Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

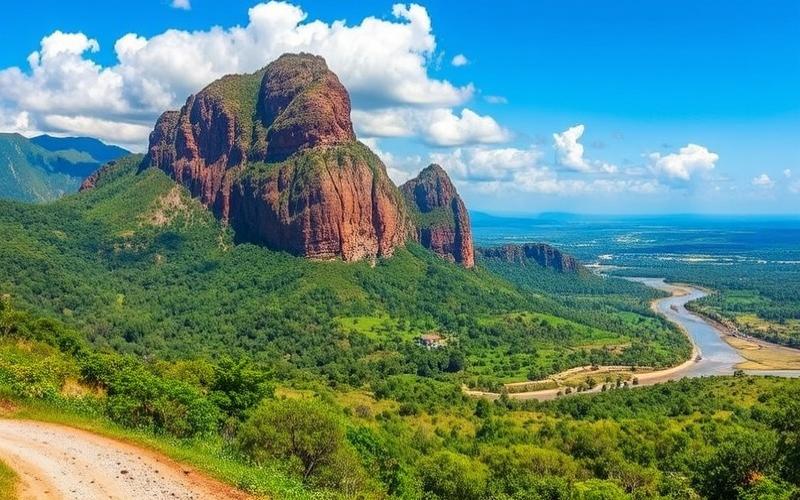

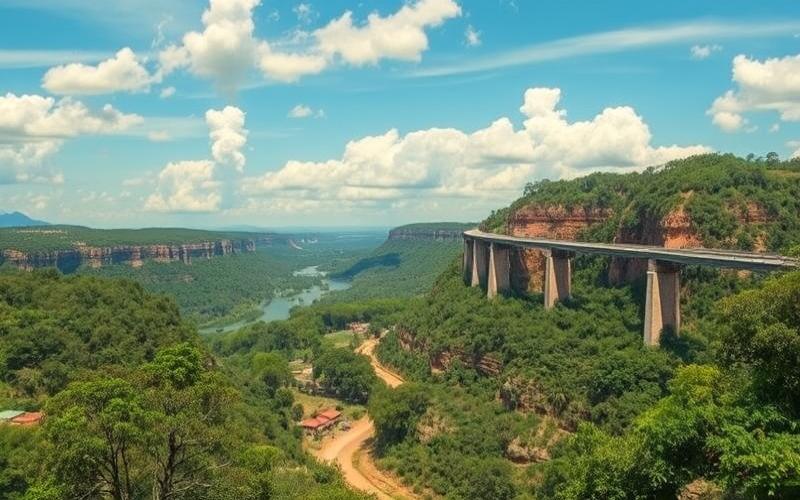

Paraguay is establishing itself as a prime destination for international entrepreneurs and investors seeking favorable tax conditions. Located in the heart of South America, this country offers a particularly attractive tax environment, combining some of the lowest tax rates on the continent with business-friendly regulations. Let’s explore together the tax advantages that make Paraguay a genuine opportunity for foreign companies.

A Tax Regime That Makes Entrepreneurs Dream

Paraguay stands out for its extremely competitive corporate taxation. The country has implemented a simple and advantageous system aimed at attracting foreign investment and stimulating its economy. Here are the main taxes applicable to companies established in Paraguay:

- Corporate Income Tax (IS): The standard rate is set at only 10% of profits, one of the lowest in Latin America. This rate applies to income generated both in Paraguay and abroad for resident companies.

- Value Added Tax (VAT): The general VAT rate is 10%, with reduced rates of 5% for certain essential goods and services. Exports are exempt from VAT.

- Dividend Tax: Dividends distributed to shareholders are subject to a 15% withholding tax for non-residents.

- Social Security Contributions: Employers must contribute approximately 16.5% of employees’ gross salaries for social security.

Paraguay also offers highly advantageous special tax regimes for certain business sectors. For example, the Maquila regime allows exporting companies to benefit from a single 1% tax on the value added of their production. Similarly, companies established in free trade zones can enjoy significant tax exemptions.

Good to Know:

The 10% corporate tax rate in Paraguay is significantly lower than that of many neighboring countries like Brazil (34%) or Argentina (35%), making it a very attractive tax destination in the region.

