Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

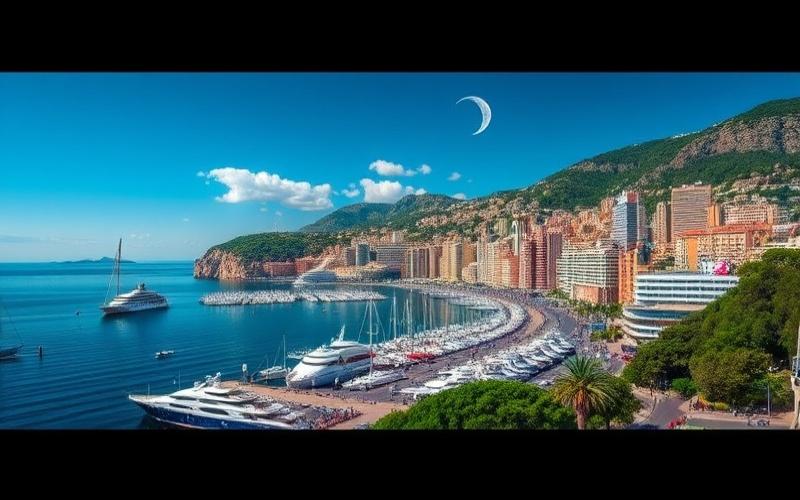

Monaco, this small sovereign state nestled on the French Riviera, is much more than just a luxury destination for celebrities and the wealthy. It’s also a true paradise for visionary entrepreneurs looking to develop their business in one of the most favorable tax and economic environments. In this article, we’ll explore in detail all aspects of company formation in Monaco, from tax benefits to administrative procedures, including the most promising business sectors.

Explore our articles on company formation in Monaco:

Monaco, this small sovereign state nestled on the French Riviera, continues to attract entrepreneurs from around the world thanks to [...]

Monaco, famous for its luxurious lifestyle and Formula 1 Grand Prix, is also renowned for its favorable tax system. The [...]

Monaco, this small principality nestled on the French Riviera, is renowned for its luxurious lifestyle and thriving economy. But what [...]

Monaco, this small sovereign state nestled on the French Riviera, is renowned for its favorable tax environment and sophisticated banking [...]

Monaco, this small principality nestled on the French Riviera, is a dynamic economic hub that attracts numerous businesses and talents [...]

The Principality of Monaco, famous for its glamour and exceptional living environment, is also fertile ground for visionary entrepreneurs. With [...]

Monaco, renowned for its favorable tax environment and dynamic economic landscape, attracts numerous entrepreneurs looking to establish their businesses there. [...]

Monaco, this small Mediterranean principality, attracts numerous entrepreneurs thanks to its favorable tax framework and dynamic economic environment. However, establishing [...]

Monaco, this small Mediterranean principality, is a premier economic and financial hub that attracts numerous companies from around the world. [...]

Monaco, this small principality nestled on the French Riviera, attracts numerous entrepreneurs drawn by its favorable tax environment and international [...]

Monaco, this small Mediterranean principality, attracts numerous entrepreneurs thanks to its favorable tax framework and dynamic business environment. However, before [...]

Monaco, this small principality nestled on the French Riviera, is much more than a tax haven for the ultra-wealthy. It [...]

The Principality of Monaco, this small sovereign state nestled on the French Riviera, is renowned for its luxurious lifestyle and [...]

Monaco: A Haven of Prosperity for Your Business

Establishing a company in Monaco offers numerous advantages that make it a prime destination for entrepreneurs worldwide. Here are the main reasons why more and more businesspeople are choosing to set up in the Principality:

Attractive tax regime: Monaco is renowned for its favorable taxation, particularly the absence of income tax for resident individuals. For businesses, the tax system is also very advantageous, with corporate tax limited to 25% and only applicable to companies generating more than 25% of their revenue outside Monaco.

Stable and secure economic environment: The Principality benefits from remarkable political and economic stability, providing a serene framework for business development. Security is also exemplary, making it an ideal place to live and work in complete tranquility.

Strategic geographical location: Located in the heart of Europe, immediately adjacent to France and Italy, Monaco enjoys a privileged geographical position. This location provides easy access to European markets while benefiting from an exceptional living environment on the French Riviera.

