Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

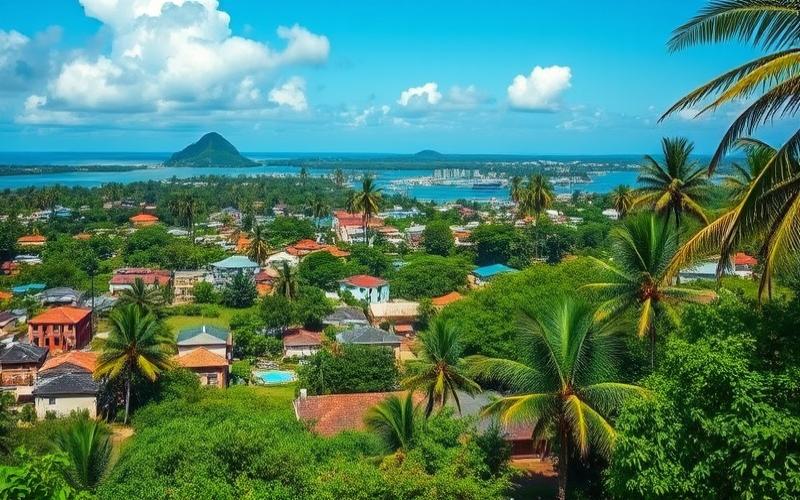

The Dominican Republic offers a dynamic and favorable environment for entrepreneurship, with a rapidly growing economy and an attractive market for investors. However, raising funds to develop your business in this Caribbean country requires a strategic approach and a solid understanding of the local ecosystem. Here is a comprehensive guide to help you succeed in your fundraising efforts in the Dominican Republic.

Hidden Treasures of Dominican Financing: Explore All Your Options

The first crucial step is to identify the best funding sources suited to your project and development stage. The Dominican Republic offers several interesting options:

1. Local Commercial Banks: Institutions like Banco Popular Dominicano, Banco BHD León, or Scotiabank offer business loans at competitive rates. They are particularly suitable for established businesses with a solid financial history.

2. Venture Capital Funds: The country has several funds specializing in financing innovative startups, such as Caoba Capital or Ingenio Capital. These funds can provide not only capital but also valuable expertise to accelerate your growth.

3. Business Angels: The Dominican Republic has a growing network of individual investors, often successful entrepreneurs, willing to support promising young companies. The Angels.do network is an excellent gateway to meet them.

4. Government Programs: The Dominican government has implemented several initiatives to support entrepreneurship, such as the Fondo CONFIE managed by the Ministry of Industry and Commerce. These programs offer funding on favorable terms for local SMEs.

5. Crowdfunding: Platforms like Jompéame allow raising funds from the general public, an interesting option for projects with strong social or environmental impact.

Good to Know:

Diversify your funding sources to optimize your chances of success and reduce your dependence on a single investor.

Prepare a Rock-Solid Application: The Key to Winning Over Dominican Investors

Once you’ve identified your funding targets, it’s essential to prepare a solid application that will convince potential investors. Here are the key elements to include:

1. A Detailed Business Plan: Clearly present your business model, growth strategy, and financial projections for 3 to 5 years. Make sure to include a thorough analysis of the Dominican market and your competitive positioning.

2. A Strong Team: Highlight the skills and experience of your management team. Dominican investors place great importance on human capital.

3. Proof of Traction: If possible, present concrete figures demonstrating market interest in your product or service (first customers, sales growth, etc.).

4. A Clear Value Proposition: Explain how your business addresses a specific need in the Dominican market and how it differentiates itself from the competition.

5. A Fund Utilization Plan: Detail precisely how you plan to use the raised money and what impact it will have on your growth.

Good to Know:

Have your application translated into Spanish to facilitate understanding by local investors and show your commitment to the Dominican market.

The Art of the Dominican Pitch: Captivate Your Audience

Presenting your project to investors is a crucial moment. Here are some tips for a successful pitch in the Dominican Republic:

1. Adapt to the Local Culture: Dominicans appreciate human warmth and personal relationships. Start by establishing rapport before diving into technical details.

2. Be Concise and Impactful: Prepare a 5 to 10 minute pitch that gets straight to the point. Focus on the key points that will make a difference.

3. Use Visual Aids: Prepare an attractive PowerPoint presentation with graphics and key figures to illustrate your points.

4. Show Your Passion: Enthusiasm is contagious. Let your passion for your project shine through, as this will inspire confidence in investors.

5. Prepare for Questions: Anticipate potential investor questions and prepare clear and concise answers.

Good to Know:

Don’t hesitate to seek help from a local mentor or specialized consultant to refine your pitch and adapt it to the expectations of Dominican investors.

Negotiate Like a Pro: Get the Best Terms for Your Business

Once you’ve sparked investor interest, the crucial stage of negotiation begins. Here are some tips to get the best terms:

1. Know Your Worth: Have a clear idea of your company’s value and what you’re willing to give up in terms of equity.

2. Be Flexible: Be prepared to compromise on certain points to get what’s truly important to you.

3. Think Long-Term: Don’t focus solely on the investment amount, but also on the added value the investor can bring (network, expertise, etc.).

4. Clarify Expectations: Ensure all agreement terms are clearly defined and understood by all parties.

5. Get Support: Don’t hesitate to enlist a lawyer specialized in Dominican business law to assist you in negotiations and contract drafting.

Good to Know:

Negotiation in the Dominican Republic can take time. Be patient and cultivate good relationships with your counterparts throughout the process.

Cultivate Your Relationships: Post-Investment Follow-Up is Crucial

Once funds are raised, it’s essential to maintain a strong relationship with your investors. Here’s how to achieve that:

1. Communicate Regularly: Keep your investors informed about your project’s progress and results achieved. A monthly or quarterly report is generally appreciated.

2. Be Transparent: Don’t hesitate to share encountered difficulties. Investors can often help you overcome them.

3. Seek Their Expertise: Draw on your investors’ experience and network to accelerate your development.

4. Honor Your Commitments: Keep the promises made during fundraising and promptly inform your investors of any change in direction.

5. Celebrate Successes Together: Share your achievements with your investors and thank them for their contribution.

Good to Know:

In the Dominican Republic, personal relationships are very important. Don’t hesitate to organize informal meetings with your investors to strengthen bonds.

Raising funds for your business in the Dominican Republic may seem complex, but with proper preparation and a strategic approach, you can maximize your chances of success. Remember that each fundraising is unique, and the important thing is to find partners who share your vision and can support you long-term.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.