Registering with the Paraguayan Tax Authorities: A Simplified Formality

Tax registration for a company in Paraguay is a relatively simple and quick procedure. Paraguayan authorities have established a one-stop shop to facilitate procedures for foreign investors. Here are the main steps to follow:

- Obtaining the tax identification number (RUC – Registro Único del Contribuyente) from the Subsecretaría de Estado de Tributación (SET).

- Registration with the Ministry of Labor and Social Security.

- Registration with the commercial registry.

- Opening a local bank account for the company.

The entire process can be completed within a few weeks, with the assistance of a local lawyer or accountant. Many specialized firms offer support services for foreign entrepreneurs looking to establish themselves in Paraguay.

Good to Know:

Paraguay has implemented an online tax filing system, allowing companies to fulfill their tax obligations digitally and in a simplified manner.

Reduced Tax Obligations for Companies

Tax obligations for companies in Paraguay are relatively light compared to many other countries. Here are the main declarations and payments to be made:

- Annual corporate tax return: To be filed within 4 months after the fiscal year closes.

- Monthly VAT declarations: To be submitted before the 15th of the following month.

- Withholdings at source: Companies must withhold and remit monthly withholdings on salaries and dividends.

- Corporate tax installments: Quarterly payments based on the previous year’s results.

Paraguay has also implemented a simplified regime for small businesses, allowing for further reduction of administrative and tax constraints for modest-sized structures.

Good to Know:

Paraguayan companies are not subject to a wealth tax or significant local taxes, which considerably lightens their overall tax burden.

An Expanding Network of Tax Treaties

Paraguay has signed several double taxation treaties (DTT) with other countries, aiming to prevent corporate income from being taxed twice. Although the treaty network is still limited, it is constantly expanding. The main agreements in force concern:

- Chile

- Taiwan

- United Arab Emirates

- Uruguay

Negotiations are underway with other countries, particularly European ones, to expand this network of tax treaties. These agreements enhance Paraguay’s attractiveness as a base for international operations by facilitating financial flows and reducing the overall tax burden for multinational companies.

Good to Know:

Even in the absence of a tax treaty, the Paraguayan tax system is designed to avoid double taxation of foreign income, with mechanisms for tax credits on taxes paid abroad.

Paraguay vs. Other Tax Havens: A Serious Competitor

Paraguay positions itself as a credible alternative to traditional offshore jurisdictions, offering an interesting balance between tax advantages and economic stability. Here’s how it compares to other attractive tax destinations:

- Panama: Although Panama also offers advantageous taxation, Paraguay benefits from a better international reputation and a lower cost of living.

- Cayman Islands: Paraguay offers almost as advantageous taxation, but with the benefit of a real and diversified economy, reducing the risks of blacklisting.

- Singapore: While Singapore remains a benchmark in terms of business environment, Paraguay offers significantly lower setup costs and lighter taxation.

- Andorra: Paraguay presents similar advantages in terms of taxation, but with a much larger potential market and greater growth opportunities.

Paraguay stands out for its strategic geographical location in the heart of South America, offering privileged access to expanding regional markets. Moreover, unlike many island tax havens, Paraguay has a diversified economy and abundant natural resources, offering real investment opportunities.

Good to Know:

Paraguay is not considered a tax haven by the OECD or the European Union, which reduces the risks of sanctions or restrictions for companies establishing there.

Conclusion: Paraguay, A Tax Opportunity to Seize

Paraguay is establishing itself as a premier tax destination for international companies. With some of the lowest tax rates in Latin America, simplified procedures, and a constantly improving business environment, the country offers unique opportunities to optimize corporate taxation.

Paraguay’s tax advantages, combined with its political and economic stability, make it a serious alternative to traditional tax havens. For entrepreneurs and investors seeking a tax-advantaged jurisdiction that also offers real growth prospects, Paraguay deserves special attention.

However, as with any international establishment decision, it is crucial to thoroughly evaluate all legal, tax, and operational aspects. Support from local experts is highly recommended to effectively navigate the Paraguayan tax environment and fully leverage the opportunities offered by this emerging country.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.