International business network: Monaco attracts numerous entrepreneurs and investors from around the world, creating a dynamic and cosmopolitan business ecosystem. This diversity offers many opportunities for networking and international partnerships.

Prestigious brand image: Establishing your company in Monaco also means benefiting from the prestigious aura associated with the Principality. This image can be a significant asset for developing your business and attracting high-end clientele.

Good to know:

Although Monaco is not part of the European Union, the Principality benefits from specific agreements with the EU that facilitate trade and the movement of people.

Legal Structures Driving the Success of Monegasque Companies

When it comes to establishing a company in Monaco, several legal forms are available. Each has its advantages and specific characteristics, suited to different types of projects and entrepreneurial ambitions. Here are the main structures to consider:

SàRL (Limited Liability Company): This is the most common legal form in Monaco. It offers great flexibility and is perfectly suited for small and medium-sized enterprises. The SàRL requires a minimum share capital of €15,000 and can be formed by a single partner (single-member SàRL) or multiple partners (up to 50).

SAM (Monegasque Public Limited Company): This structure is suitable for larger-scale projects. It requires a minimum share capital of €150,000 and must have at least two shareholders. The SAM projects an image of solidity and credibility, particularly valued in certain business sectors.

SNC (General Partnership): This legal form is less common but may suit certain specific projects. It doesn’t require minimum share capital but involves unlimited and joint liability of partners.

SCS (Limited Partnership): This structure allows for a combination of general partners (with unlimited and joint liability) and limited partners (liable only up to their contributions).

Civil Company: This legal form is mainly used for managing real estate or movable assets. It is not suitable for commercial activities.

The choice of legal structure will depend on many factors such as the nature of your activity, your development objectives, the number of partners envisaged, and your personal situation. It is highly recommended to consult with legal and tax experts to guide you in this crucial choice.

Good to know:

Establishing a company in Monaco generally requires the presence of at least one partner or shareholder of Monegasque nationality, or a Monegasque resident with close ties to the Principality. This requirement can be circumvented in certain cases, particularly for public limited companies, by appointing a local managing director.

Monegasque Taxation: A Major Asset for Your Business

One of Monaco’s main attractions for entrepreneurs is undoubtedly its advantageous tax regime. Although the Principality is not completely tax-free as some believe, its taxation remains particularly attractive compared to many other countries. Here are the main points to remember regarding corporate taxation in Monaco:

Corporate tax: Contrary to popular belief, Monaco does apply corporate tax. However, this only concerns companies generating more than 25% of their revenue outside the Principality. The standard rate is 25%, but significant exemptions are provided for new businesses: – Full exemption for the first two years – Reduced rate of 8.33% in the third year – Rate of 16.66% in the fourth year – Full rate of 25% from the fifth year

VAT: Monaco applies the same VAT rate as France (20% for the standard rate), under customs agreements between the two countries.

Payroll tax: There is no payroll tax in Monaco, which represents a considerable advantage for companies employing staff.

Social contributions: Social contribution rates in Monaco are generally lower than in France, helping to reduce labor costs.

No withholding tax: Monaco does not practice withholding tax on dividends, interest, and royalties paid to non-residents, which can be very advantageous for international structures.

Tax treaties: Although Monaco has signed few tax treaties, the Principality has concluded tax information exchange agreements with many countries, thereby strengthening its credibility on the international stage.

This advantageous taxation allows companies to retain a larger portion of their profits, thus promoting investment and development. However, it’s important to note that the Monegasque tax regime is constantly evolving to adapt to international standards regarding transparency and combating tax evasion.

Good to know:

Although income tax doesn’t exist in Monaco for individuals, French residents in Monaco remain subject to French income tax under a tax treaty between the two countries. However, this rule doesn’t apply to French citizens who have become naturalized Monegasques or who have resided in Monaco for more than 5 years as of October 13, 1962.

From Idea to Reality: Key Steps to Create Your Company in Monaco

Establishing a company in Monaco follows a well-defined process, which may seem complex at first but guarantees the solidity and legality of your structure. Here are the main steps to follow to realize your entrepreneurial project in the Principality:

1. Define your project: Before any procedure, it’s crucial to clearly define your activity, business plan, and objectives. This step will help you choose the most suitable legal form and prepare the necessary documents.

