Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

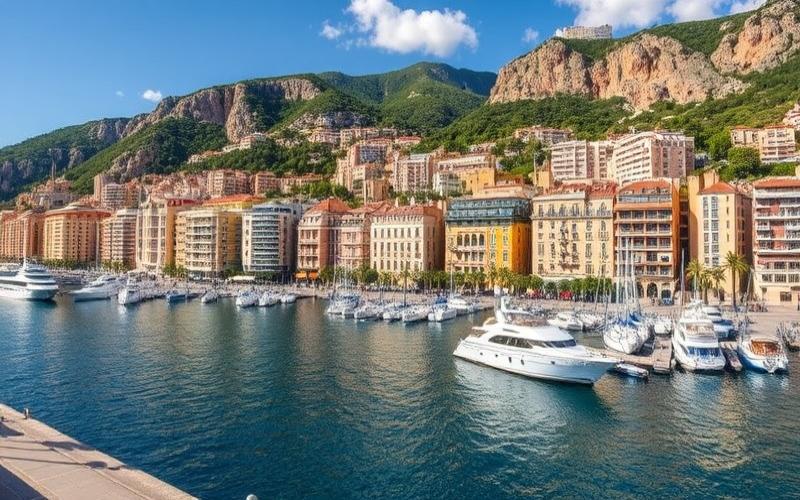

Monaco, famous for its luxurious lifestyle and Formula 1 Grand Prix, is also renowned for its favorable tax system. The Principality offers a particularly attractive tax environment for businesses, making it a preferred destination for many international entrepreneurs and investors. Let’s explore together the specifics of corporate taxation in Monaco and the advantages it offers compared to other offshore jurisdictions.

A Light Tax Regime: Main Taxes for Monegasque Companies

Unlike many countries, Monaco offers a relatively simple and advantageous tax system for businesses. Here are the main taxes that Monegasque companies may be subject to:

Corporate Income Tax (CIT)

Corporate Income Tax is the main tax that Monegasque companies may be subject to. However, this tax only applies under specific conditions:

– It only concerns companies engaged in industrial or commercial activities. – The company must generate more than 25% of its turnover outside Monaco.

If these conditions are met, the tax rate is currently set at 25% of profits. It’s important to note that this rate has been gradually reduced in recent years, from 33.33% to 25% in 2022, with the aim of strengthening the Principality’s tax attractiveness.

Value Added Tax (VAT)

Monaco applies the same VAT system as France, due to its customs union with that country. The standard rate is 20%, with reduced rates for certain goods and services. Monegasque companies must collect and remit VAT according to the same rules as in France.

Social Security Contributions

Monegasque companies are required to pay social security contributions for their employees. These contributions cover various risks such as illness, retirement, and unemployment. The rates vary depending on the type of risk covered and the employee’s status.

Payroll Tax

Unlike many countries, Monaco does not impose a specific tax on wages paid by companies. This absence of tax helps reduce payroll costs for employers.

Good to Know:

Most Monegasque companies are not subject to Corporate Income Tax if they conduct their activities primarily within the Principality. This exemption represents a major tax advantage for entrepreneurs choosing to establish themselves in Monaco.

Simplified Procedures: How to Register with the Monegasque Tax Administration

Tax registration for a company in Monaco is a relatively simple and quick procedure. Here are the main steps to follow:

1. Company Formation: The first step is to create your company according to the chosen legal form (SAM, SARL, SNC, etc.). This process is carried out with the Traffic Titles Service.

2. Obtaining the NIS Number: Once the company is created, you must obtain a Statistical Identification Number (NIS) from the Monegasque Institute of Statistics and Economic Studies (IMSEE).

3. VAT Registration: If your activity is subject to VAT, you must register with the Monaco Tax Services Department. This procedure can be completed online or directly at their offices.

4. Activity Declaration: You must declare the start of your activity to the Economic Expansion Department. This step is crucial to obtain authorization to conduct your activity in Monaco.

5. CCSS Affiliation: If you employ staff, you must affiliate with the Social Services Compensation Fund (CCSS) to manage your employees’ social security contributions.

Simplicity Serving Efficiency

The Monegasque administration is renowned for its efficiency and responsiveness. Tax registration procedures are generally processed quickly, allowing entrepreneurs to start their business under the best conditions.

Good to Know:

The Monegasque government has established a one-stop shop for businesses, thereby facilitating administrative and tax procedures. This centralized service allows entrepreneurs to save valuable time when creating and managing their company.

Transparency and Compliance: Tax Obligations for Companies in Monaco

Although the Monegasque tax regime is advantageous, companies established in the Principality must comply with certain tax obligations to maintain their compliance:

Annual Tax Returns

Companies subject to Corporate Income Tax must file an annual tax return with the Tax Services Department. This return must be accompanied by the company’s financial statements and must be filed within three months following the end of the fiscal year.

