Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

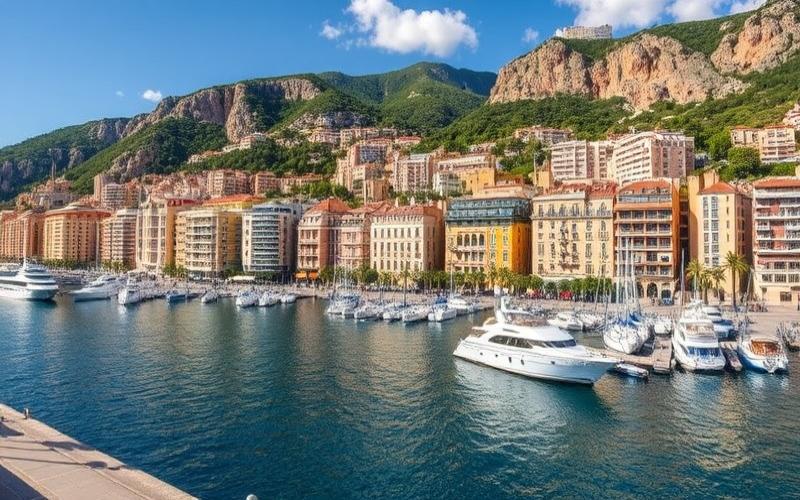

Monaco, this small Mediterranean principality, attracts numerous entrepreneurs thanks to its favorable tax framework and dynamic economic environment. However, establishing a company in Monaco requires following a rigorous administrative process. Here is a detailed guide to the steps to follow and documents to provide to bring your entrepreneurial project to life on the Rock.

Key Steps to Launch Your Monegasque Business

Establishing a company in Monaco involves several essential administrative procedures:

1. Choose the Appropriate Legal Structure

First and foremost, it’s crucial to determine the most suitable legal structure for your project. Monaco offers various options, including:

– Monegasque Public Limited Company (SAM) – Limited Liability Company (SARL) – Limited Partnership (SCS) – General Partnership (SNC)

Each legal structure has its own advantages and constraints. It’s recommended to consult an accountant or specialized lawyer to make the most informed choice.

2. Obtain Government Authorization

Unlike many countries, Monaco requires prior government authorization to establish a business. This application must be submitted to the Department of Economic Expansion. The file must include:

– A detailed description of the planned activity – A 3-year business plan – CVs of directors and partners – Proof of domiciliation in Monaco

Processing time typically ranges between 2 and 4 months.

3. Draft the Company Bylaws

Once authorization is obtained, you must draft the company bylaws. This fundamental document defines the company’s operating rules. It’s strongly advised to engage a Monegasque notary to ensure the bylaws comply with local legislation.

4. Open a Bank Account

Opening a bank account in Monaco is an essential step. Monegasque banks are known for their rigorous file verification. Be prepared to provide numerous documents regarding fund origins and the nature of your activity.

5. Complete the Registration

Final registration is done with Monaco’s Trade and Industry Registry (RCI). This procedure formalizes your company’s creation and grants it legal existence.

Good to Know:

The process of establishing a company in Monaco may seem complex, but it guarantees the strength and credibility of businesses established in the Principality. Professional assistance can greatly facilitate these procedures.

Essential Documents: Prepare Your Solid File

The list of required documents varies depending on the chosen legal structure. Here’s an overview of generally required items:

For a Monegasque Public Limited Company (SAM)

– Company bylaws signed by all shareholders – Minutes of the constitutive general meeting – List of directors with their identification documents – Proof of registered office domiciliation in Monaco – Bank certificate of share capital deposit (minimum €150,000) – Criminal record extract for directors

For a Limited Liability Company (SARL)

– Company bylaws signed by all partners – Identification documents for managers and partners – Proof of registered office domiciliation – Bank certificate of share capital deposit (minimum €15,000) – Declaration of non-conviction for managers

For a Limited Partnership (SCS)

– Company bylaws signed by all partners – Identification documents for general and limited partners – Proof of registered office domiciliation – Bank certificate of share capital deposit (no legal minimum)

For a General Partnership (SNC)

– Company bylaws signed by all partners – Identification documents for all partners – Proof of registered office domiciliation – Bank certificate of share capital deposit (no legal minimum)

Good to Know:

All documents must be provided in French or accompanied by an official translation. Particular attention must be paid to the quality and completeness of the file to avoid any delays in the registration process.

Monegasque Specifics Not to Overlook

Establishing a company in Monaco presents certain particularities that are important to consider:

Domiciliation Requirement

Every Monegasque company must have a physical registered office in the Principality. Simple commercial domiciliation is not sufficient. Therefore, you must plan for office rental or purchase of professional premises.

Mandatory Local Presence

For SARLs and partnerships, at least one manager or partner must reside in Monaco or neighboring French communes. This requirement aims to guarantee effective local management.

Relaxed Exchange Controls

Although Monaco is not part of the European Union, the Principality benefits from agreements with France that facilitate capital movements. There are no strict exchange controls, but banks remain vigilant about fund origins.

Advantageous but Regulated Taxation

The absence of income tax for individuals is a major advantage of Monaco. However, companies generating more than 25% of their turnover outside Monaco are subject to corporate tax. Rigorous tax planning is therefore essential.

Good to Know:

Establishing a company in Monaco requires regular physical presence in the Principality. Authorities are attentive to companies having real local economic substance.

The Importance of Expert Support

Given the complexity of procedures and specificities of Monegasque law, it’s highly recommended to surround yourself with experienced professionals:

– A lawyer specialized in Monegasque business law – An accountant familiar with local regulations – A notary for drafting and authenticating documents – An authorized agent to facilitate administrative procedures

These experts will guide you through the creation process, help optimize your structure, and avoid potential pitfalls.

Anticipate Costs

Establishing a company in Monaco represents a significant investment. Beyond administrative fees and professional fees, you should plan for:

– Minimum share capital (varies by legal structure) – Office rental or purchase costs – Setup-related expenses (furniture, equipment, etc.) – Banking fees, often higher than elsewhere

Rigorous financial planning is essential to successfully carry out your project.

Good to Know:

Although initial costs may seem high, Monaco’s tax and economic environment offers interesting long-term prospects for well-structured businesses.

Establishing a company in Monaco is an ambitious project that requires meticulous preparation and a good understanding of the local environment. By scrupulously following administrative procedures and surrounding yourself with the right experts, you’ll maximize your chances of success in this premier financial hub.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.