Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

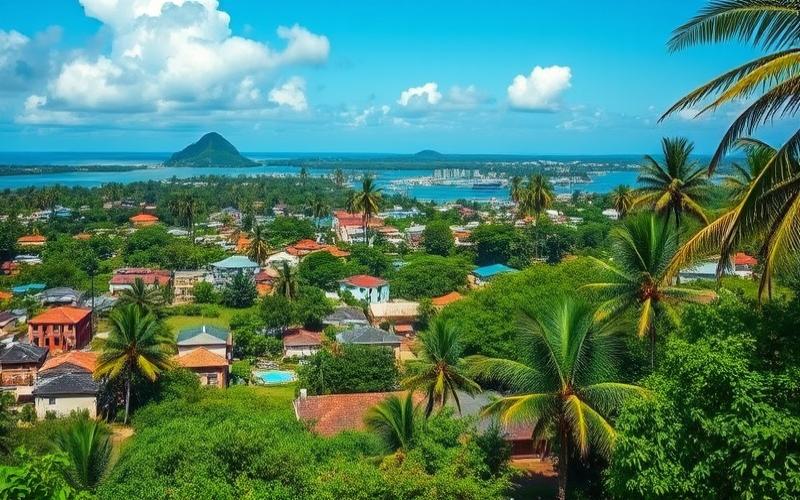

The Dominican Republic, Caribbean gem, is attracting an increasing number of international entrepreneurs eager to expand their operations in a dynamic economic environment favorable to business. This article will guide you through the essential steps of establishing a company in this tropical country, highlighting competitive advantages, available legal structures, and procedures to follow for a successful setup.

In recent years, the Dominican Republic has become an increasingly popular destination for entrepreneurs and foreign investors seeking to benefit [...]

The Dominican Republic, a Caribbean country sharing the island of Hispaniola with Haiti, has experienced significant economic growth in recent [...]

The Dominican Republic, with its dynamic economy and business-friendly environment, is attracting more and more foreign entrepreneurs. Opening a corporate [...]

The Dominican Republic, with its dynamic economy and diverse workforce, offers numerous opportunities for businesses seeking to recruit qualified personnel. [...]

The Dominican Republic, with its white sand beaches, tropical climate, and rapidly growing economy, is attracting more and more foreign [...]

The Dominican Republic, a Caribbean gem, offers fertile ground for visionary entrepreneurs. With a rapidly growing economy and a business-friendly [...]

The Dominican Republic, with its dynamic economy and strategic position in the Caribbean, is attracting more and more foreign investors [...]

The Dominican Republic offers a favorable environment for foreign entrepreneurs looking to establish their business there. However, choosing the right [...]

The Dominican Republic offers a favorable environment for foreign investors looking to establish a business. With a growing economy and [...]

The Dominican Republic has become a preferred destination for many entrepreneurs looking to expand their business in the Caribbean. With [...]

The Dominican Republic, a Caribbean gem, offers a dynamic and rapidly expanding consumer market. Understanding the nuances of this market [...]

The Dominican Republic, with its dynamic economy and growing appeal to foreign investors, offers numerous opportunities for entrepreneurs. However, to [...]

The Dominican Republic offers a dynamic and favorable environment for entrepreneurship, with a rapidly growing economy and an attractive market [...]

The Dominican Republic, a Caribbean gem, offers an increasingly favorable environment for bold and visionary entrepreneurs. With a rapidly expanding [...]

The Dominican Republic is attracting more and more foreign entrepreneurs thanks to its dynamic economy and business-friendly environment. However, before [...]

The Dominican Republic, known for its white sand beaches and turquoise waters, is proving to be much more than just [...]

The Dominican Republic is experiencing rapid growth in its e-commerce sector, driven by a young and connected population as well [...]

The Dominican Republic, with its white sand beaches, tropical climate, and rapidly growing economy, is attracting more and more foreign [...]

The Dominican Republic’s Assets for Entrepreneurs

The Dominican Republic offers numerous advantages to foreign entrepreneurs looking to establish their companies there. Its strategic location in the heart of the Caribbean makes it an ideal gateway to Latin American and United States markets. The country benefits from a growing economy, with GDP that has increased by an average of 5.3% annually over the past decade.

The Dominican government has implemented policies favorable to foreign investment, including attractive tax incentives and simplified procedures for business creation. Additionally, the country has modern infrastructure, including well-developed free zones that facilitate import-export activities.