2. Choose a name for your company: Check the availability of your chosen name with Monaco’s Trade and Industry Directory.

3. Draft the articles of association: Your company’s articles of association must be written in French and include all information required by Monegasque law. It’s strongly recommended to use a specialized lawyer for this crucial step.

4. Obtain necessary authorizations: Depending on your activity, you’ll need to obtain various authorizations, including: – Ministerial authorization for company formation – Authorization to practice for certain regulated professions – Authorization from the Department of Economic Expansion

5. Open a bank account: You’ll need to open a bank account in the name of the company being formed to deposit the share capital.

6. Register the articles of association: The articles of association must be registered with Monaco’s Department of Tax Services.

7. Publish a formation notice: A formation notice must be published in the Journal de Monaco.

8. Register the company: Registration is done with Monaco’s Trade and Industry Directory.

9. Obtain the intra-community VAT number: If your activity requires it, you’ll need to apply for an intra-community VAT number.

10. Join social security funds: You’ll need to register with Monaco’s Social Security Funds for managing your employees’ social contributions.

This process can take several weeks, or even months, depending on the complexity of your project and the speed of obtaining various authorizations. It’s highly recommended to be accompanied by professionals (lawyers, accountants) familiar with the specificities of Monegasque law to ensure all these steps are properly completed.

Good to know:

Establishing a company in Monaco generally requires a significant initial investment, not only for the share capital but also to cover formation costs and fees for professionals who will assist you in your procedures. It’s important to properly budget these costs in your initial financing plan.

Monaco vs Other Offshore Jurisdictions: A Strategic Choice

When it comes to choosing a jurisdiction to establish your company, Monaco competes with other destinations renowned for their advantageous taxation. Here’s a brief comparison with some of these jurisdictions:

Monaco vs Luxembourg: – Monaco: No income tax, 25% corporate tax under conditions – Luxembourg: Progressive income tax, 17% corporate tax – Monaco advantage: Generally more advantageous taxation, exceptional living environment

Monaco vs Singapore: – Monaco: Political stability, proximity to European markets – Singapore: Asian financial hub, very dynamic economy – Monaco advantage: More suitable for companies targeting the European market

Monaco vs Dubai: – Monaco: Civil law legal regime, long-term stability – Dubai: Attractive free zones, no corporate tax – Monaco advantage: Better international reputation, more stable regulatory framework

Monaco vs Cayman Islands: – Monaco: Onshore jurisdiction with real economic substance – Cayman Islands: Offshore jurisdiction, complete absence of corporate tax – Monaco advantage: Better image and credibility for business partners

The choice between these different jurisdictions will depend on many factors such as the nature of your activity, your target markets, your financing needs, and your personal situation. Monaco stands out for its stability, security, exceptional living environment, and proximity to major European markets, while offering very attractive taxation.

Good to know:

Unlike some offshore jurisdictions, Monaco is not considered a tax haven by the OECD or the European Union. The Principality has made considerable efforts in recent years to improve its tax transparency and comply with international standards, which strengthens its credibility on the global economic stage.

Social Obligations in Monaco: A Protective Framework for Employers and Employees

The Monegasque social system, although distinct from that of France, offers quality social protection while maintaining relatively moderate charges for employers. Here are the main points to know regarding social obligations in Monaco:

Affiliation with social security funds: Every employer in Monaco must affiliate with Monaco’s Social Security Funds (CSM) for managing their employees’ social contributions. This affiliation covers sickness, maternity, disability, death, work accidents, and unemployment risks.

Contribution rates: Social contribution rates in Monaco are generally lower than in France. On average, the employer’s share represents about 28% of gross salary, while the employee’s share is about 14%. These rates may vary slightly depending on the business sector.

Contribution ceiling: There is a monthly contribution ceiling, set at €8,600 in 2025. Beyond this ceiling, contributions are calculated at a reduced rate.

Complementary pension: Monegasque employers must also affiliate their employees with a complementary pension scheme. The choice of scheme is free but must be approved by Monegasque authorities.

Occupational medicine: Employers are required to affiliate their employees with Monaco’s Occupational Medicine Office, which ensures medical monitoring of employees.

