Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

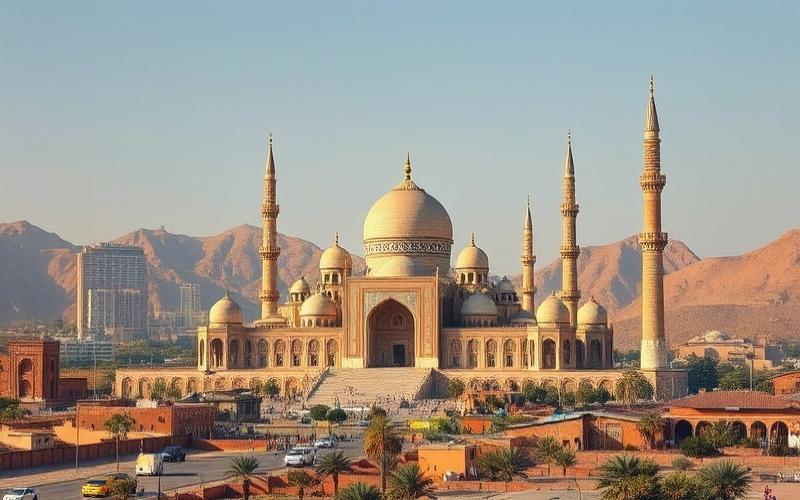

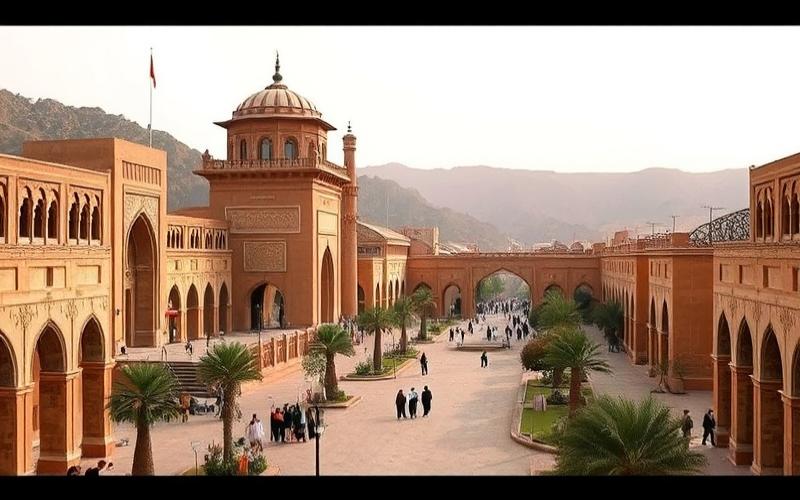

The Kingdom of Bahrain, a small island nation in the Persian Gulf, has established itself as a premier destination for entrepreneurs and investors worldwide. With a rapidly diversifying economy and a business-friendly environment, Bahrain offers numerous opportunities across various dynamic sectors. Let’s explore together the most promising sectors for business development and the available financing options to bring your projects to life.

Future Sectors Driving Bahrain’s Economy

In recent years, Bahrain has undertaken an ambitious economic diversification strategy aimed at reducing its dependence on hydrocarbons. This policy has led to the emergence of new promising sectors offering excellent prospects for entrepreneurs:

The Booming Financial Sector

Bahrain has established itself as a major financial hub in the Middle East, attracting numerous international financial institutions. The country is particularly focusing on developing Islamic finance and financial technology (fintech).

According to the latest figures from the Central Bank of Bahrain, the financial sector now accounts for nearly 17% of the kingdom’s GDP. Banking assets reached $214 billion in 2024, a 5.2% year-over-year increase. Meanwhile, the number of fintechs operating in the country has doubled over the past three years to reach over 100 companies.

Information and Communication Technology (ICT) Undergoing a Revolution

Bahrain has made ICT one of the pillars of its economic diversification strategy. The country is heavily investing in digital infrastructure and attracting many international technology companies.

According to the latest report from the Bahrain Economic Development Board, the ICT sector has experienced an average annual growth of 8.3% over the past five years. It now represents 4% of the kingdom’s GDP and employs over 15,000 people. The most dynamic areas include cloud computing, cybersecurity, artificial intelligence, and the Internet of Things.