The Dominican workforce is known for being skilled and competitive in terms of costs, representing a major asset for companies seeking to optimize their operations. Finally, the high quality of life and relatively low cost of living make the Dominican Republic an attractive destination for expatriate entrepreneurs.

Good to know:

The Dominican Republic ranks 115th out of 190 countries in the World Bank’s Doing Business 2020 report, demonstrating the country’s ongoing efforts to improve its business environment.

Most Common Legal Structures in the Dominican Republic

When it comes to creating a company in the Dominican Republic, several legal forms are available to entrepreneurs. Here are the main options:

1. Sociedad Anónima (S.A.)

The Sociedad Anónima is equivalent to a corporation. This structure is suitable for large companies and projects requiring significant investments. It requires a minimum of two shareholders and minimum share capital of 30,000 Dominican pesos (approximately $500).

2. Sociedad de Responsabilidad Limitada (S.R.L.)

The S.R.L. is similar to a limited liability company. This is the most popular legal form among small and medium-sized businesses. It requires at least two partners and minimum share capital of 100,000 Dominican pesos (approximately $1,700).

3. Empresa Individual de Responsabilidad Limitada (E.I.R.L.)

The E.I.R.L. is equivalent to a sole proprietorship with limited liability. It perfectly suits individual entrepreneurs wanting to separate their personal assets from their business assets. There is no minimum capital requirement for this legal form.

4. Sucursal (Branch Office)

Foreign companies can also choose to establish a branch in the Dominican Republic. This option allows maintaining close ties with the parent company while benefiting from a local presence.

The choice of legal structure will depend on several factors, including company size, business objectives, and needs in terms of flexibility and liability.

Good to know:

The S.R.L. is generally recommended for foreign investors due to its flexibility and management simplicity.

Corporate Taxation in the Dominican Republic: A Competitive Regime

The Dominican tax system offers a relatively advantageous framework for businesses, with competitive tax rates compared to many developed countries. Here are the main elements to know:

Corporate Income Tax

The standard corporate income tax rate in the Dominican Republic is 27%. However, there are numerous tax incentives that can significantly reduce this burden, particularly for companies operating in free zones or in priority sectors like tourism or renewable energy.

Value Added Tax (ITBIS)

The equivalent of VAT in the Dominican Republic is ITBIS (Impuesto sobre Transferencias de Bienes Industrializados y Servicios). The standard rate is 18%, with reduced rates for certain basic products.

Withholding Tax

Dividends paid to non-resident shareholders are subject to a 10% withholding tax. Interest paid to foreign entities is generally subject to a 10% withholding, while royalties are taxed at 27%.

Tax Treaties

The Dominican Republic has signed tax treaties with several countries, including Spain and Canada, which can offer additional benefits to investors from these countries.

It’s important to note that the Dominican government offers attractive tax incentives for certain sectors and geographic areas. For example, companies operating in free zones can benefit from full corporate tax exemption for periods up to 15 years.

Good to know:

Companies established in free zones benefit from 100% exemption from corporate tax, customs duties, and VAT on imports.

Key Steps to Create Your Company in the Dominican Republic

Creating a company in the Dominican Republic involves several important steps. Here’s a detailed guide to help you navigate this process:

1. Choose a Unique Business Name

Start by checking the availability of your business name with the National Office of Industrial Property (ONAPI). It’s crucial to ensure the chosen name isn’t already used or too similar to an existing business.

2. Prepare Incorporation Documents

Draft your company’s bylaws and prepare all necessary documents, including founders’ identification documents and powers of attorney if needed. These documents will need to be translated into Spanish and notarized.

3. Obtain a Tax Identification Number

Register your company with the General Directorate of Internal Taxes (DGII) to obtain a tax identification number (RNC – Registro Nacional de Contribuyentes).

4. Registration with the Chamber of Commerce

Register your company with the local Chamber of Commerce and Production. This registration is mandatory and will allow you to obtain your commercial registration certificate.

5. Obtain Necessary Licenses

Depending on your business sector, you may need to obtain specific licenses or authorizations from the relevant authorities.

6. Social Security Registration

Register your company with the Social Security Treasury (TSS) to comply with social obligations.

7. Open a Corporate Bank Account

Choose a local bank and open a corporate bank account. This account will be necessary to deposit the share capital and manage your company’s transactions.