Paid leave: Employees in Monaco are entitled to 2.5 working days of paid leave per month of actual work, i.e., 30 working days per year for a full year of work.

Working hours: The legal working week in Monaco is 39 hours, compared to 35 hours in France. This difference can represent a competitive advantage for Monegasque companies.

Protection against dismissal: Monegasque labor law offers protection against unfair dismissal, but procedures are generally more flexible than in France.

These social obligations, although representing a cost for the employer, contribute to creating a stable and attractive work environment, thus promoting talent retention and team productivity.

Good to know:

French cross-border workers employed in Monaco benefit from a special regime that allows them to maintain certain advantages of the French social system while working in the Principality. This flexibility can be an asset for attracting talent from the neighboring region.

Opening a Bank Account for Your Business in Monaco: Keys to Success

Opening a bank account is a crucial step in creating your company in Monaco. Although the Principality is renowned for its quality banking services, the process can be more complex than one might think. Here are the steps to follow and important points to consider:

1. Choose the right bank: Monaco has several renowned banks, each with its specificities. Take the time to compare offers and services to find the one that best suits your needs.

2. Prepare a solid file: Monegasque banks are very vigilant about compliance. You’ll need to provide numerous documents, including: – Your company’s articles of association – Extract from the Trade and Industry Register – Identity documents of directors and beneficial owners – A detailed business plan – Proof of fund origins – Banking references

3. Schedule an in-person appointment: Most Monegasque banks require an in-person meeting with the company’s directors to open an account. Be prepared to explain your project and business model in detail.

4. Be patient: The account opening process can take several weeks, or even months. Banks conduct thorough checks to ensure compliance with anti-money laundering regulations.

5. Plan for a substantial initial deposit: Monegasque banks generally require a significant initial deposit to open a professional account. The amount may vary depending on the bank and your company’s profile.

6. Anticipate banking fees: Banking services in Monaco can be more expensive than elsewhere. Make sure you fully understand the fee structure before committing.

7. Consider alternative solutions: If opening a traditional bank account proves difficult, you can explore other options like neobanks or payment institutions, which may offer more flexible solutions for certain types of activities.

Opening a bank account in Monaco may seem like a tedious process, but it’s an essential step that contributes to the credibility and solidity of your business in the Principality.

Good to know:

Some Monegasque banks offer private banking services coupled with professional accounts, which can be interesting for entrepreneurs who also wish to manage their personal wealth in Monaco.

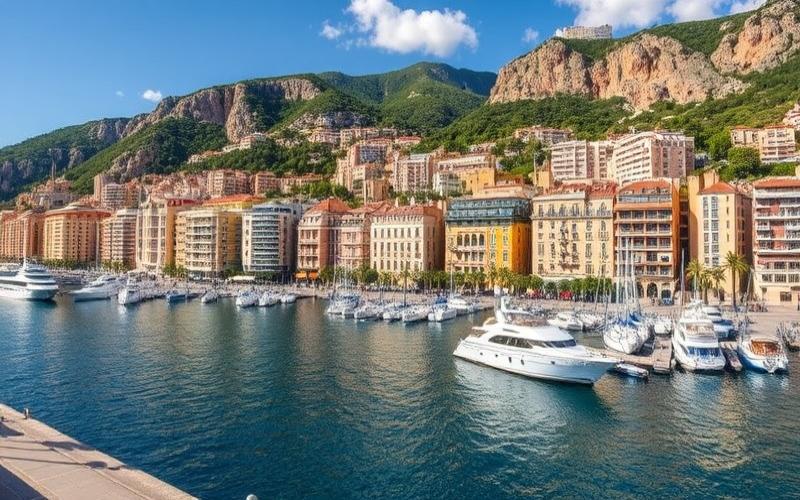

Business Sectors Driving the Monegasque Economy

Monaco, although small in size, hosts a dynamic and diversified economy. Certain business sectors are particularly flourishing and offer excellent opportunities for entrepreneurs. Here’s an overview of the most promising areas:

Financial services and wealth management: Monaco is renowned for its expertise in private banking and wealth management. This sector continues to attract wealthy international clientele and offers numerous opportunities for management companies, family offices, and financial advisors.

Luxury real estate: The Monegasque real estate market is one of the most expensive in the world. Real estate agencies, developers, and rental management companies specializing in high-end properties find fertile ground here.