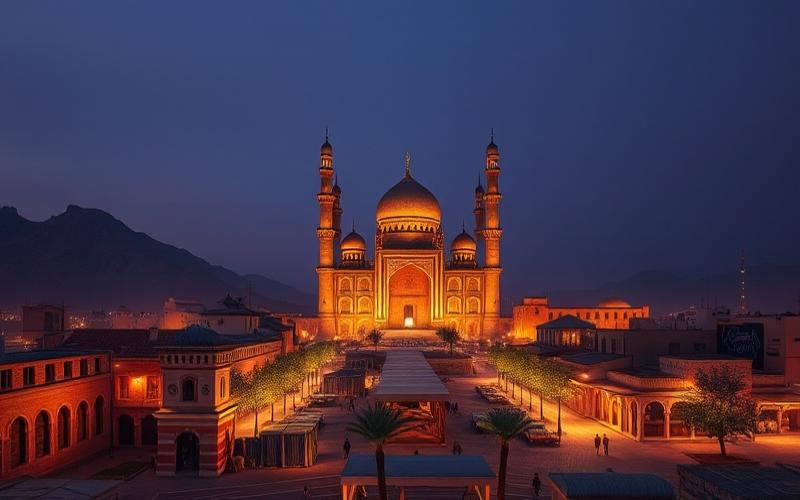

Tourism, an Expanding Sector

Bahrain is betting on tourism development to diversify its economy and create jobs. The country is investing in new hotel complexes, shopping centers, and tourist attractions.

According to figures from the Bahrain Tourism Authority, the number of visitors reached 12.2 million in 2024, a 6.8% increase compared to 2023. Tourism-generated revenues grew by 7.5% to reach $4.5 billion. The sector now represents 6.3% of the kingdom’s GDP and employs over 70,000 people.

Manufacturing Industry Undergoing Modernization

Bahrain aims to develop a high-value-added manufacturing industry, particularly in aluminum, petrochemicals, and renewable energy sectors.

According to data from the Ministry of Industry, Commerce, and Tourism, the manufacturing sector grew by 4.8% in 2024 and now represents 14.5% of the kingdom’s GDP. Investments in this sector reached $1.2 billion last year, a 12% year-over-year increase.

Renewable Energy, a Future Sector

Bahrain has set the ambitious goal of producing 10% of its electricity from renewable sources by 2035. The country is heavily investing in solar and wind power, creating numerous opportunities for businesses in the sector.

According to the latest report from the Bahrain Electricity and Water Authority, installed renewable energy capacity reached 250 MW by the end of 2024, compared to only 70 MW in 2020. Investments in this sector exceeded $500 million last year.

Good to Know:

Bahrain offers numerous advantages to foreign companies looking to establish themselves there, including favorable taxation, simplified administrative procedures, and the possibility of owning 100% of their company’s capital in most sectors.

Financing Your Business Project in Bahrain: Options Available to You

Developing a business in Bahrain often requires significant capital. Fortunately, the kingdom offers numerous financing options for entrepreneurs:

Local Banks, Preferred Partners for Businesses

Bahraini banks offer a wide range of financing products tailored to business needs, from conventional loans to credit lines and leasing. Some banks have even developed specific offerings for SMEs and startups.

The National Bank of Bahrain, for example, launched an SME-focused financing program in 2024 with a budget of $500 million. This program offers loans at favorable rates and flexible repayment periods.

Investment Funds, Key Players in Financing

Bahrain has numerous investment funds, both public and private, specializing in business financing. These funds can provide capital as well as valuable strategic support.

The sovereign wealth fund Mumtalakat, for example, manages over $18 billion in assets and regularly invests in promising local companies. In 2024, it invested over $500 million in about ten Bahraini companies.

Angel Investors, Supporters of Innovative Startups

The angel investor network is rapidly developing in Bahrain, offering an alternative funding source for innovative young companies. These private investors provide not only capital but also their expertise and network.

According to figures from the Bahrain Angel Investors Association, its members invested over $50 million in about thirty startups in 2024, compared to only $20 million in 2020.

Public Aid, a Welcome Boost

The Bahraini government has implemented several business financing assistance programs, particularly in sectors deemed strategic. This aid can take the form of grants, subsidized loans, or credit guarantees.

The Tamkeen Fund, for example, granted over $200 million in aid to Bahraini companies in 2024, benefiting more than 4,000 companies. This aid helped create or preserve over 15,000 jobs.

Crowdfunding, a Booming Option

Crowdfunding platforms are rapidly developing in Bahrain, offering a new funding source for entrepreneurs. These platforms allow raising funds from a large number of individual investors.

The Bahraini platform Beehive, the crowdfunding leader in the Gulf, raised over $100 million for regional SMEs in 2024, including $30 million for Bahraini companies.

Good to Know:

The Central Bank of Bahrain has established a regulatory framework favorable to the development of crowdfunding, offering increased protection to investors while facilitating business access to this funding source.

Thus, Bahrain offers a conducive environment for business development, with promising sectors in full growth and numerous financing options. Ambitious entrepreneurs will find in this small Gulf kingdom fertile ground to realize their projects and help them prosper.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.