The complete process can take between 2 and 4 weeks, depending on the complexity of your structure and how quickly you provide the necessary documents.

Good to know:

The Dominican government has established a one-stop shop for business creation, significantly simplifying the process for foreign investors.

The Dominican Republic Compared to Other Offshore Jurisdictions: Comparative Analysis

Although the Dominican Republic isn’t traditionally considered an offshore jurisdiction, it nevertheless offers competitive advantages that make it attractive to international investors. Here’s a comparison with other popular destinations:

Advantages Compared to Cayman Islands and Bahamas

Unlike these classic offshore jurisdictions, the Dominican Republic offers a more diversified economy and a larger domestic market. Additionally, it benefits from a better international reputation, which can facilitate banking and commercial relationships.

Comparison with Panama

Panama is often considered a direct competitor of the Dominican Republic in the region. Although Panama offers similar tax advantages, the Dominican Republic stands out with its lower operational costs and cheaper skilled labor.

Positioning Relative to Puerto Rico

Puerto Rico, as a US territory, offers certain advantages for companies seeking access to the American market. However, the Dominican Republic offers lower operating costs and greater regulatory flexibility.

Advantages Compared to Barbados

Barbados is recognized for its advantageous tax regime for international companies. Nevertheless, the Dominican Republic offers a larger domestic market and greater growth opportunities in various sectors.

In summary, the Dominican Republic positions itself as an interesting alternative to traditional offshore jurisdictions, offering a balance between tax advantages, market opportunities, and international reputation.

Good to know:

The Dominican Republic has signed free trade agreements with the European Union and the United States, thus offering privileged access to these important markets.

Understanding Social Obligations in the Dominican Republic

Employers in the Dominican Republic must comply with various social obligations to ensure their employees’ well-being and respect local legislation. Here are the main aspects to know:

Social Security

Employers must contribute 7.09% of each employee’s salary for social security. This contribution covers health insurance, pensions, and workplace accident insurance. Employees also contribute 3.04% of their salary.

Paid Leave

Employees are entitled to 14 days of paid leave per year after working for the company for one year. This number increases with seniority, reaching up to 18 days after 5 years of service.

Christmas Bonus

Employers are required to pay a 13th month salary, called “Christmas bonus,” to all employees in December each year.

Profit Sharing

Companies must distribute 10% of their annual profits to their employees, with some exceptions for small businesses and specific sectors.

Severance Pay

In case of dismissal without serious misconduct, employees are entitled to severance pay based on their tenure with the company.

Occupational Health and Safety

Employers must implement measures to ensure employee health and safety in the workplace, in accordance with local regulations.

It’s crucial to understand and respect these social obligations to avoid any disputes with authorities or employees.

Good to know:

The Dominican Labor Code is generally considered employee-friendly, so it’s recommended to consult a local attorney specialized in labor law to ensure compliance.

Opening a Corporate Bank Account in the Dominican Republic: Step-by-Step Guide

Opening a corporate bank account is a crucial step in the process of creating your company in the Dominican Republic. Here are the steps to follow:

1. Choose the Appropriate Bank

Start by researching the main banks operating in the Dominican Republic. The most important banks include Banco Popular Dominicano, Banco BHD León, and Scotiabank. Compare their offerings, fees, and services to choose the one that best fits your needs.

2. Prepare Necessary Documents

- Your company’s bylaws

- The commercial registration certificate

- The tax identification number (RNC)

- Identification documents of directors and authorized signatories

- Proof of business address

- Bank references (if available)

3. Schedule an Appointment with the Bank

Contact the chosen bank to schedule an appointment with a business advisor. It’s recommended to do this in person, as it will facilitate the process and allow you to answer all your questions.

4. Present Your File

During the appointment, present all required documents and explain the nature of your business. Be prepared to provide detailed information about your planned activities, financial projections, and source of funds.

5. Make the Initial Deposit

Once your file is approved, you’ll need to make an initial deposit. The minimum amount varies by bank, but generally plan between $500 and $1,000 US dollars.

6. Obtain Banking Tools

After opening the account, you’ll receive the necessary information to manage your account, including online banking access, bank cards, and checkbooks if needed.

It’s important to note that the account opening process can take several weeks, particularly for foreign companies. Dominican banks’ due diligence has strengthened in recent years to combat money laundering, so it’s crucial to be transparent and provide all requested information.