Luxury tourism and hospitality: Monaco attracts millions of visitors each year. Luxury hotels, gourmet restaurants, and companies providing services related to high-end tourism have excellent development prospects.

Yachting and nautical industry: With its renowned marina, Monaco is an important hub for the yachting industry. Companies specializing in yacht sales, charters, and maintenance thrive here.

Technology and innovation: Monaco is heavily investing in digital transition and green technologies. Innovative startups, particularly in fintech, greentech, and smart city domains, are especially encouraged.

Events and entertainment: The Principality hosts numerous prestigious events throughout the year (Formula 1 Grand Prix, tennis tournaments, galas…). Companies specializing in organizing high-end events find a promising market here.

Health and wellness: Monaco is focusing on developing cutting-edge health and wellness offerings. Private clinics, thalassotherapy centers, and companies specializing in medical technologies have excellent prospects.

Luxury retail: Luxury boutiques and prestigious brands are numerous in Monaco, attracting wealthy clientele from around the world.

Business services: With the presence of numerous international companies, businesses offering legal, accounting, consulting, or recruitment services find a dynamic market in Monaco.

Clean industries: Although space is limited, Monaco encourages the establishment of non-polluting, high-value-added industries, particularly in cosmetics, pharmaceuticals, or cutting-edge technologies.

These sectors benefit not only from a dynamic local market but also from Monaco’s international reputation, which attracts wealthy clientele from around the world.

Good to know:

The Monegasque government has launched several initiatives to encourage innovation and entrepreneurship, particularly through the MonacoTech program, a startup incubator and accelerator that provides valuable support to young innovative companies.

Recruiting in Monaco: How to Attract and Retain the Best Talent

Recruiting in Monaco has specific characteristics that are important to know to attract and retain the best talent. Here are some key points to consider:

Priority to local employment: Monegasque legislation gives priority to hiring Monegasques, then residents of Monaco, and finally residents of neighboring municipalities. This hierarchy must be respected in your recruitment processes.

Work permits: For non-resident employees, obtaining a work permit is necessary. This process can take several weeks and requires justification of the need for specific skills not available locally.

Attractive salaries: Salaries in Monaco are generally higher than in France, partly due to the high cost of living in the Principality. Plan competitive remuneration to attract the best profiles.

Social benefits: Besides salary, employees in Monaco benefit from interesting social benefits, particularly in terms of health coverage and pensions. You can stand out by offering additional benefits like high-end health insurance or company savings plans.

Continuing education: Monaco encourages professional training. Offering skills development opportunities can be an asset for attracting and retaining talent.

Work flexibility: Although teleworking is less common in Monaco than elsewhere, offering some flexibility in work organization can be a strong argument for certain candidates.

International recruitment: Don’t hesitate to expand your search beyond Monegasque borders. The Principality attracts talent from around the world, drawn by its exceptional living environment and professional opportunities.

Partnerships with schools: Develop relationships with higher education institutions in the region to facilitate the recruitment of recent graduates.

Using specialized agencies: Using recruitment agencies that know the Monegasque market well can help you find profiles suited to your needs.

Employer branding: Work on your employer brand to attract the best talent. Highlight the advantages of working for your company in Monaco.

Recruiting in Monaco may seem complex at first, but with a good strategy and understanding of local specificities, you can build a talented team to make your business prosper in the Principality.

Good to know:

Monaco regularly organizes job fairs and networking events that can be excellent opportunities to meet potential candidates and make your company known on the local job market.

Establishing a company in Monaco represents an exceptional opportunity for ambitious entrepreneurs. The Principality offers an advantageous tax environment, an exceptional living environment, and a dynamic international business ecosystem. Although the company formation process and legal obligations may seem complex, the long-term benefits are considerable.

The key to success lies in meticulous preparation, a thorough understanding of local specificities, and support from experienced professionals. Whether you’re in finance, real estate, luxury tourism, or innovative technologies, Monaco offers fertile ground for your business to prosper.

Remember that success in Monaco isn’t limited to the tax aspect. The Principality values innovation, quality, and excellence in all domains. By adopting these values and contributing positively to the local economy, your business can fully flourish in this privileged setting.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.