Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

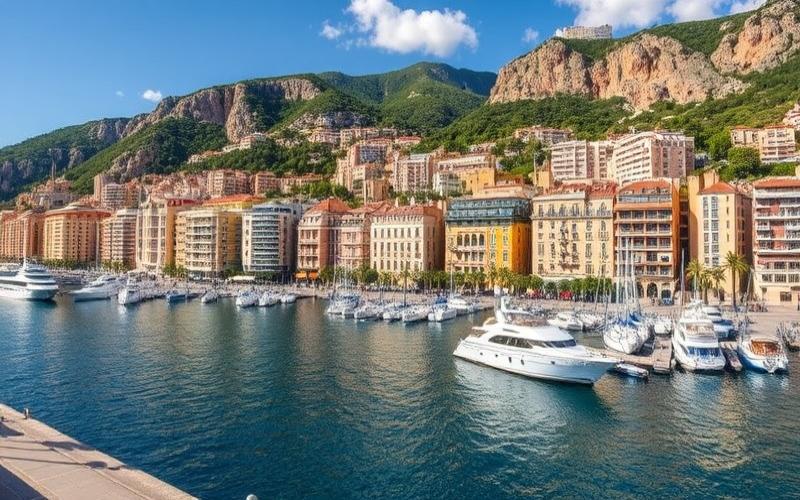

Monaco, this small principality nestled on the French Riviera, is much more than a tax haven for the ultra-wealthy. It is increasingly establishing itself as a dynamic and attractive ecosystem for innovative entrepreneurs. Let’s explore together why and how launching your startup in Monaco could be a strategic decision to propel your project toward success.

Monaco: Fertile Ground for Ambitious Startups

The Principality of Monaco has long been associated with luxury, casinos, and yachts. However, in recent years, it has reinvented itself to become a leading hub for innovation and entrepreneurship. Here’s why Monaco has become a preferred destination for startups:

Advantageous Tax Environment

One of Monaco’s major assets is undoubtedly its attractive tax regime. The Principality does not levy personal income tax on residents, allowing entrepreneurs to reinvest more in their businesses. Additionally, Monegasque companies benefit from favorable taxation, with a corporate tax rate of only 25% for businesses generating more than 25% of their revenue outside Monaco.

A Thriving Innovation Ecosystem

Monaco has implemented several initiatives to stimulate innovation and support startups. The Princely Government notably created Monaco Boost, a business incubator offering affordable workspace and personalized support to innovative young companies. Moreover, events like the Monaco International Blockchain & Web3 Summit attract investors and entrepreneurs from around the world, creating unique networking and funding opportunities.

Political and Economic Stability

Monaco’s political and economic stability is a significant asset for entrepreneurs. The Principality provides a safe and predictable legal framework, essential for the long-term development of a business. Additionally, its strategic geographic location, at the heart of Europe and close to major economic centers, makes it an ideal starting point for conquering international markets.

Access to an Affluent Clientele

With its unique concentration of wealthy residents and international companies, Monaco offers a particularly interesting niche market for startups providing high-end products or services. This proximity to a demanding and solvent clientele can be a growth accelerator for many young businesses.

Good to Know:

Monaco is not just a tax haven but a true ecosystem favorable to innovation and entrepreneurship, offering stability, networking opportunities, and access to a high-end international clientele.

Ideal Legal Structures for Launching Your Startup in Monaco

Choosing the right legal structure is a crucial step in creating your startup in Monaco. The Principality offers several options, each with its advantages and specificities. Here are the main legal forms suitable for startups:

The SARL (Limited Liability Company)

The SARL is a popular legal form for startups in Monaco. It offers great flexibility and limited liability to the contributions of partners. The main characteristics are:

– Minimum share capital: €15,000 – Number of partners: between 2 and 50 – Management: one or more managers – Taxation: 25% corporate tax if more than 25% of revenue is generated outside Monaco

The SAM (Monegasque Public Limited Company)

The SAM is a more formal structure, suitable for ambitious projects requiring significant fundraising. Its characteristics are:

– Minimum share capital: €150,000 – Number of shareholders: minimum 2 – Management: board of directors and general management – Taxation: similar to SARL

The SAS (Simplified Joint-Stock Company)

Although less common in Monaco, the SAS is gaining popularity due to its flexibility. It allows great freedom in governance organization and capital distribution. Its characteristics:

– Share capital: freely determined by the bylaws – Number of partners: minimum 1 – Management: president and possibly general managers – Taxation: similar to other corporate forms

The SASU (Single-Person Simplified Joint-Stock Company)

A variant of the SAS, the SASU is particularly suitable for solo entrepreneurs. It offers the same advantages as the SAS but with a single partner.

The Sole Proprietorship Status

For small-scale projects or testing phases, the sole proprietorship status can be an interesting option. It allows starting an activity without creating a separate legal structure but does not offer separation between personal and professional assets.

Good to Know:

The choice of legal structure depends on many factors such as the nature of your activity, your growth objectives, and your funding needs. It is recommended to consult an accountant or specialized lawyer to make the choice best suited to your situation.

Funding Your Startup in Monaco: Keys to Raising Funds

Funding is often the lifeblood for startups. Fortunately, Monaco offers an environment conducive to fundraising, with several options available to ambitious entrepreneurs.

Monegasque Business Angels

Monaco has many wealthy residents, some of whom are active business angels. These private investors can not only provide funds but also their experience and network. The Monaco Private Equity and Venture Capital Association (MVCA) is an excellent starting point to connect with these investors.

Venture Capital Funds

Several venture capital funds are active in Monaco and the region. They are often specialized in certain sectors like tech, health, or sustainable development. Among them, Monaco Venture Capital (MVC) invests in innovative startups with high growth potential.

Government Support

The Monegasque government has implemented several schemes to support startups:

– The Blue Fund: intended to finance innovative projects related to the blue economy – The Green Fund: for projects related to energy transition and sustainable development – Monaco Boost: offers subsidized workspace and personalized support

Crowdfunding

Although less developed than elsewhere, crowdfunding is gaining ground in Monaco. Platforms like MonacoTech allow startups to raise funds from the general public while validating their concept with potential customers.

Strategic Partnerships

As Monaco is an international business hub, opportunities for strategic partnerships are numerous. These partnerships can take the form of direct investments, co-developments, or commercial agreements, thus providing valuable financial and operational resources.

Incubators and Accelerators

Monaco has several support structures that can facilitate access to funding:

– MonacoTech: the national incubator and accelerator, offering a comprehensive support program and opportunities to connect with investors – Monaco Digital: specialized in digital startups, it provides support and connections with the local and international tech ecosystem

Good to Know:

The diversity of funding sources in Monaco allows startups to combine different approaches to create an optimal funding mix. It is crucial to prepare your pitch and business plan well to maximize your chances of securing funds.

Conclusion: Monaco, a Springboard for Ambitious Startups

Creating a startup in Monaco offers numerous advantages: an attractive tax environment, a thriving innovation ecosystem, political and economic stability, and access to an affluent international clientele. With the right legal structures and an adapted funding strategy, your startup can benefit from fertile ground to develop and shine far beyond the Principality’s borders.

The key to success lies in meticulous preparation, a strong network, and a clear vision of your objectives. Do not hesitate to surround yourself with local experts to navigate the specificities of the Monegasque market and fully leverage the opportunities offered by this rapidly growing innovation hub.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.