Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

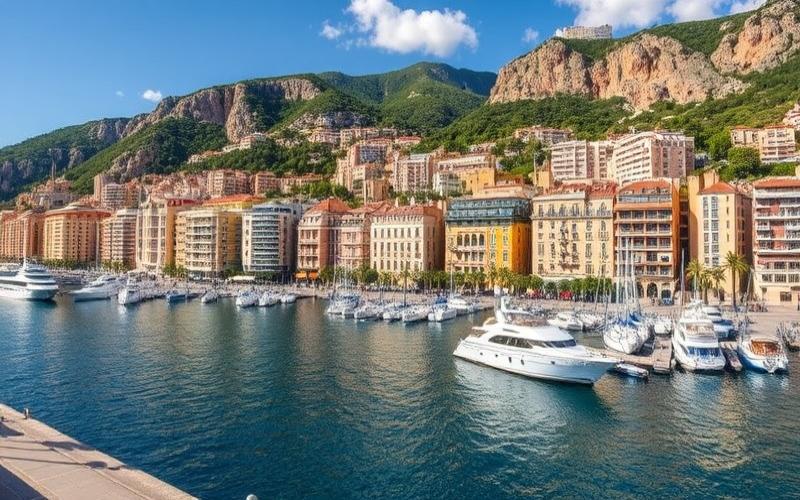

Monaco, this small sovereign state nestled on the French Riviera, is renowned for its favorable tax environment and sophisticated banking sector. For entrepreneurs looking to establish their business there, opening a corporate bank account is a crucial step. Here is a detailed guide to help you successfully navigate this process.

Keys to Opening Your Corporate Bank Account in Monaco

Opening a corporate bank account in Monaco may seem complex, but with the right information and proper preparation, the process can be simplified. Here are the essential steps to follow:

1. Choose the right legal structure: Before even thinking about opening an account, make sure your company is legally established in Monaco. The most common legal forms are SARL (Limited Liability Company) and SAM (Monégasque Public Limited Company).

2. Select your bank: Research Monégasque banks that best match your needs in terms of services, fees, and reputation.

3. Prepare your file: Gather all necessary documents (we’ll cover this in detail later).

4. Schedule an appointment: Contact your chosen bank to set up a meeting with a business advisor.

5. Present your project: During the appointment, be prepared to explain your business, financial projections, and banking needs in detail.

6. Follow the verification procedure: Monégasque banks are subject to strict anti-money laundering regulations. Be patient and cooperative during this process.

The Perfect File: Essential Documents to Convince Your Banker

To open a corporate bank account in Monaco, you’ll need to provide a complete set of documents. Here is a list of generally required items:

- Duly registered company statutes

- Extract from the Monaco Trade and Industry Registry (less than 3 months old)

- Identification documents for directors, shareholders, and beneficial owners

- Proof of address for directors (less than 3 months old)

- Detailed business plan and financial projections

- Latest balance sheets and income statements (for existing businesses)

- Proof of origin for funds to be deposited

- Monégasque residence permit for residents

Expert Tip: Also prepare a clear and concise executive summary of your business. This will help the banker quickly understand your project and could speed up the account opening process.

From Paperwork to Activation: The Journey of Creating Your Bank Account

Once you’ve chosen your bank and prepared your file, here are the typical steps in the account opening process:

1. File submission: During your appointment, you’ll present all required documents to the banking advisor.

2. File analysis: The bank will examine your application in detail, which may take several weeks.

3. Request for additional information: It’s common for the bank to come back to you for clarifications or additional documents.

4. Committee decision: An internal bank committee will evaluate your file and decide whether to accept or reject the account opening.

5. Contract signing: If accepted, you’ll be invited to sign various contracts and general terms and conditions.

6. Account activation: Once formalities are completed, your account will be activated and you’ll receive your online banking credentials.

7. Initial deposit: Most banks require a minimum initial deposit, which can vary significantly depending on the institution.

Good to Know:

The account opening process in Monaco typically takes 4 to 8 weeks on average. Plan accordingly in your setup timeline.

Monaco’s Banking Giants: Choose Your Ideal Financial Partner

Monaco is home to several renowned banking institutions. Here’s an overview of the main banks and their advantages for businesses:

- Advantages: Strong expertise in wealth management, customized services for entrepreneurs

- Specialty: Personalized support for growing businesses

- Advantages: Solid international network, innovative financing solutions

- Specialty: Support for international transactions and foreign trade

- Advantages: Advanced digital platform, investment banking expertise

- Specialty: Banking services for technology and innovative companies

- Advantages: Wide range of banking products, international presence

- Specialty: Cash management solutions and structured financing

- Advantages: Risk management expertise, private banking services for executives

- Specialty: Support for family businesses and wealth management

Good to Know:

Some Monégasque banks may require a substantial initial deposit, sometimes in the range of several hundred thousand euros. Make sure you fully understand the conditions before committing.

Maximize Your Chances: Secrets to Successful Account Opening

To increase your chances of success when opening your corporate bank account in Monaco, follow these expert tips:

1. Be transparent: Transparency is key. Don’t hesitate to provide all requested information and clearly explain your business model.

2. Prepare a solid business plan: A well-structured business plan and realistic financial projections will demonstrate your seriousness and professionalism.

3. Show your local commitment: Monégasque banks appreciate businesses that contribute to the local economy. Highlight your hiring plans or local partnerships.

4. Anticipate questions about fund origin: Be prepared to justify in detail the origin of your initial funds and future income.

5. Consider an introducer: Using a recognized local lawyer or accountant can sometimes facilitate the process and add additional credibility to your file.

6. Remain patient and professional: The process can be lengthy. Keep your composure and remain courteous in all your interactions with the bank.

Good to Know:

Monégasque banks are particularly vigilant about compliance and anti-money laundering. Ensure your business is perfectly legal and transparent to avoid any rejection of your application.

Beyond Opening: Effectively Managing Your Monégasque Bank Account

Once your account is open, here are some key points for optimal management:

1. Master digital tools: Familiarize yourself with your institution’s online banking platform to efficiently manage your daily operations.

2. Monitor banking fees: Monégasque banks can have complex fee structures. Stay vigilant and don’t hesitate to negotiate if necessary.

3. Take advantage of ancillary services: Many banks offer investment advisory or wealth management services. Explore these options to optimize your company’s financial management.

4. Maintain regular communication: Keep in regular contact with your banking advisor, particularly to inform them of significant developments in your business.

5. Respect reporting obligations: Monaco has strict financial reporting requirements. Make sure you meet all your obligations to avoid any problems.

Opening a corporate bank account in Monaco may seem challenging, but with careful preparation and a clear understanding of the process, you can successfully navigate this sophisticated banking environment. Remember that each bank has its own criteria and procedures, so take the time to choose the one that best matches your specific needs.

Good to Know:

Monaco offers a favorable tax environment, but it’s crucial to comply with all local and international regulations. Consult a tax expert to ensure your structure is compliant.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.