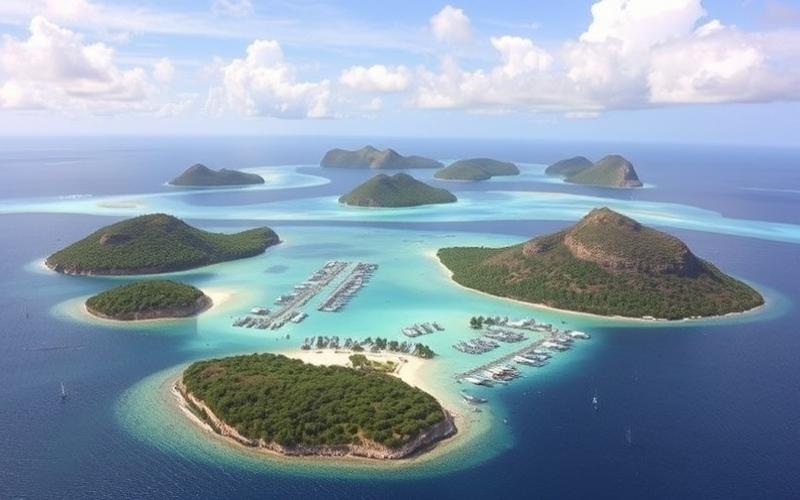

The Cayman Islands, a British Overseas Territory located in the Caribbean, are renowned for their robust financial sector and advantageous tax environment. For entrepreneurs seeking to establish a banking presence in this tax haven, opening a corporate bank account is a crucial step. This article will guide you through the various steps of the process, the documentary requirements, and introduce you to the main banks operating in this offshore financial center.

Keys to Opening a Corporate Bank Account in the Cayman Islands

Opening a corporate bank account in the Cayman Islands may seem complex, but with the right information and adequate preparation, the process can be simplified. The first step is to choose the bank that best fits your business needs. The Cayman Islands are home to many reputable international financial institutions, each offering specific services tailored to different types of businesses.

Once you’ve selected a bank, it’s highly recommended to schedule an appointment with a bank representative. This meeting will allow you to discuss your specific needs, understand the products and services offered, and obtain detailed information about the account opening process. Many banks in the Cayman Islands offer dedicated account management services for business clients, which can greatly facilitate the management of your offshore finances.

It’s important to note that Cayman Islands banks apply strict due diligence procedures. This means they will conduct thorough checks on your company and its beneficial owners. This process aims to prevent money laundering and other illicit financial activities, in accordance with international Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations.

Good to Know:

The Cayman Islands have strengthened their financial regulations in recent years to maintain their reputation as a premier offshore financial center. This means the account opening process may be more rigorous than in some other jurisdictions, but it also ensures a high level of security and compliance for your business.

The Winning File: Essential Documents for Opening Your Account

To open a corporate bank account in the Cayman Islands, you’ll need to provide a series of documents. The exact list may vary slightly from bank to bank, but here are the generally required documents:

- Company Certificate of Incorporation

- Company Bylaws

- Register of Directors and Shareholders

- Proof of Company Address (recent utility bill, for example)

- Detailed Business Plan outlining the company’s activities

- Audited Financial Statements (for existing companies)

- Passports and Proof of Address for all directors, authorized signatories, and beneficial owners

- Bank References for directors and major shareholders

- IRS W-8BEN-E Form (for non-US entities)

It’s crucial to provide up-to-date and authentic documents. Cayman Islands banks are particularly vigilant regarding the verification of document authenticity. Any document in a foreign language must be accompanied by a certified English translation.

Additionally, banks may request additional information about the source of funds that will be deposited into the account. This may include commercial contracts, historical bank statements, or other evidence of the legitimate origin of the funds.

Good to Know:

Careful preparation of your documentary file is essential to speed up the account opening process. The more complete and transparent your file is, the higher the chances of quick approval of your application.

From Application to Activation: Key Steps to Create Your Bank Account

The procedure for opening a corporate bank account in the Cayman Islands generally follows these steps:

1. Initial Contact: Contact the chosen bank to express your interest in opening a corporate account. At this stage, you can request preliminary information about requirements and services offered.

2. Meeting with a Relationship Manager: Arrange a meeting, in person or via video conference, to discuss your specific needs and obtain personalized advice.

3. Application Submission: Fill out the account opening application form provided by the bank. This form will include detailed questions about your company, its activities, and its beneficial owners.

4. Document Provision: Gather and submit all required documents, as mentioned in the previous section.

5. Due Diligence Verification: The bank will conduct thorough checks on your company and the individuals involved. This step can take several weeks, or even months in some complex cases.

6. Account Approval: Once the checks are successfully completed, the bank will inform you of the approval of your application.

7. Initial Deposit: Make the required initial deposit to activate the account. The minimum amount varies depending on the bank and the type of account chosen.

8. Online Services Activation: Set up your access to online and mobile banking services to manage your account remotely.

It’s important to note that the process can take several weeks, or even months in some cases. The duration depends on the complexity of your company structure, how quickly you provide the required documents, and the bank’s current workload.

Good to Know:

Some banks in the Cayman Islands offer expedited account opening services for premium clients. If time is a critical factor for your business, inquire about these premium options, which can significantly reduce account opening timelines.

Cayman Islands Banking Giants: Choosing the Ideal Partner for Your Business

The Cayman Islands are home to many world-renowned financial institutions. Here’s an overview of some of the main banks operating in this offshore financial center, along with their specific advantages:

1. Butterfield Bank (Cayman) Limited – Advantages: – Wide range of international banking services – Expertise in wealth management and trust services – Robust online banking platform

2. Cayman National Bank – Advantages: – Strong local presence with deep knowledge of the Cayman market – Personalized banking services for local and international businesses – Flexible financing solutions for businesses

3. Scotiabank & Trust (Cayman) Ltd. – Advantages: – Extensive international banking network – Multi-currency banking services – Advanced cash management solutions for businesses

4. CIBC FirstCaribbean International Bank – Advantages: – Expertise in offshore banking services – Innovative commercial financing solutions – Sophisticated treasury management services

5. RBC Royal Bank (Cayman) Limited – Advantages: – Wide range of investment products – High-end private banking services – Advanced digital banking solutions

Each bank has its own strengths and specialties. It’s crucial to carefully evaluate your specific banking service needs before making your choice. Consider factors such as banking fees, exchange rates, customer service quality, and ease of use of online services.

Good to Know:

Some of these banks offer dedicated “relationship management” services for business clients, which can be particularly helpful for navigating the complex financial landscape of the Cayman Islands and optimizing your offshore banking strategy.

Conclusion: Your Springboard to Offshore Financial Success

Opening a corporate bank account in the Cayman Islands is a strategic step for many international entrepreneurs and investors. Although the process may seem complex at first glance, careful preparation and a clear understanding of the requirements can greatly facilitate the process.

The Cayman Islands offer a sophisticated banking environment, with world-class financial institutions and a robust regulatory framework. This combination not only ensures the security of your funds but also offers unique opportunities for the international financial management of your business.

However, it’s crucial to remain vigilant and comply with all local and international regulations. Transparency and compliance are essential to maintaining a healthy and sustainable banking relationship in this premier offshore financial center.

By following the steps outlined in this article, carefully preparing your file, and choosing the bank that best fits your needs, you’ll be well positioned to fully leverage the advantages offered by the Cayman Islands banking system.

Good to Know:

Although the Cayman Islands offer many financial advantages, it’s always recommended to consult an international tax expert and a specialized lawyer before opening an offshore bank account. This will help you navigate the legal and tax complexities and optimize your overall financial strategy.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.