Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

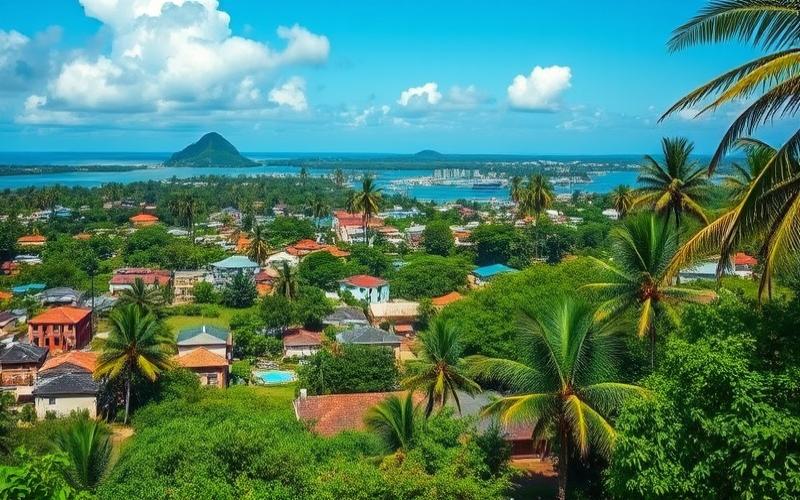

The Dominican Republic, with its dynamic economy and business-friendly environment, is attracting more and more foreign entrepreneurs. Opening a corporate bank account is a crucial step for any company looking to establish itself in this Caribbean country. This article will guide you through the different steps of the process, the required documents, and introduce you to the country’s main banks.

Keys to Opening a Corporate Bank Account in the Dominican Republic

Opening a corporate bank account in the Dominican Republic might seem complex at first, but with the right information and adequate preparation, the process can be relatively straightforward. Here are the essential points to know:

Tax Residency and Physical Presence: Unlike some countries, the Dominican Republic does not require a company to have tax residency in the country to open a bank account. However, physical presence is generally required when opening the account, meaning the company’s legal representative will need to be present in person.

Bank Selection: It’s crucial to choose the right banking institution based on your specific needs. Some banks are more open to foreign businesses than others. It’s recommended to contact several banks to compare their offers and requirements.

Prior Appointment: Most Dominican banks require a prior appointment to open a corporate account. This appointment allows you to discuss your needs and verify that you have all the necessary documents.

Initial Deposit: An initial deposit is generally required to activate the account. The amount varies by bank but is often between $500 and $2,000 US dollars.

The Winning File: Essential Documents for Opening Your Account

To open a corporate bank account in the Dominican Republic, you’ll need to provide several documents. Here’s a list of the main required documents:

- Company Certificate of Incorporation (apostilled and translated into Spanish if the company is foreign)

- Company Bylaws (apostilled and translated into Spanish)

- Company Tax Identification Number (RNC for Dominican companies or equivalent for foreign companies)

- Valid passport or ID document of the legal representative and authorized signatories

- Recent proof of company address (less than 3 months old)

- Meeting minutes authorizing account opening and designating signatories

- Letter of recommendation from a bank where the company already has an account

- Business plan or detailed description of company activities

- Recent company financial statements (if available)

Important: All documents in foreign languages must be translated into Spanish by a sworn translator in the Dominican Republic.

Good to Know:

It’s highly recommended to have your file reviewed by a local attorney specializing in business law before submitting it to the bank. This can save you valuable time and avoid unnecessary back-and-forth.

Step by Step: The Procedure for Creating Your Corporate Bank Account

Here are the main steps to follow to open your corporate bank account in the Dominican Republic:

1. Research and Bank Selection: Compare offers from different banks and choose the one that best fits your needs.

2. Scheduling an Appointment: Contact your chosen bank to schedule an appointment with a business advisor.

3. File Preparation: Gather all required documents and have them translated if necessary.

4. Bank Interview: During the appointment, present your business project and submit your complete file.

5. File Verification: The bank will conduct a thorough verification of your file, which may take several days.

6. Approval and Signing: Once the file is approved, you’ll be invited to sign the account opening documents.

7. Initial Deposit: Make the required initial deposit to activate your account.

8. Receiving Banking Documents: The bank will provide you with your account information, along with access methods (bank card, online banking credentials, etc.).

Dominican Banking Giants: Which Bank to Choose for Your Business?

The Dominican Republic has several reputable banks offering business services. Here’s an overview of the main banks and their advantages:

1. Banco Popular Dominicano

- Largest bank in the country with an extensive network of branches and ATMs

- Advanced online banking services

- Special offers for international businesses

2. Banco BHD León

- Strong presence in the corporate sector

- Personalized financial advisory services

- Secure and intuitive online banking platform

3. Scotiabank

- International bank with strong presence in the Caribbean

- Specialized services for Canadian and American businesses

- Ease of international transactions

4. Banreservas

- State-owned bank offering great stability

- Competitive rates for deposits and loans

- Special services for public sector businesses

5. Banco Santa Cruz

- Specialized in services for SMEs

- Simplified account opening process

- Personalized support for entrepreneurs

Good to Know:

Some banks offer dedicated “relationship manager” services for foreign businesses, greatly facilitating the daily management of your account and banking operations.

Opening a corporate bank account in the Dominican Republic is an important step in developing your business in this country. Although the process might seem complex, proper preparation and choosing the right bank can make things much easier. Don’t hesitate to seek help from local professionals, such as attorneys or accountants, to guide you through this process.

The Dominican Republic offers a modern and stable banking environment, conducive to business development. With a local bank account, your company will be better positioned to take advantage of the opportunities offered by this dynamic Caribbean market.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.