Good to know:

Some Dominican banks offer private banking and wealth management services, which can be interesting for entrepreneurs seeking to optimize their overall financial strategy.

Most Promising Business Sectors in the Dominican Republic

The Dominican Republic offers numerous investment opportunities in various sectors. Here’s an overview of the most promising areas for entrepreneurs:

1. Tourism and Hospitality

Tourism remains the pillar of the Dominican economy, with over 6 million visitors annually before the pandemic. Opportunities abound in luxury hotels, ecotourism, and related services like restaurants and entertainment.

2. Renewable Energy

The Dominican government strongly encourages investments in clean energy. Solar, wind, and biomass projects benefit from attractive tax incentives.

3. Information Technology and Business Process Outsourcing

With a young and skilled workforce, the Dominican Republic positions itself as a regional hub for IT services and business process outsourcing.

4. Agriculture and Food Processing

The country has strong agricultural potential, particularly in cocoa, coffee, and tropical fruit production. Opportunities are numerous in processing and exporting value-added products.

5. Real Estate and Construction

The real estate sector is experiencing sustained growth, particularly in tourist areas and major cities. Infrastructure development projects also offer interesting opportunities.

6. Manufacturing Industry

Dominican free zones attract many investors in sectors such as textiles, electronics, and medical devices.

7. Financial Services

The banking sector and financial services are experiencing rapid growth, with opportunities in fintech and digital financial services.

These sectors often benefit from government incentives and a favorable regulatory environment, making them particularly attractive to foreign investors.

Good to know:

The Dominican government has established specific programs to attract investments in these priority sectors, offering tax benefits and simplified procedures.

Recruiting and Managing Your Team in the Dominican Republic

Recruiting and effectively managing staff are essential to your company’s success in the Dominican Republic. Here are some tips to help you in this process:

1. Understand the Local Labor Market

The Dominican Republic has a young and increasingly skilled workforce. The unemployment rate is relatively low, around 5.5% in 2021, which can make finding qualified talent competitive in certain sectors.

2. Use the Right Recruitment Channels

Online job sites like Empleo.com.do and CompuTrabajo are popular. Social networks, particularly LinkedIn, are also widely used for recruitment. Don’t hesitate to use local recruitment agencies for key positions.

3. Respect Labor Legislation

Familiarize yourself with the Dominican Labor Code. Employment contracts must be written and registered with the Ministry of Labor. The standard work week is 44 hours, spread over 5 or 6 days.

4. Offer Competitive Benefits

Beyond salary, Dominican employees value social benefits. Consider offering supplemental health insurance, performance bonuses, and training opportunities to attract and retain the best talent.

5. Invest in Training

Continuous training is essential to maintain your company’s competitiveness. Consider implementing skill development programs for your employees.

6. Manage Cultural Differences

If you’re a foreign entrepreneur, be aware of cultural differences in the Dominican workplace. Personal relationships are often valued as much as professional skills.

7. Consider Outsourcing

For certain functions, outsourcing can be an interesting option. Many Dominican companies offer quality outsourcing services in areas such as accounting, customer support, and IT.

By following these tips and adapting to the specifics of the Dominican labor market, you’ll be able to build a high-performing and motivated team to support your company’s growth.

Good to know:

The Dominican government has established vocational training programs to improve the skills of the local workforce, particularly in tourism and technology sectors.

Conclusion: Your Entrepreneurial Future in the Dominican Republic

Creating a company in the Dominican Republic offers numerous opportunities for visionary entrepreneurs. With its growing economy, attractive tax incentives, and strategic position in the Caribbean, the country positions itself as a prime destination for international investors.

By following the detailed steps in this article, you’ll be well prepared to launch your business in this dynamic market. From selecting the appropriate legal structure to opening your bank account, and recruiting your team, each step is crucial to establishing a solid foundation for your success.

Remember that the key to success lies in meticulous preparation and thorough understanding of the local context. It’s strongly recommended to surround yourself with experienced local professionals, such as lawyers and accountants, to effectively navigate the Dominican business environment.

The Dominican Republic awaits you with its white sand beaches, tropical climate, and flourishing business opportunities. Are you ready to transform your entrepreneurial vision into reality in this Caribbean paradise?

Good to know:

The Dominican Republic recently launched a special visa for entrepreneurs and digital nomads, thus facilitating the settlement of foreign entrepreneurs wishing to develop their activities in the country.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.