VAT Returns

Companies subject to VAT must submit monthly or quarterly returns, depending on their turnover. These returns must be accompanied by payment of the VAT due.

Accounting Maintenance

All Monegasque companies are required to maintain accounting records in accordance with applicable accounting standards. These records must be kept for at least 10 years.

Social Security Contribution Payments

Employers must regularly pay social security contributions for their employees to the CCSS. These payments are generally made on a monthly basis.

Tax Audits

Although less frequent than in other countries, tax audits exist in Monaco. Companies must therefore be able to justify their tax situation at any time.

Transparency as a Guiding Principle

Monaco has significantly strengthened its tax transparency in recent years, particularly by signing tax information exchange agreements with many countries. Monegasque companies must therefore be particularly vigilant about their tax compliance.

Good to Know:

Monaco has implemented an automatic financial information reporting system as part of the fight against tax evasion. Monegasque financial institutions are required to communicate certain information about accounts held by non-residents to the tax authorities of their country of residence.

International Cooperation: Double Taxation Agreements Concluded by Monaco

Although Monaco is not a member of the European Union, the Principality has concluded several Double Taxation Agreements (DTA) with other countries. These agreements aim to prevent companies and individuals from being taxed twice on the same income. Here are some of the main agreements in force:

– France: A special agreement exists between Monaco and France, governing in particular the tax situation of French nationals residing in Monaco.

– Luxembourg: A comprehensive DTA covering income tax and wealth tax.

– United Arab Emirates: An agreement covering income tax and aimed at promoting mutual investments.

– Qatar: A DTA similar to the one concluded with the United Arab Emirates.

– Malta: An agreement covering income tax and aimed at strengthening economic relations between the two countries.

Ongoing Negotiations

Monaco is actively pursuing efforts to expand its network of tax agreements. Negotiations are underway with several other countries, with the aim of strengthening the Principality’s tax attractiveness for international investors.

Importance of Tax Information Exchange Agreements

In addition to DTAs, Monaco has signed numerous Tax Information Exchange Agreements (TIEA) with other countries. These agreements allow for the exchange of tax information upon request, thereby strengthening transparency and international cooperation in tax matters.

Good to Know:

Despite its status as a tax-advantaged jurisdiction, Monaco strives to maintain a balance between tax attractiveness and compliance with international standards for transparency and tax cooperation.

Monaco vs Other Tax Havens: An Undeniable Competitive Advantage

Compared to other jurisdictions renowned for their tax attractiveness, Monaco stands out in several aspects:

Political and Economic Stability

Unlike some island tax havens, Monaco benefits from great political and economic stability. The Principality has been ruled by the Grimaldi family for over 700 years, thus offering a safe and predictable framework for investors.

Quality Infrastructure

Monaco has modern, high-quality infrastructure, particularly in terms of telecommunications, transportation, and banking services. This quality of life and professional environment is a major asset compared to other offshore jurisdictions.

Proximity to Europe

Located on the French Riviera, Monaco benefits from a strategic geographical position, close to major European business centers. This location is a definite advantage compared to more isolated jurisdictions like the Cayman Islands or Bermuda.

Reputation and Brand Image

Monaco enjoys a prestigious brand image, associated with luxury and excellence. This reputation can be an asset for companies seeking to strengthen their international credibility.

Tax Rate Comparison

Here is a comparative table of corporate tax rates in various attractive offshore jurisdictions:

| Jurisdiction | Corporate Tax Rate | |————-|———————————–| | Monaco | 25% (only for companies generating over 25% of turnover outside Monaco) | | Cayman Islands | 0% | | British Virgin Islands | 0% | | Singapore | 17% | | Hong Kong | 16.5% | | Dubai (DIFC) | 0% |

Although the tax rate in Monaco may seem higher than in some other jurisdictions, it’s important to note that most Monegasque companies are not subject to this tax if they conduct their activities primarily within the Principality.

Good to Know:

Beyond tax advantages, Monaco offers an exceptional living environment, unparalleled security, and easy access to European markets. These assets make the Principality a preferred destination for international entrepreneurs and investors, despite a slightly less advantageous tax system than some more “exotic” tax havens.

Conclusion: Monaco, A Tax Haven Combining Attractiveness and Compliance

Corporate taxation in Monaco offers numerous advantages for international entrepreneurs and investors. With an advantageous tax system, simplified administrative procedures, and an exceptional living environment, the Principality stands out as a preferred destination for business development.

However, it’s crucial to emphasize that Monaco has significantly strengthened its tax transparency in recent years. Companies wishing to establish themselves in the Principality must therefore be perfectly compliant and scrupulously respect their tax obligations.

Ultimately, the choice of Monaco as a location for a company should result from comprehensive consideration, taking into account not only tax advantages but also development opportunities, quality of life, and the political and economic stability offered by the Principality.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.